Enlarge image

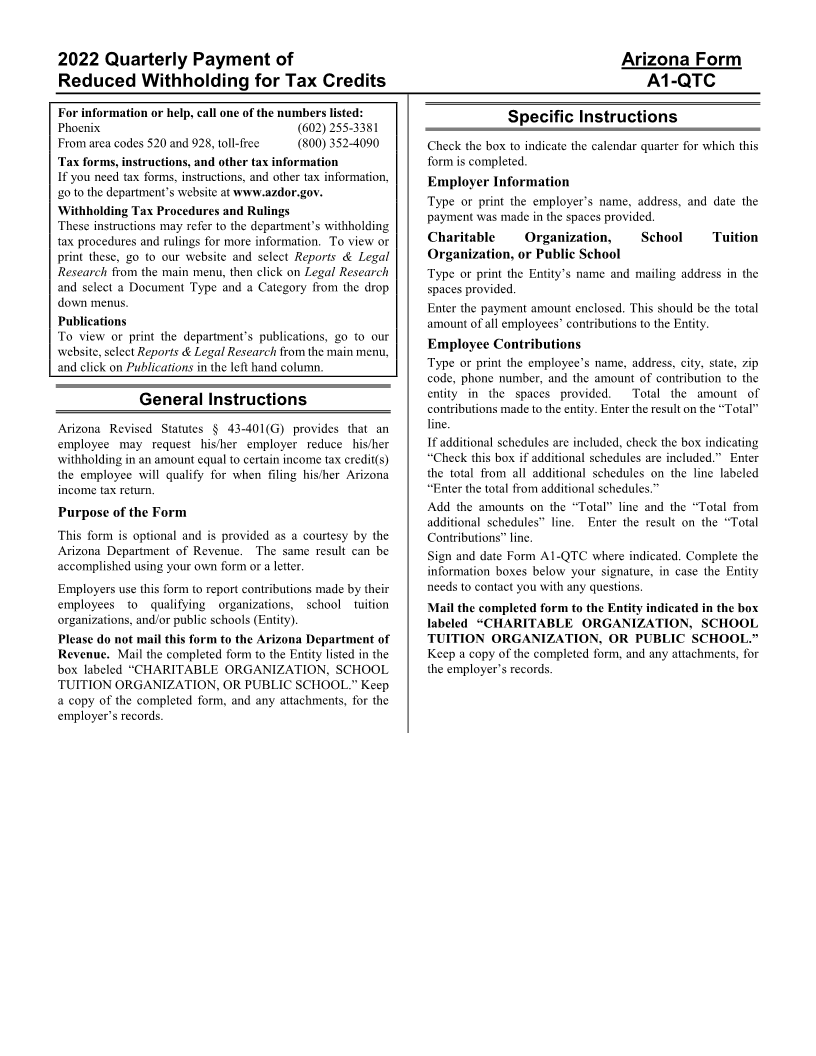

2022 Quarterly Payment of Arizona Form

Reduced Withholding for Tax Credits A1-QTC

For information or help, call one of the numbers listed:

Specific Instructions

Phoenix (602) 255-3381

From area codes 520 and 928, toll-free (800) 352-4090 Check the box to indicate the calendar quarter for which this

Tax forms, instructions, and other tax information form is completed.

If you need tax forms, instructions, and other tax information, Employer Information

go to the department’s website atwww.azdor.gov. Type or print the employer’s name, address, and date the

Withholding Tax Procedures and Rulings payment was made in the spaces provided.

These instructions may refer to the department’s withholding

tax procedures and rulings for more information. To view or Charitable Organization, School Tuition

print these, go to our website and select Reports & Legal Organization, or Public School

Research from the main menu, then click on Legal Research Type or print the Entity’s name and mailing address in the

and select a Document Type and a Category from the drop spaces provided.

down menus. Enter the payment amount enclosed. This should be the total

Publications amount of all employees’ contributions to the Entity.

To view or print the department’s publications, go to our

website, selectReports & Legal Research from the main menu, Employee Contributions

and click on Publications in the left hand column. Type or print the employee’s name, address, city, state, zip

code, phone number, and the amount of contribution to the

entity in the spaces provided. Total the amount of

General Instructions contributions made to the entity. Enter the result on the “Total”

Arizona Revised Statutes § 43-401(G) provides that an line.

employee may request his/her employer reduce his/her If additional schedules are included, check the box indicating

withholding in an amount equal to certain income tax credit(s) “Check this box if additional schedules are included.” Enter

the employee will qualify for when filing his/her Arizona the total from all additional schedules on the line labeled

income tax return. “Enter the total from additional schedules.”

Add the amounts on the “Total” line and the “Total from

Purpose of the Form additional schedules” line. Enter the result on the “Total

This form is optional and is provided as a courtesy by the Contributions” line.

Arizona Department of Revenue. The same result can be Sign and date Form A1-QTC where indicated. Complete the

accomplished using your own form or a letter. information boxes below your signature, in case the Entity

Employers use this form to report contributions made by their needs to contact you with any questions.

employees to qualifying organizations, school tuition Mail the completed form to the Entity indicated in the box

organizations, and/or public schools (Entity). labeled “CHARITABLE ORGANIZATION, SCHOOL

Please do not mail this form to the Arizona Department of TUITION ORGANIZATION, OR PUBLIC SCHOOL.”

Revenue. Mail the completed form to the Entity listed in the Keep a copy of the completed form, and any attachments, for

box labeled “CHARITABLE ORGANIZATION, SCHOOL the employer’s records.

TUITION ORGANIZATION, OR PUBLIC SCHOOL.” Keep

a copy of the completed form, and any attachments, for the

employer’s records.