Enlarge image

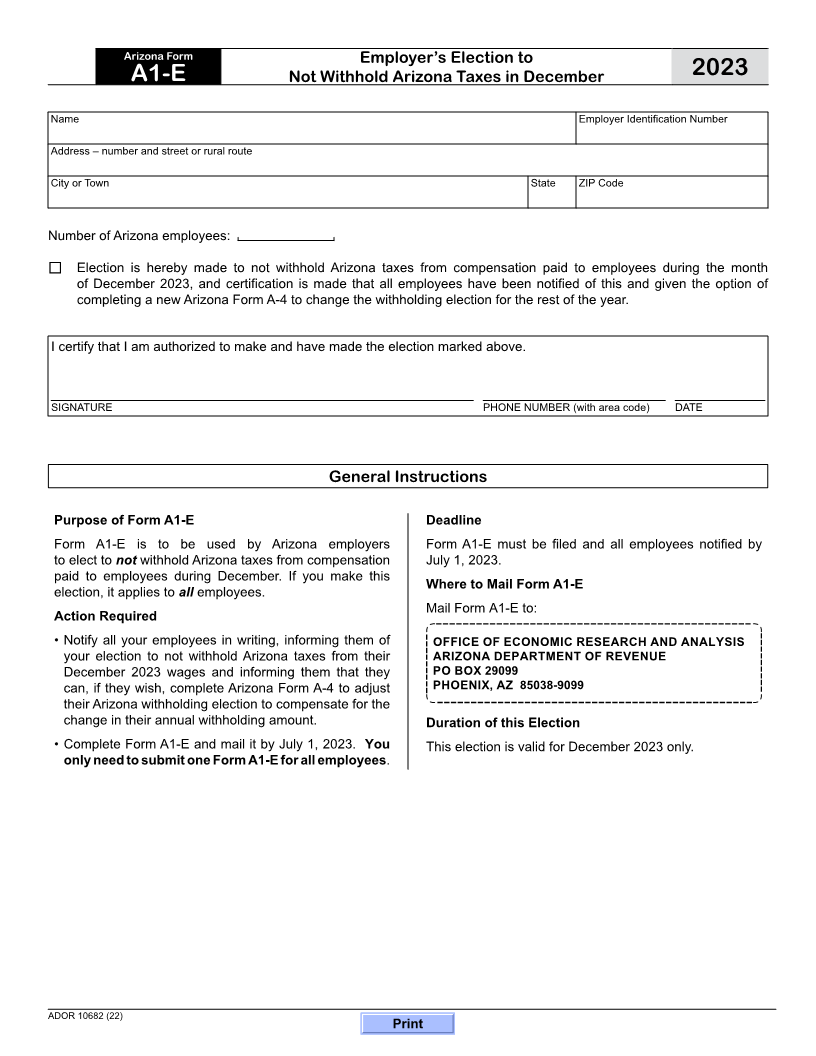

Arizona Form Employer’s Election to

A1-E Not Withhold Arizona Taxes in December 2023

Name Employer Identification Number

Address – number and street or rural route

City or Town State ZIP Code

Number of Arizona employees:

Election is hereby made to not withhold Arizona taxes from compensation paid to employees during the month

of December 2023, and certification is made that all employees have been notified of this and given the option of

completing a new Arizona Form A-4 to change the withholding election for the rest of the year.

I certify that I am authorized to make and have made the election marked above.

SIGNATURE PHONE NUMBER (with area code) DATE

General Instructions

Purpose of Form A1-E Deadline

Form A1-E is to be used by Arizona employers Form A1-E must be filed and all employees notified by

to elect to not withhold Arizona taxes from compensation July 1, 2023.

paid to employees during December. If you make this

Where to Mail Form A1-E

election, it applies to all employees.

Mail Form A1-E to:

Action Required

• Notify all your employees in writing, informing them of OFFICE OF ECONOMIC RESEARCH AND ANALYSIS

your election to not withhold Arizona taxes from their ARIZONA DEPARTMENT OF REVENUE

December 2023 wages and informing them that they PO BOX 29099

can, if they wish, complete Arizona Form A-4 to adjust PHOENIX, AZ 85038-9099

their Arizona withholding election to compensate for the

change in their annual withholding amount. Duration of this Election

• Complete Form A1-E and mail it by July 1, 2023. You This election is valid for December 2023 only.

only need to submit one Form A1-E for all employees.

ADOR 10682 (22)

Print