Enlarge image

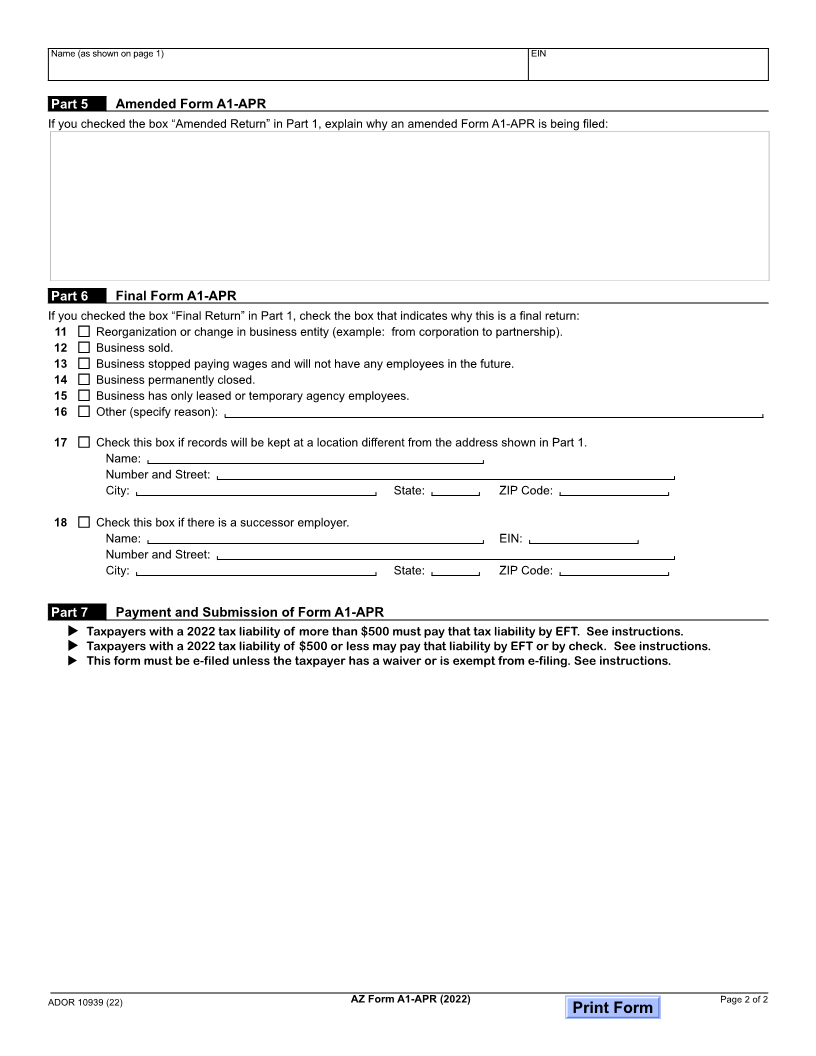

Arizona Form

Arizona Annual Payment Withholding Tax Return

A1-APR 2022

DO NOT FILE MORE THAN ONE ORIGINAL FORM A1-APR PER EIN PER YEAR.

Form A1-APR is due on or before January 31, 2023.

If you file Form A1-QRT, do not file this form.

Part 1 Taxpayer Information (Refer to the instructions before completing Part 1.)

Business Name (As listed on the Arizona Joint Tax Application - Form JT-1) Employer Identification Number (EIN)

Number and street or PO Box

City or town, state and ZIP Code REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

Business telephone number (with area code)

Check box if:

A Amended Return B Address Change C Final Return (CANCEL ACCOUNT)

If this is your final return, the department will cancel your withholding account. Enter the date final

wages were paid and complete Part 6 ............................................. M M D D Y Y Y Y 81 PM 66 RCVD

D Check this box if this return is an early-filed return for calendar year 2023 due to an

account cancellation during calendar year 2023.

E Check this box if this cancellation was due to a merger or acquisition and the

surviving employer is filing Forms W-2.

Part 2 Arizona Withholding Tax Liability

1 Total Annual Withholding Tax Liability from all sources: Enter the total amount withheld during the

calendar year ............................................................................................................................................ 1

Part 3 Tax Payments (See instructions.)

2 Withholding tax payments previously made for 2022 ............................................................................... 2

3 Amount of tax paid when filing extension request .................................................................................... 3

4 Total payments .......................................................................................................................................... 4

5 Balance of tax due: If line 1 is larger than line 4, subtract line 4 from line 1. Enter the difference.

This is the balance of tax due. Skip line 6. Non-EFT payment must accompany return........................... 5

6 Overpayment of tax: If line 4 is larger than line 1, subtract line 1 from line 4. Enter the difference. This

is the overpayment of tax .......................................................................................................................... 6

Part 4 Federal Form Transmittal Information

7 Total amount of Arizona income tax withheld as shown on federal Forms W-2, W-2c, W-2G, and

1099 for 2022 ............................................................................................................................................ 7

8 Total Arizona wages paid to employees for 2022 ..................................................................................... 8

9 Total number of employees paid Arizona wages for 2022 ........................................................................ 9

10 Total number of federal Forms W-2, W-2c, W-2G, and 1099 submitted to the department. ..................... 10

Instructions: If line 1 does not equal line 7, you have misreported your annual tax withholdings OR

you have misreported your employee wage withholdings.

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, it is a true, complete

Declaration

and correct return.

Please

Sign

Here TAXPAYER’S SIGNATURE DATE BUSINESS PHONE NUMBER

Paid PAID PREPARER’S SIGNATURE DATE PAID PREPARER’S TIN

Preparer’s

FIRM’S NAME (OR PAID PREPARER’S NAME, IF SELF-EMPLOYED) FIRM’S EIN

Use

Only FIRM’S STREET ADDRESS FIRM’S PHONE NUMBER.

CITY STATE ZIP CODE

ADOR 10939 (22)