Enlarge image

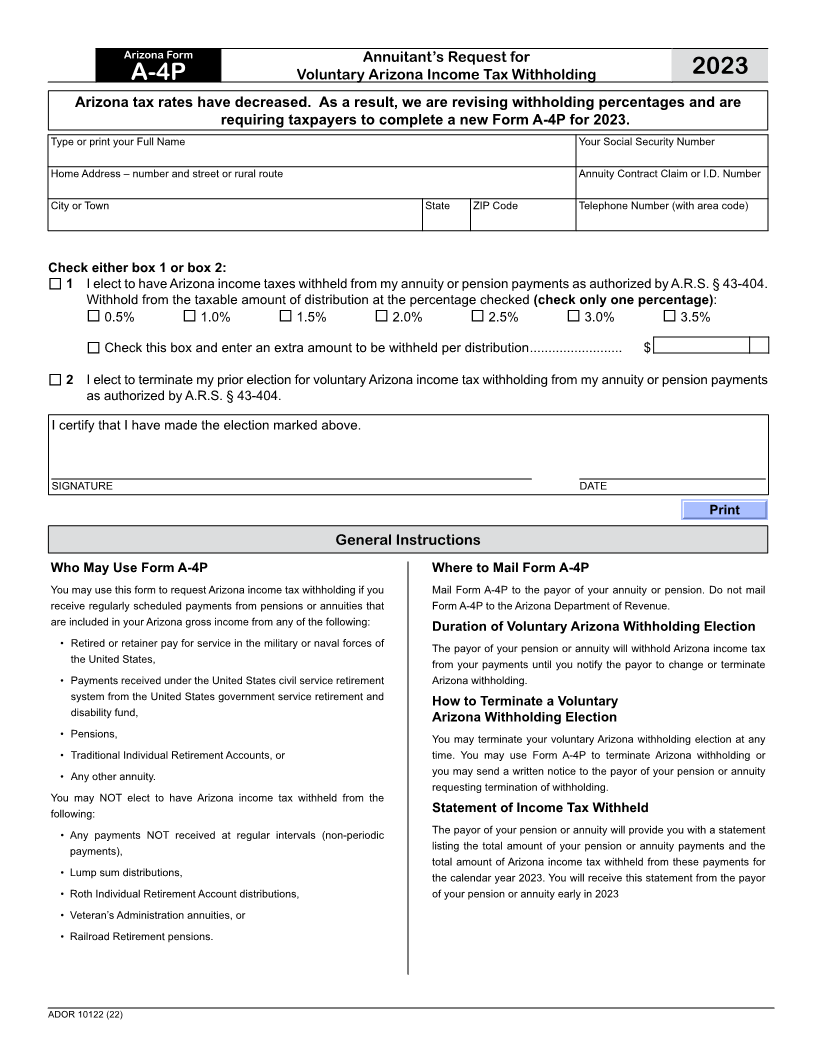

Arizona Form Annuitant’s Request for

A-4P Voluntary Arizona Income Tax Withholding 2023

Arizona tax rates have decreased. As a result, we are revising withholding percentages and are

requiring taxpayers to complete a new Form A-4P for 2023.

Type or print your Full Name Your Social Security Number

Home Address – number and street or rural route Annuity Contract Claim or I.D. Number

City or Town State ZIP Code Telephone Number (with area code)

Check either box 1 or box 2:

1I elect to have Arizona income taxes withheld from my annuity or pension payments as authorized by A.R.S. § 43-404.

Withhold from the taxable amount of distribution at the percentage checked (check only one percentage):

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5%

Check this box and enter an extra amount to be withheld per distribution ......................... $

2I elect to terminate my prior election for voluntary Arizona income tax withholding from my annuity or pension payments

as authorized by A.R.S. § 43-404.

I certify that I have made the election marked above.

SIGNATURE DATE

Print

General Instructions

Who May Use Form A-4P Where to Mail Form A-4P

You may use this form to request Arizona income tax withholding if you Mail Form A-4P to the payor of your annuity or pension. Do not mail

receive regularly scheduled payments from pensions or annuities that Form A-4P to the Arizona Department of Revenue.

are included in your Arizona gross income from any of the following:

Duration of Voluntary Arizona Withholding Election

• Retired or retainer pay for service in the military or naval forces of The payor of your pension or annuity will withhold Arizona income tax

the United States, from your payments until you notify the payor to change or terminate

• Payments received under the United States civil service retirement Arizona withholding.

system from the United States government service retirement and

How to Terminate a Voluntary

disability fund,

Arizona Withholding Election

• Pensions, You may terminate your voluntary Arizona withholding election at any

• Traditional Individual Retirement Accounts, or time. You may use Form A-4P to terminate Arizona withholding or

• Any other annuity. you may send a written notice to the payor of your pension or annuity

requesting termination of withholding.

You may NOT elect to have Arizona income tax withheld from the

following: Statement of Income Tax Withheld

• Any payments NOT received at regular intervals (non-periodic The payor of your pension or annuity will provide you with a statement

payments), listing the total amount of your pension or annuity payments and the

total amount of Arizona income tax withheld from these payments for

• Lump sum distributions, the calendar year 2023. You will receive this statement from the payor

• Roth Individual Retirement Account distributions, of your pension or annuity early in 2023

• Veteran’s Administration annuities, or

• Railroad Retirement pensions.

ADOR 10122 (22)