Enlarge image

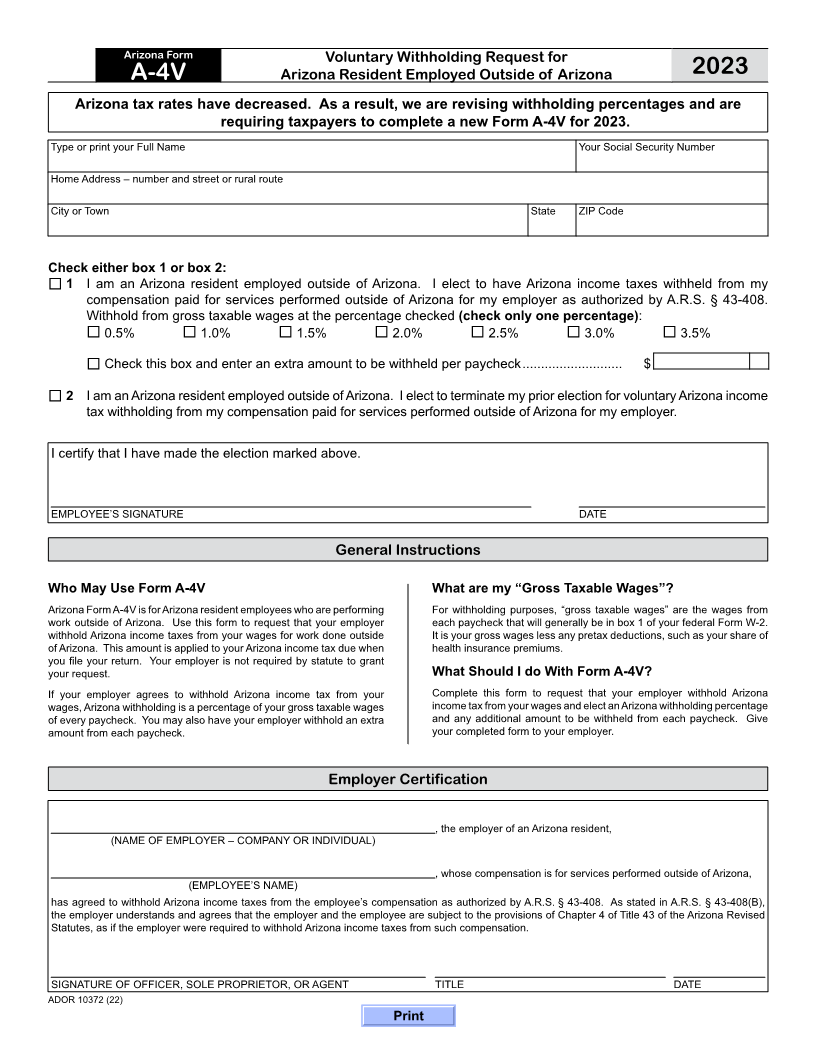

Arizona Form Voluntary Withholding Request for

A-4V Arizona Resident Employed Outside of Arizona 2023

Arizona tax rates have decreased. As a result, we are revising withholding percentages and are

requiring taxpayers to complete a new Form A-4V for 2023.

Type or print your Full Name Your Social Security Number

Home Address – number and street or rural route

City or Town State ZIP Code

Check either box 1 or box 2:

1I am an Arizona resident employed outside of Arizona. I elect to have Arizona income taxes withheld from my

compensation paid for services performed outside of Arizona for my employer as authorized by A.R.S. § 43‑408.

Withhold from gross taxable wages at the percentage checked (check only one percentage):

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5%

Check this box and enter an extra amount to be withheld per paycheck ........................... $

2I am an Arizona resident employed outside of Arizona. I elect to terminate my prior election for voluntary Arizona income

tax withholding from my compensation paid for services performed outside of Arizona for my employer.

I certify that I have made the election marked above.

EMPLOYEE’S SIGNATURE DATE

General Instructions

Who May Use Form A-4V What are my “Gross Taxable Wages”?

Arizona Form A‑4V is for Arizona resident employees who are performing For withholding purposes, “gross taxable wages” are the wages from

work outside of Arizona. Use this form to request that your employer each paycheck that will generally be in box 1 of your federal Form W‑2.

withhold Arizona income taxes from your wages for work done outside It is your gross wages less any pretax deductions, such as your share of

of Arizona. This amount is applied to your Arizona income tax due when health insurance premiums.

you file your return. Your employer is not required by statute to grant

your request. What Should I do With Form A-4V?

If your employer agrees to withhold Arizona income tax from your Complete this form to request that your employer withhold Arizona

wages, Arizona withholding is a percentage of your gross taxable wages income tax from your wages and elect an Arizona withholding percentage

of every paycheck. You may also have your employer withhold an extra and any additional amount to be withheld from each paycheck. Give

amount from each paycheck. your completed form to your employer.

Employer Certification

, the employer of an Arizona resident,

(NAME OF EMPLOYER – COMPANY OR INDIVIDUAL)

, whose compensation is for services performed outside of Arizona,

(EMPLOYEE’S NAME)

has agreed to withhold Arizona income taxes from the employee’s compensation as authorized by A.R.S. § 43‑408. As stated in A.R.S. § 43‑408(B),

the employer understands and agrees that the employer and the employee are subject to the provisions of Chapter 4 of Title 43 of the Arizona Revised

Statutes, as if the employer were required to withhold Arizona income taxes from such compensation.

SIGNATURE OF OFFICER, SOLE PROPRIETOR, OR AGENT TITLE DATE

ADOR 10372 (22)

Print