Enlarge image

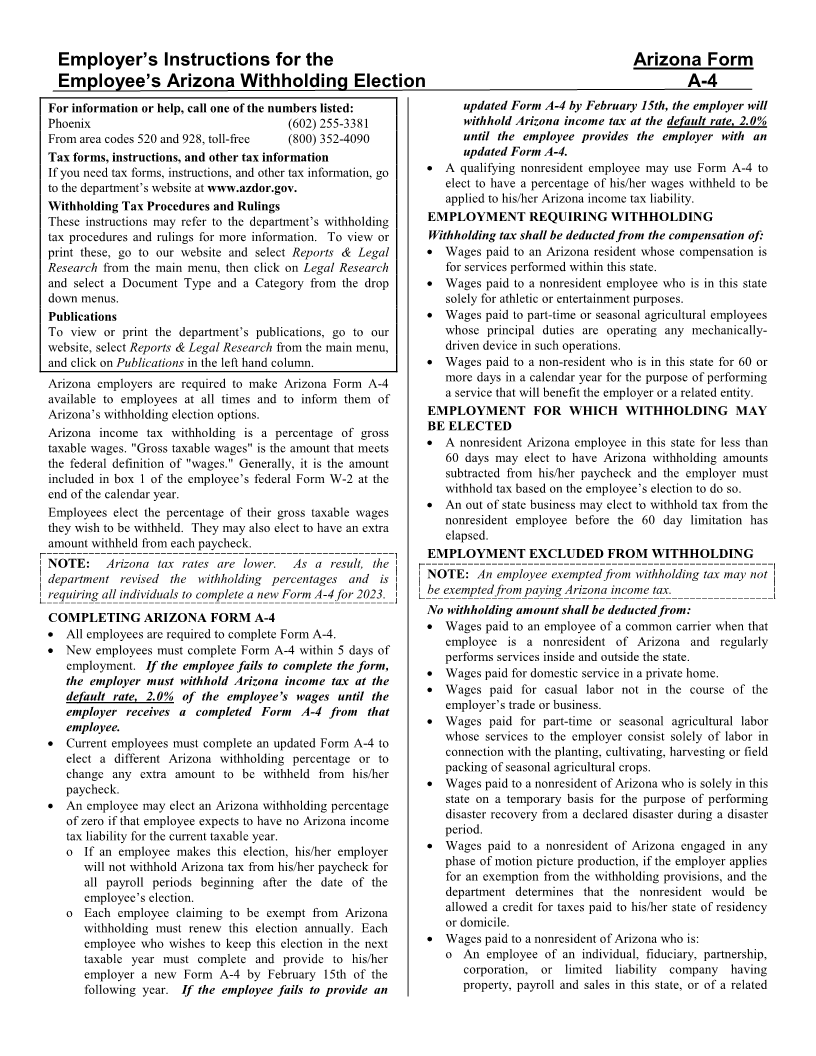

Employer’s Instructions for the Arizona Form

Employee’s Arizona Withholding Election A-4

For information or help, call one of the numbers listed: updated Form A-4 by February 15th, the employer will

Phoenix (602) 255-3381 withhold Arizona income tax at the default rate, 2.0%

From area codes 520 and 928, toll-free (800) 352-4090 until the employee provides the employer with an

Tax forms, instructions, and other tax information updated Form A-4.

If you need tax forms, instructions, and other tax information, go • A qualifying nonresident employee may use Form A-4 to

elect to have a percentage of his/her wages withheld to be

to the department’s website atwww.azdor.gov.

applied to his/her Arizona income tax liability.

Withholding Tax Procedures and Rulings

These instructions may refer to the department’s withholding EMPLOYMENT REQUIRING WITHHOLDING

tax procedures and rulings for more information. To view or Withholding tax shall be deducted from the compensation of:

print these, go to our website and select Reports & Legal • Wages paid to an Arizona resident whose compensation is

Research from the main menu, then click on Legal Research for services performed within this state.

and select a Document Type and a Category from the drop • Wages paid to a nonresident employee who is in this state

down menus. solely for athletic or entertainment purposes.

Publications • Wages paid to part-time or seasonal agricultural employees

To view or print the department’s publications, go to our whose principal duties are operating any mechanically-

website, select Reports & Legal Research from the main menu, driven device in such operations.

•

and click on Publications in the left hand column. Wages paid to a non-resident who is in this state for 60 or

Arizona employers are required to make Arizona Form A-4 more days in a calendar year for the purpose of performing

available to employees at all times and to inform them of a service that will benefit the employer or a related entity.

Arizona’s withholding election options. EMPLOYMENT FOR WHICH WITHHOLDING MAY

Arizona income tax withholding is a percentage of gross BE ELECTED

•

taxable wages. "Gross taxable wages" is the amount that meets A nonresident Arizona employee in this state for less than

the federal definition of "wages." Generally, it is the amount 60 days may elect to have Arizona withholding amounts

included in box 1 of the employee’s federal Form W-2 at the subtracted from his/her paycheck and the employer must

withhold tax based on the employee’s election to do so.

end of the calendar year.

• An out of state business may elect to withhold tax from the

Employees elect the percentage of their gross taxable wages

nonresident employee before the 60 day limitation has

they wish to be withheld. They may also elect to have an extra

elapsed.

amount withheld from each paycheck.

EMPLOYMENT EXCLUDED FROM WITHHOLDING

NOTE: Arizona tax rates are lower. As a result, the

department revised the withholding percentages and is NOTE: An employee exempted from withholding tax may not

be exempted from paying Arizona income tax.

requiring all individuals to complete a new Form A-4 for 2023.

No withholding amount shall be deducted from:

COMPLETING ARIZONA FORM A-4

• Wages paid to an employee of a common carrier when that

• All employees are required to complete Form A-4.

employee is a nonresident of Arizona and regularly

• New employees must complete Form A-4 within 5 days of performs services inside and outside the state.

employment. If the employee fails to complete the form, • Wages paid for domestic service in a private home.

the employer must withhold Arizona income tax at the

•

default rate, 2.0% of the employee’s wages until the Wages paid for casual labor not in the course of the

employer’s trade or business.

employer receives a completed Form A-4 from that

•

employee. Wages paid for part-time or seasonal agricultural labor

whose services to the employer consist solely of labor in

• Current employees must complete an updated Form A-4 to

connection with the planting, cultivating, harvesting or field

elect a different Arizona withholding percentage or to

packing of seasonal agricultural crops.

change any extra amount to be withheld from his/her

•

paycheck. Wages paid to a nonresident of Arizona who is solely in this

state on a temporary basis for the purpose of performing

• An employee may elect an Arizona withholding percentage

disaster recovery from a declared disaster during a disaster

of zero if that employee expects to have no Arizona income

period.

tax liability for the current taxable year.

•

o If an employee makes this election, his/her employer Wages paid to a nonresident of Arizona engaged in any

will not withhold Arizona tax from his/her paycheck for phase of motion picture production, if the employer applies

all payroll periods beginning after the date of the for an exemption from the withholding provisions, and the

employee’s election. department determines that the nonresident would be

o Each employee claiming to be exempt from Arizona allowed a credit for taxes paid to his/her state of residency

withholding must renew this election annually. Each or domicile.

employee who wishes to keep this election in the next • Wages paid to a nonresident of Arizona who is:

taxable year must complete and provide to his/her o An employee of an individual, fiduciary, partnership,

employer a new Form A-4 by February 15th of the corporation, or limited liability company having

following year. If the employee fails to provide an property, payroll and sales in this state, or of a related