Enlarge image

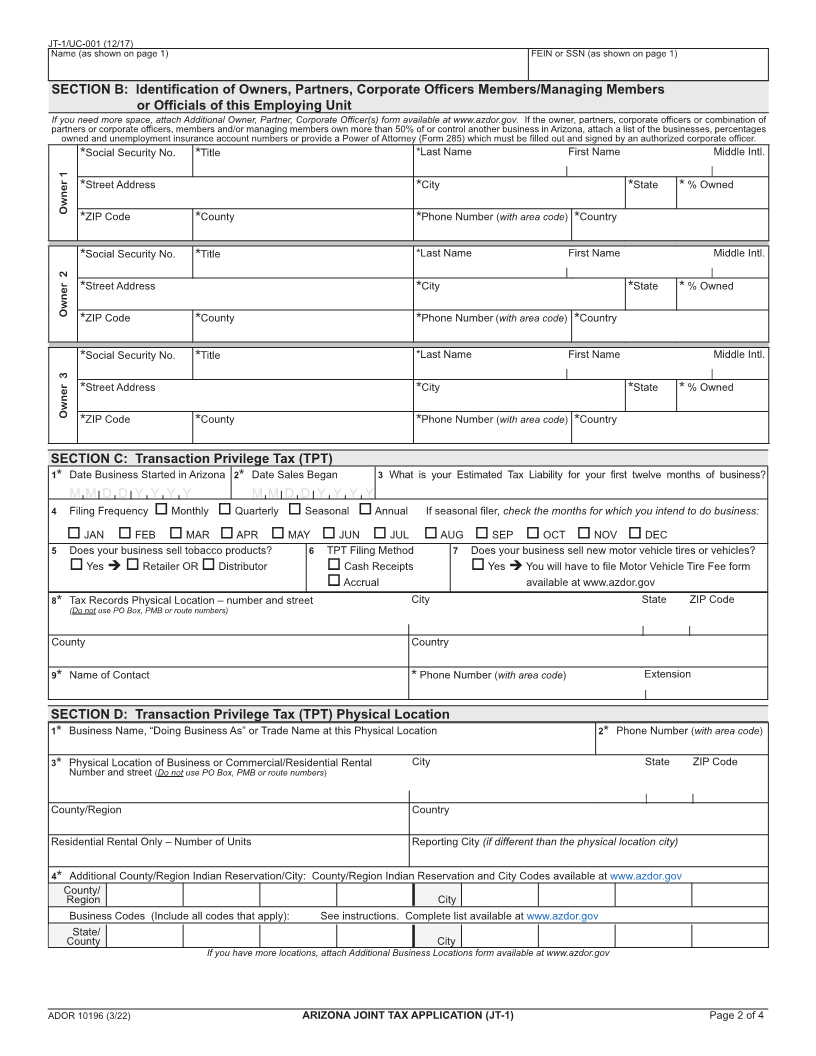

JT-1/UC-001 (12/17)

ARIZONA JOINT TAX APPLICATION (JT-1)

IMPORTANT! Incomplete applications WILL NOT BE PROCESSED.

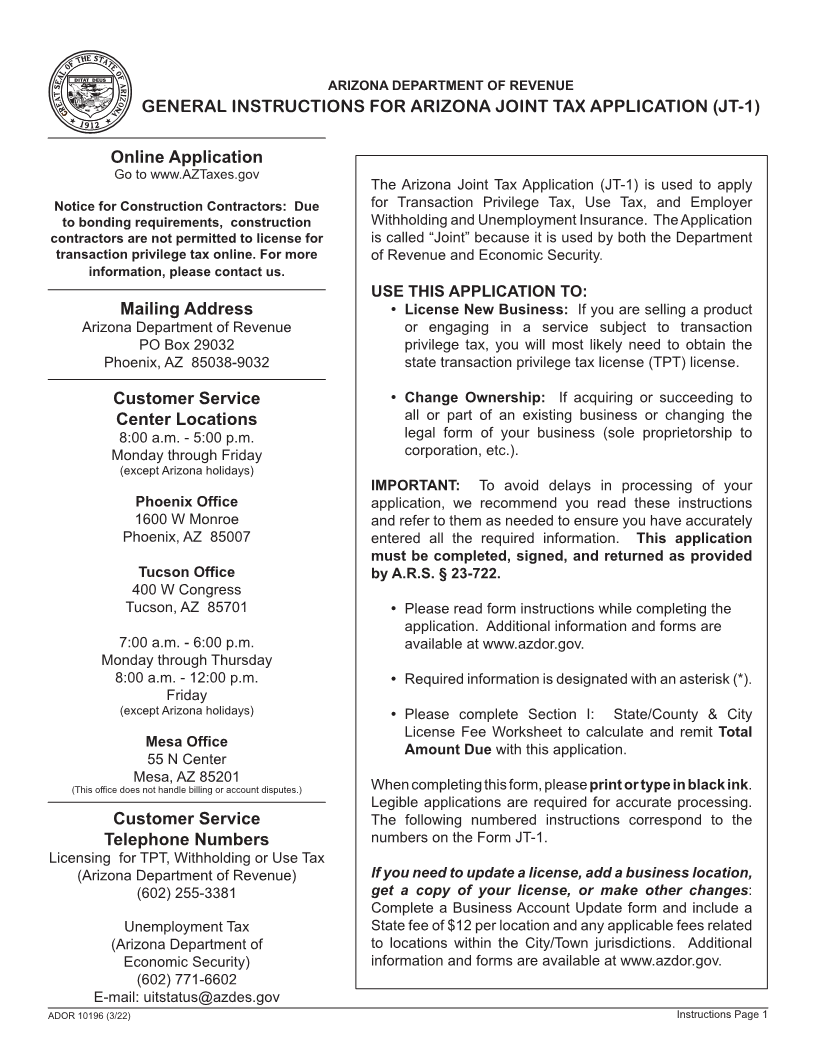

• Please read form instructions while completing the application.

Additional information and forms available at www.azdor.gov

License and Registration • Required information is designated with an asterisk ( ). * You can register, file

ARIZONA DEPARTMENT OF REVENUE and pay for this

PO BOX 29032 • Return completed application AND applicable license fee(s) to application online at

Phoenix, AZ 85038-9032 address shown at left.

www.AZTaxes.gov.

• For licensing questions regarding transaction privilege tax, call

It is fast and secure.

Customer Care and Outreach: (602) 255-3381

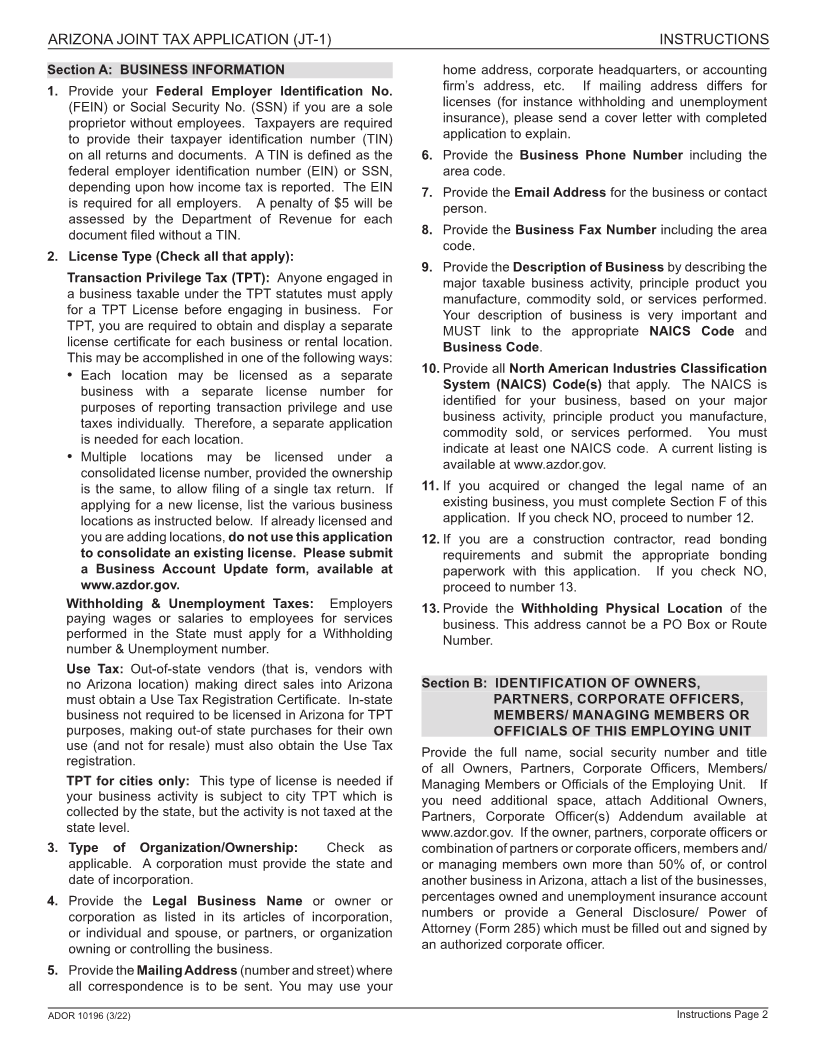

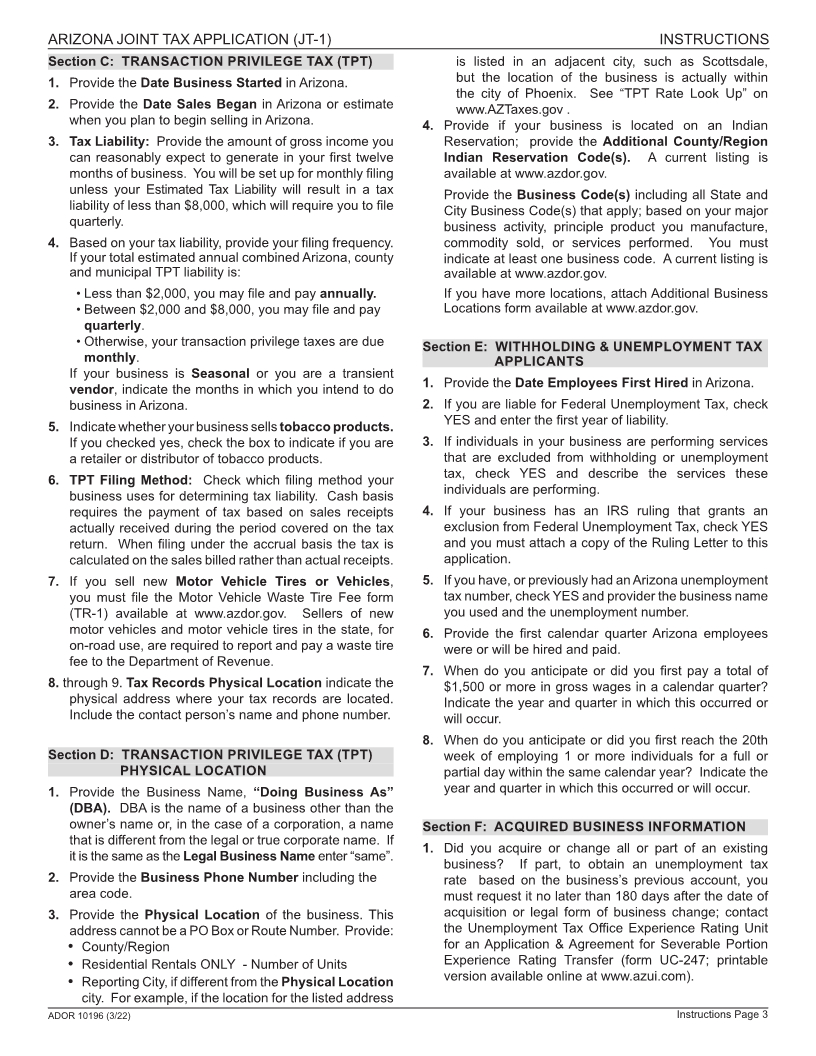

SECTION A: Business Information

1* Federal Employer Identification Number 2* License Type – Check all that apply:

or Social Security Number, required if sole proprietor

with no employees Transaction Privilege Tax (TPT) Use Tax

Withholding/Unemployment Tax (if hiring employees) TPT for Cities ONLY

3* Type of Organization/Ownership – Tax exempt organizations must attach a copy of the Internal Revenue Service’s letter of determination.

Individual/Sole Proprietorship Subchapter S Corporation Government Joint Venture

Corporation Association Estate Receivership

State of Inc. Partnership Trust

Date of Inc. M M D D Y Y Y Y Limited Liability Company Limited Liability Partnership

4* Legal Business Name

5* Mailing Address – number and street City State ZIP Code

| | |

County/Region Country

6* Business Phone No. (with area code) 7 Email Address 8 Fax Number (with area code)

9* Description of Business: Describe merchandise sold or taxable activity.

10* NAICS Codes: Available at www.azdor.gov

11* Did you acquire or change the legal form of an existing business? 12* Are you a construction contractor?

No Yes You must complete Section F. No Yes (see bonding requirements)

BONDING REQUIREMENTS: Prior to the issuance of a Transaction Privilege Tax license, new or out-of-state contractors are required to post a Taxpayer Bond for

Contractors unless the contractor qualifies for an exemption from the bonding requirement. The primary type of contracting being performed determines the amount of bond

to be posted. Bonds may also be required from applicants who are delinquent in paying Arizona taxes or have a history of delinquencies. Refer to the publication, Taxpayer

Bonds, available online at www.azdor.gov or in Arizona Department of Revenue offices.

WITHHOLDING LICENSE ONLY

13* Withholding Physical Location City State ZIP Code

Number and street (Do not use PO Box, PMB or route numbers)

| | |

County/Region Country

Continued on page 2

FOR AGENCY USE ONLY CASHIER’S STAMP ONLY. DO NOT MARK IN THIS AREA.

ACCOUNT NUMBER DLN

New START TRANSACTION PRIVILEGE TAX

Change S/E DATE WITHHOLDING / SSN / EIN

Revise COMPLETED DATE EMPLOYEE’S NAME

Reopen LIABILITY LIABILITY ESTABLISHED

ADOR 10196 (3/22)