Enlarge image

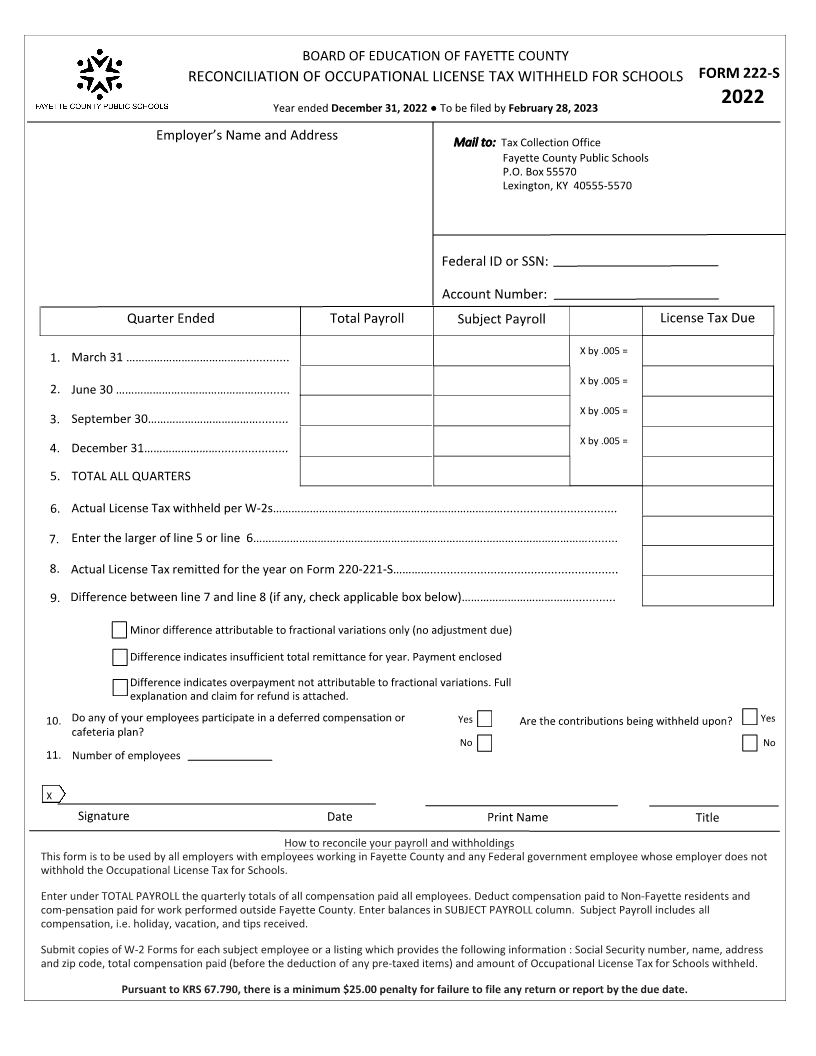

BOARD OF EDUCATION OF FAYETTE COUNTY

RECONCILIATION OF OCCUPATIONAL LICENSE TAX WITHHELD FOR SCHOOLS FORM 222-S

Year ended December 31, 2022 ● To be filed by February 28, 2023 2022

Employer’s Name and Address Mail to: Tax Collection Office

Fayette County Public Schools

P.O. Box 55570

Lexington, KY 40555-5570

Federal ID or SSN:

Account Number:

Quarter Ended Total Payroll Subject Payroll License Tax Due

X by .005 =

1. March 31 ………………………………….............

X by .005 =

2. June 30 …………………………………………........

X by .005 =

3. September 30……………………………….........

X by .005 =

4. December 31…………………….....................

5. TOTAL ALL QUARTERS

6. Actual License Tax withheld per W-2s…………………………………………………………………..................................

7. Enter the larger of line 5 or line 6………………………………………………………………….…………………………….........

8. Actual License Tax remitted for the year on Form 220-221-S…………........................................................

9. Difference between line 7 and line 8 (if any, check applicable box below)……………………………….............

Minor difference attributable to fractional variations only (no adjustment due)

Difference indicates insufficient total remittance for year. Payment enclosed

Difference indicates overpayment not attributable to fractional variations. Full

explanation and claim for refund is attached.

10. Do any of your employees participate in a deferred compensation or Yes Are the contributions being withheld upon? Yes

cafeteria plan?

No No

11. Number of employees

X

Signature Date Print Name Title

How to reconcile your payroll and withholdings

This form is to be used by all employers with employees working in Fayette County and any Federal government employee whose employer does not

withhold the Occupational License Tax for Schools.

Enter under TOTAL PAYROLL the quarterly totals of all compensation paid all employees. Deduct compensation paid to Non-Fayette residents and

com-pensation paid for work performed outside Fayette County. Enter balances in SUBJECT PAYROLL column. Subject Payroll includes all

compensation, i.e. holiday, vacation, and tips received.

Submit copies of W-2 Forms for each subject employee or a listing which provides the following information : Social Security number, name, address

and zip code, total compensation paid (before the deduction of any pre-taxed items) and amount of Occupational License Tax for Schools withheld.

Pursuant to KRS 67.790, there is a minimum $25.00 penalty for failure to file any return or report by the due date.