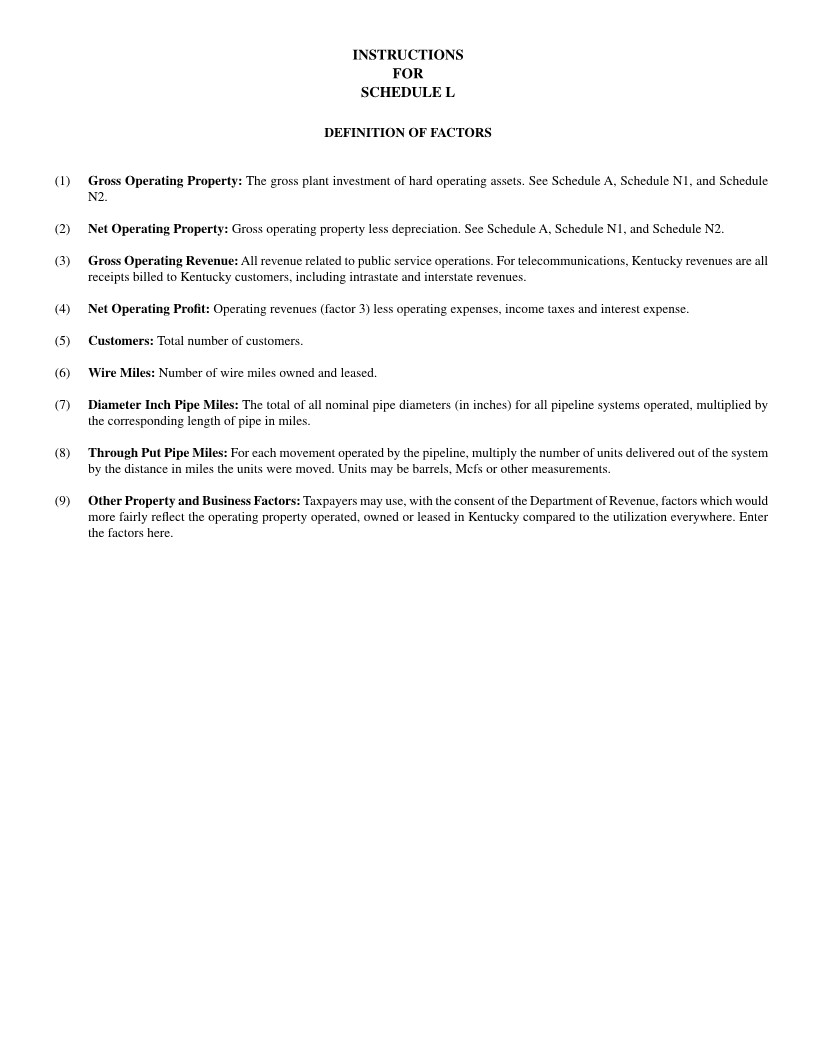

- 3 -

Enlarge image

|

The Kentucky Department of Revenue has made all returns and schedules available on the newly created web site —

www.revenue.ky.gov .

All public service companies should download the general PSC packet (Form 61A200(P)). Taxpayers who take advantage

of this service can save the Commonwealth of Kentucky significant budget resources, resources that can then be spent on

other taxpayer needs.

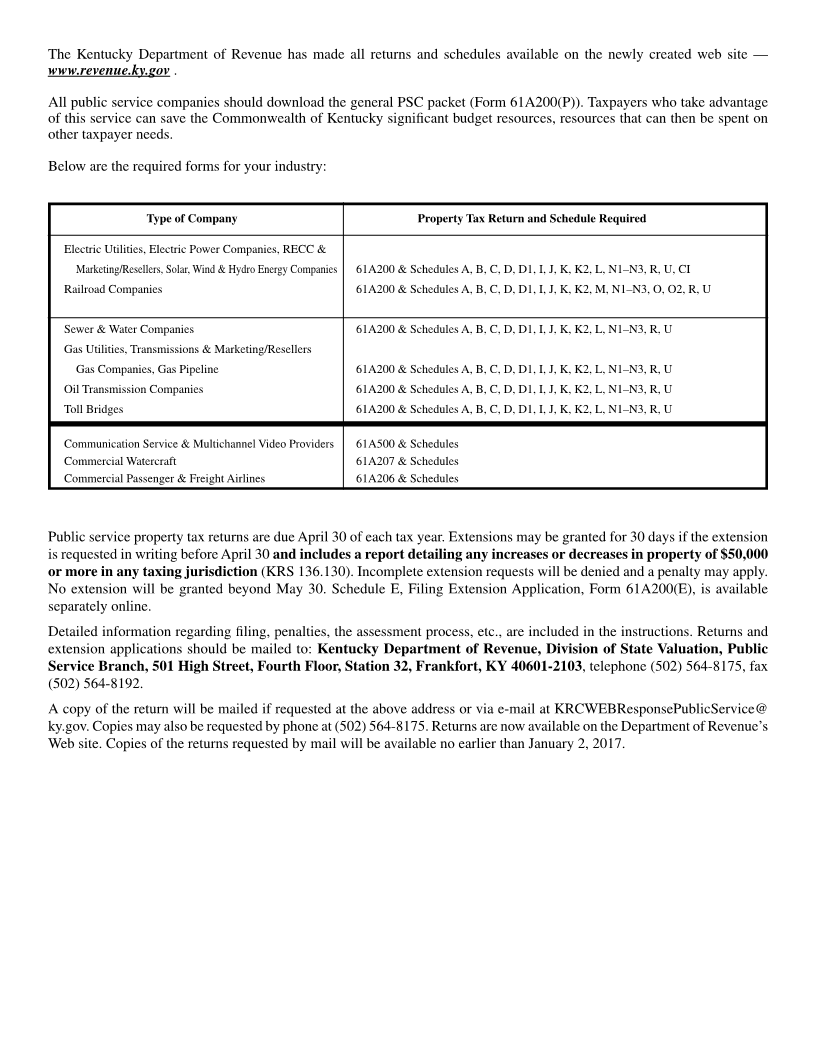

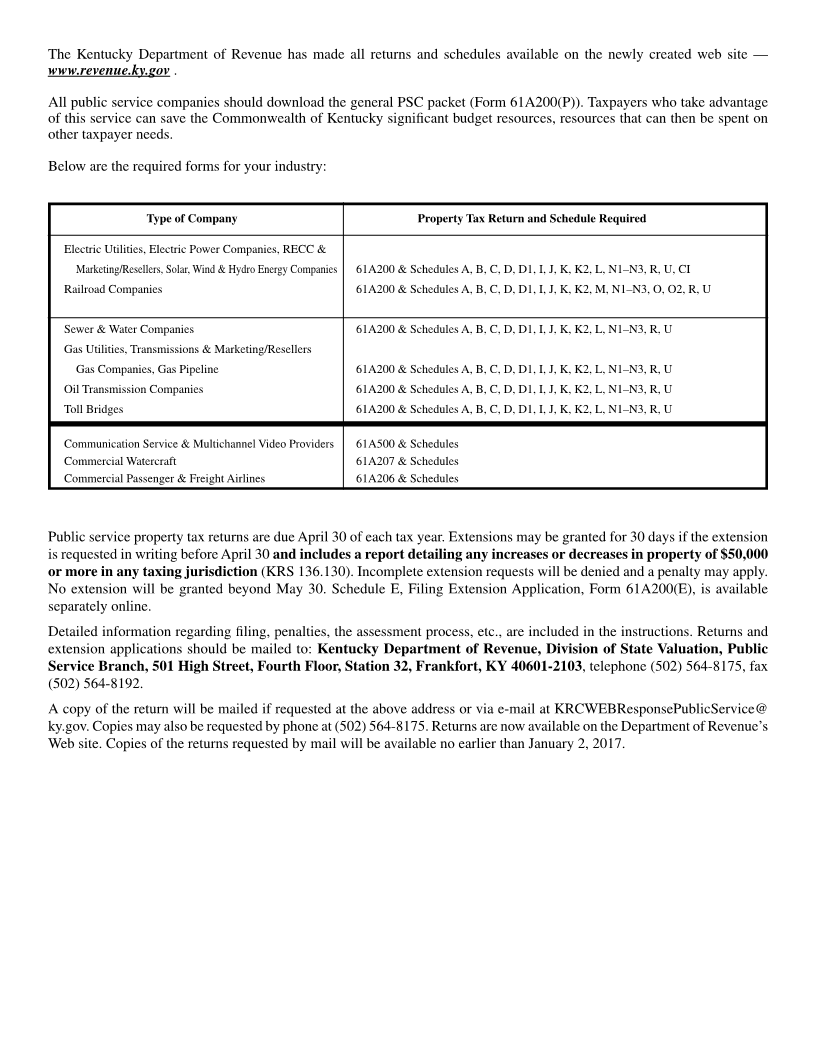

Below are the required forms for your industry:

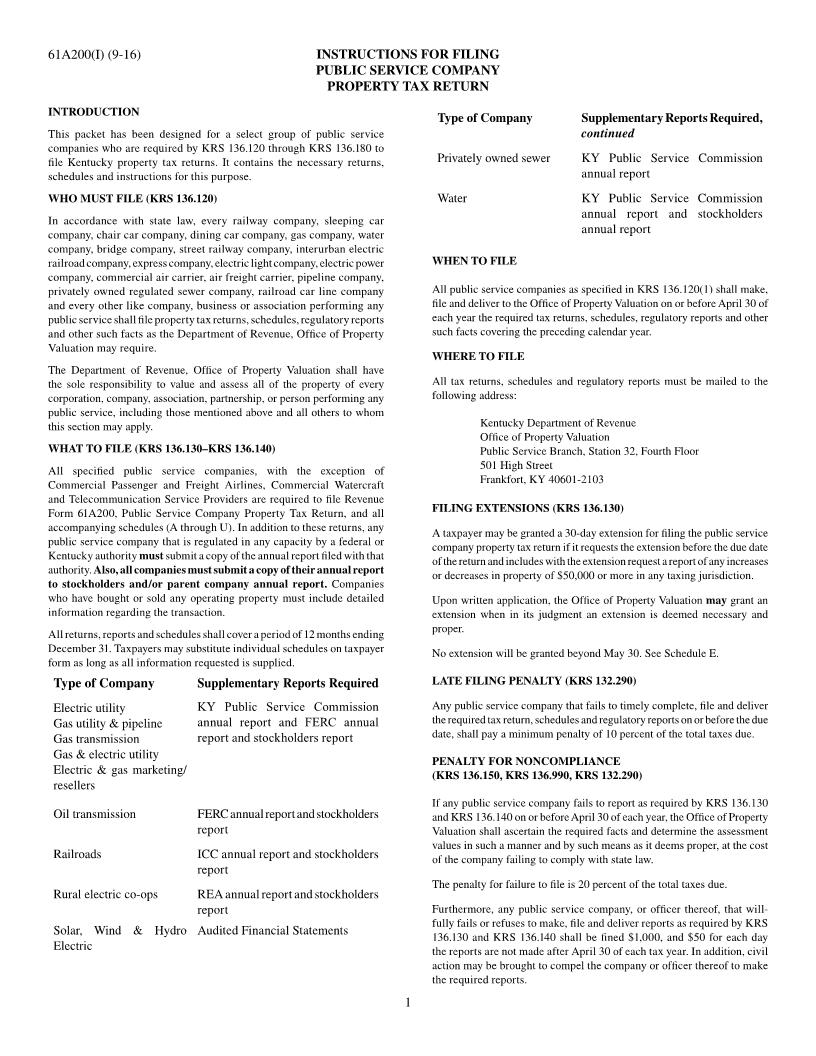

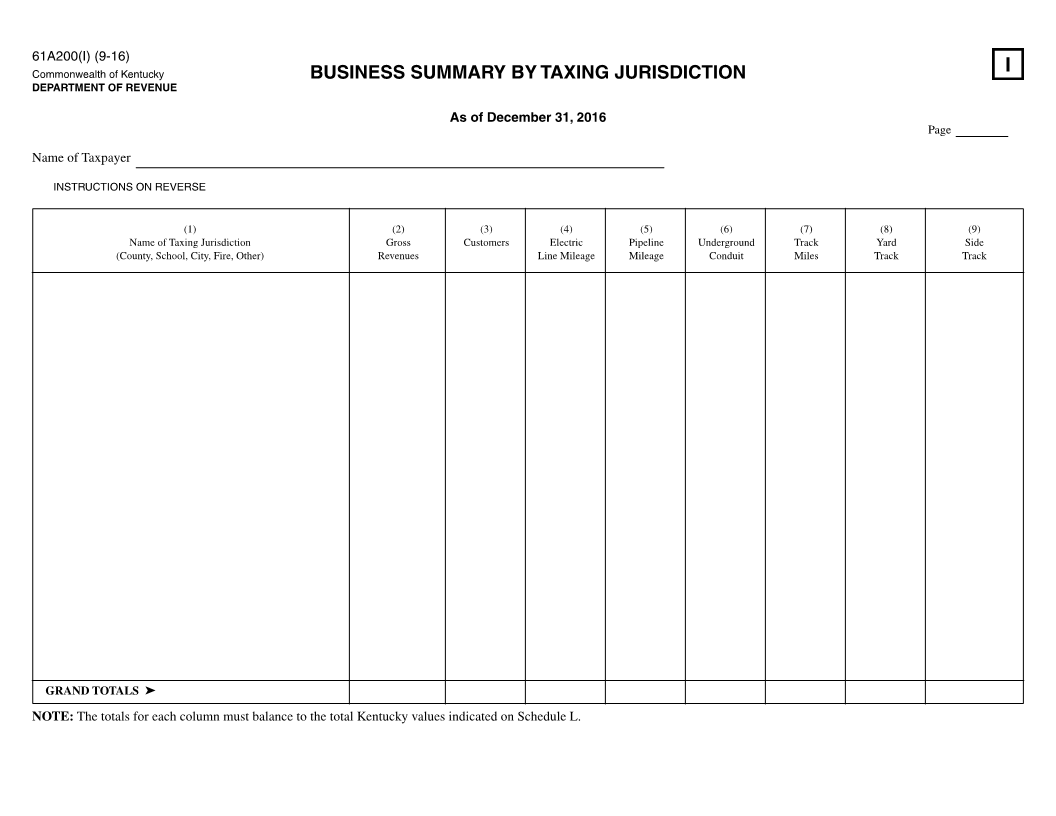

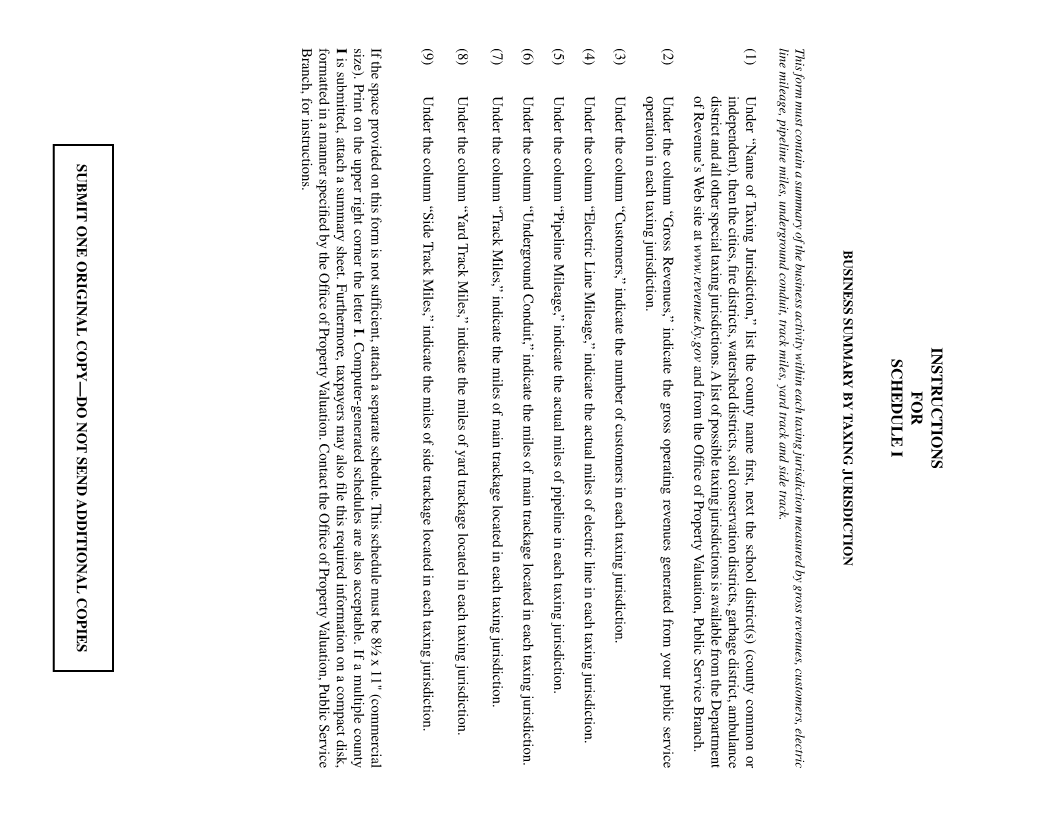

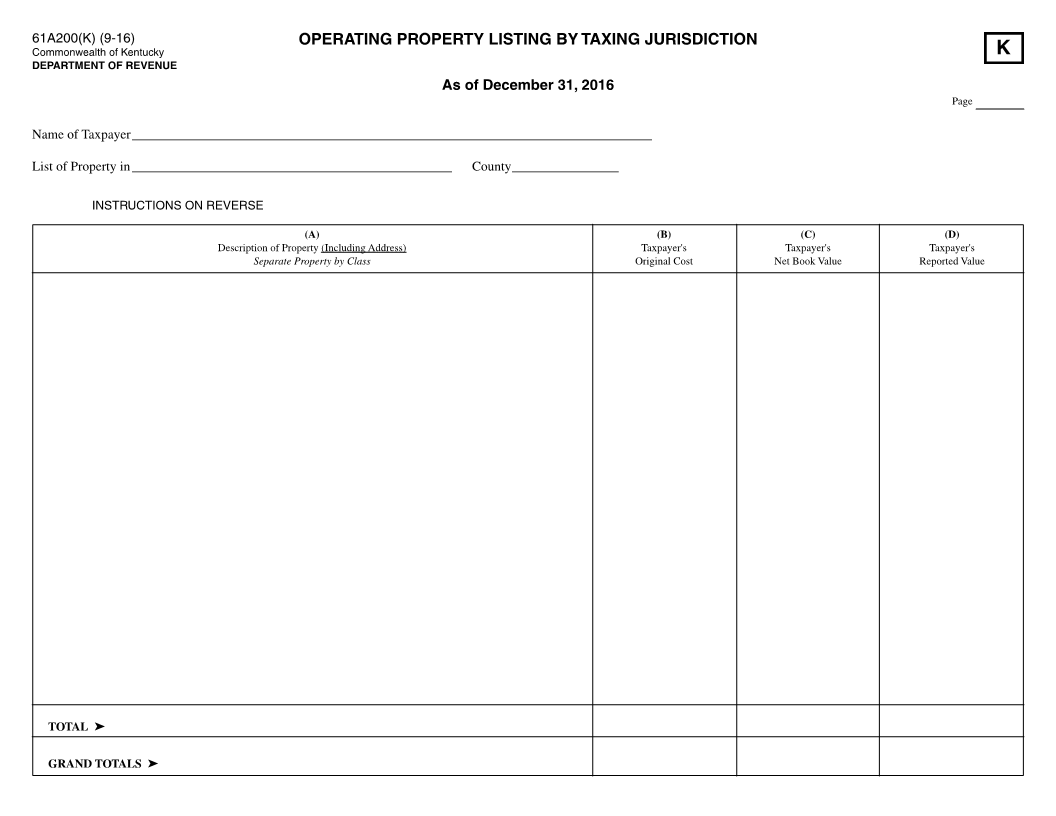

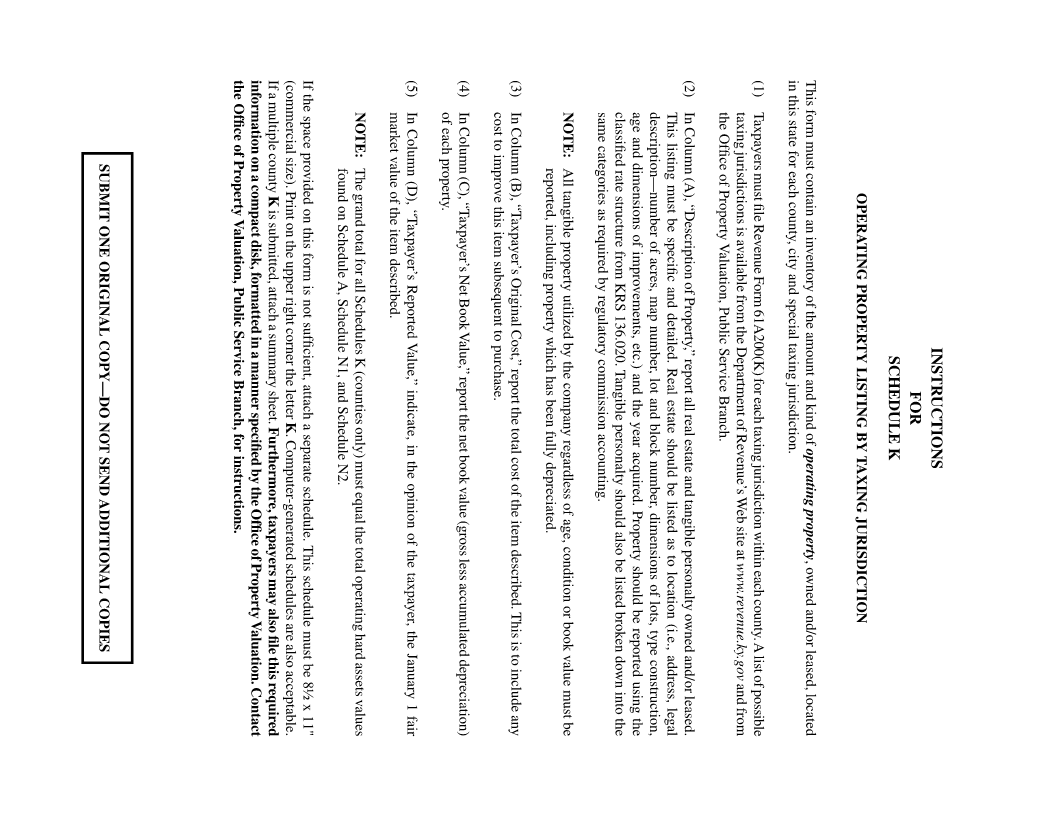

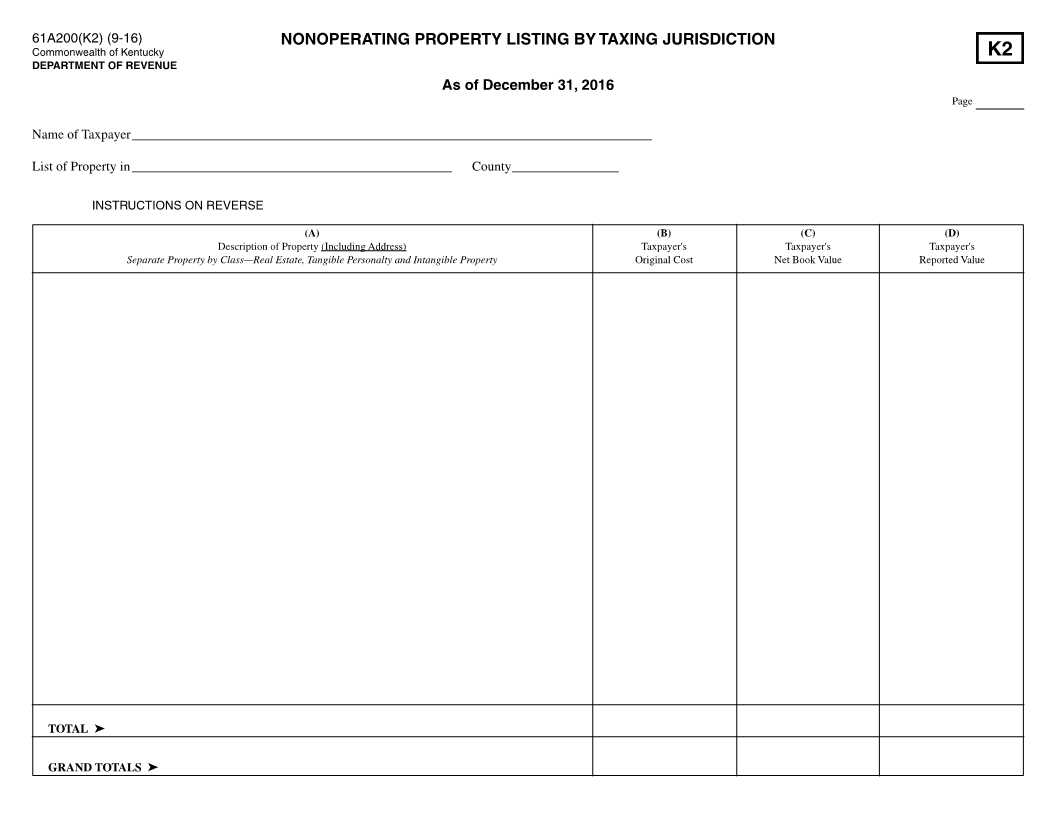

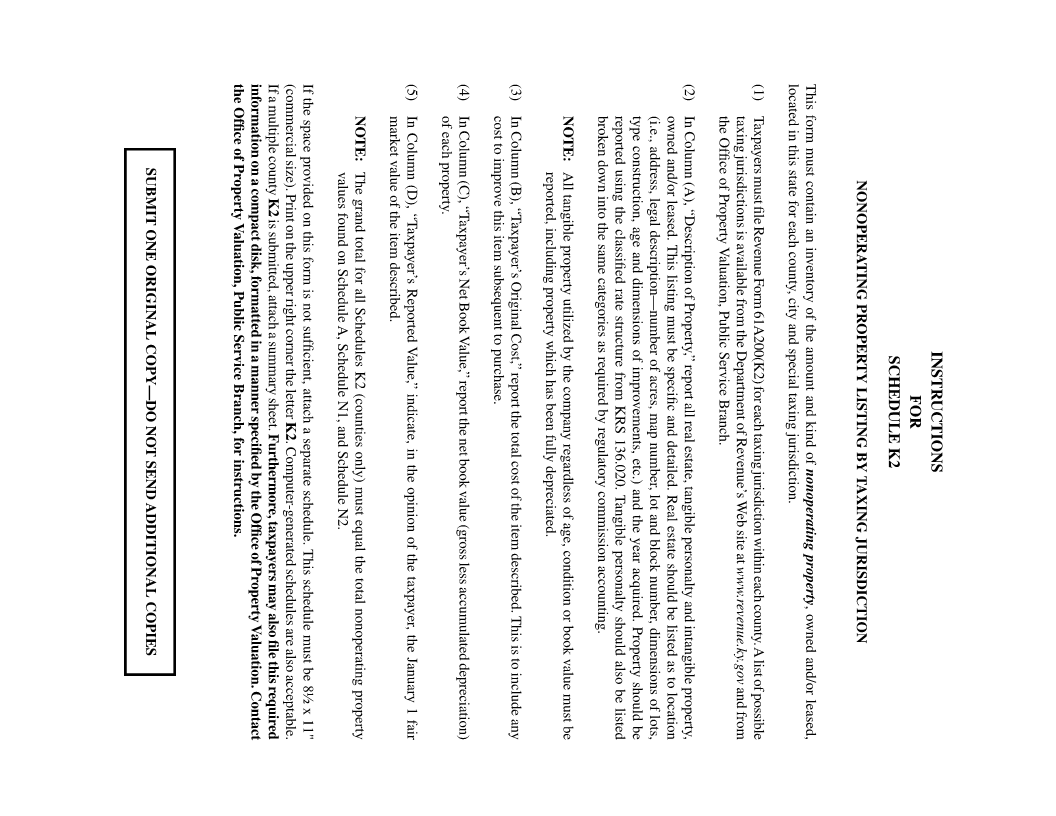

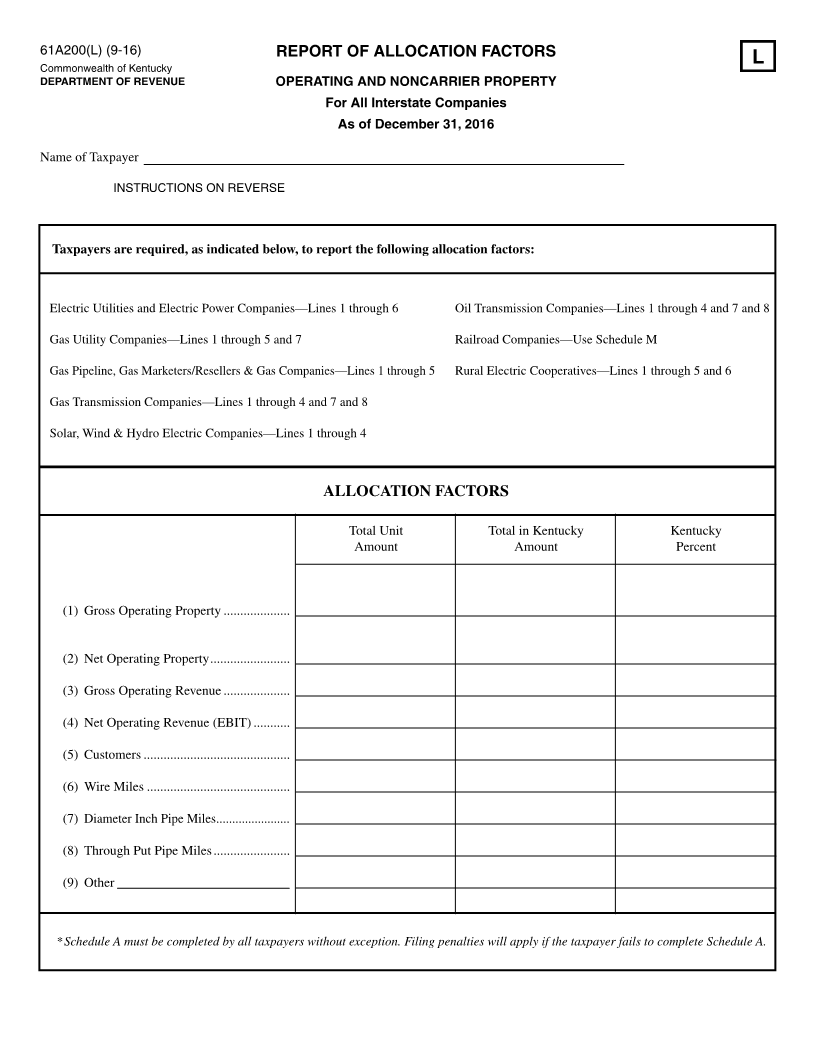

Type of Company Property Tax Return and Schedule Required

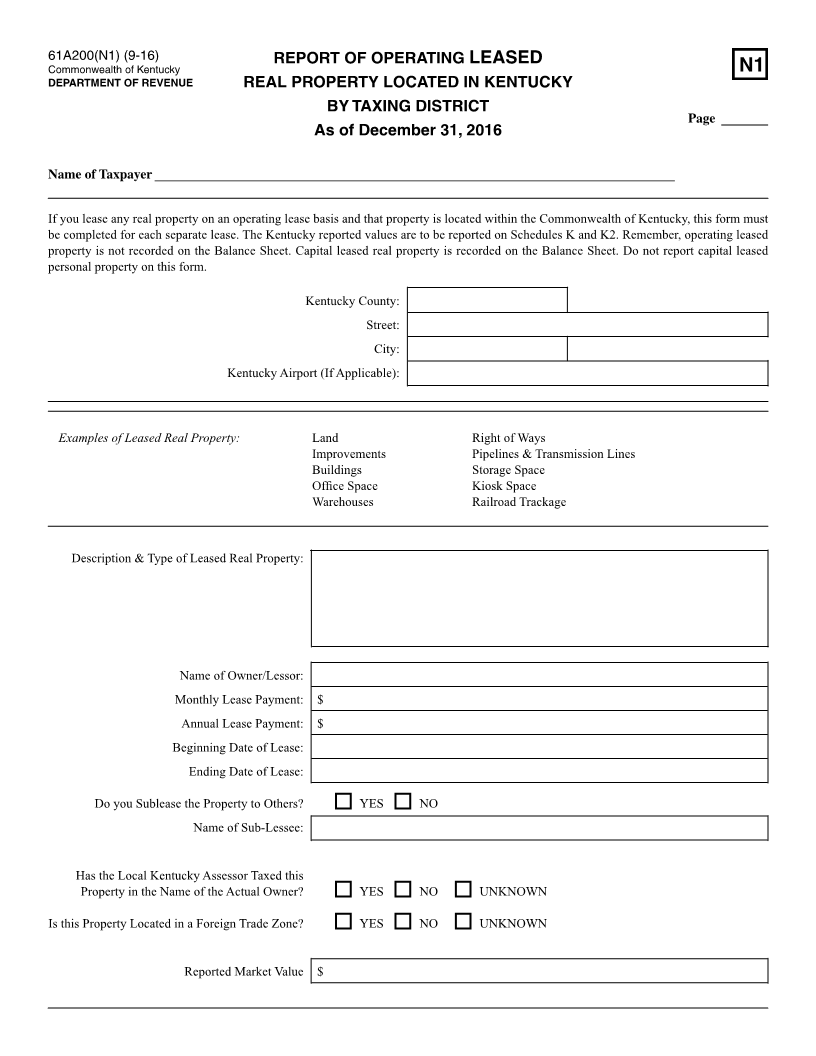

Electric Utilities, Electric Power Companies, RECC &

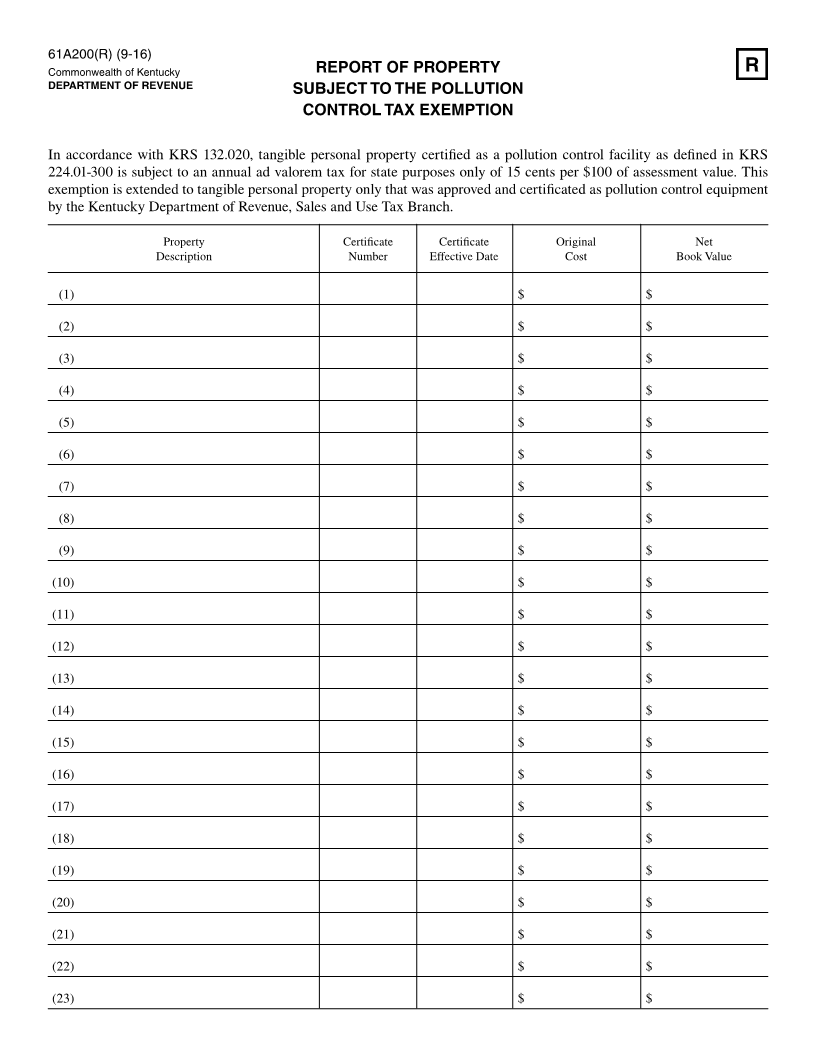

Marketing/Resellers, Solar, Wind & Hydro Energy Companies 61A200 & Schedules A, B, C, D, D1, I, J, K, K2, L, N1–N3, R, U, CI

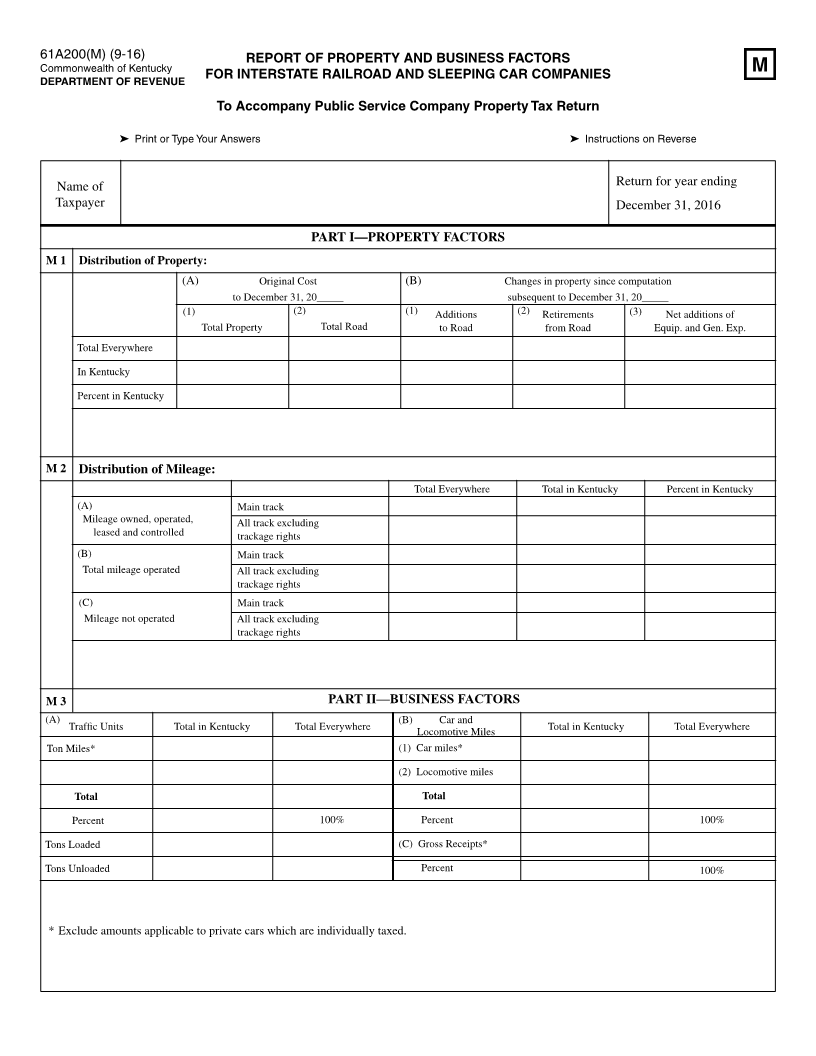

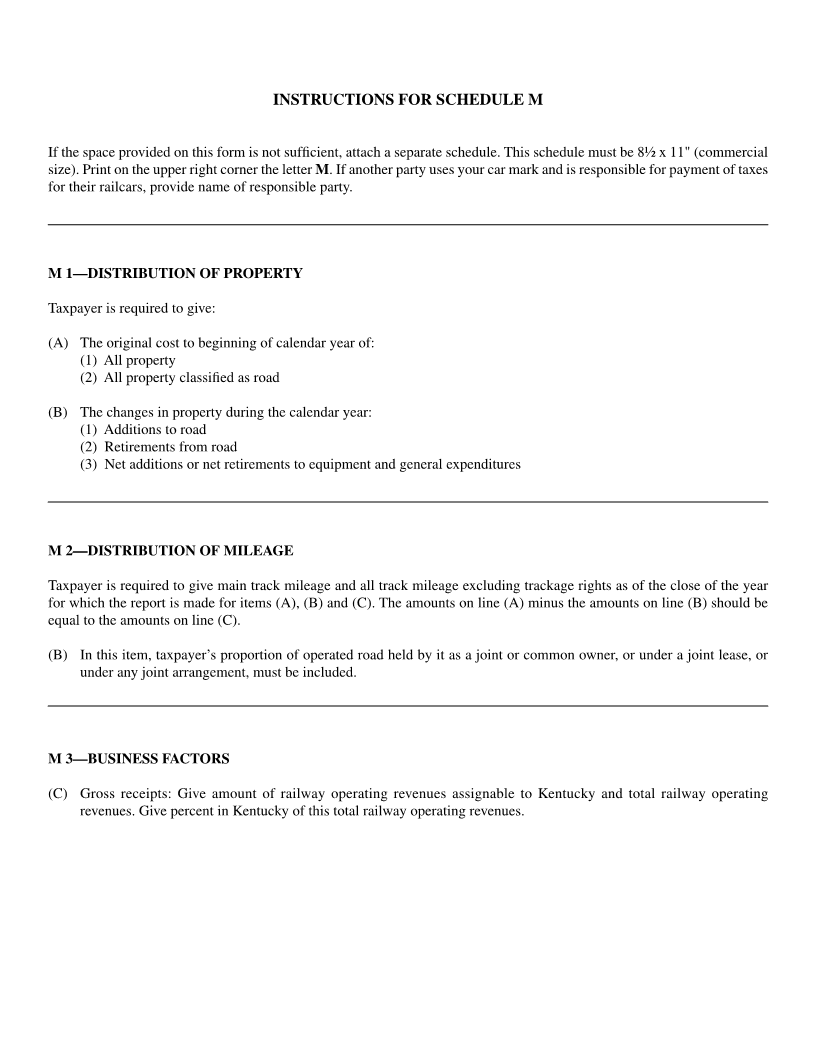

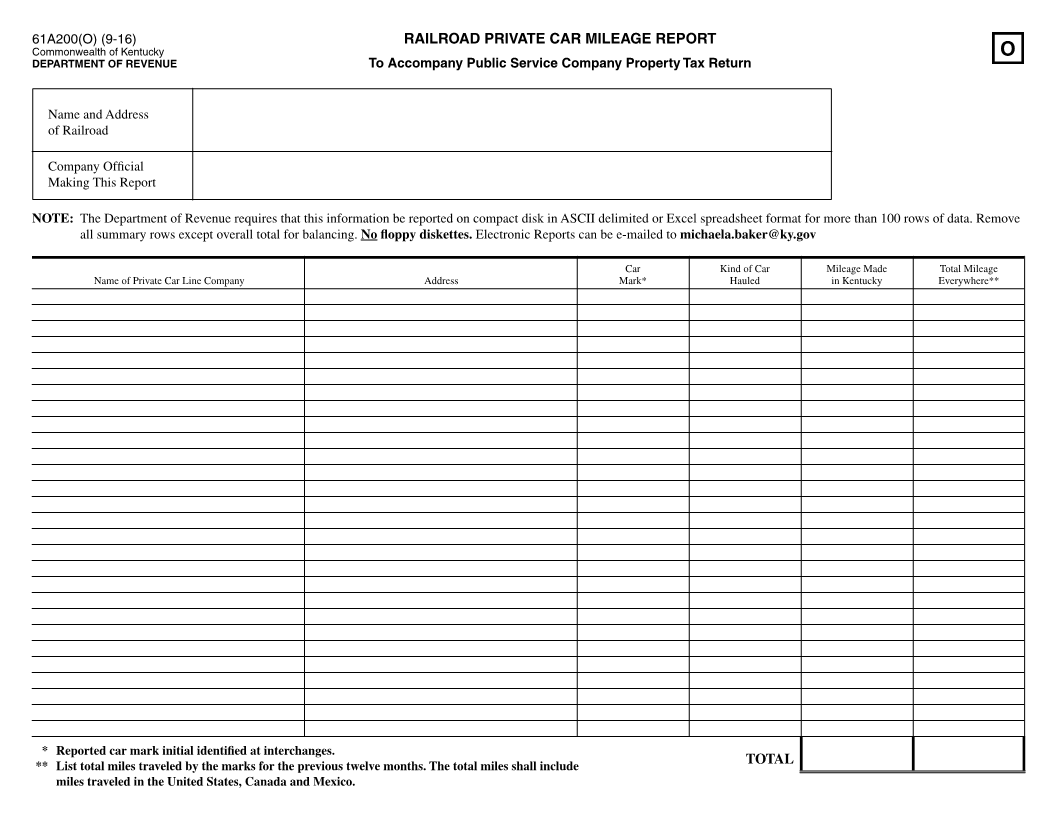

Railroad Companies 61A200 & Schedules A, B, C, D, D1, I, J, K, K2, M, N1–N3, O, O2, R, U

Sewer & Water Companies 61A200 & Schedules A, B, C, D, D1, I, J, K, K2, L, N1–N3, R, U

Gas Utilities, Transmissions & Marketing/Resellers

Gas Companies, Gas Pipeline 61A200 & Schedules A, B, C, D, D1, I, J, K, K2, L, N1–N3, R, U

Oil Transmission Companies 61A200 & Schedules A, B, C, D, D1, I, J, K, K2, L, N1–N3, R, U

Toll Bridges 61A200 & Schedules A, B, C, D, D1, I, J, K, K2, L, N1–N3, R, U

Communication Service & Multichannel Video Providers 61A500 & Schedules

Commercial Watercraft 61A207 & Schedules

Commercial Passenger & Freight Airlines 61A206 & Schedules

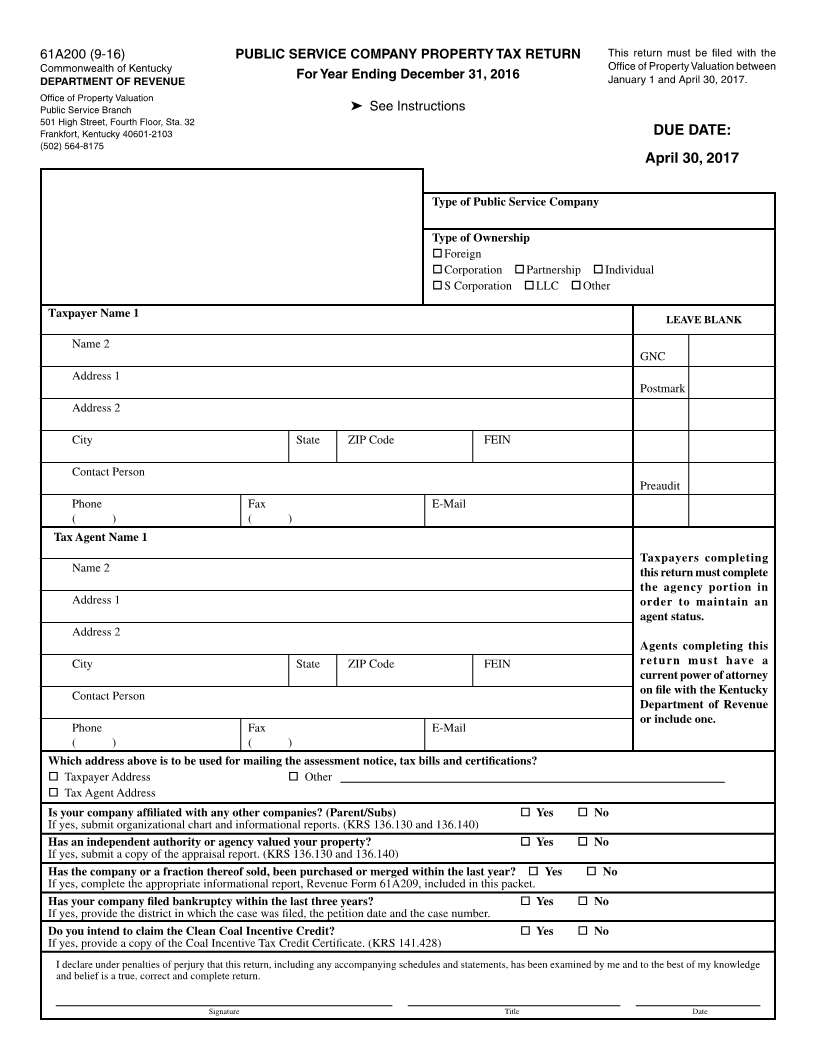

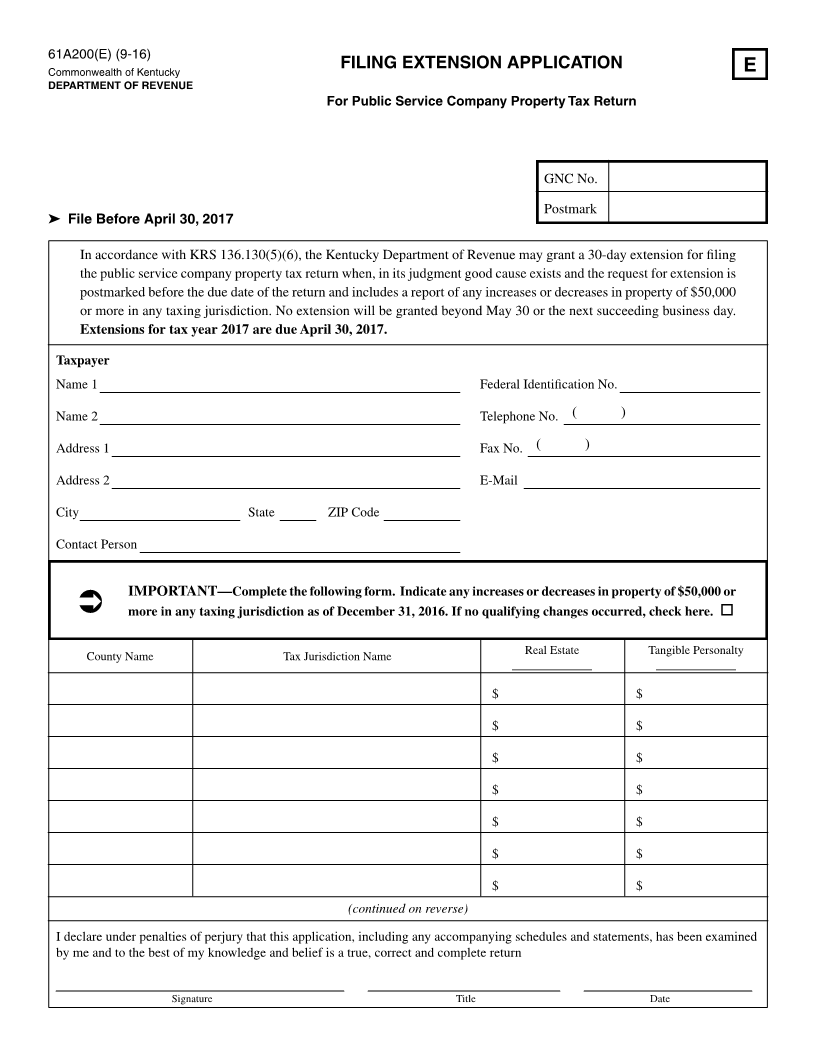

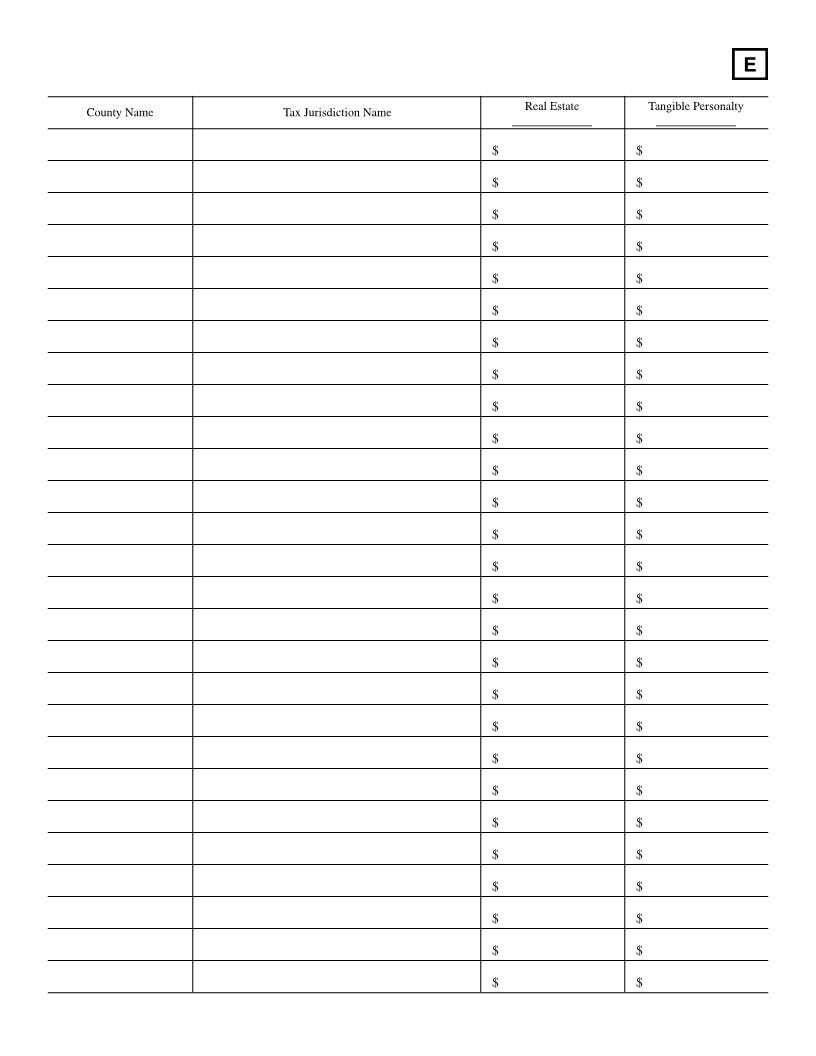

Public service property tax returns are due April 30of each tax year. Extensions may be granted for 30 days if the extension

is requested in writing before April 30 and includes a report detailing any increases or decreases in property of $50,000

or more in any taxing jurisdiction (KRS 136.130). Incomplete extension requests will be denied and a penalty may apply.

No extension will be granted beyond May 30. Schedule E, Filing Extension Application, Form 61A200(E), is available

separately online.

Detailed information regarding filing, penalties, the assessment process, etc., are included in the instructions. Returns and

extension applications should be mailed to: Kentucky Department of Revenue, Division of State Valuation, Public

Service Branch, 501 High Street, Fourth Floor, Station 32, Frankfort, KY 40601-2103, telephone (502) 564-8175, fax

(502) 564-8192.

A copy of the return will be mailed if requested at the above address or via e-mail at KRCWEBResponsePublicService@

ky.gov. Copies may also be requested by phone at (502) 564-8175. Returns are now available on the Department of Revenue’s

Web site. Copies of the returns requested by mail will be available no earlier than January 2, 2017.

|