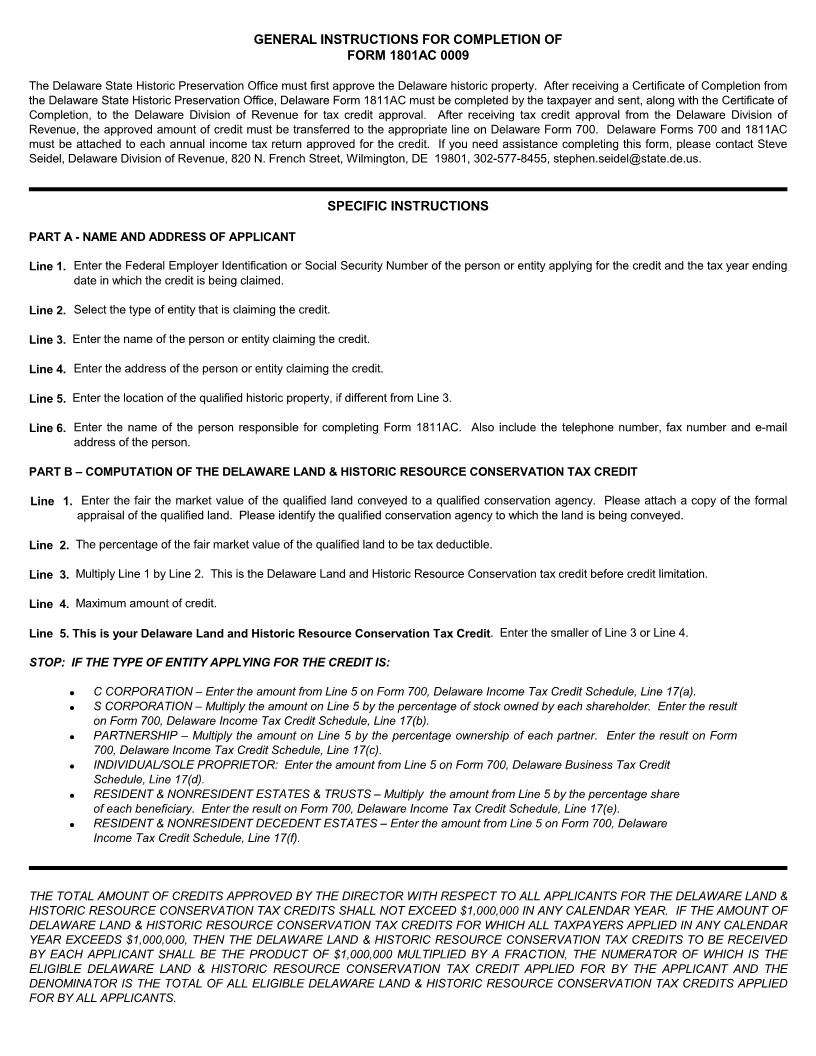

Enlarge image

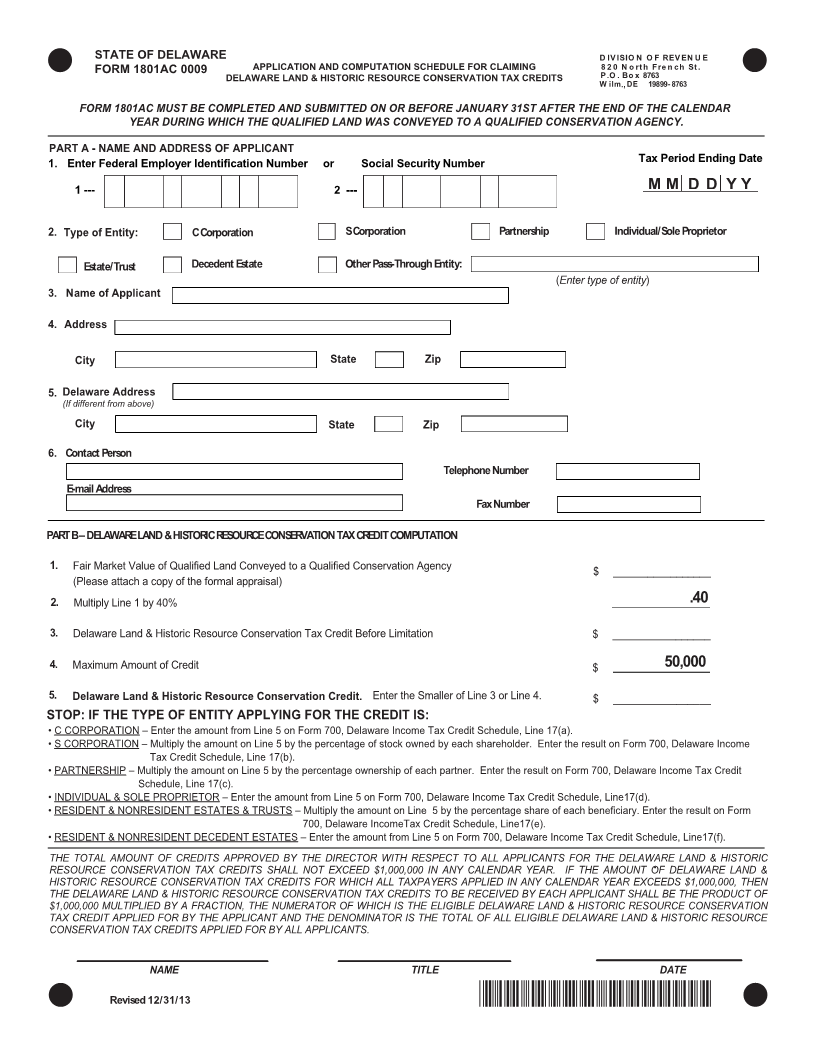

STATE OF DELAWARE DIVISION OF REVENUE

FORM 1801AC 0009 APPLICATION AND COMPUTATION SCHEDULE FOR CLAIMING 820 North French St.

P.O. Box 8763

DELAWARE LAND & HISTORIC RESOURCE CONSERVATION TAX CREDITS Wilm DE., 19899-8763

FORM 1801AC MUST BE COMPLETED AND SUBMITTED ON OR BEFORE JANUARY 31ST AFTER THE END OF THE CALENDAR

YEAR DURING WHICH THE QUALIFIED LAND WAS CONVEYED TO A QUALIFIED CONSERVATION AGENCY.

PART A - NAME AND ADDRESS OF APPLICANT

1. Enter Federal Employer Identification Number or Social Security Number Tax Period Ending Date

1 --- 2 ---

2. Type of Entity: CCorporation SCorporation Partnership Individual/Sole Proprietor

Estate/Trust DecedentEstate OtherPass-Through Entity:

(Enter typeof entity)

3. Name of Applicant

4. Address

City State Zip

5. Delaware Address

(If different from above)

City State Zip

6. ContactPerson

TelephoneNumber

E-mailAddress

FaxNumber

PARTB – DELAWARELAND &HISTORICRESOURCECONSERVATIONTAXCREDITCOMPUTATION

1. FairMarket Valueof QualifiedLandConveyed toaQualifiedConservationAgency $ _________________

(Pleaseattachacopyoftheformalappraisal)

2. MultiplyLine1by40% .40

3. DelawareLand&HistoricResourceConservationTaxCredit BeforeLimitation $ _________________

4. MaximumAmount of Credit $ 50,000

5. Delaware Land & Historic Resource Conservation Credit. Enter theSmaller of Line3or Line4. $ _________________

STOP: IF THE TYPE OF ENTITY APPLYING FOR THE CREDIT IS:

• C CORPORATION – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line 17(a).

• S CORPORATION – Multiply the amount on Line 5 by the percentage of stock owned by each shareholder. Enter the result on Form 700, Delaware Income

Tax Credit Schedule, Line 17(b).

• PARTNERSHIP – Multiply the amount on Line 5 by the percentage ownership of each partner. Enter the result on Form 700, Delaware Income Tax Credit

Schedule, Line 17(c).

• INDIVIDUAL & SOLE PROPRIETOR – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line17(d).

• RESIDENT & NONRESIDENT ESTATES & TRUSTS – Multiply the amount on Line 5 by the percentage share of each beneficiary. Enter the result on Form

700, Delaware IncomeTax Credit Schedule, Line17(e).

• RESIDENT & NONRESIDENT DECEDENT ESTATES – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line17(f).

THE TOTAL AMOUNT OF CREDITS APPROVED BY THE DIRECTOR WITH RESPECT TO ALL APPLICANTS FOR THE DELAWARE LAND & HISTORIC

RESOURCE CONSERVATION TAX CREDITS SHALL NOT EXCEED $1,000,000 IN ANY CALENDAR YEAR. IF THE AMOUNT OF DELAWARE LAND &

HISTORIC RESOURCE CONSERVATION TAX CREDITS FOR WHICH ALL TAXPAYERS APPLIED IN ANY CALENDAR YEAR EXCEEDS $1,000,000, THEN

THE DELAWARE LAND& HISTORICRESOURCE CONSERVATIONTAX CREDITS TOBE RECEIVEDBY EACHAPPLICANTSHALLBETHEPRODUCTOF

$1,000,000 MULTIPLIED BY A FRACTION, THE NUMERATOR OF WHICH IS THE ELIGIBLE DELAWARE LAND & HISTORIC RESOURCE CONSERVATION

TAX CREDIT APPLIEDFORBY THE APPLICANT ANDTHE DENOMINATORIS THE TOTALOFALLELIGIBLE DELAWARE LAND& HISTORICRESOURCE

CONSERVATIONTAXCREDITSAPPLIEDFORBYALLAPPLICANTS.

NAME TITLE DATE

Revised12/31/13 *DF41713019999*