Enlarge image

PRINT

1100CR

RESET

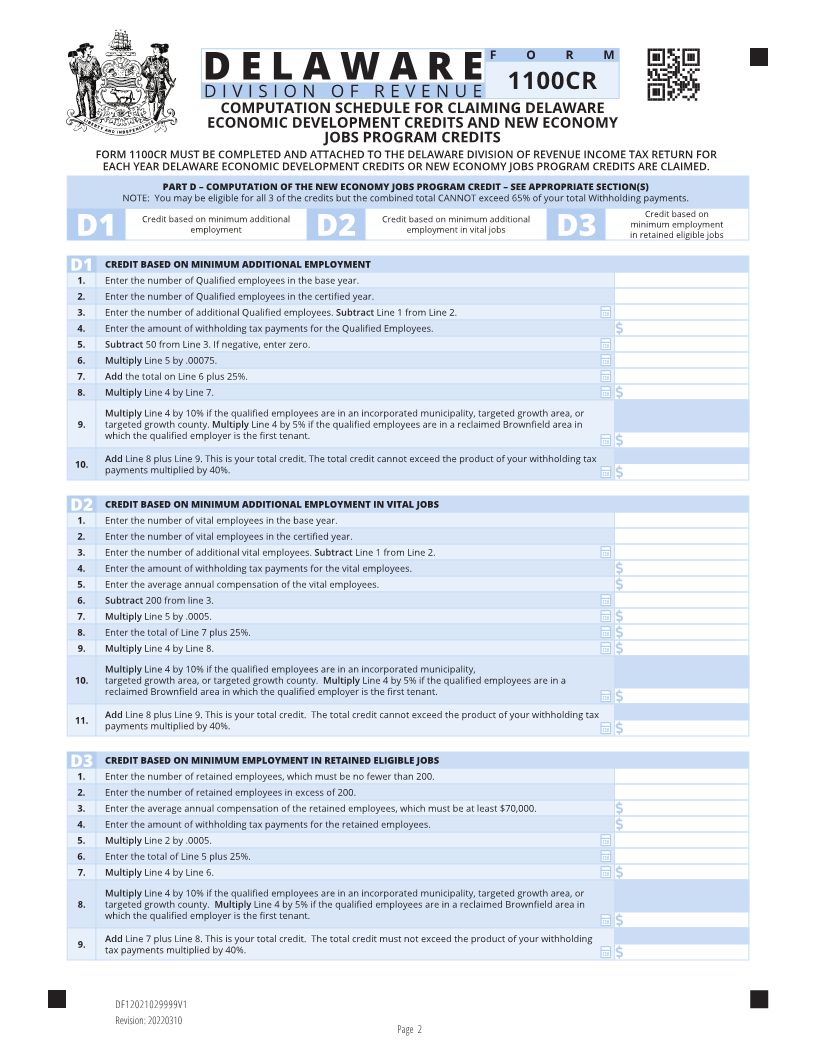

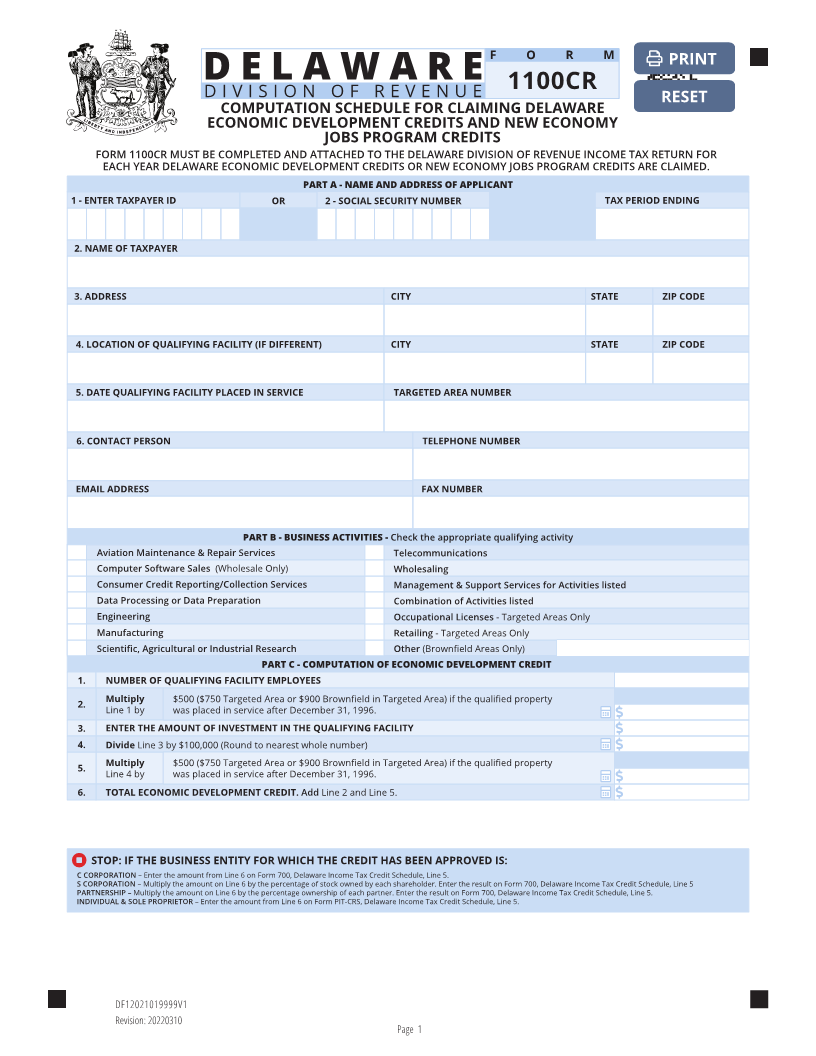

COMPUTATION SCHEDULE FOR CLAIMING DELAWARE

ECONOMIC DEVELOPMENT CREDITS AND NEW ECONOMY

JOBS PROGRAM CREDITS

FORM 1100CR MUST BE COMPLETED AND ATTACHED TO THE DELAWARE DIVISION OF REVENUE INCOME TAX RETURN FOR

EACH YEAR DELAWARE ECONOMIC DEVELOPMENT CREDITS OR NEW ECONOMY JOBS PROGRAM CREDITS ARE CLAIMED.

PART A - NAME AND ADDRESS OF APPLICANT

1 - ENTER TAXPAYER ID OR 2 - SOCIAL SECURITY NUMBER TAX PERIOD ENDING

2. NAME OF TAXPAYER

3. ADDRESS CITY STATE ZIP CODE

4. LOCATION OF QUALIFYING FACILITY (IF DIFFERENT) CITY STATE ZIP CODE

5. DATE QUALIFYING FACILITY PLACED IN SERVICE TARGETED AREA NUMBER

6. CONTACT PERSON TELEPHONE NUMBER

EMAIL ADDRESS FAX NUMBER

PART B - BUSINESS ACTIVITIES - Check the appropriate qualifying activity

Aviation Maintenance & Repair Services Telecommunications

Computer Software Sales (Wholesale Only) Wholesaling

Consumer Credit Reporting/Collection Services Management & Support Services for Activities listed

Data Processing or Data Preparation Combination of Activities listed

Engineering Occupational Licenses - Targeted Areas Only

Manufacturing Retailing - Targeted Areas Only

Scientific, Agricultural or Industrial Research Other (Brownfield Areas Only)

PART C - COMPUTATION OF ECONOMIC DEVELOPMENT CREDIT

1. NUMBER OF QUALIFYING FACILITY EMPLOYEES

2. Multiply $500 ($750 Targeted Area or $900 Brownfield in Targeted Area) if the qualified property

Line 1 by was placed in service after December 31, 1996.

3. ENTER THE AMOUNT OF INVESTMENT IN THE QUALIFYING FACILITY

4. Divide Line 3 by $100,000 (Round to nearest whole number)

5. Multiply $500 ($750 Targeted Area or $900 Brownfield in Targeted Area) if the qualified property

Line 4 by was placed in service after December 31, 1996.

6. TOTAL ECONOMIC DEVELOPMENT CREDIT. Add Line 2 and Line 5.

STOP: IF THE BUSINESS ENTITY FOR WHICH THE CREDIT HAS BEEN APPROVED IS:

C CORPORATION – Enter the amount from Line 6 on Form 700, Delaware Income Tax Credit Schedule, Line 5.

S CORPORATION – Multiply the amount on Line 6 by the percentage of stock owned by each shareholder. Enter the result on Form 700, Delaware Income Tax Credit Schedule, Line 5

PARTNERSHIP – Multiply the amount on Line 6 by the percentage ownership of each partner. Enter the result on Form 700, Delaware Income Tax Credit Schedule, Line 5.

INDIVIDUAL & SOLE PROPRIETOR – Enter the amount from Line 6 on Form PIT-CRS, Delaware Income Tax Credit Schedule, Line 5.

DF12021019999V1

Revision: 20220310

Page 1