Enlarge image

42A740-S4 (10-16)

INSTRUCTIONS FOR FILING

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

ESTIMATED TAX VOUCHERS 2017

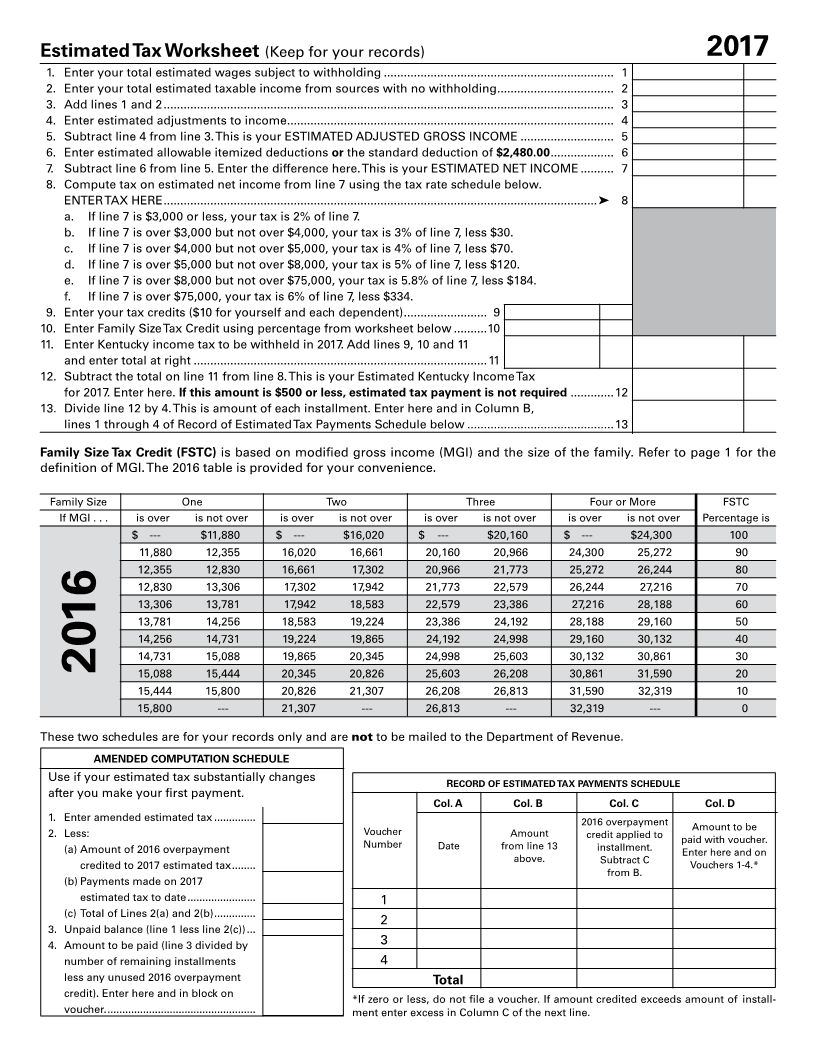

WHAT’S NEW FOR 2017—The standard deduction will increase FAMILY SIZE TAX CREDIT—The Family Size Tax Credit is based

to $2,480.00 for 2017. Individuals who electronically file their on modified gross income (MGI) and the size of the family. If

return will now have the option to have their estimated tax your total MGI is $32,319 or less you may qualify for Kentucky

payment(s) debited from their bank account. Family Size Tax Credit.

“Modified gross income” used to calculate the Family Size Tax

WHO MUST MAKE PAYMENTS— Individuals who can

Credit means the greater of:

reasonably expect to have income of more than $5,000 from

which no Kentucky income tax will be withheld may be required Federal adjusted gross income adjusted to include interest

to make estimated tax payments as required by KRS 141.300. income derived from municipal bonds (non-Kentucky) and

Individuals who do not prepay at least 70 percent of their lump-sum pension distributions not included in federal

income tax liability for the year will be subject to a penalty for adjusted gross income;

underpayment of estimated tax. The prepayments may be made or

through withholding, a credit forward from the previous year’s

Kentucky adjusted gross income adjusted to include

income tax return or estimated tax payments. The worksheet

lump-sum pension distributions not included in federal

on the reverse should be used to determine the amount which

adjusted gross income.

should be paid through estimated tax payments. If the amount

of estimated tax for the year is $500 or less, no payment is PASS-THROUGH ENTITIES AND INDIVIDUAL OWNERS OF

required. DISREGARDED SINGLE MEMBER LLCs—For taxable years

beginning on or after January 1, 2007, all pass-through entities

WHEN TO PAY—Taxpayers may pay the full amount of estimated and individual owners of disregarded single member LLCs that

tax in one payment on the earliest applicable due date, or they file on Schedules C, E or F for federal income tax purposes will be

may pay in installments. Installments for calendar year 2017 treated the same for Kentucky income tax purposes as they are

are due April 18, June 15, September 15, 2017, and January treated for federal income tax purposes except for the differences

16, 2018. Any credit from a 2016 income tax return should be between Kentucky law and federal law. Individuals with income

applied to the amount owed before any payments are made. from pass-through entities or disregarded single member LLCs

Installment payments should not be made until the amount of that file Schedule C, E or F for federal income tax purposes may

the credit has been used. A voucher should be filed only when be required to make individual estimated tax payments.

a payment is required.

FARM INCOME—Taxpayers with income from farming are not

IF INCOME CHANGES—Due to changes in sources or amounts required to make installment payments if they meet the following

of income during the year, a taxpayer who is not required to criteria: (1) two-thirds of gross income is from farming; and (2)

pay estimated tax at the beginning of the year may be required the entire amount of estimated tax is paid on or before January

to pay during the year. A taxpayer may also be required to 16, 2018; or (3) the 2017 income tax return is filed and total tax

recompute the estimated tax and to adjust the amount of the is paid on or before March 1, 2018.

installments during the year as a result of changes in sources PENALTY FOR UNDERPAYMENT—A penalty equal to 10 percent

or amounts of income. Whenever the initial estimate is required of any underpayment may be assessed. The underpayment is

or the change occurs, a taxpayer electing to pay in installments calculated by taking 70 percent of the amount on Form 740, Line

must pay the total amount of tax due in equal amounts on the 26 (income tax liability) and subtracting taxes prepaid through

remaining due dates. a credit forward, withholding, estimated tax payments and

Period When refundable credits. Minimum penalty is $25.

Estimate Required Number of

or Change Occurs Due Date Equal Installments HOW TO USE ESTIMATED TAX VOUCHERS— Enter your

name, address and Social Security number(s) in the spaces

January 1–April 1 April 18, 2017 4 provided. In the payment block, enter the amount of payment. Do

not enter amounts paid through a credit from a previous year.

April 2–June 1 June 15, 2017 3

June 2–September 1 September 15, 2017 2 HOW TO PAY—Make check payable to Kentucky State

Treasurer. Mail the check with the voucher to: Kentucky

September 2–December 31* January 16, 2018 1 Department of Revenue, Frankfort, KY 40620-0009. To ensure

*If the change occurs after September 1, 2017, the voucher is not accurate crediting to your account, you must send the voucher

required if the 2017 Kentucky income tax return is filed and the tax with your check. Please write your Social Security number(s) on

shown to be due is paid on or before January 31, 2018. the face of your check. If you wish to mail your first installment

with Form 740, please prepare a separate check for the amount

Failure to make required estimated installments by the specified shown on the voucher and include the voucher marked

dates may result in interest due. “Installment 1.” If you file electronically you can now elect to

have your estimated tax payments debited from your bank

FISCAL YEAR FILERS—If you pay tax for a fiscal year instead account; see Form 8879-K for additional information. You may

of a calendar year, your due date is the 15th day of the fourth, authorize the Kentucky Department of Revenue to debit up to

sixth and ninth months of your fiscal year and the 15th day of all four of your installments on the dates due. This option must

the first month of the following fiscal year. be initiated at the time of filing.