Enlarge image

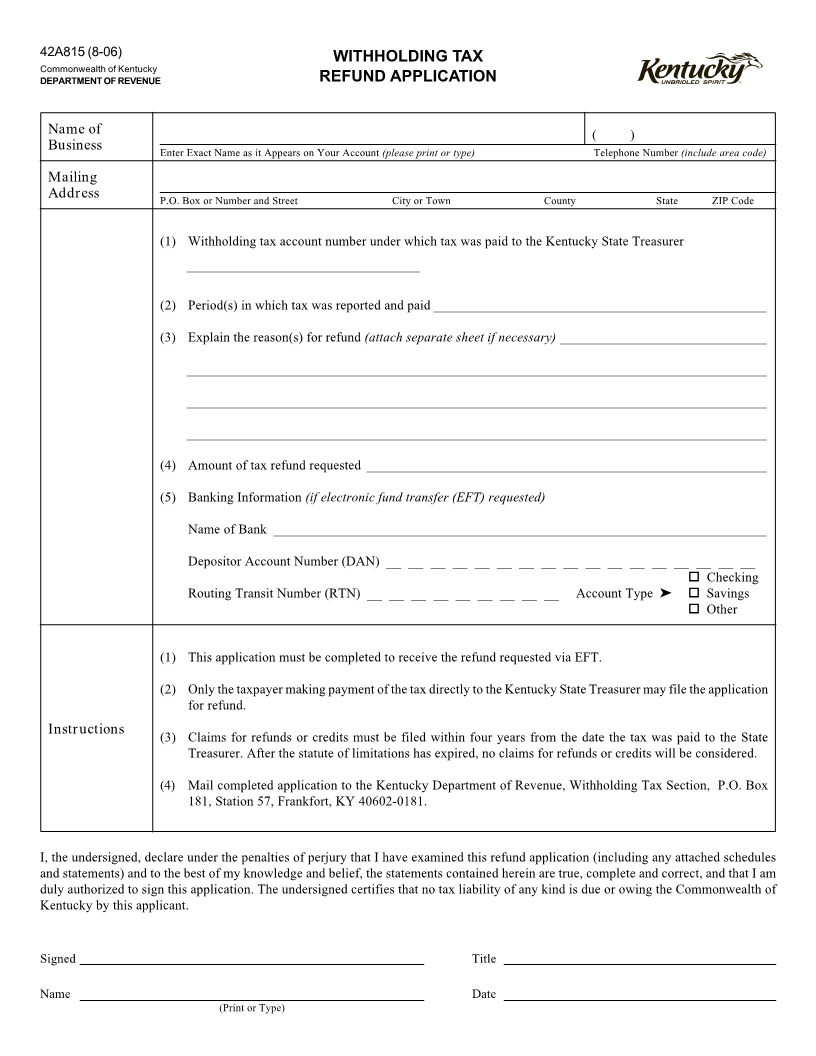

42A815 (8-06) WITHHOLDING TAX

Commonwealth of Kentucky

DEPARTMENT OF REVENUE REFUND APPLICATION

Name of ( )

Business Enter Exact Name as it Appears on Your Account (please print or type) Telephone Number (include area code)

Mailing

Address P.O. Box or Number and Street City or Town County State ZIP Code

(1) Withholding tax account number under which tax was paid to the Kentucky State Treasurer

___________________________________

(2) Period(s) in which tax was reported and paid__________________________________________________

(3) Explain the reason(s) for refund (attach separate sheet if necessary)_______________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

(4) Amount of tax refund requested ____________________________________________________________

(5) Banking Information (if electronic fund transfer (EFT) requested)

Name of Bank __________________________________________________________________________

Depositor Account Number (DAN) __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

Checking

Routing Transit Number (RTN) __ __ __ __ __ __ __ __ __ Account Type ➤ Savings

Other

(1) This application must be completed to receive the refund requested via EFT.

(2) Only the taxpayer making payment of the tax directly to the Kentucky State Treasurer may file the application

for refund.

Instructions

(3) Claims for refunds or credits must be filed within four years from the date the tax was paid to the State

Treasurer. After the statute of limitations has expired, no claims for refunds or credits will be considered.

(4) Mail completed application to the Kentucky Department of Revenue, Withholding Tax Section, P.O. Box

181, Station 57, Frankfort, KY 40602-0181.

I, the undersigned, declare under the penalties of perjury that I have examined this refund application (including any attached schedules

and statements) and to the best of my knowledge and belief, the statements contained herein are true, complete and correct, and that I am

duly authorized to sign this application. The undersigned certifies that no tax liability of any kind is due or owing the Commonwealth of

Kentucky by this applicant.

Signed Title

Name Date

(Print or Type)