Enlarge image

10A104 (08-20) UPDATE OR CANCELLATION OF KENTUCKY TAX ACCOUNT(S)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE FOR OFFICE USE ONLY

CRIS Coded / Entered / Date

• Incomplete or illegible updates will delay processing and will be returned.

• See instructions for questions regarding completion of this form. Commonwealth Business Identifier (CBI) NAICS

• Need Help? Call (502) 564-2694 or visit www.revenue.ky.gov

Federal Employer Identification Number (FEIN)

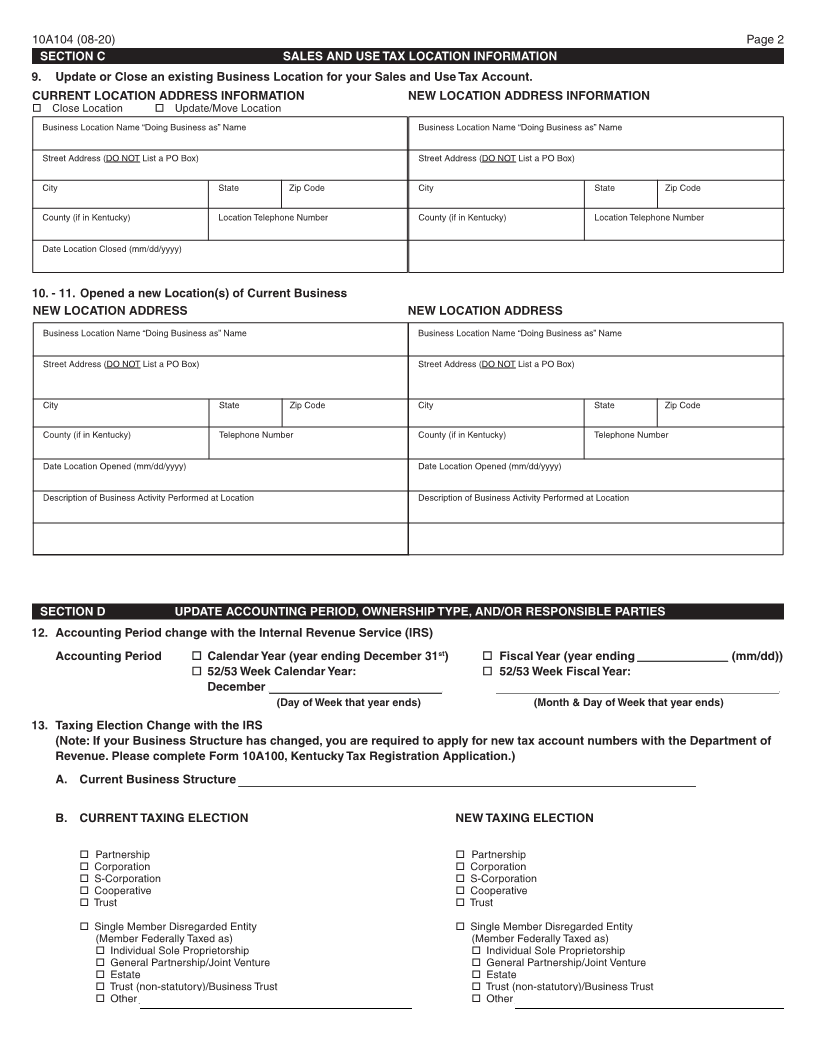

SECTION A REASON FOR COMPLETING THIS UPDATE (Must Be Completed)

This Form may only be used to update current account information. 2. Effective Date / /

To apply for additional accounts or to reinstate previous account Check all that apply.

numbers, use Form 10A100, Kentucky Tax Registration Application. Update business name or DBA name

Update an existing location’s information for the

1. Current Account Numbers Sales and Use Tax Account

Close a location of current business for the Sales and Use Tax

Kentucky Employer’s Withholding Tax ____________________________ Account

Kentucky Sales and Use Tax ___________________________________ Open a new location of current business for the Sales and Use

Kentucky Telecommunications Tax ______________________________ Tax Account

Kentucky Utility Gross Receipts License Tax _______________________ Add a mine location to an existing Coal Tax Account

Kentucky Consumer’s Use Tax _________________________________ Change accounting periods

Kentucky Corporation Income Tax and/or Change taxing election

Kentucky Limited Liability Entity Tax ___________________________ Update/provide new responsible party information

Kentucky Coal Severance and Processing Tax _____________________ Update mailing address(es) / mailing address telephone number(s)

Kentucky Pass-Through Non-Resident WH ________________________ Request cancellation of an account

Closing business / Close all tax accounts

SECTION B BUSINESS AND CONTACT INFORMATION (Must Be Completed)

3. Legal Business Name

Current Name New Name (if applicable)

________________________________________________________ ________________________________________________________________

________________________________________________________ __________________________________________________________

4. Doing Business As (DBA) Name

Current DBA New DBA

________________________________________________________ ________________________________________________________________

5. Federal Employer Identification Number (FEIN) 6. Kentucky Secretary of State Organization Number

(Required, complete prior to submitting) (If applicable)

7. Commonwealth Business Identifier (CBI)

8. Person to Contact Regarding this Update Form:

Name (Last, First, Middle) Title Daytime Telephone Extension

( ) –

E-mail: (By supplying your e-mail address you grant the Department

of Revenue permission to contact you via E-mail.)