- 27 -

Enlarge image

|

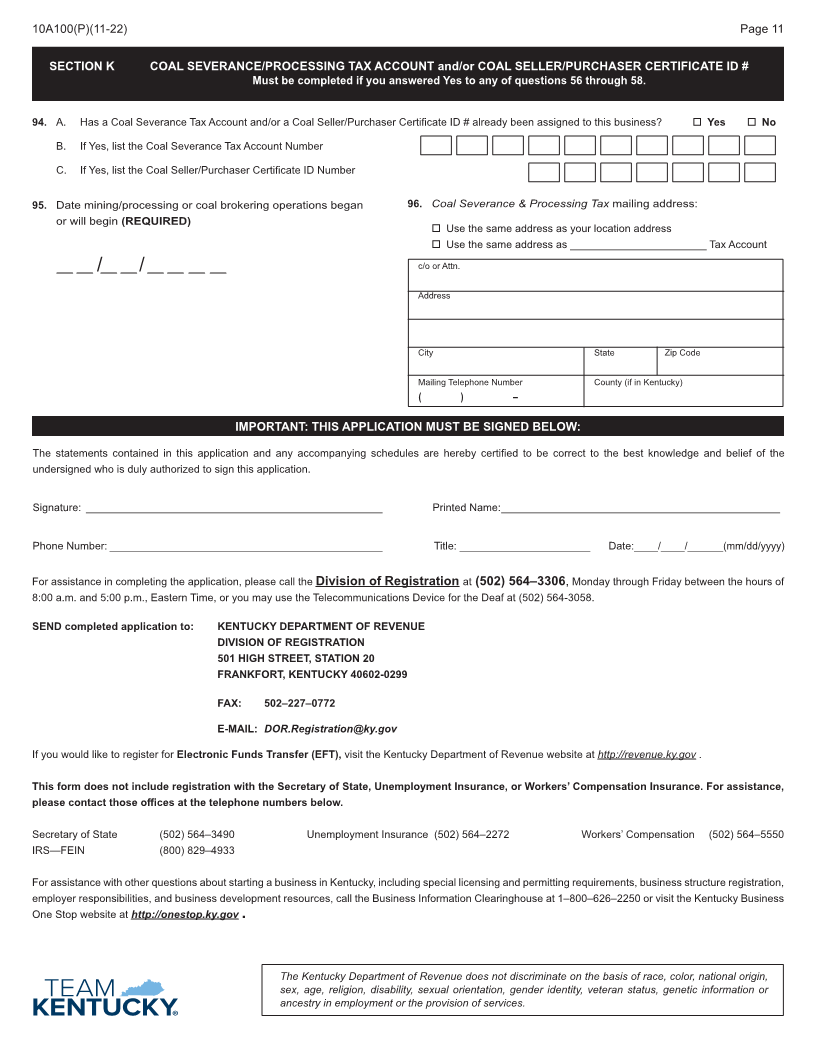

10A100(P)(11-22) Page 11

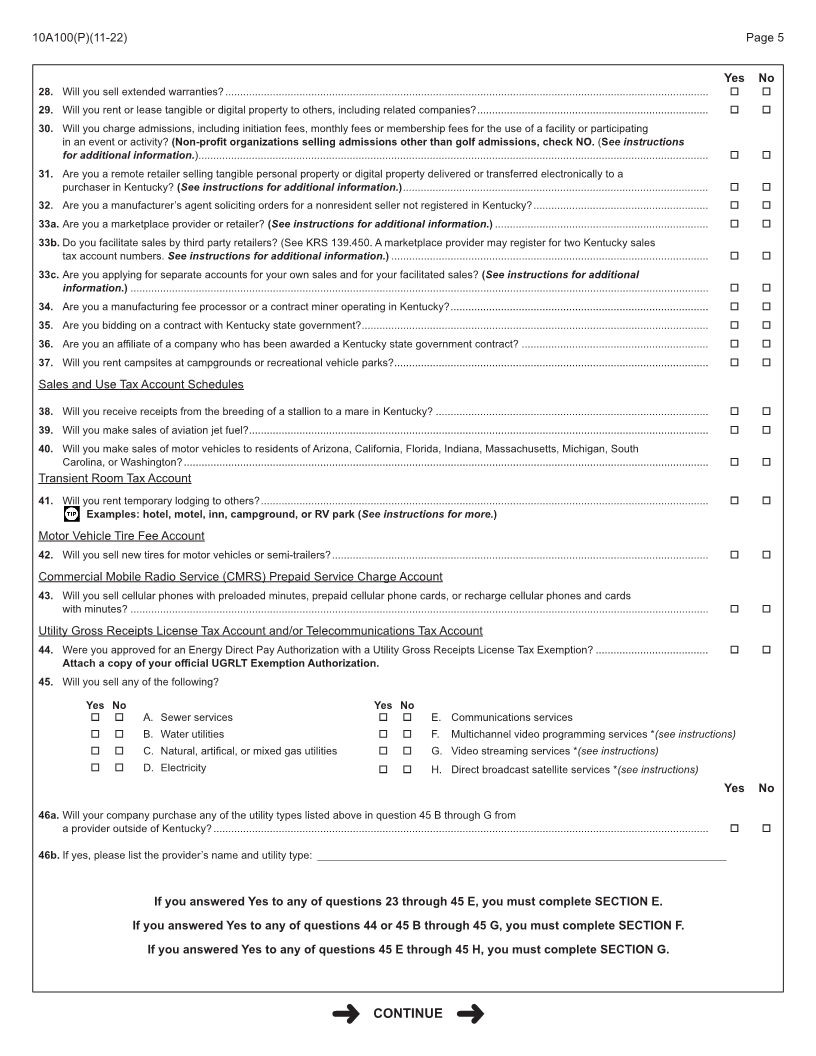

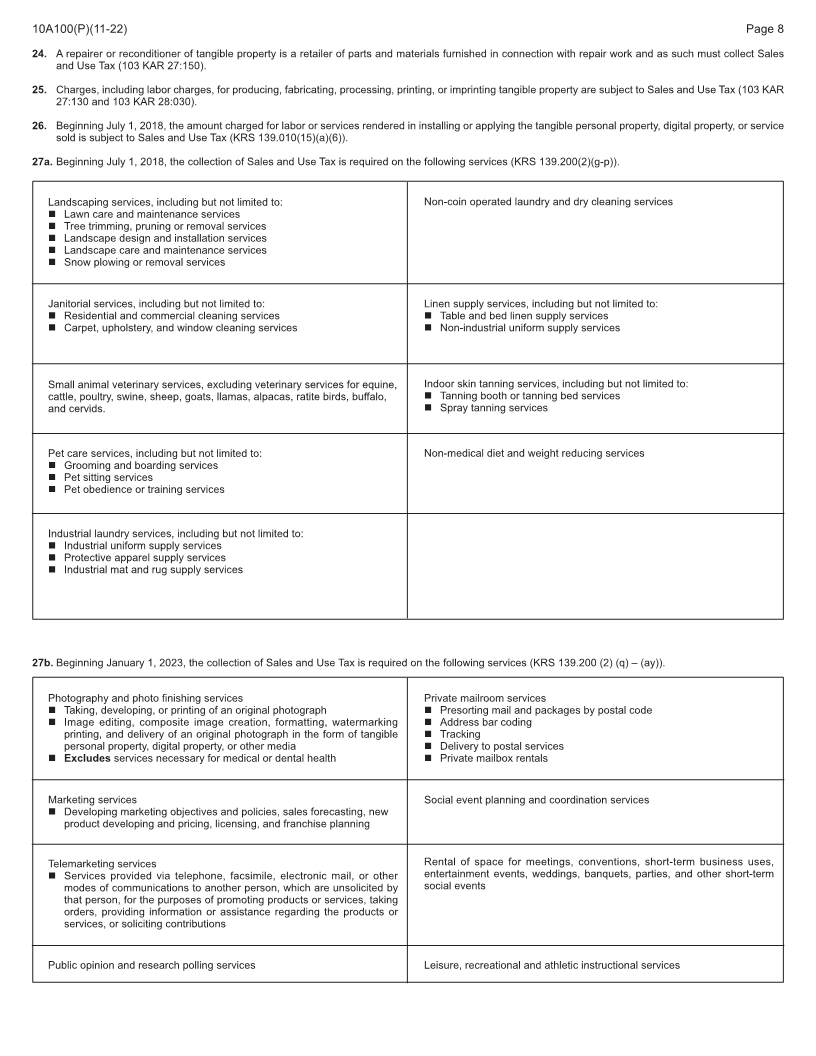

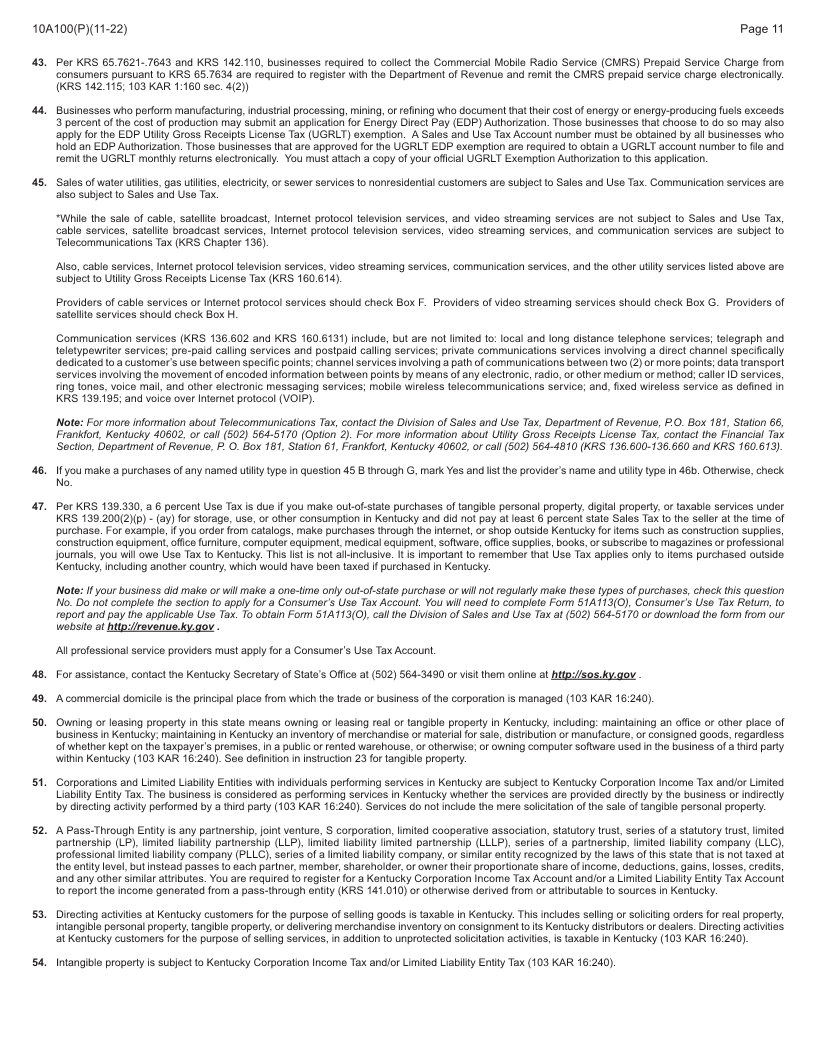

43. Per KRS 65.7621-.7643 and KRS 142.110, businesses required to collect the Commercial Mobile Radio Service (CMRS) Prepaid Service Charge from

consumers pursuant to KRS 65.7634 are required to register with the Department of Revenue and remit the CMRS prepaid service charge electronically.

(KRS 142.115; 103 KAR 1:160 sec. 4(2))

44. Businesses who perform manufacturing, industrial processing, mining, or refining who document that their cost of energy or energy-producing fuels exceeds

3 percent of the cost of production may submit an application for Energy Direct Pay (EDP) Authorization. Those businesses that choose to do so may also

apply for the EDP Utility Gross Receipts License Tax (UGRLT) exemption. A Sales and Use Tax Account number must be obtained by all businesses who

hold an EDP Authorization. Those businesses that are approved for the UGRLT EDP exemption are required to obtain a UGRLT account number to file and

remit the UGRLT monthly returns electronically. You must attach a copy of your official UGRLT Exemption Authorization to this application.

45. Sales of water utilities, gas utilities, electricity, or sewer services to nonresidential customers are subject to Sales and Use Tax. Communication services are

also subject to Sales and Use Tax.

*While the sale of cable, satellite broadcast, Internet protocol television services, and video streaming services are not subject to Sales and Use Tax,

cable services, satellite broadcast services, Internet protocol television services, video streaming services, and communication services are subject to

Telecommunications Tax (KRS Chapter 136).

Also, cable services, Internet protocol television services, video streaming services, communication services, and the other utility services listed above are

subject to Utility Gross Receipts License Tax (KRS 160.614).

Providers of cable services or Internet protocol services should check Box F. Providers of video streaming services should check Box G. Providers of

satellite services should check Box H.

Communication services (KRS 136.602 and KRS 160.6131) include, but are not limited to: local and long distance telephone services; telegraph and

teletypewriter services; pre-paid calling services and postpaid calling services; private communications services involving a direct channel specifically

dedicated to a customer’s use between specific points; channel services involving a path of communications between two (2) or more points; data transport

services involving the movement of encoded information between points by means of any electronic, radio, or other medium or method; caller ID services,

ring tones, voice mail, and other electronic messaging services; mobile wireless telecommunications service; and, fixed wireless service as defined in

KRS 139.195; and voice over Internet protocol (VOIP).

Note: For more information about Telecommunications Tax, contact the Division of Sales and Use Tax, Department of Revenue, P.O. Box 181, Station 66,

Frankfort, Kentucky 40602, or call (502) 564-5170 (Option 2). For more information about Utility Gross Receipts License Tax, contact the Financial Tax

Section, Department of Revenue, P. O. Box 181, Station 61, Frankfort, Kentucky 40602, or call (502) 564-4810 (KRS 136.600-136.660 and KRS 160.613).

46. If you make a purchases of any named utility type in question 45 B through G, mark Yes and list the provider’s name and utility type in 46b. Otherwise, check

No.

47. Per KRS 139.330, a 6 percent Use Tax is due if you make out-of-state purchases of tangible personal property, digital property, or taxable services under

KRS 139.200(2)(p) - (ay) for storage, use, or other consumption in Kentucky and did not pay at least 6 percent state Sales Tax to the seller at the time of

purchase. For example, if you order from catalogs, make purchases through the internet, or shop outside Kentucky for items such as construction supplies,

construction equipment, office furniture, computer equipment, medical equipment, software, office supplies, books, or subscribe to magazines or professional

journals, you will owe Use Tax to Kentucky. This list is not all-inclusive. It is important to remember that Use Tax applies only to items purchased outside

Kentucky, including another country, which would have been taxed if purchased in Kentucky.

Note: If your business did make or will make a one-time only out-of-state purchase or will not regularly make these types of purchases, check this question

No. Do not complete the section to apply for a Consumer’s Use Tax Account. You will need to complete Form 51A113(O), Consumer’s Use Tax Return, to

report and pay the applicable Use Tax. To obtain Form 51A113(O), call the Division of Sales and Use Tax at (502) 564-5170 or download the form from our

website at http://revenue.ky.gov .

All professional service providers must apply for a Consumer’s Use Tax Account.

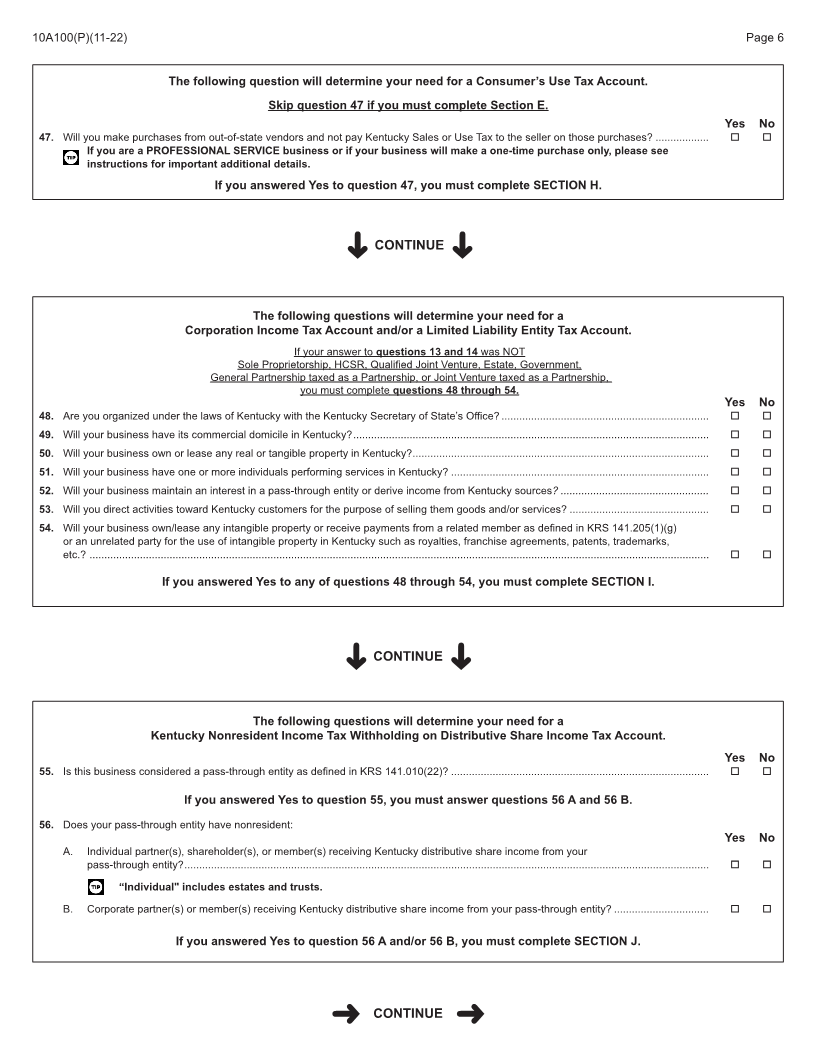

48. For assistance, contact the Kentucky Secretary of State’s Office at (502) 564-3490 or visit them online at http://sos.ky.gov .

49. A commercial domicile is the principal place from which the trade or business of the corporation is managed (103 KAR 16:240).

50. Owning or leasing property in this state means owning or leasing real or tangible property in Kentucky, including: maintaining an office or other place of

business in Kentucky; maintaining in Kentucky an inventory of merchandise or material for sale, distribution or manufacture, or consigned goods, regardless

of whether kept on the taxpayer’s premises, in a public or rented warehouse, or otherwise; or owning computer software used in the business of a third party

within Kentucky (103 KAR 16:240). See definition in instruction 23 for tangible property.

51. Corporations and Limited Liability Entities with individuals performing services in Kentucky are subject to Kentucky Corporation Income Tax and/or Limited

Liability Entity Tax. The business is considered as performing services in Kentucky whether the services are provided directly by the business or indirectly

by directing activity performed by a third party (103 KAR 16:240). Services do not include the mere solicitation of the sale of tangible personal property.

52. A Pass-Through Entity is any partnership, joint venture, S corporation, limited cooperative association, statutory trust, series of a statutory trust, limited

partnership (LP), limited liability partnership (LLP), limited liability limited partnership (LLLP), series of a partnership, limited liability company (LLC),

professional limited liability company (PLLC), series of a limited liability company, or similar entity recognized by the laws of this state that is not taxed at

the entity level, but instead passes to each partner, member, shareholder, or owner their proportionate share of income, deductions, gains, losses, credits,

and any other similar attributes. You are required to register for a Kentucky Corporation Income Tax Account and/or a Limited Liability Entity Tax Account

to report the income generated from a pass-through entity (KRS 141.010) or otherwise derived from or attributable to sources in Kentucky.

53. Directing activities at Kentucky customers for the purpose of selling goods is taxable in Kentucky. This includes selling or soliciting orders for real property,

intangible personal property, tangible property, or delivering merchandise inventory on consignment to its Kentucky distributors or dealers. Directing activities

at Kentucky customers for the purpose of selling services, in addition to unprotected solicitation activities, is taxable in Kentucky (103 KAR 16:240).

54. Intangible property is subject to Kentucky Corporation Income Tax and/or Limited Liability Entity Tax (103 KAR 16:240).

|