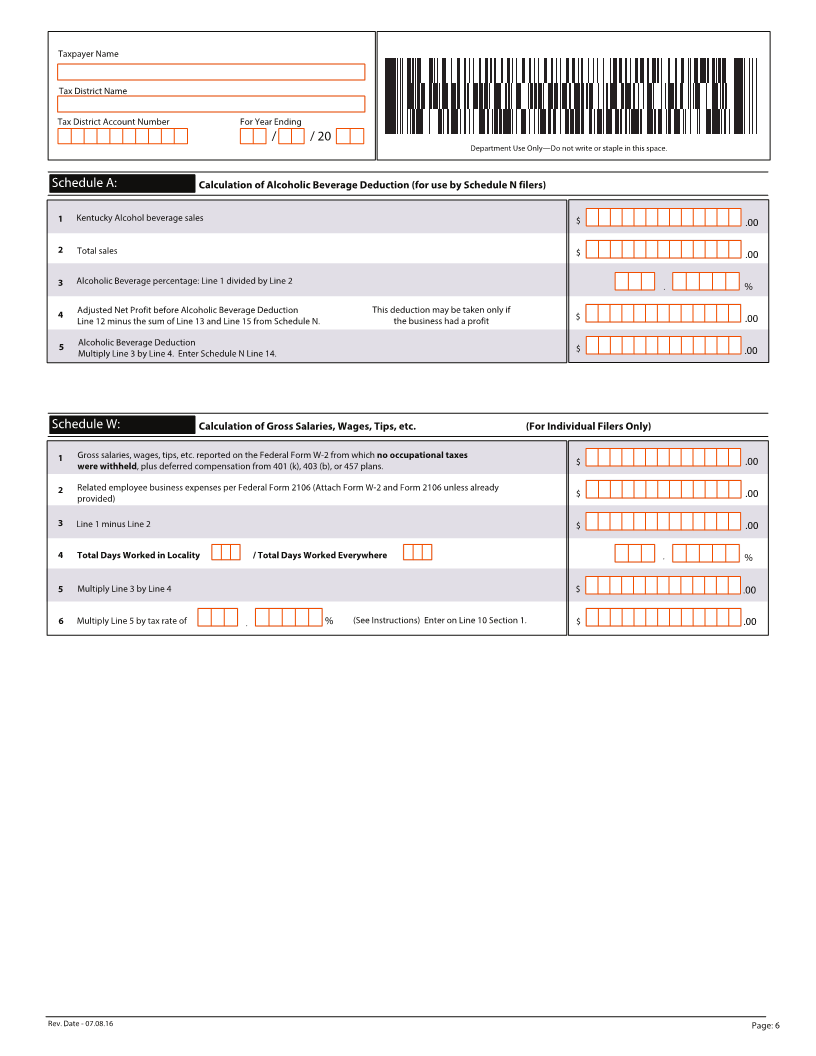

Enlarge image

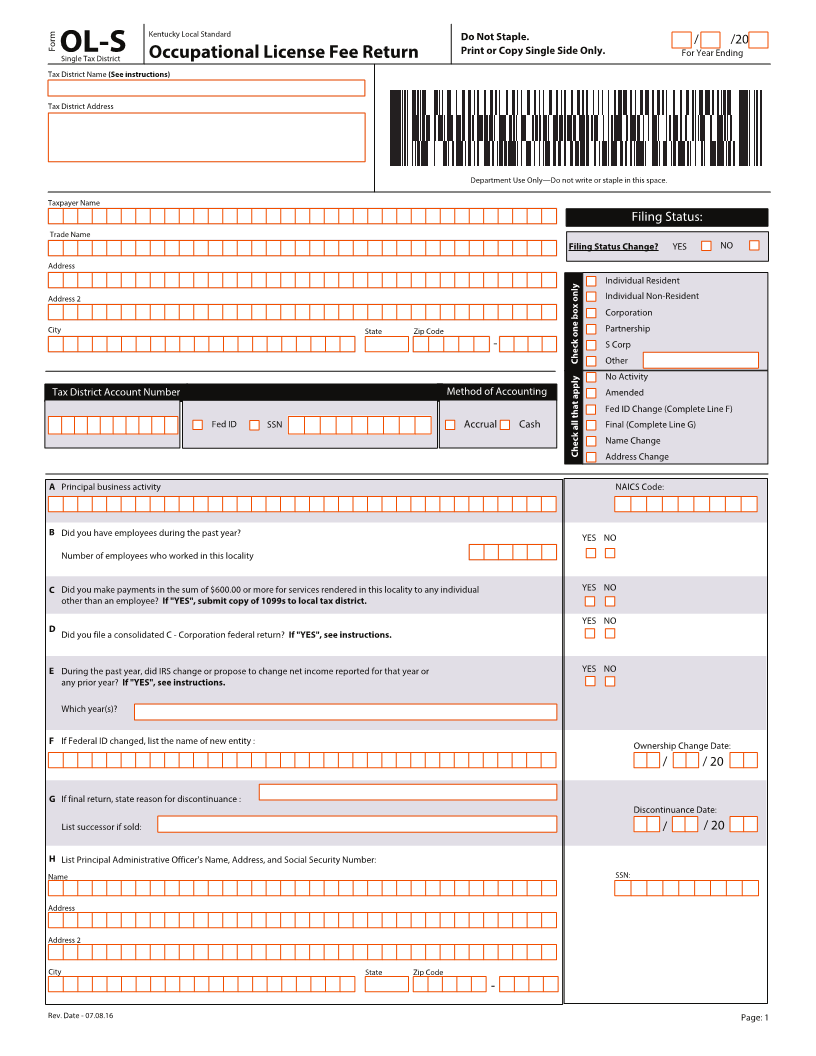

Kentucky Local Standard

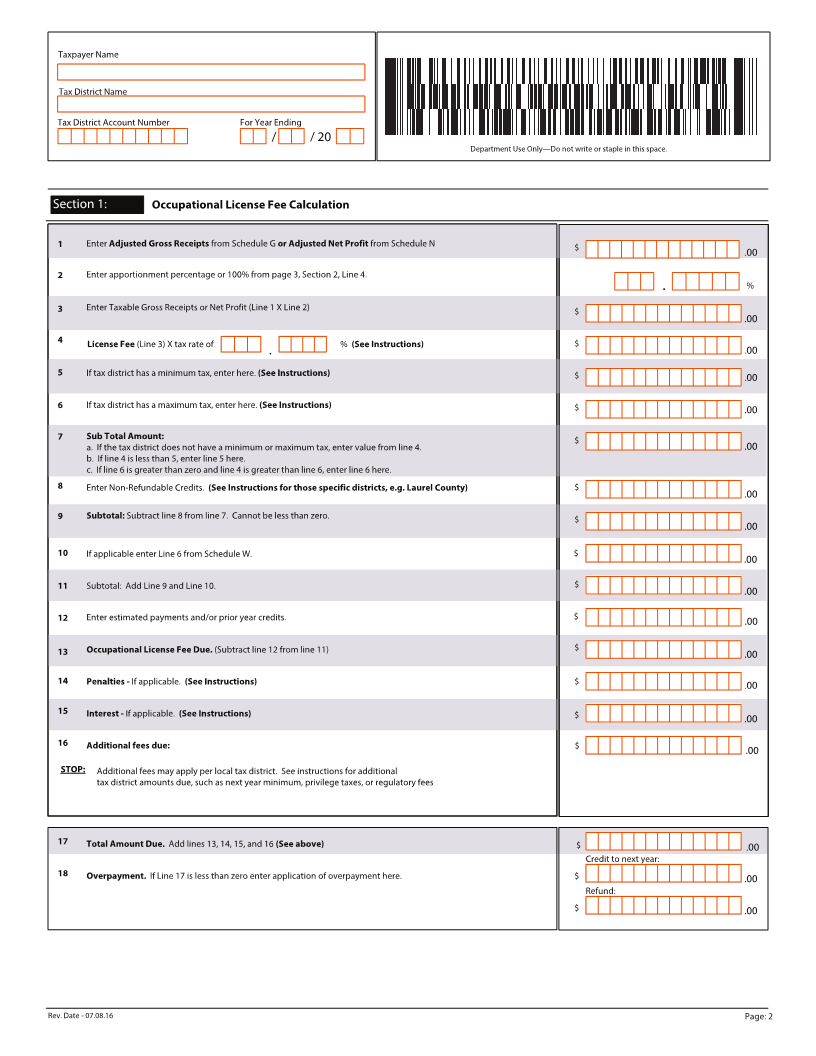

Form Do Not Staple. / /20

Print or Copy Single Side Only.

OL-SSingle Tax District Occupational License Fee Return For Year Ending

Tax District Name (See instructions)

Tax District Address

Department Use Only—Do not write or staple in this space.

Taxpayer Name

Filing Status:

Trade Name

Filing Status Change? YES NO

Address

Individual Resident

Address 2 Individual Non-Resident

Corporation

City State Zip Code Partnership

- S Corp

Check one box only Other

No Activity

Tax District Account Number Method of Accounting Amended

Fed ID Change (Complete Line F)

Fed ID SSN Accrual Cash Final (Complete Line G)

Name Change

Check all that apply Address Change

A Principal business activity NAICS Code:

B Did you have employees during the past year? YES NO

Number of employees who worked in this locality

C Did you make payments in the sum of $600.00 or more for services rendered in this locality to any individual YES NO

other than an employee? If "YES", submit copy of 1099s to local tax district.

YES NO

D Did you file a consolidated C - Corporation federal return? If "YES", see instructions.

E During the past year, did IRS change or propose to change net income reported for that year or YES NO

any prior year? If "YES", see instructions.

Which year(s)?

F If Federal ID changed, list the name of new entity : Ownership Change Date:

/ / 20

G If final return, state reason for discontinuance :

Discontinuance Date:

List successor if sold: / / 20

H List Principal Administrative Officer's Name, Address, and Social Security Number:

Name SSN:

Address

Address 2

City State Zip Code

-

Rev. Date - 07.08.16 Page: 1