Enlarge image

2017

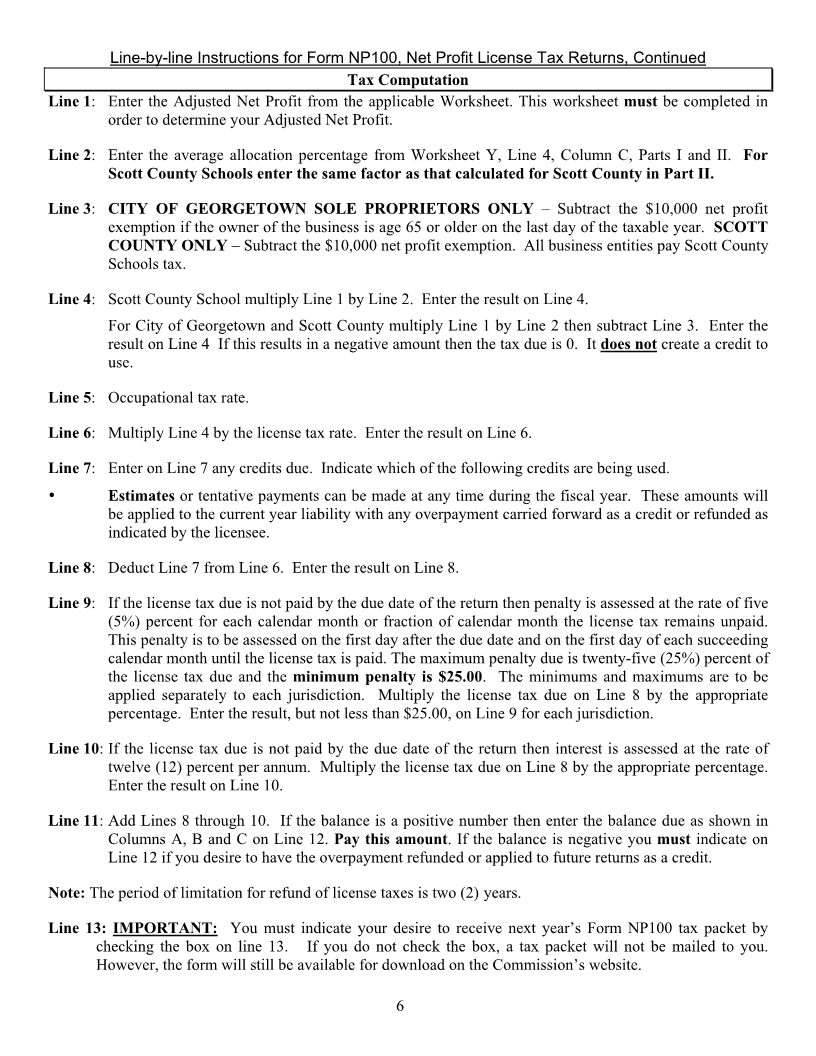

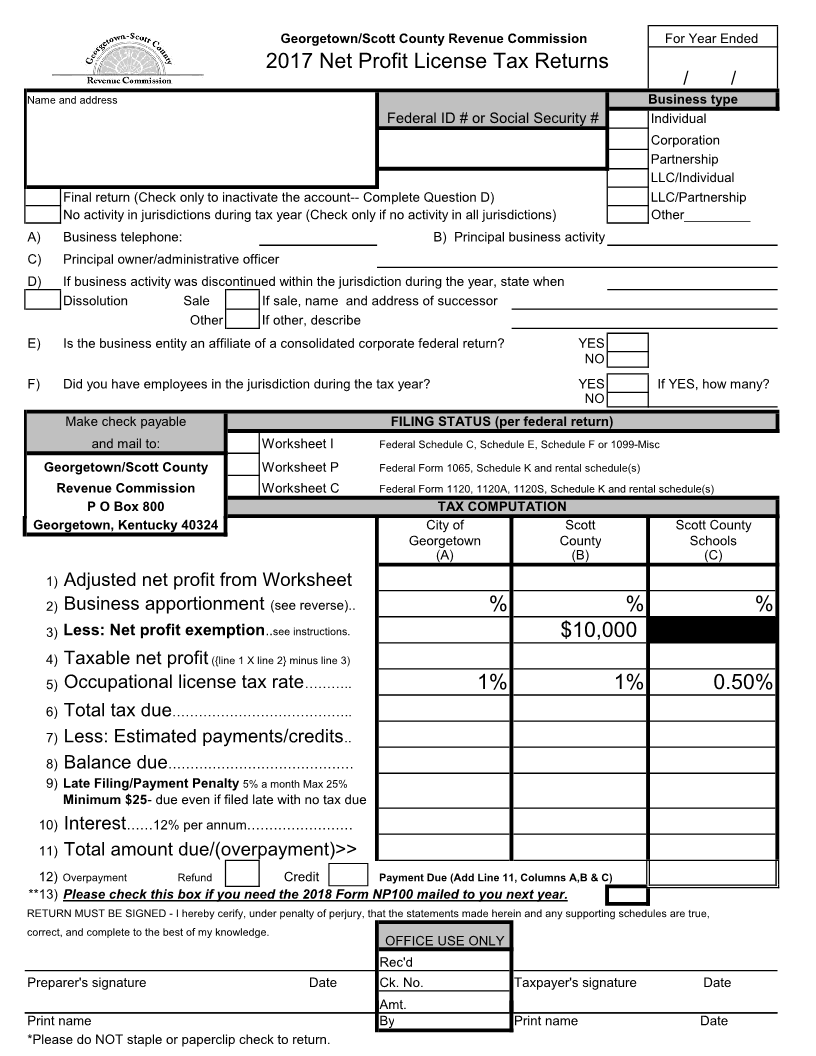

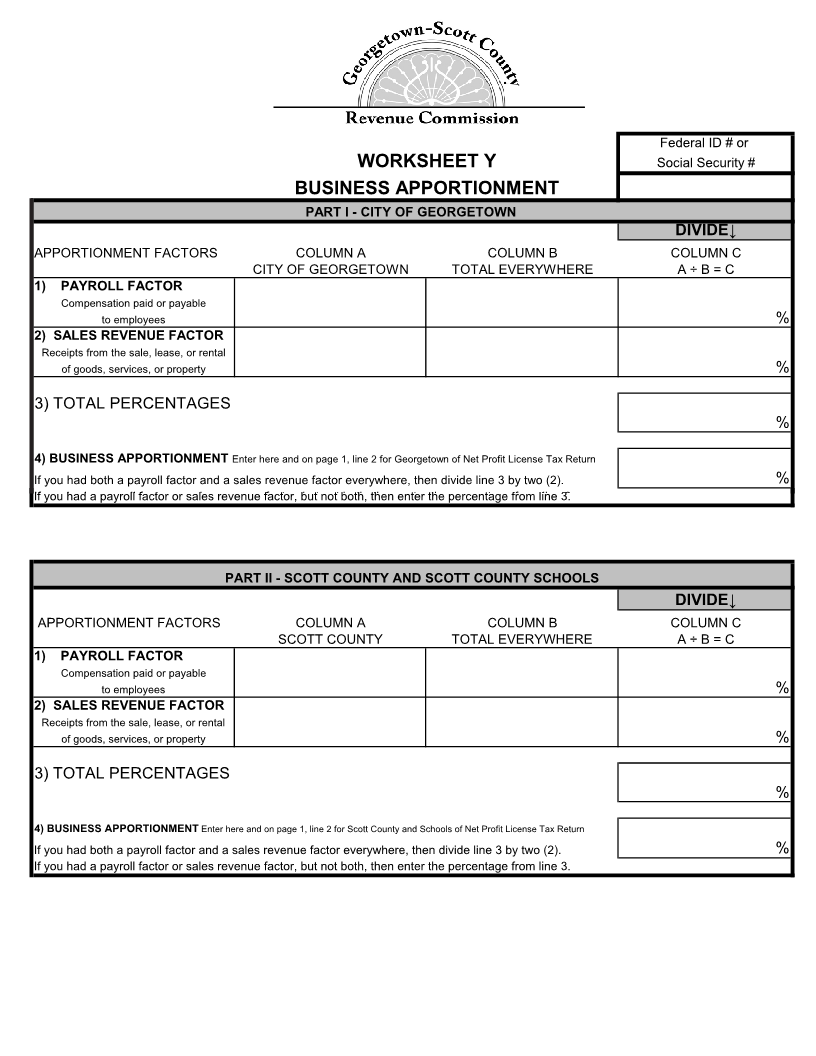

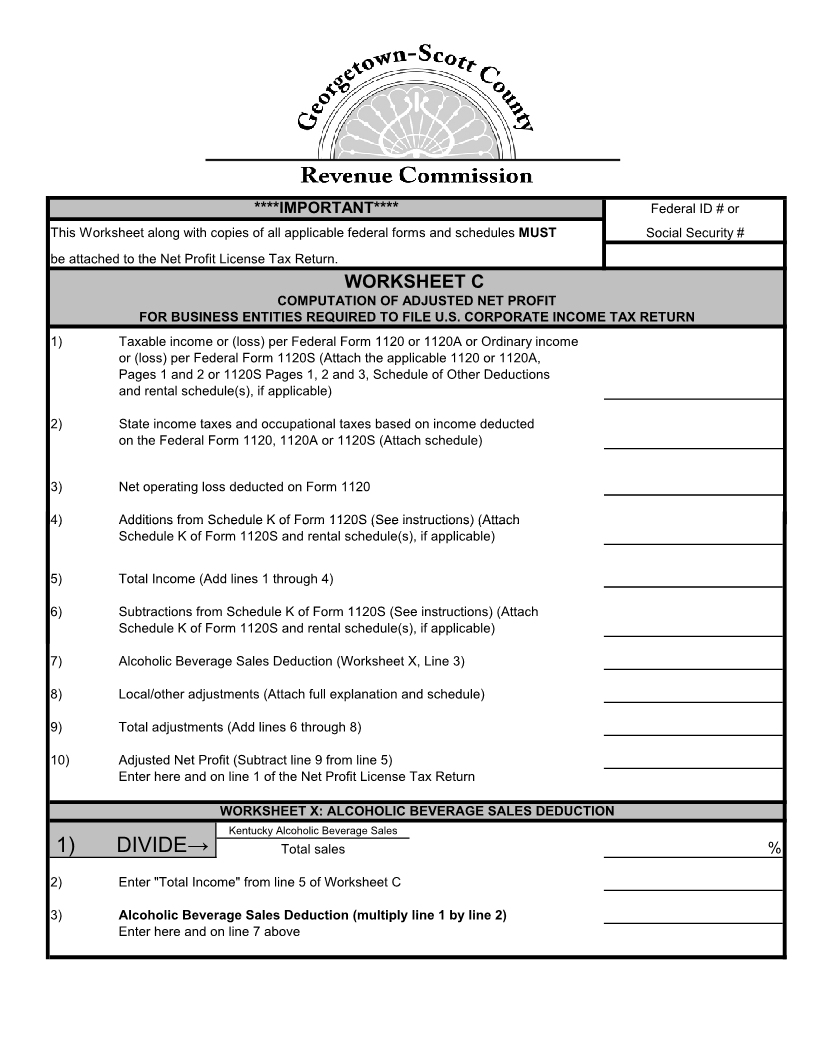

Form NP100

Net Profit License Tax Returns

And

Instructions

2017 Highlights and Announcements

n IMPORTANT - Please indicate on the Form NP100, Line 13, whether or not you wish to have the

Form NP100 tax packet mailed to you for the subsequent tax year. If you leave the check box blank you

will not receive Form NP100 via mail. However, it will still be available via download from the

Revenue Commission’s website at www.gscrevenue.com.

o Please be advised that IRS extensions are not acceptable unless you file a copy with this office, along

with any estimated tax due, on or before the original due date of the return. Attaching a copy of the

approved Federal extension at the time of filing the NP100 is not sufficient.

For additional information contact:

Georgetown/Scott County Revenue Commission

P O Box 800

Georgetown, KY 40324

Telephone: (502) 863-9805

Fax: (502) 863-9808

Hours: Monday-Friday

8:00 A.M. – 4:00 P.M.

http://www.gscrevenue.com

Paid for with Georgetown/Scott County Revenue Commission funds.

Revised 11-2017