- 7 -

Enlarge image

|

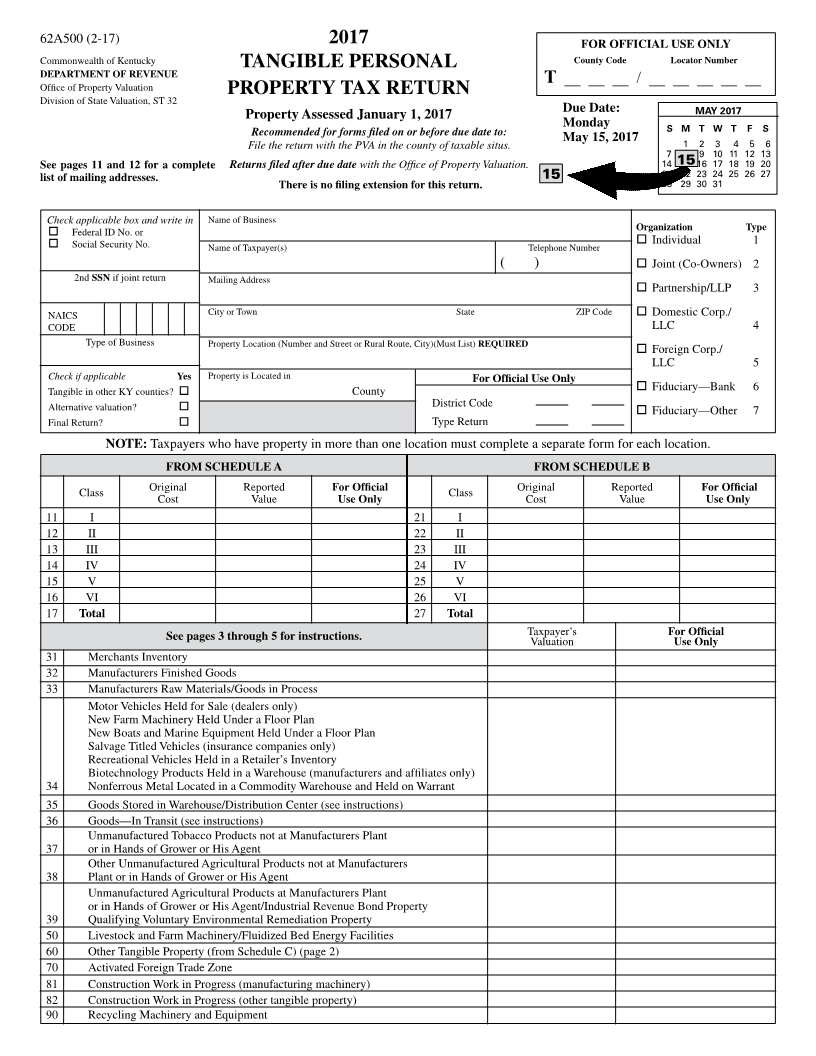

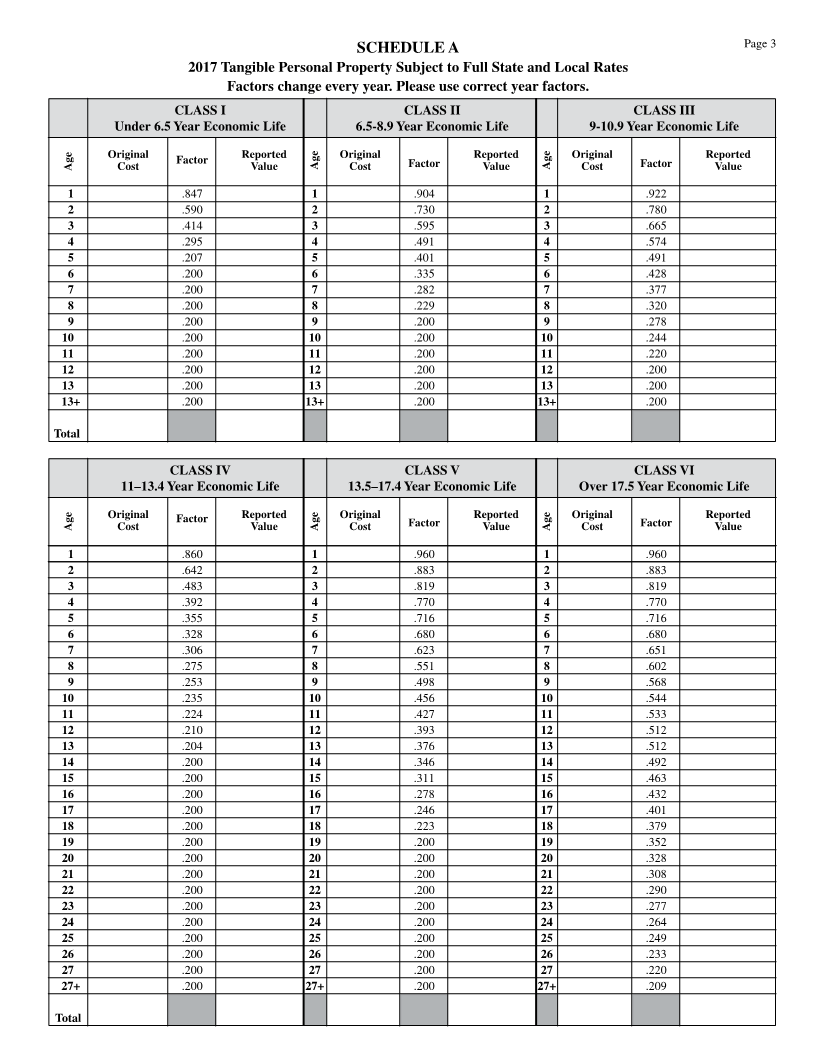

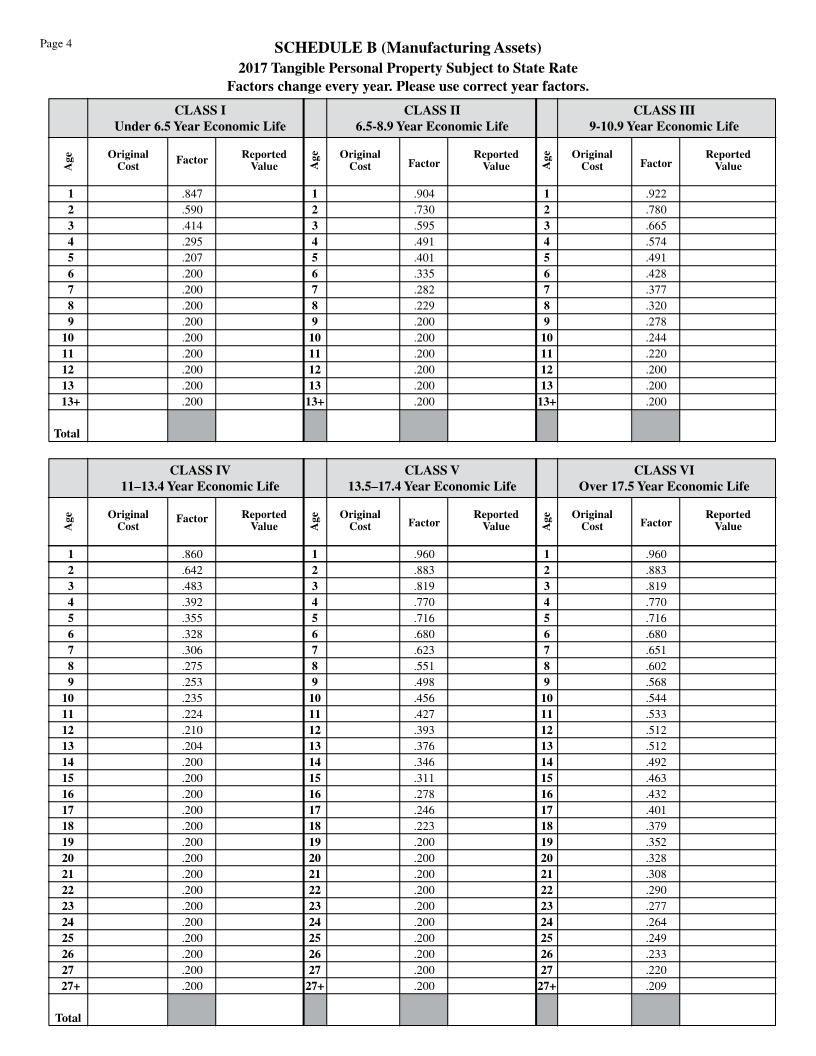

Qualifying Voluntary Environmental Remediation Property 81 Construction Work in Progress (Manufacturing Machinery)—

—Provided the property owner has corrected the effect of all Machinery and equipment that eventually becomes part of the

known releases of hazardous substances, pollutants, contaminants, manufacturing process is classified as manufacturing machinery

petroleum, or petroleum products located on the property during the construction period. Report such property at original

consistent with a corrective action plan approved by the Energy cost.

and Environment Cabinet pursuant to KRS 224.01-400, 224.01-

405, or 224.60-135, and provided the cleanup was not financed 82 Construction Work in Progress (Other Tangible Property) —

through a public grant or the petroleum storage tank environmental During the construction period, list all tangible property that does

assurance fund, the property may be reported on Line 39. This rate not become part of the manufacturing process on line 82. NOTE:

shall apply for a period of three (3) years following the Energy and Tangible property includes contractor’s building components.

Environment Cabinet’s issuance of a No Further Action Letter or

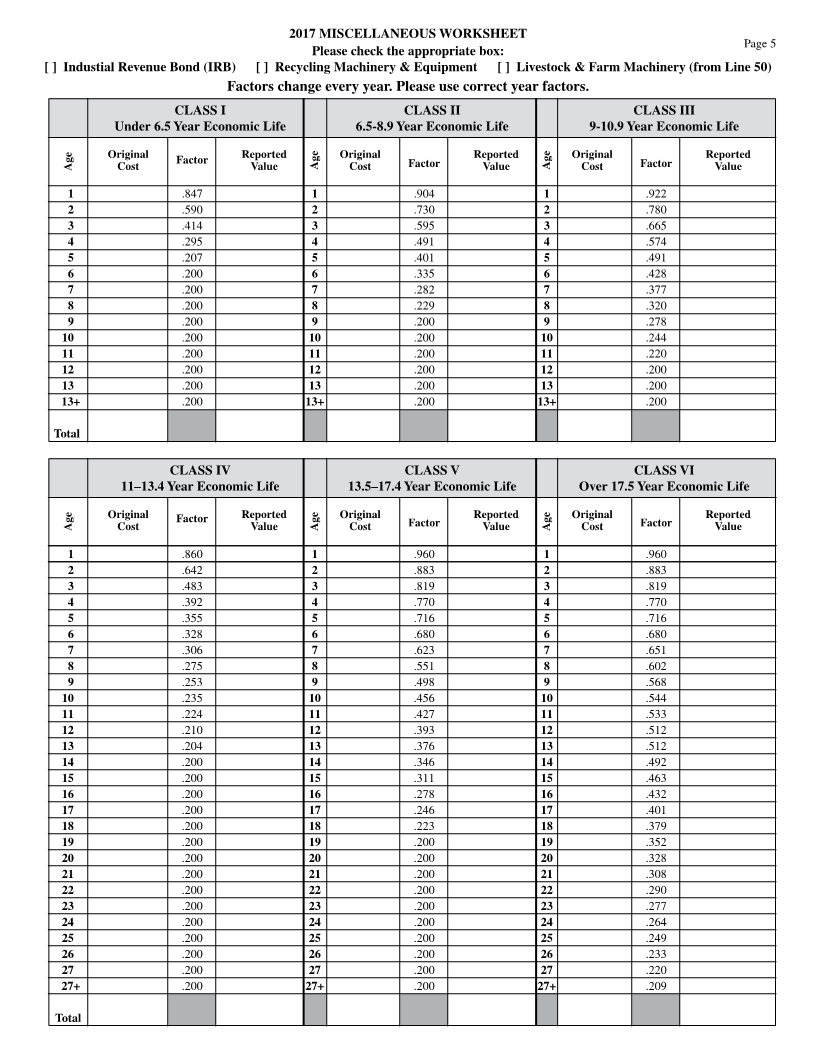

its equivalent, after which the regular tax rate shall apply. 90 Recycling Machinery and Equipment—List machinery or

equipment, not used in a manufacturing process, owned by a

50 Livestock and Farm Equipment—List the fair cash value of all business, industry or organization in order to collect, source

owned or leased farm equipment and livestock. The Miscellaneous separate, compress, bale, shred or otherwise handle waste materials

Worksheet can be used for depreciation purposes. if the machinery or equipment is primarily used for recycling

purposes (KRS 132.200(15)). Examples: balers, briquetters,

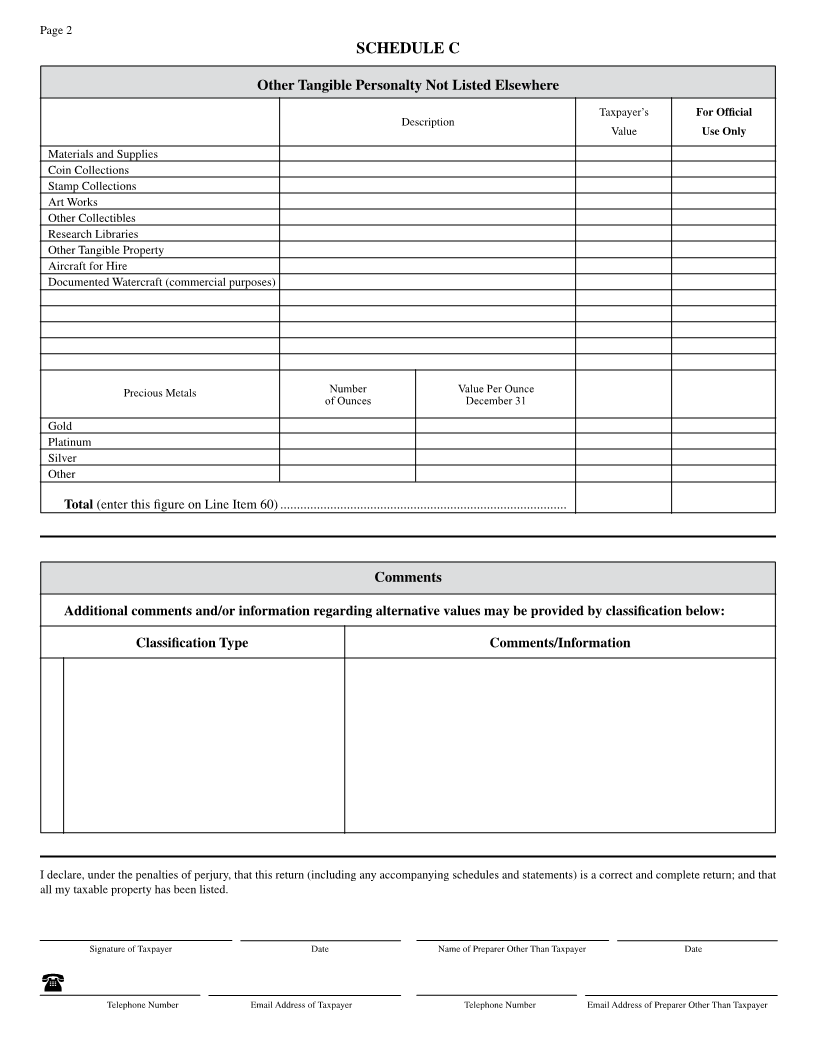

60 Other Tangible Personal Property—List the totals from compactors, containers, conveyors, conveyor systems, cranes

Schedule C on Form 62A500, line 60. with grapple hooks, crushers, densifyers, exhaust fans, fluffers,

granulators, lift-gates, magnetic separators, material recovery

Schedule C property includes: facility equipment, pallet jacks, perforators, pumps with oil, scales,

screeners, shears, shredders, two-wheel carts and vacuum systems.

• inventory held by service industries; Use the trending factors in the Miscellaneous Worksheet to age

• aircraft for hire (not reported on Form 61A200); the equipment.

• non-Kentucky registered watercraft (not reported on Form

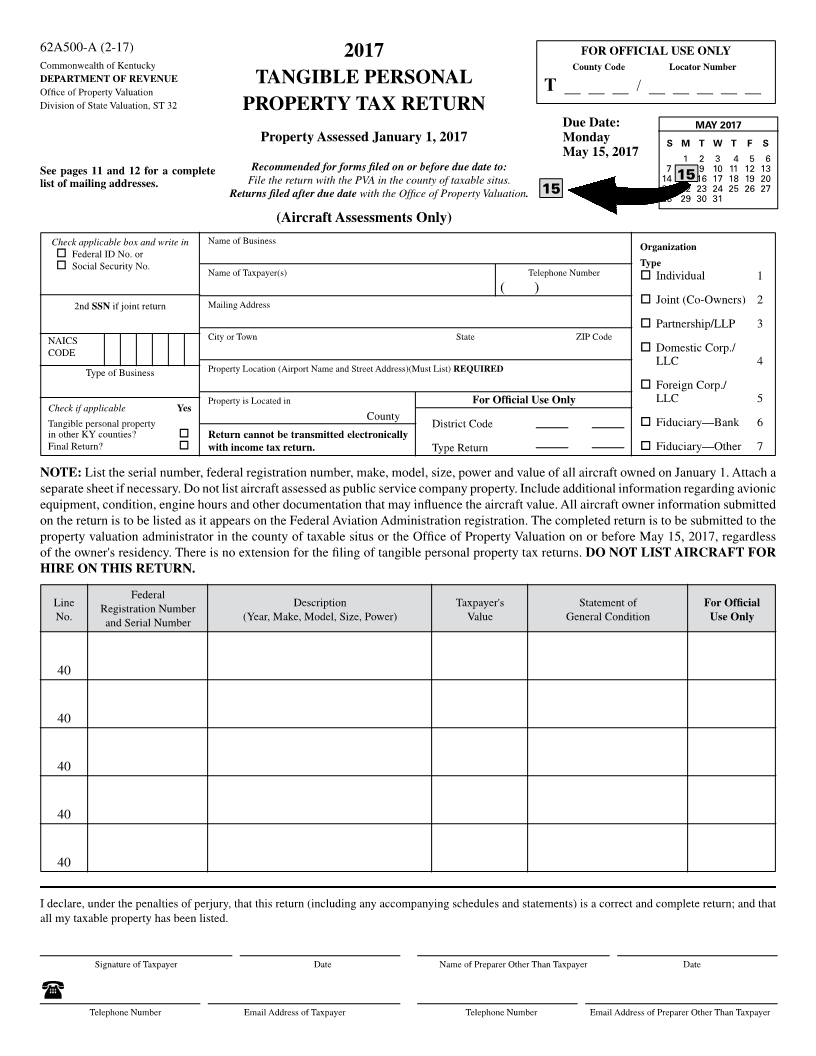

61A207); Revenue Form 62A500-A

• U.S. Coast Guard documented watercraft used for commercial

purposes (not reported on Form 61A207); Noncommercial Aircraft — List the serial number, federal

registration number, make, year, model, size, power and value

• materials, supplies and spare parts; of all aircraft owned on January 1. Attach a separate sheet if

• investment properties such as coin, stamp, art or other necessary. Include additional information regarding avionics

collections; equipment, engine hours, condition and other documentation that

• research libraries; and may influence the aircraft value in the space provided. Do not list

• precious metals. aircraft assessed as public service company property. List aircraft

used in the business of transporting persons or property for

List aircraft for hire on the appropriate line on Schedule C at fair compensation or hire and not assessed as a public utility on

market value. Revenue Form 62A500, Schedule C. Taxation is based on the

situs of the aircraft, on January 1 stor the majority of the year,

Materials, supplies and spare parts, normally expensed, must regardless of the owner’s residency.

be segregated and valued separately. Any supplies included in

inventory should be removed from the inventory value and reported Revenue Form 62A500-C

on Schedule C. In all cases, list such property at original cost.

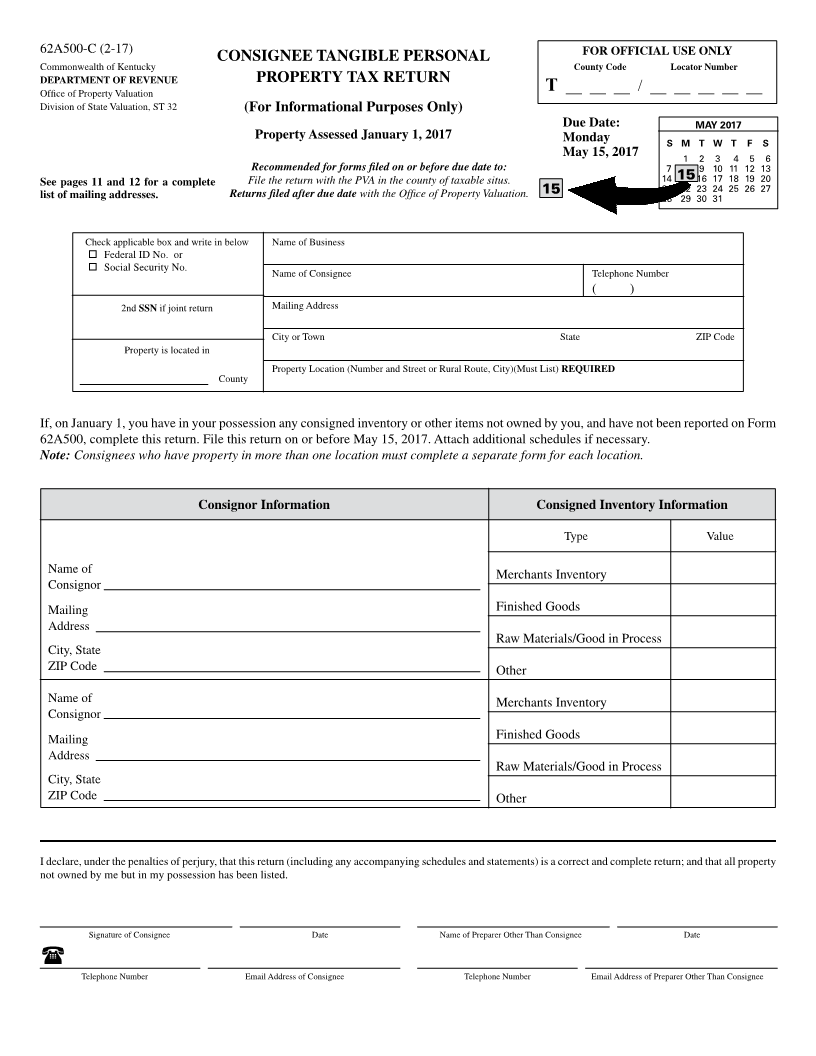

If on January 1 you have in your possession any consigned inventory

Supply items are valued at original cost in the amount on hand at that is held and not owned by you, you are required to complete

year-end. Returnable containers, such as barrels, bottles, carboys, this form and report the kind, nature, owner and value of all such

coops, cylinders, drums, reels, etc., are valued separately at original inventory. If you are assuming the responsibility for the property

cost. In absence of year end totals, use the yearly expense accounts taxes on the consigned inventory, you must report the value of such

total divided by 12. inventory on the tangible personal property tax return appropriate

for your business activity. Consigned inventory must be valued

List the fair market value of all coin collections, stamp collections, using full absorption first-in-first-out (FIFO) costing. LIFO

art works, other collectibles and research libraries. List the number deductions are not allowable. A separate return is required for each

of ounces of all gold, silver, platinum and other precious metals. location at which consigned goods are located. File the return as

If the market value of a precious metal is known, list the value per an attachment to Revenue Form 62A500.

ounce as of the preceding December 31 in the Value Per Ounce

column. Multiply the number of ounces by the value per ounce to Revenue Form 62A500-L

determine the total fair market value.

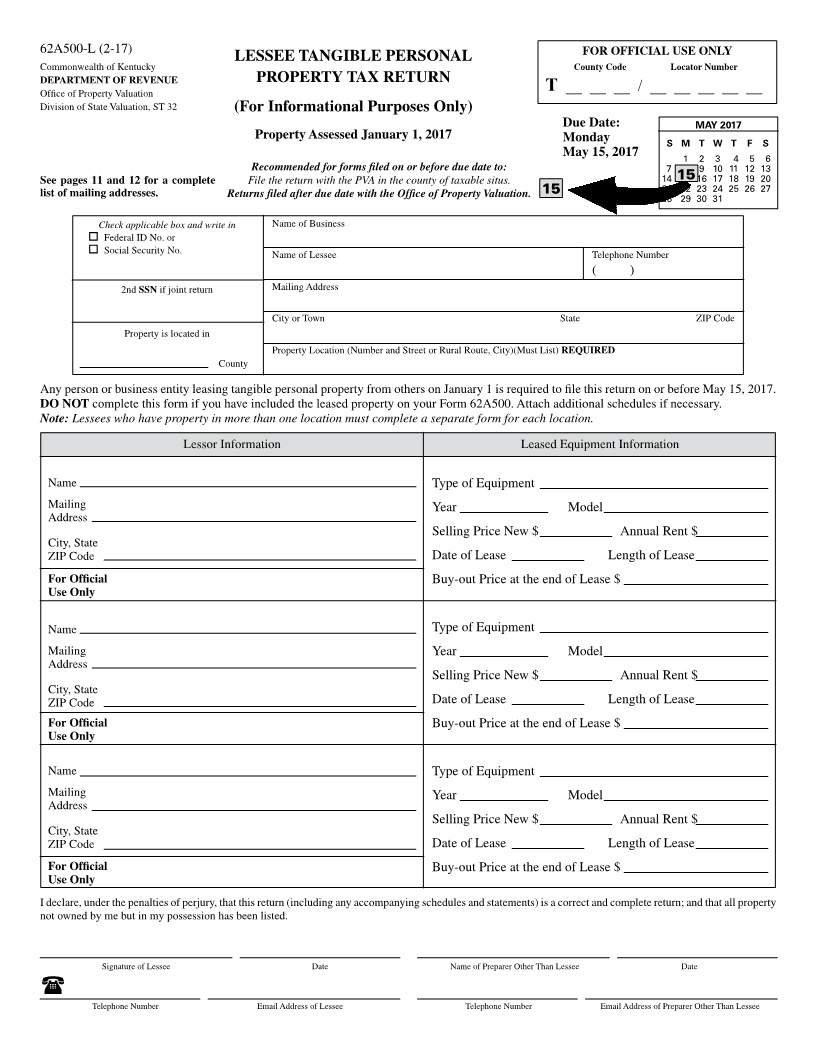

All persons and business entities who lease tangible personal

70 Activated Foreign Trade Zone—Tangible personal property property from others (e.g., lessees) are required to file the Lessee

located within an activated foreign trade zone as designated under Tangible Personal Property Tax Return, Revenue Form 62A500-L.

Title 19 U.S.C. Section 81 is subject to taxation at a state rate only. A separate return for each property location is required. File the

Complete Form 62A500 using the composite conversion factors for return as an attachment to Revenue Form 62A500.

depreciable assets. Attach a copy of foreign trade zone activation

certificate or letter. Provide all information requested. List the name and address of the

lessor and the related equipment information, including the type of

5

|