Enlarge image

COMMONWEALTH OF KENTUCKY

DEPARTMENT OF REVENUE

FRANKFORT, KENTUCKY 40620

73A801(P)

2016 KENTUCKY BANK FRANCHISE TAX

FORMS AND INSTRUCTIONS

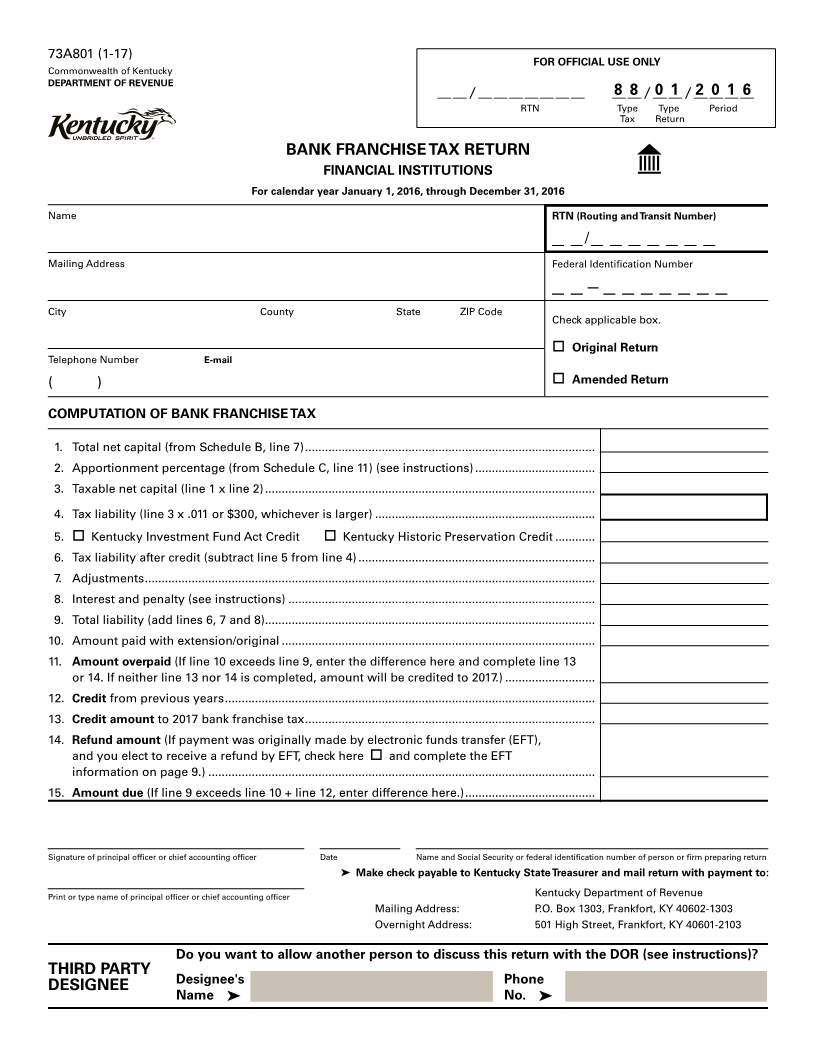

Bank Franchise Tax Return (Form 73A801)

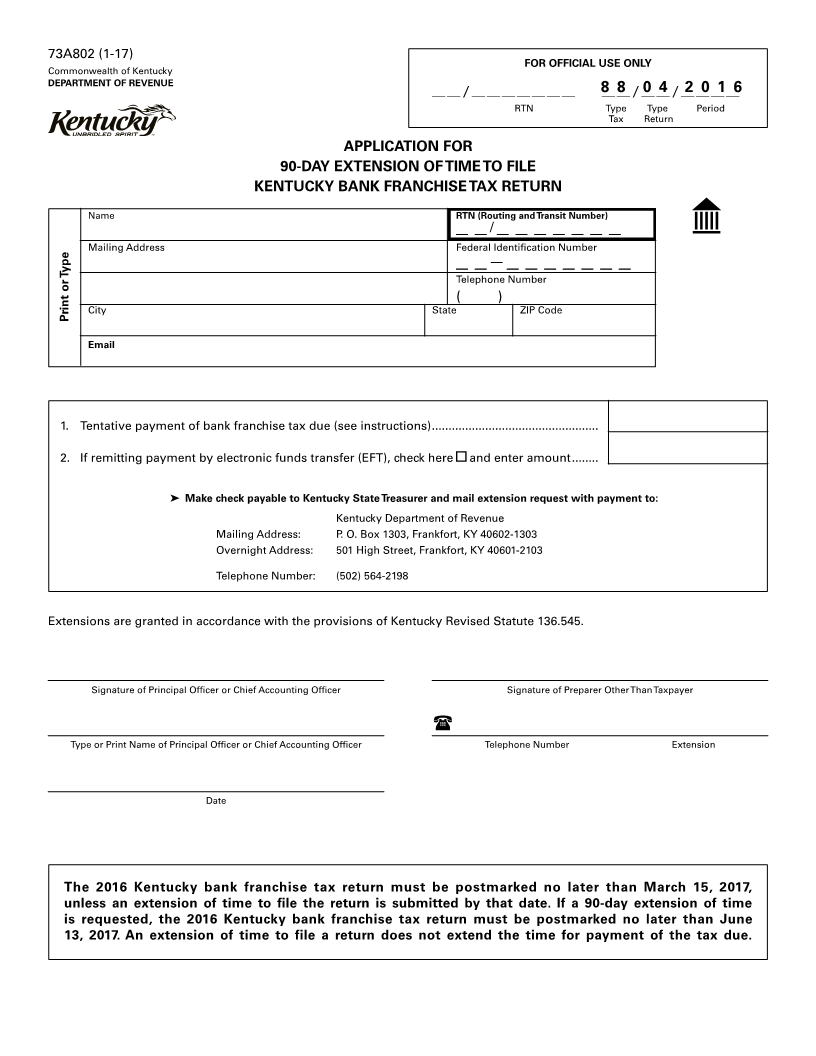

Application for 90-Day Extension of Time to File (Form 73A802)

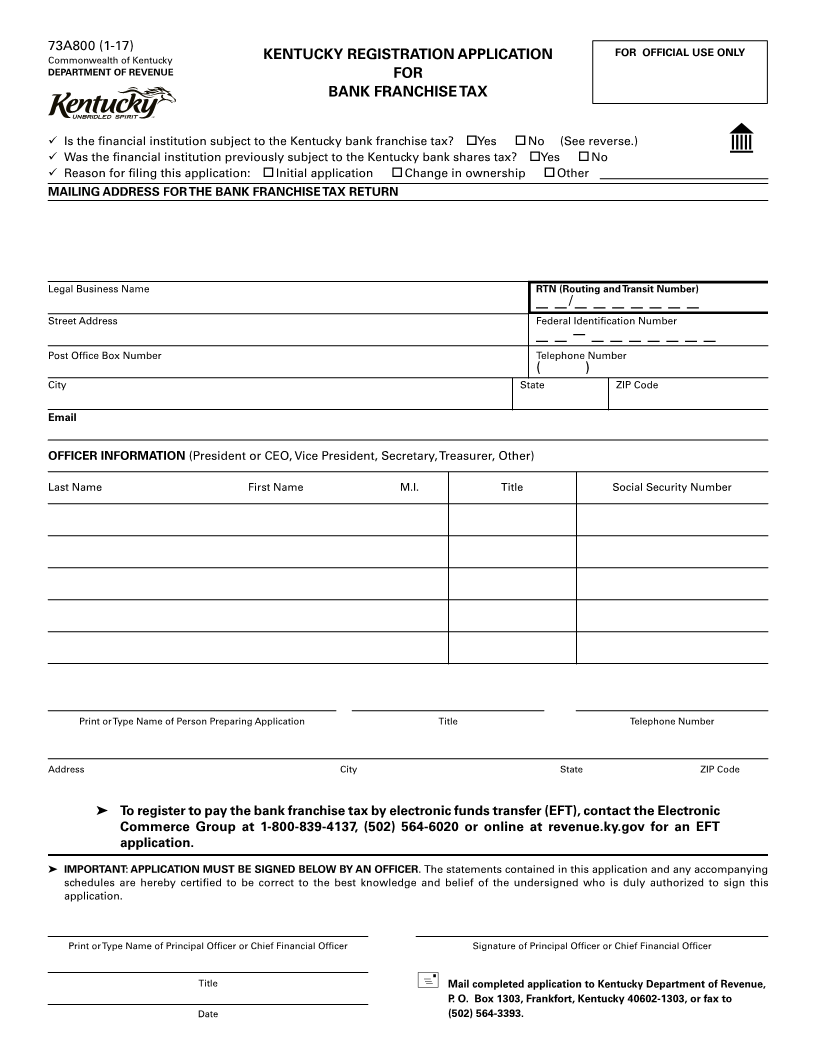

Kentucky Registration Application for Bank Franchise Tax (Form 73A800)

RTN (BANK FRANCHISE TAX ACCOUNT NUMBER)

The routing and transit number (RTN) will be the financial institution's bank franchise tax account number. This number

must be listed in the appropriate spaces on each applicable form.

PURPOSE OF THE FORMS PACKET c. any corporation organized under the provisions of 12

U.S.C. secs. 611 to 631, in effect on December 31, 1997,

This packet has been designed for financial institutions, exclusive of any amendments made subsequent to

both domestic and foreign, which are required by law to that date, or any corporation organized after Decem-

file the Bank Franchise Tax Return, Revenue Form 73A801. ber 31, 1997, that meets the requirements of 12 U.S.C.

It contains the forms and schedules needed by most secs. 611 to 631, in effect on December 31, 1997; or

financial institutions.

d. any agency or branch of a foreign depository as

WHO MUST FILE defined in 12 U.S.C. sec. 3101, in effect on December

31, 1997, exclusive of any amendments made

Every financial institution regularly engaged in business subsequent to that date, or any agency or branch of

in Kentucky at any time during the taxable year must a foreign depository established after December 31,

file Form 73A801. A financial institution is presumed to 1997, that meets the requirements of 12 U.S.C. sec.

be regularly engaging in business in Kentucky if during 3101 in effect on December 31, 1997.

any taxable year it obtains or solicits business with 20 or

more persons within Kentucky, or if receipts attributable Each financial institution engaging in business in

to sources in Kentucky equal or exceed $100,000. Kentucky should obtain and complete a Kentucky

Registration Application for Bank Franchise Tax, Form

"Financial institution" means: 73A800. Copies of the application are available by

accessing the Kentucky Department of Revenue’s Web

a. a national bank organized as a body corporate and site at www.revenue.ky.gov, or by requesting a copy of

existing or in the process of organizing as a national the form from the taxpayer service centers throughout

bank association pursuant to the provisions of the Kentucky or from the Miscellaneous Tax Branch,

National Bank Act, 12 U.S.C. sec. 21 et seq., in effect Department of Revenue, P.O. Box 1303, Frankfort, KY

on December 31, 1997, exclusive of any amendments 40602-1303.

made subsequent to that date;

The bank franchise tax is in lieu of all city, county and

b. any bank or trust company incorporated or organized local taxes, except the real estate transfer tax levied in

under the laws of any state, except a banker’s bank KRS Chapter 142, real property and tangible personal

organized under KRS 287.135; property taxes levied in KRS Chapter 132, the local