Enlarge image

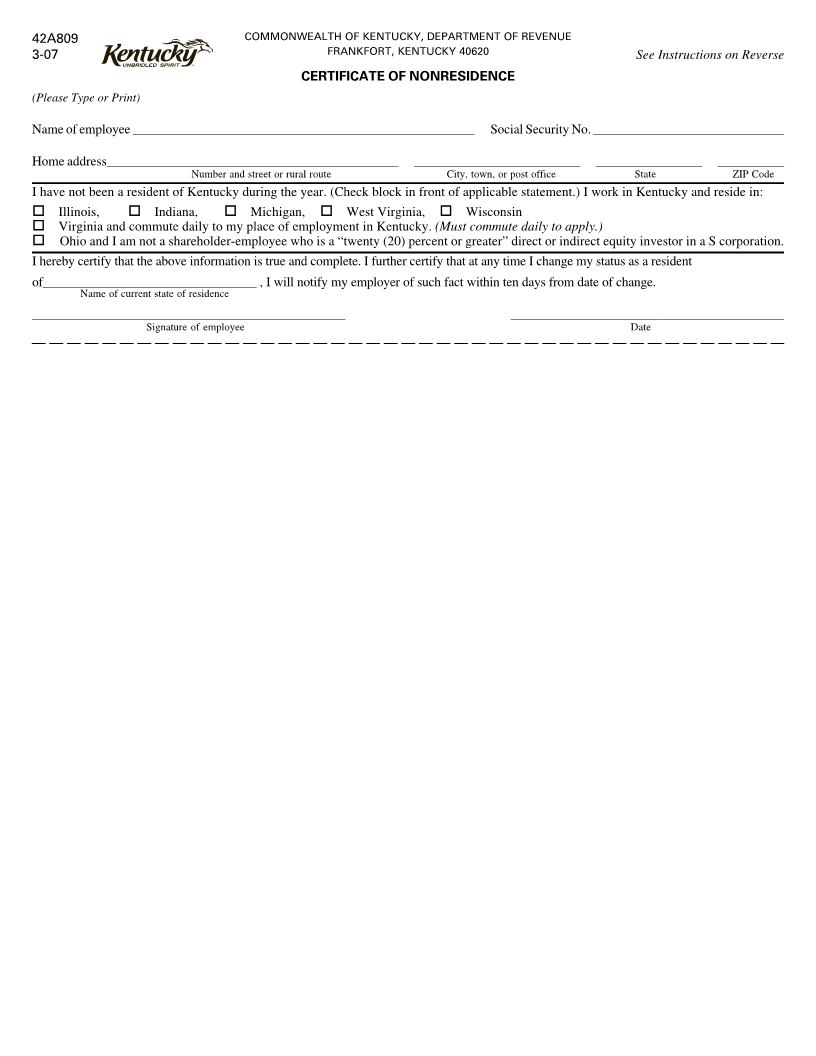

42A809 COMMONWEALTH OF KENTUCKY, DEPARTMENT OF REVENUE

3-07 FRANKFORT, KENTUCKY 40620 See Instructions on Reverse

CERTIFICATE OF NONRESIDENCE

(Please Type or Print)

Name of employee ____________________________________________________ Social Security No. _____________________________

Home address____________________________________________ _________________________ ________________ __________

Number and street or rural route City, town, or post office State ZIP Code

I have not been a resident of Kentucky during the year. (Check block in front of applicable statement.) I work in Kentucky and reside in:

Illinois, Indiana, Michigan, West Virginia, Wisconsin

Virginia and commute daily to my place of employment in Kentucky. (Must commute daily to apply.)

Ohio and I am not a shareholder-employee who is a “twenty (20) percent or greater” direct or indirect equity investor in a S corporation.

I hereby certify that the above information is true and complete. I further certify that at any time I change my status as a resident

of_________________________________ , I will notify my employer of such fact within ten days from date of change.

Name of current state of residence

_______________________________________________ _________________________________________

Signature of employee Date