Enlarge image

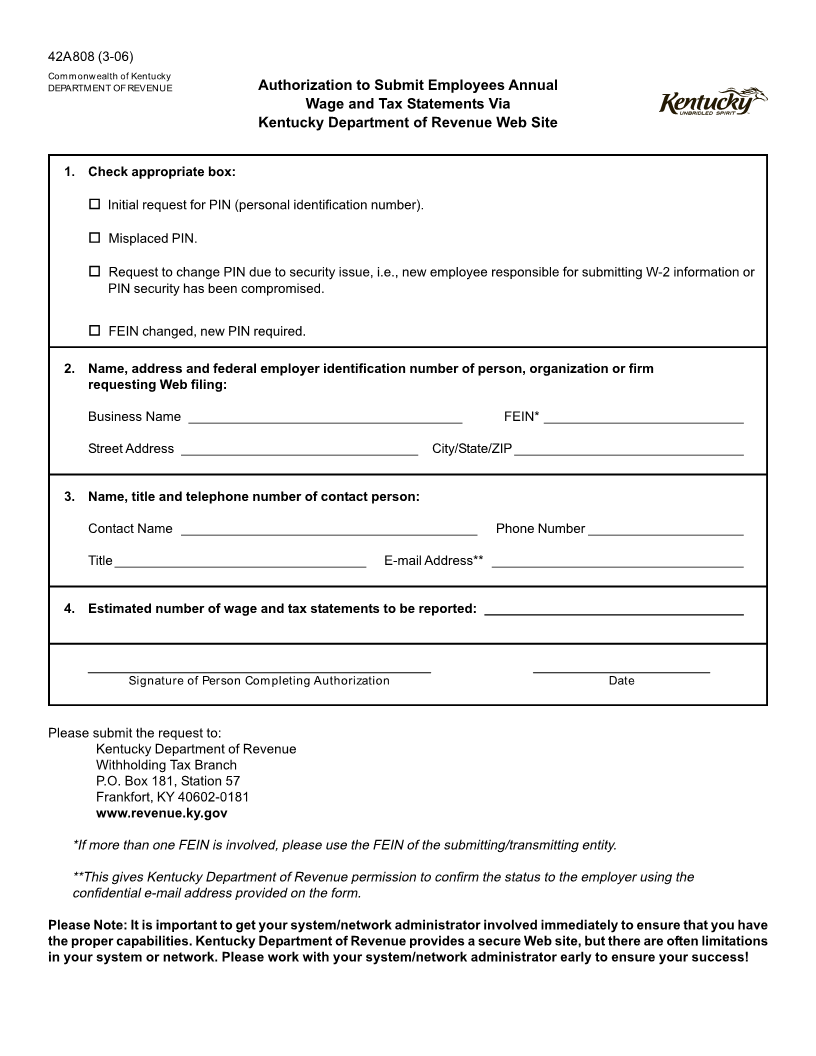

42A808 (3-06)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE Authorization to Submit Employees Annual

Wage and Tax Statements Via

Kentucky Department of Revenue Web Site

1. Check appropriate box:

Initial request for PIN (personal identification number).

Misplaced PIN.

Request to change PIN due to security issue, i.e., new employee responsible for submitting W-2 information or

PIN security has been compromised.

FEIN changed, new PIN required.

2. Name, address and federal employer identification number of person, organization or firm

requesting Web filing:

Business Name _____________________________________ FEIN* ___________________________

Street Address ________________________________ City/State/ZIP_______________________________

3. Name, title and telephone number of contact person:

Contact Name ________________________________________ Phone Number_____________________

Title__________________________________ E-mail Address** __________________________________

4. Estimated number of wage and tax statements to be reported: ___________________________________

Signature of Person Completing Authorization Date

Please submit the request to:

Kentucky Department of Revenue

Withholding Tax Branch

P.O. Box 181, Station 57

Frankfort, KY 40602-0181

www.revenue.ky.gov

*If more than one FEIN is involved, please use the FEIN of the submitting/transmitting entity.

**This gives Kentucky Department of Revenue permission to confirm the status to the employer using the

confidential e-mail address provided on the form.

Please Note: It is important to get your system/network administrator involved immediately to ensure that you have

the proper capabilities. Kentucky Department of Revenue provides a secure Web site, but there are often limitations

in your system or network. Please work with your system/network administrator early to ensure your success!