Enlarge image

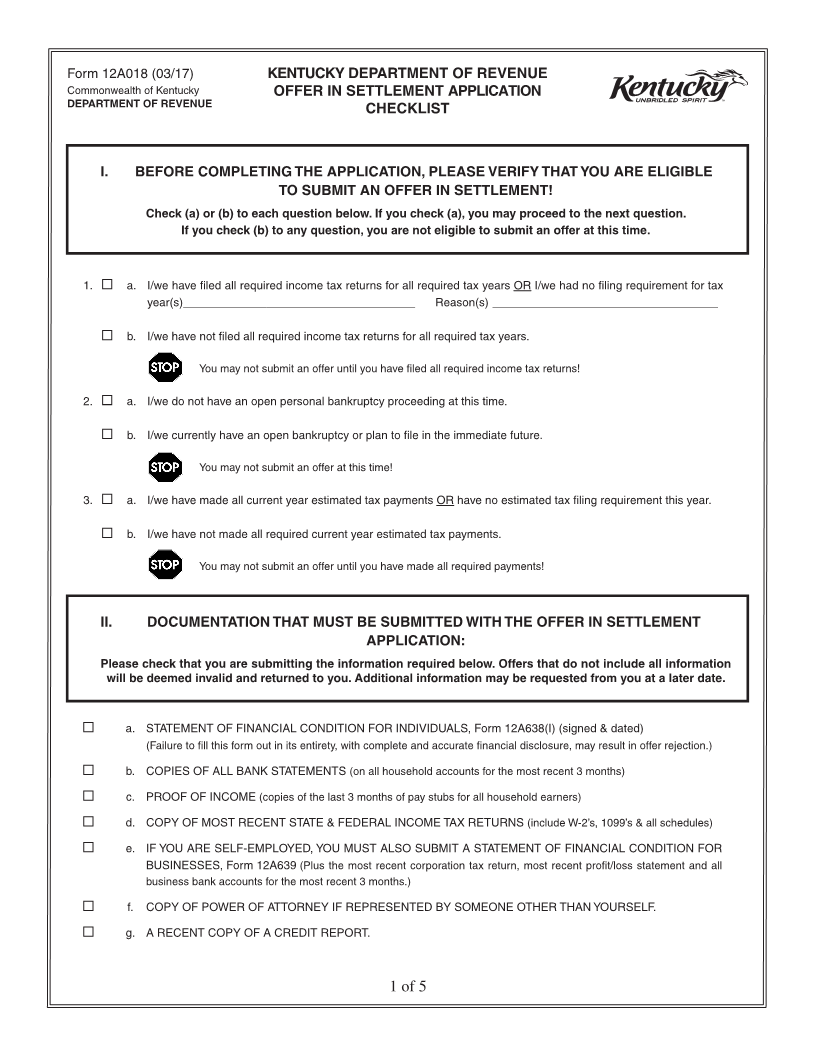

Form 12A018 (03/17) KENTUCKY DEPARTMENT OF REVENUE

Commonwealth of Kentucky OFFER IN SETTLEMENT APPLICATION

DEPARTMENT OF REVENUE

CHECKLIST

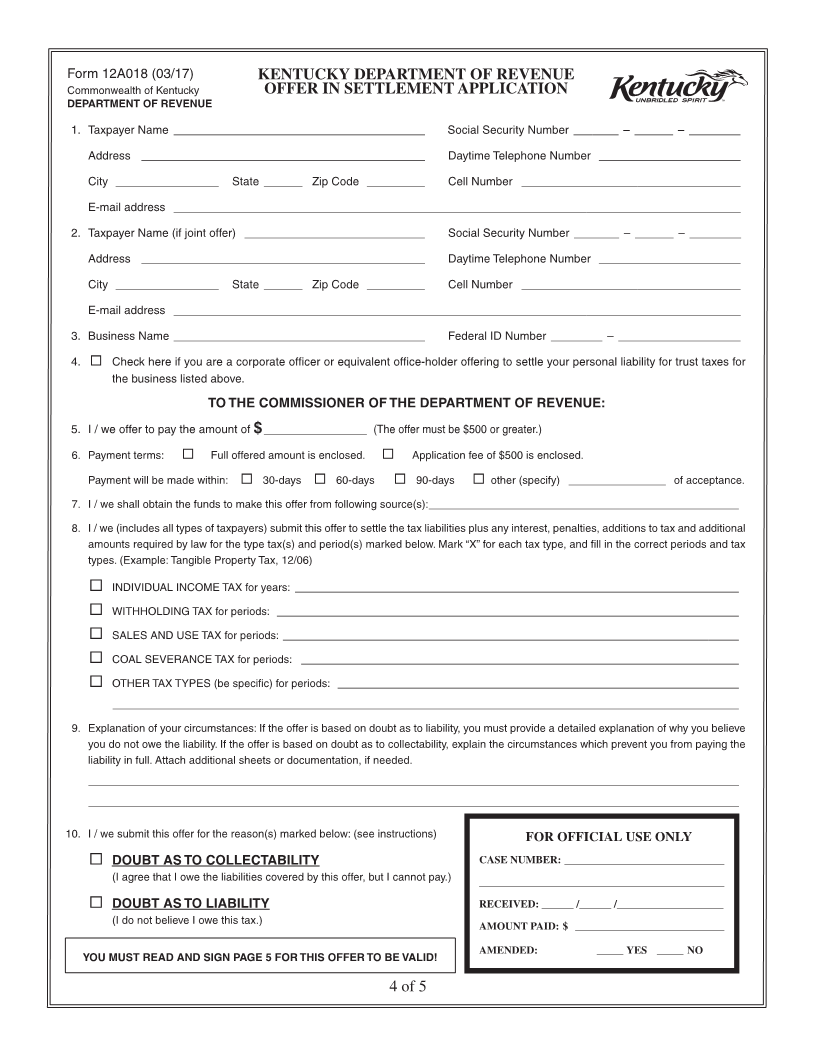

I. BEFORE COMPLETING THE APPLICATION, PLEASE VERIFY THAT YOU ARE ELIGIBLE

TO SUBMIT AN OFFER IN SETTLEMENT!

Check (a) or (b) to each question below. If you check (a), you may proceed to the next question.

If you check (b) to any question, you are not eligible to submit an offer at this time.

1. ¨ a. I/we have filed all required income tax returns for all required tax years OR I/we had no filing requirement for tax

year(s) ____________________________________ Reason(s) ___________________________________

¨ b. I/we have not filed all required income tax returns for all required tax years.

You may not submit an offer until you have filed all required income tax returns!

2. ¨ a. I/we do not have an open personal bankruptcy proceeding at this time.

¨ b. I/we currently have an open bankruptcy or plan to file in the immediate future.

You may not submit an offer at this time!

3. ¨ a. I/we have made all current year estimated tax payments OR have no estimated tax filing requirement this year.

¨ b. I/we have not made all required current year estimated tax payments.

You may not submit an offer until you have made all required payments!

II. DOCUMENTATION THAT MUST BE SUBMITTED WITH THE OFFER IN SETTLEMENT

APPLICATION:

Please check that you are submitting the information required below. Offers that do not include all information

will be deemed invalid and returned to you. Additional information may be requested from you at a later date.

¨ a. STATEMENT OF FINANCIAL CONDITION FOR INDIVIDUALS, Form 12A638(I) (signed & dated)

(Failure to fill this form out in its entirety, with complete and accurate financial disclosure, may result in offer rejection.)

¨ b. COPIES OF ALL BANK STATEMENTS (on all household accounts for the most recent 3 months)

¨ c. PROOF OF INCOME (copies of the last 3 months of pay stubs for all household earners)

¨ d. COPY OF MOST RECENT STATE & FEDERAL INCOME TAX RETURNS (include W-2’s, 1099’s & all schedules)

¨ e. IF YOU ARE SELF-EMPLOYED, YOU MUST ALSO SUBMIT A STATEMENT OF FINANCIAL CONDITION FOR

BUSINESSES, Form 12A639 (Plus the most recent corporation tax return, most recent profit/loss statement and all

business bank accounts for the most recent 3 months.)

¨ f. COPY OF POWER OF ATTORNEY IF REPRESENTED BY SOMEONE OTHER THAN YOURSELF.

¨ g. A RECENT COPY OF A CREDIT REPORT.

1 of 5