Enlarge image

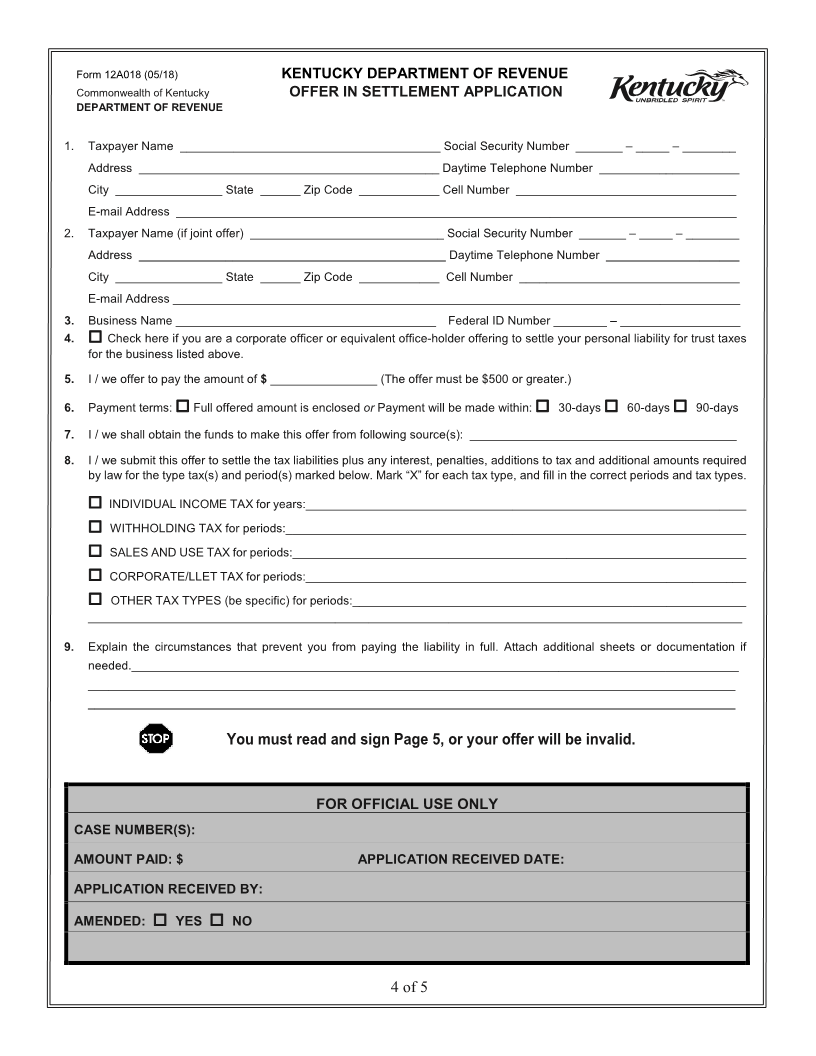

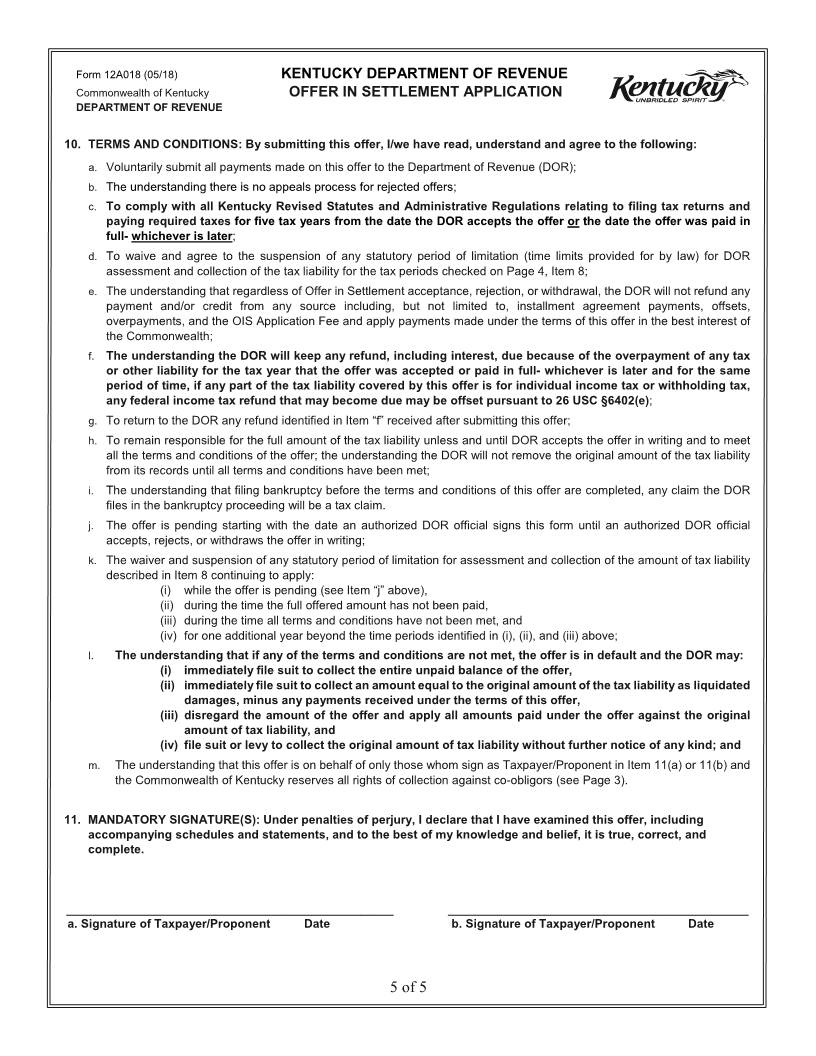

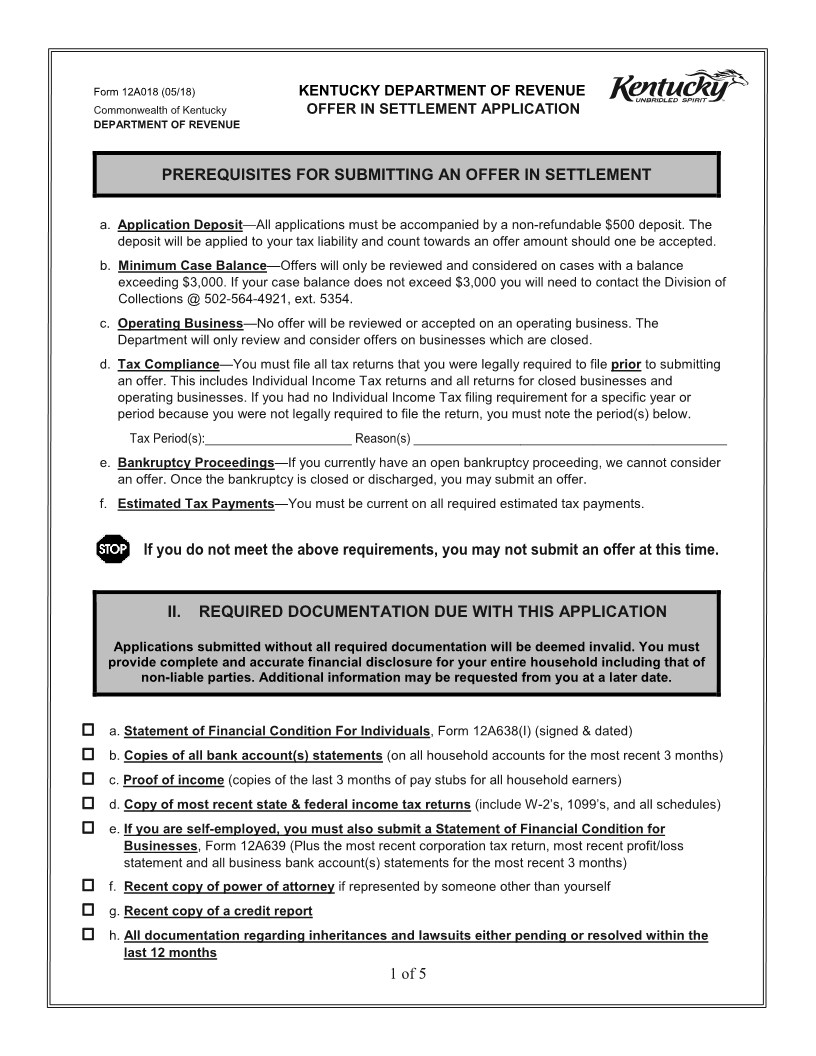

Form 12A018 (05/18) KENTUCKY DEPARTMENT OF REVENUE Commonwealth of Kentucky OFFER IN SETTLEMENT APPLICATION DEPARTMENT OF REVENUE PREREQUISITES FOR SUBMITTING AN OFFER IN SETTLEMENT a. Application Deposit—All applications must be accompanied by a non-refundable $500 deposit. The deposit will be applied to your tax liability and count towards an offer amount should one be accepted. b. Minimum Case Balance—Offers will only be reviewed and considered on cases with a balance exceeding $3,000. If your case balance does not exceed $3,000 you will need to contact the Division of Collections @ 502-564-4921, ext. 5354. c. Operating Business—No offer will be reviewed or accepted on an operating business. The Department will only review and consider offers on businesses which are closed. d. Tax Compliance—You must file all tax returns that you were legally required to file prior to submitting an offer. This includes Individual Income Tax returns and all returns for closed businesses and operating businesses. If you had no Individual Income Tax filing requirement for a specific year or period because you were not legally required to file the return, you must note the period(s) below. Tax Period(s):______________________ Reason(s) _______________________________________________ e. Bankruptcy Proceedings—If you currently have an open bankruptcy proceeding, we cannot consider an offer. Once the bankruptcy is closed or discharged, you may submit an offer. f. Estimated Tax Payments—You must be current on all required estimated tax payments. If you do not meet the above requirements, you may not submit an offer at this time. II. REQUIRED DOCUMENTATION DUE WITH THIS APPLICATION Applications submitted without all required documentation will be deemed invalid. You must provide complete and accurate financial disclosure for your entire household including that of non-liable parties. Additional information may be requested from you at a later date. a. Statement of Financial Condition For Individuals, Form 12A638(I) (signed & dated) b. Copies of all bank account(s) statements (on all household accounts for the most recent 3 months) c. Proof of income (copies of the last 3 months of pay stubs for all household earners) d. Copy of most recent state & federal income tax returns (include W-2’s, 1099’s, and all schedules) e. If you are self-employed, you must also submit a Statement of Financial Condition for Businesses, Form 12A639 (Plus the most recent corporation tax return, most recent profit/loss statement and all business bank account(s) statements for the most recent 3 months) f. Recent copy of power of attorney if represented by someone other than yourself g. Recent copy of a credit report h. All documentation regarding inheritances and lawsuits either pending or resolved within the last 12 months 1 of 5