Enlarge image

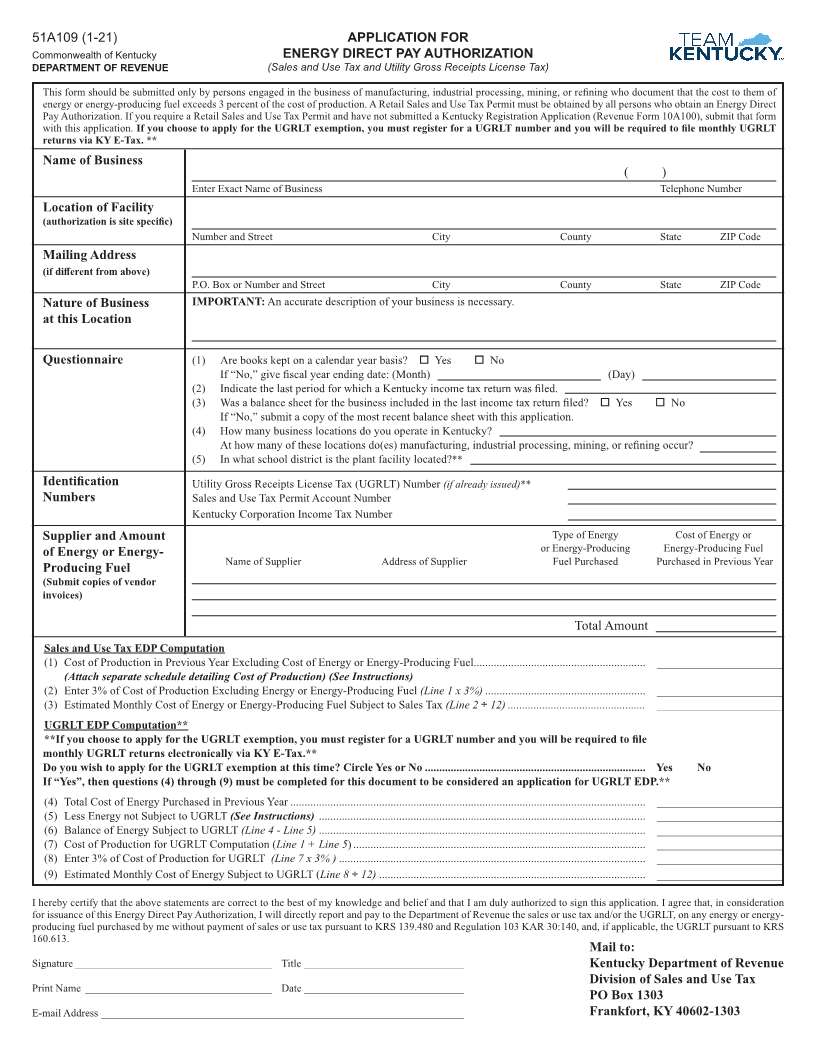

51A109 (1-21) APPLICATION FOR Commonwealth of Kentucky ENERGY DIRECT PAY AUTHORIZATION DEPARTMENT OF REVENUE (Sales and Use Tax and Utility Gross Receipts License Tax) This form should be submitted only by persons engaged in the business of manufacturing, industrial processing, mining, or refining who document that the cost to them of energy or energy-producing fuel exceeds 3 percent of the cost of production. A Retail Sales and Use Tax Permit must be obtained by all persons who obtain an Energy Direct Pay Authorization. If you require a Retail Sales and Use Tax Permit and have not submitted a Kentucky Registration Application (Revenue Form 10A100), submit that form with this application. If you choose to apply for the UGRLT exemption, you must register for a UGRLT number and you will be required to file monthly UGRLT returns via KY E-Tax. ** Name of Business ( ) Enter Exact Name of Business Telephone Number Location of Facility (authorization is site specific) Number and Street City County State ZIP Code Mailing Address (if different from above) P.O. Box or Number and Street City County State ZIP Code Nature of Business IMPORTANT: An accurate description of your business is necessary. at this Location Questionnaire (1) Are books kept on a calendar year basis? Yes No If “No,” give fiscal year ending date: (Month) (Day) (2) Indicate the last period for which a Kentucky income tax return was filed. (3) Was a balance sheet for the business included in the last income tax return filed? Yes No If “No,” submit a copy of the most recent balance sheet with this application. (4) How many business locations do you operate in Kentucky? At how many of these locations do(es) manufacturing, industrial processing, mining, or refining occur? (5) In what school district is the plant facility located?** Identification Utility Gross Receipts License Tax (UGRLT) Number (if already issued)** Numbers Sales and Use Tax Permit Account Number Kentucky Corporation Income Tax Number Supplier and Amount Type of Energy Cost of Energy or of Energy or Energy- or Energy-Producing Energy-Producing Fuel Name of Supplier Address of Supplier Fuel Purchased Purchased in Previous Year Producing Fuel (Submit copies of vendor invoices) Total Amount Sales and Use Tax EDP Computation (1) Cost of Production in Previous Year Excluding Cost of Energy or Energy-Producing Fuel............................................................ ______________________ (Attach separate schedule detailing Cost of Production) (See Instructions) (2) Enter 3% of Cost of Production Excluding Energy or Energy-Producing Fuel (Line 1 x 3%) ........................................................ ______________________ (3) Estimated Monthly Cost of Energy or Energy-Producing Fuel Subject to Sales Tax (Line 2 ÷12) ................................................ ______________________ UGRLT EDP Computation** **If you choose to apply for the UGRLT exemption, you must register for a UGRLT number and you will be required to file monthly UGRLT returns electronically via KY E-Tax.** Do you wish to apply for the UGRLT exemption at this time? Circle Yes or No ............................................................................. Yes No If “Yes”, then questions (4) through (9) must be completed for this document to be considered an application for UGRLT EDP.** (4) Total Cost of Energy Purchased in Previous Year ............................................................................................................................ ______________________ (5) Less Energy not Subject to UGRLT (See Instructions) .................................................................................................................. ______________________ (6) Balance of Energy Subject to UGRLT (Line 4 - Line 5) .................................................................................................................. ______________________ (7) Cost of Production for UGRLT Computation (Line 1 + Line 5) ...................................................................................................... ______________________ (8) Enter 3% of Cost of Production for UGRLT (Line 7 x 3% ) ........................................................................................................... ______________________ (9) Estimated Monthly Cost of Energy Subject to UGRLT (Line 8 ÷12) ............................................................................................. ______________________ I hereby certify that the above statements are correct to the best of my knowledge and belief and that I am duly authorized to sign this application. I agree that, in consideration for issuance of this Energy Direct Pay Authorization, I will directly report and pay to the Department of Revenue the sales or use tax and/or the UGRLT, on any energy or energy- producing fuel purchased by me without payment of sales or use tax pursuant to KRS 139.480 and Regulation 103 KAR 30:140, and, if applicable, the UGRLT pursuant to KRS 160.613. Mail to: Signature _____________________________________ Title ______________________________ Kentucky Department of Revenue Division of Sales and Use Tax Print Name ___________________________________ Date ______________________________ PO Box 1303 E-mail Address ____________________________________________________________________ Frankfort, KY 40602-1303