Enlarge image

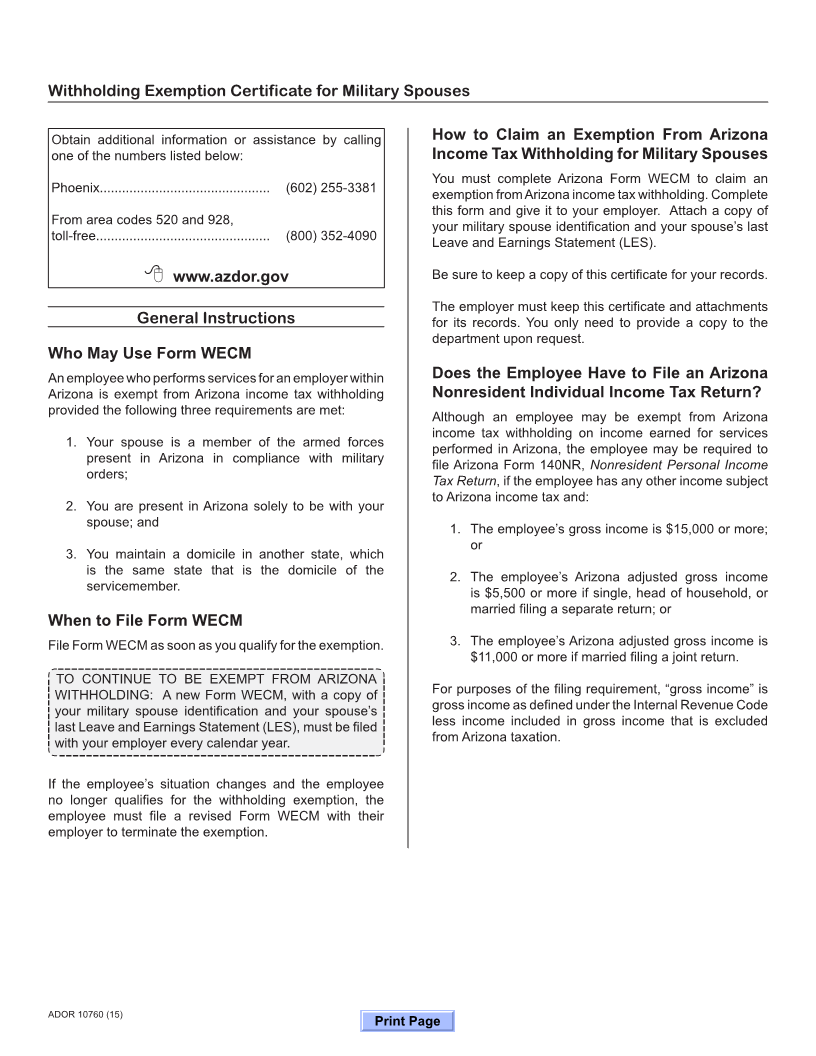

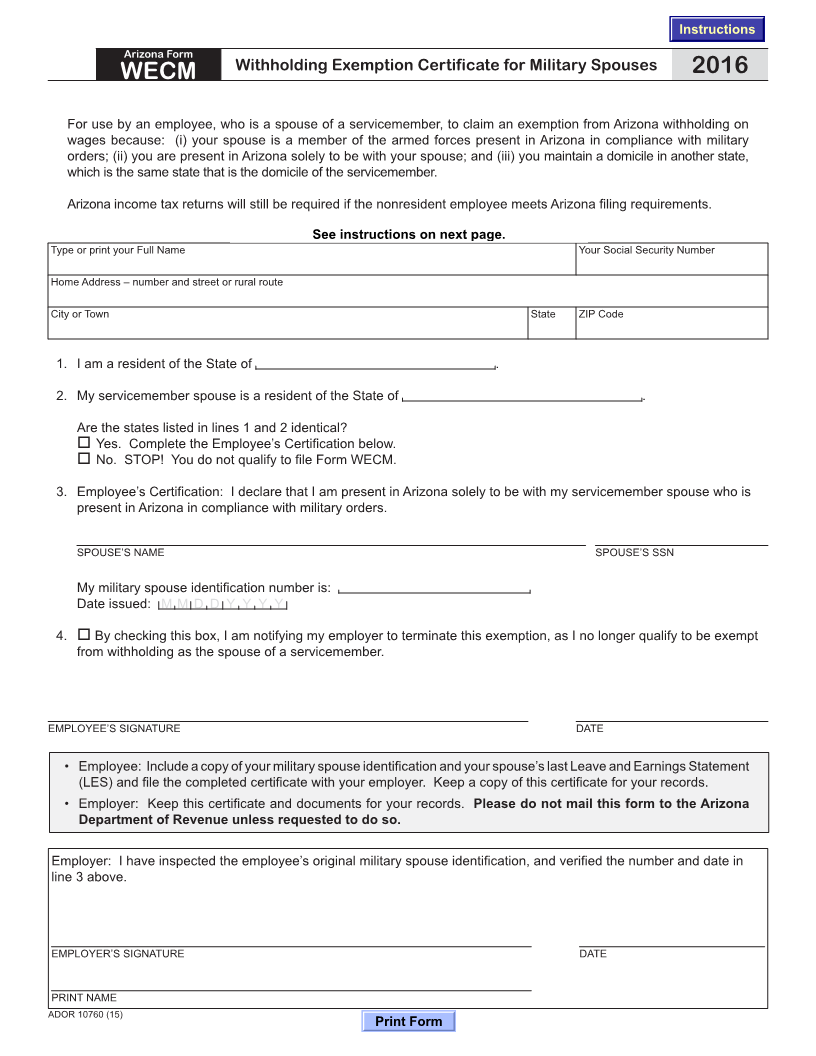

Instructions

Arizona Form

Withholding Exemption Certificate for Military Spouses

WECM 2016

For use by an employee, who is a spouse of a servicemember, to claim an exemption from Arizona withholding on

wages because: (i) your spouse is a member of the armed forces present in Arizona in compliance with military

orders; (ii) you are present in Arizona solely to be with your spouse; and (iii) you maintain a domicile in another state,

which is the same state that is the domicile of the servicemember.

Arizona income tax returns will still be required if the nonresident employee meets Arizona filing requirements.

SeeSeeinstructionsinstructionsononreversenext page.side.

Type or print your Full Name Your Social Security Number

Home Address – number and street or rural route

City or Town State ZIP Code

1. I am a resident of the State of .

2. My servicemember spouse is a resident of the State of .

Are the states listed in lines 1 and 2 identical?

Yes. Complete the Employee’s Certification below.

No. STOP! You do not qualify to file Form WECM.

3. Employee’s Certification: I declare that I am present in Arizona solely to be with my servicemember spouse who is

present in Arizona in compliance with military orders.

SPOUSE’S NAME SPOUSE’S SSN

My military spouse identification number is:

Date issued: M M D D YYYY

4. By checking this box, I am notifying my employer to terminate this exemption, as I no longer qualify to be exempt

from withholding as the spouse of a servicemember.

EMPLOYEE’S SIGNATURE DATE

• Employee: Include a copy of your military spouse identification and your spouse’s last Leave and Earnings Statement

(LES) and file the completed certificate with your employer. Keep a copy of this certificate for your records.

• Employer: Keep this certificate and documents for your records. Please do not mail this form to the Arizona

Department of Revenue unless requested to do so.

Employer: I have inspected the employee’s original military spouse identification, and verified the number and date in

line 3 above.

EMPLOYER’S SIGNATURE DATE

PRINT NAME

ADOR 10760 (15)

Print Form