Enlarge image

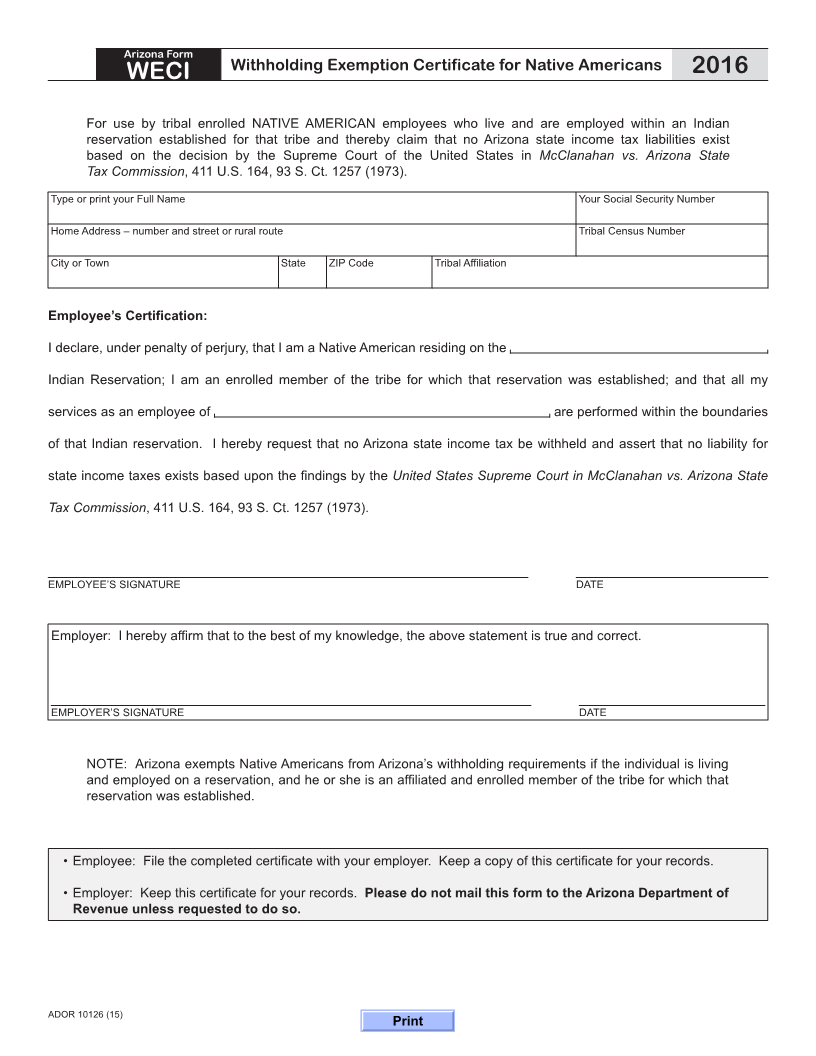

Arizona Form

Withholding Exemption Certificate for Native Americans

WECI 2016

For use by tribal enrolled NATIVE AMERICAN employees who live and are employed within an Indian

reservation established for that tribe and thereby claim that no Arizona state income tax liabilities exist

based on the decision by the Supreme Court of the United States in McClanahan vs. Arizona State

Tax Commission, 411 U.S. 164, 93 S. Ct. 1257 (1973).

Type or print your Full Name Your Social Security Number

Home Address – number and street or rural route Tribal Census Number

City or Town State ZIP Code Tribal Affiliation

Employee’s Certification:

I declare, under penalty of perjury, that I am a Native American residing on the

Indian Reservation; I am an enrolled member of the tribe for which that reservation was established; and that all my

services as an employee of are performed within the boundaries

of that Indian reservation. I hereby request that no Arizona state income tax be withheld and assert that no liability for

state income taxes exists based upon the findings by the United States Supreme Court in McClanahan vs. Arizona State

Tax Commission, 411 U.S. 164, 93 S. Ct. 1257 (1973).

EMPLOYEE’S SIGNATURE DATE

Employer: I hereby affirm that to the best of my knowledge, the above statement is true and correct.

EMPLOYER’S SIGNATURE DATE

NOTE: Arizona exempts Native Americans from Arizona’s withholding requirements if the individual is living

and employed on a reservation, and he or she is an affiliated and enrolled member of the tribe for which that

reservation was established.

• Employee: File the completed certificate with your employer. Keep a copy of this certificate for your records.

• Employer: Keep this certificate for your records. Please do not mail this form to the Arizona Department of

Revenue unless requested to do so.

ADOR 10126 (15)

Print