Enlarge image

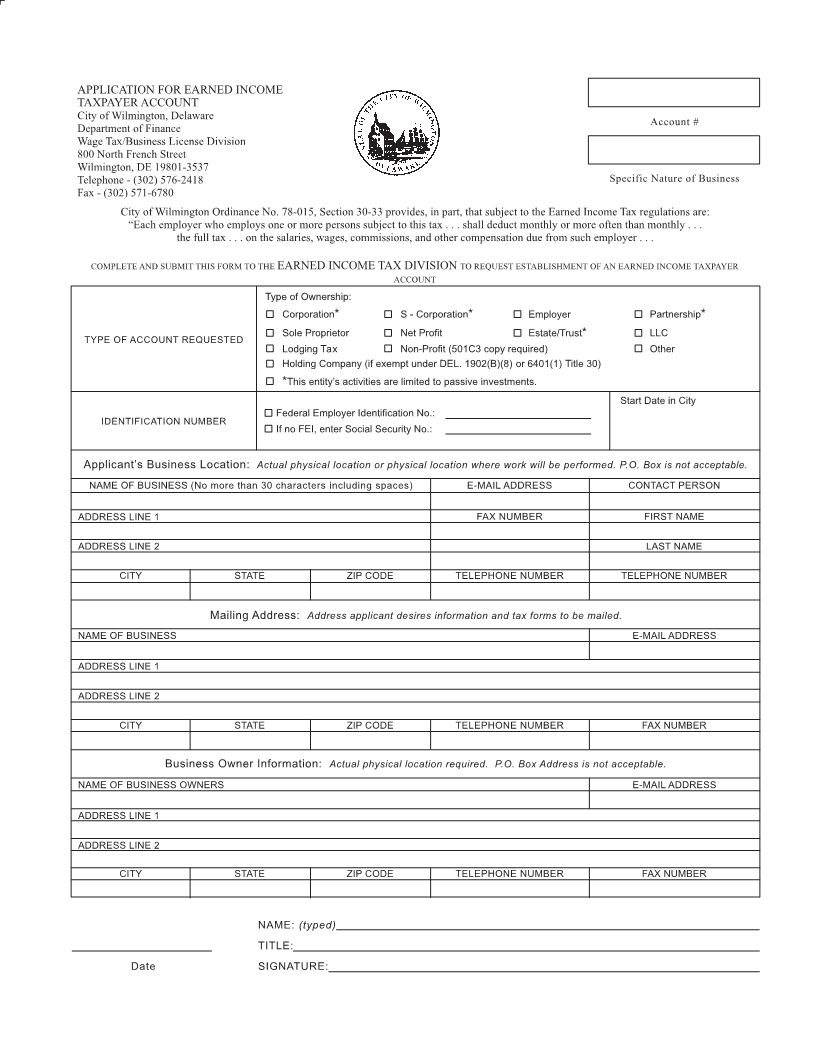

Page 4 SECTION 3 - EMPLOYER CERTIFICATION APPLICATION FOR EARNED INCOME 2019TAXPAYER ACCOUNTWCWT-5(CERTIFICATION REQUIRED FOR PROCESSING) I certify that the factsCityshownof Wilmington,above supportingAPPLICATIONEmployee’sDelawareFORClaim for allocation and CERTIFICATION BY EMPLOYER: Account # Department of FinanceREFUND OF WILMINGTONnon-taxable income are correct based on available payroll records. Wage Tax/BusinessCITYLicenseWAGE TAXDivision 800 North FrenchFEI/FN Street Wilmington,TELEPHONEDE#19801-3537 AUTHORIZED OFFICIAL (Type or Print) Telephone - (302) 576-2418 Specific Nature of Business SECTION 1Fax- BACKGROUND- (302) 571-6780INFORMATION TITLE AUTHORIZED OFFICIAL (Signature) City of Wilmington Ordinance No. 78-015, Section 30-33 provides, in part, that subject to the Earned Income Tax regulations are: “Each employer who employs one or more persons subject to this tax . . . shall deduct monthly or more often than monthly . . . 1. Name: FIRST NAME the full tax .INITIAL. . on the salaries, wages, commissions,LAST NAME andQuestionsother compensation due from such employer . . . COMPLETEAPT.NoNAMEAND& NUMBERSUBMITYesTHIS FORMSTREETTONO.THE(RFD NO.)EARNED1. DidINCOMEyou FileSTREETfor 2018NAMETAXRefund?DIVISIONTO REQUEST ESTABLISHMENT OF AN EARNED INCOME TAXPAYER 2. Home Address: No Yes 2. If Yes, Have You Since Changed Your Address? CITY OR TOWN STATE ZIP CODE HOME TEL. NO.ACCOUNT Type of Ownership: 3. Employment: PRESENT EMPLOYER NAME ADDRESS WORK TEL. NO. Corporation* S - Corporation* Employer Partnership* DATE SIGNATUREOTHEROF PREPAREREMPLOYER NAMEOTHER THAN TAXPAYER DATEADDRESSSole Proprietor TAXPAYER SIGNATURENet Profit Estate/Trust* LLC TYPE OF ACCOUNT REQUESTED General instructions: Lodging Tax Non-Profit (501C3 copy required) Other 1. You must attach a copy of yourNAMEW-2 that shows both federal and local wages.Holding CompanySOCIAL(if exemptSECURITY NUMBERunder DEL. 1902(B)(8) or 6401(1) Title 30) 2. An authorized signature must be obtained from your employer. Other Substantiation may be substituted only with the express consent of an authorized employee of the Earned Income Tax Division. This entity’s activities are limited to passive investments. 3. You must sign this form. * 5. Your refund should be issued within 90 days from the date of receipt only if your return is completed in its entirety and all employers information 4. Youmust for refund betweenADDRESSJanuary 1, 2020 and December 31, 2022. Start Date in City has been with the city prior to your this return. 6. Any tax due must be paid by April 30, 2020. Federal Employer Identification No.: 7. If you are claimingIDENTIFICATIONa refundTELEPHONErelatedNUMBERto moreNUMBERthan one employer, separate returns must be for each employer. 1. A bona non-resident of Wilmington, actually performing part or all of his work outside this city, shall If no FEI, enter Social Security No.: Form WCWT-5 where an allocation of wages, salaries, commissions,IDENTIFYINGetc.,NUMBERis claimed. An individual DOMICILED outside Wilmington is a bona non-resident. 2. Where non-resident actually works ENTIRELY WITHIN Wilmington, he may not exclude any portion of his earnings including compensation for holidays, vacation, annual leave, sick or disability leave, Saturdays and Sundays. 3. Dates workedApplicant’sout of the city mustBusinessbe listed in chronologicalLocation: order and theActualrespectivephysicallocations location (Ex:orJanphysical5, Cleveland,locationOh). Do notwhere work will be performed. P.O. Box is not acceptable. submit schedules that do not follow the required format. Convert all hours into days (eight (8) hours equals one day) and round to the 4. You must complete the schedule of non-working days. Saturdays and Sundays that you worked cannot be included in non-working nearest 1/2 day.NAME OF BUSINESS (No more than 30 characters including spaces)SECTION 4 - PROCESSING - TAX OFFICE USE ONLY E-MAIL ADDRESS CONTACT PERSON days. Only holidays, vacation, illness, and other dates must be listed in chronological order. For dates listed as “other”, please indicate what they are. If you are employed on a full-time basis, include any other type of PAID leave. Do not include any unpaid leave. 5. The allocation percentage MUST be rounded to the nearest tenth of a percent (.001). REFUND6. ExplainAMOUNTADDRESSany differences betweenLINEEMPLOYERSyour1Wilmington wages and yourWAGEFederal wages, state wages,A/PsocialCLAIMsecurity wages, and medicareA/P CLAIMwages. FAX NUMBER FIRST NAME 7. Where erroneous withholdingACCOUNTis claimed,NUMBERa letter from employerBATCHon Company’sNUMBERstationeryBATCHmust be NUMBER with application. All lettersNUMBERmust besigned originals and dated, no copies will be accepted. Dates listed for “work at home” require a letter from your employer on company stationery stating that you worked from home. 8. WhereADDRESSbusiness travel andLINEother business2 expense are included on W-2, please attach a copy of Federal Form 2106, Employee Business LAST NAME Expenses. Where moving expenses are included on W-2, please attach Federal #3903F (whichever is applicable). 9. Additional information may be required 10. P.O. Box addresses are not acceptable, if your W2 form has a P.O. Box address, then you must provide a copy of a deed or lease for your residential address. CITY STATE ZIP CODE TELEPHONE NUMBER TELEPHONE NUMBER 800MAILFRENCHTO CITYSTREET,OFwww.wilmingtonde.govDIVISIONWILMINGTON,WILMINGTON,302-576-2416OF REVENUECITY/COUNTYDELAWARE 19801-3537BLDG. Mailing Address: Address applicant desires information and tax forms to be mailed. WCWT-5 REV.APPROVALDEPARTMENT11/18(OVERHEAD$10,000) APPROVED BY – DIVISION HEAD PROCESSED BY NAME OF BUSINESS E-MAIL ADDRESS ADDRESS LINE 1 ADDRESS LINE 2 CITY STATE ZIP CODE TELEPHONE NUMBER FAX NUMBER Business Owner Information: Actual physical location required. P.O. Box Address is not acceptable. NAME OF BUSINESS OWNERS E-MAIL ADDRESS ADDRESS LINE 1 ADDRESS LINE 2 CITY STATE ZIP CODE TELEPHONE NUMBER FAX NUMBER NAME: (typed) TITLE: Date SIGNATURE: