Enlarge image

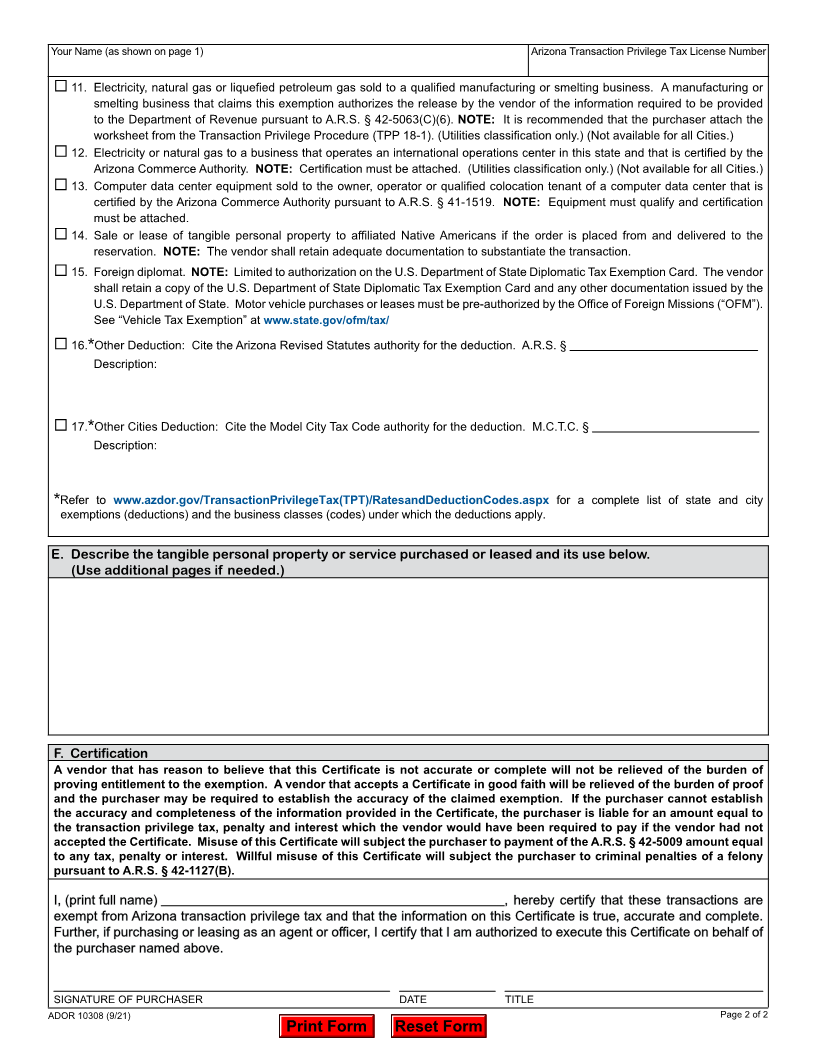

Arizona Form

Transaction Privilege Tax Exemption Certificate

5000

• Do not use Form 5000 to claim sale for resale. Use Form 5000A.

• Do not use Form 5000 if you are a non-TPT licensed contractor. Use Form 5000M.

This Certificate is prescribed by the Department of Revenue pursuant to A.R.S. § 42-5009. The purpose of the

Certificate is to document and establish a basis for state and city tax deductions or exemptions. It is to be filled

out completely by the purchaser and furnished to the vendor at the time of the sale. The vendor shall retain

this Certificate for single transactions or for the specified period as indicated below. Incomplete Certificates are

not considered to be accepted in good faith. Only one category of exemption may be claimed on a Certificate.

A. Purchaser’s Name and Address: B. Check Applicable Box:

Purchaser’s Name Single Transaction Certificate

Period From Through

Address (You must choose specific dates for which the certificate will be valid. You

are encouraged not to exceed a 12 month period. However, a certificate will be

considered to be accepted in good faith for a period not to exceed 48 months if the

City State ZIP Code vendor has documentation the TPT license is valid for each calendar year covered

in the certificate.)

Purchaser’s Email (Optional) Purchaser’s Telephone Number (Optional)

Vendor’s Name

C. Choose one transaction type per Certificate:

Transactions with a Business Transactions with Native Americans, Native American

Businesses and Tribal Governments (See reason #14.)

Arizona Transaction Privilege Tax (TPT) License Number Tribal Business License Number OR Tribal Number

SSN / EIN Name of Tribe Tribal Government

Other Tax License Number Transactions with a U.S. Government entity

(See reasons #9 and #10.)

If no license, provide reason:

Transaction with a Foreign Diplomat (See reason #15.)

Precise Nature of Purchaser’s Business.

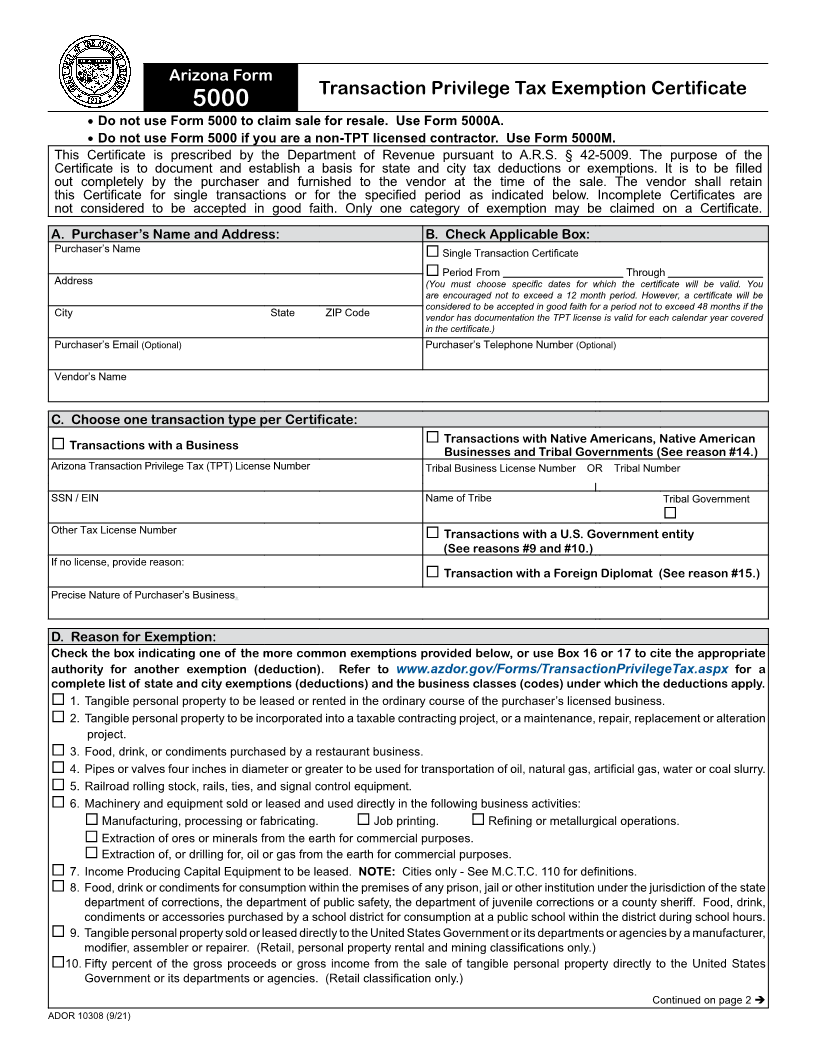

D. Reason for Exemption:

Check the box indicating one of the more common exemptions provided below, or use Box 16 or 17 to cite the appropriate

authority for another exemption (deduction). Refer to www.azdor.gov/Forms/TransactionPrivilegeTax.aspx for a

complete list of state and city exemptions (deductions) and the business classes (codes) under which the deductions apply.

1. Tangible personal property to be leased or rented in the ordinary course of the purchaser’s licensed business.

2. Tangible personal property to be incorporated into a taxable contracting project, or a maintenance, repair, replacement or alteration

project.

3. Food, drink, or condiments purchased by a restaurant business.

4. Pipes or valves four inches in diameter or greater to be used for transportation of oil, natural gas, artificial gas, water or coal slurry.

5. Railroad rolling stock, rails, ties, and signal control equipment.

6. Machinery and equipment sold or leased and used directly in the following business activities:

Manufacturing, processing or fabricating. Job printing. Refining or metallurgical operations.

Extraction of ores or minerals from the earth for commercial purposes.

Extraction of, or drilling for, oil or gas from the earth for commercial purposes.

7. Income Producing Capital Equipment to be leased. NOTE: Cities only - See M.C.T.C. 110 for definitions.

8. Food, drink or condiments for consumption within the premises of any prison, jail or other institution under the jurisdiction of the state

department of corrections, the department of public safety, the department of juvenile corrections or a county sheriff. Food, drink,

condiments or accessories purchased by a school district for consumption at a public school within the district during school hours.

9. Tangible personal property sold or leased directly to the United States Government or its departments or agencies by a manufacturer,

modifier, assembler or repairer. (Retail, personal property rental and mining classifications only.)

10. Fifty percent of the gross proceeds or gross income from the sale of tangible personal property directly to the United States

Government or its departments or agencies. (Retail classification only.)

Continued on page 2

ADOR 10308 (9/21)