Enlarge image

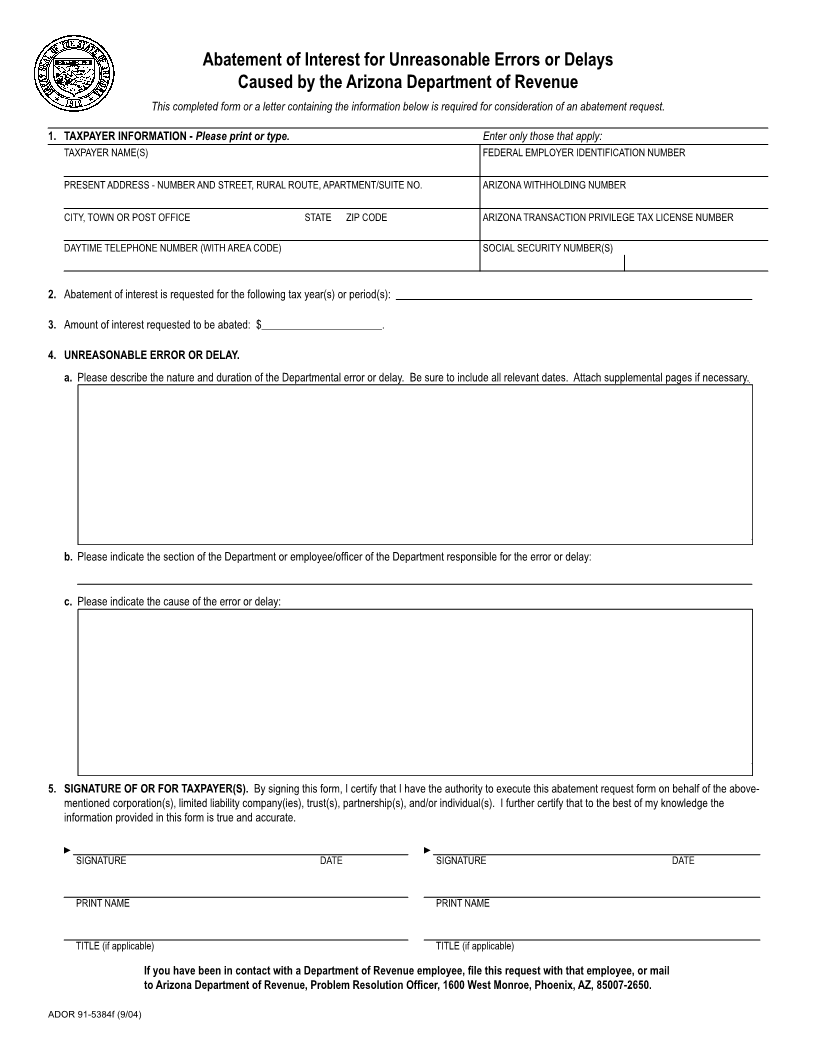

Abatement of Interest for Unreasonable Errors or Delays

Caused by the Arizona Department of Revenue

Do not use this form to request an adjustment to a

current or recent billing.

This form should be used ONLY in those cases where a taxpayer’s

fi nal bill has been affected by unreasonable errors or delays on

the part of Arizona Department of Revenue audit or collections

personnel.

For questions or concerns about a recent billing statement,

contact our Taxpayer Information and Assistance Section at:

For Income and Corporate Tax Types: (602) 255-3381

Toll-free from within Arizona: (800) 352-4090

For TPT and Withholding Tax Types: (602) 255-2060

Toll-free from within Arizona: (800) 843-7196

The mailing address is:

PO Box 29086

Phoenix, AZ 85038-9086

ADOR 91-5384f (9/04)