Enlarge image

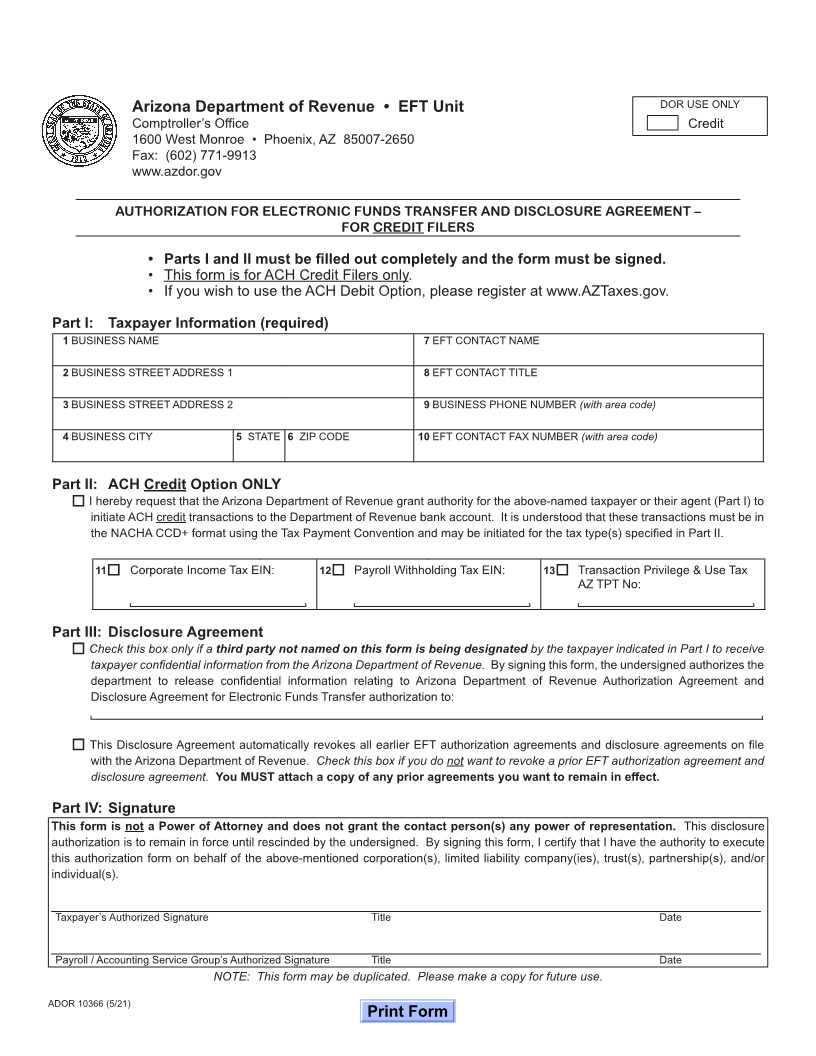

Arizona Department of Revenue • EFT Unit DOR USE ONLY

Comptroller’s Office Credit

1600 West Monroe • Phoenix, AZ 85007-2650

Fax: (602) 771-9913

www.azdor.gov

AUTHORIZATION FOR ELECTRONIC FUNDS TRANSFER AND DISCLOSURE AGREEMENT –

FOR CREDIT FILERS

• Parts I and II must be filled out completely and the form must be signed.

• This form is for ACH Credit Filers only.

• If you wish to use the ACH Debit Option, please register at www.AZTaxes.gov.

Part I: Taxpayer Information (required)

1 BUSINESS NAME 7 EFT CONTACT NAME

2 BUSINESS STREET ADDRESS 1 8 EFT CONTACT TITLE

3 BUSINESS STREET ADDRESS 2 9 BUSINESS PHONE NUMBER (with area code)

4 BUSINESS CITY 5 STATE 6 ZIP CODE 10 EFT CONTACT FAX NUMBER (with area code)

Part II: ACH Credit Option ONLY

I hereby request that the Arizona Department of Revenue grant authority for the above-named taxpayer or their agent (Part I) to

initiate ACH credit transactions to the Department of Revenue bank account. It is understood that these transactions must be in

the NACHA CCD+ format using the Tax Payment Convention and may be initiated for the tax type(s) specified in Part II.

11 Corporate Income Tax EIN: 12 Payroll Withholding Tax EIN: 13 Transaction Privilege & Use Tax

AZ TPT No:

Part III: Disclosure Agreement

Check this box only if a third party not named on this form is being designated by the taxpayer indicated in Part I to receive

taxpayer confidential information from the Arizona Department of Revenue. By signing this form, the undersigned authorizes the

department to release confidential information relating to Arizona Department of Revenue Authorization Agreement and

Disclosure Agreement for Electronic Funds Transfer authorization to:

This Disclosure Agreement automatically revokes all earlier EFT authorization agreements and disclosure agreements on file

with the Arizona Department of Revenue. Check this box if you do not want to revoke a prior EFT authorization agreement and

disclosure agreement. You MUST attach a copy of any prior agreements you want to remain in effect.

Part IV: Signature

This form is not a Power of Attorney and does not grant the contact person(s) any power of representation. This disclosure

authorization is to remain in force until rescinded by the undersigned. By signing this form, I certify that I have the authority to execute

this authorization form on behalf of the above-mentioned corporation(s), limited liability company(ies), trust(s), partnership(s), and/or

individual(s).

Taxpayer’s Authorized Signature Title Date

Payroll / Accounting Service Group’s Authorized Signature Title Date

NOTE: This form may be duplicated. Please make a copy for future use.

ADOR 10366 (5/21)

Print Form