Enlarge image

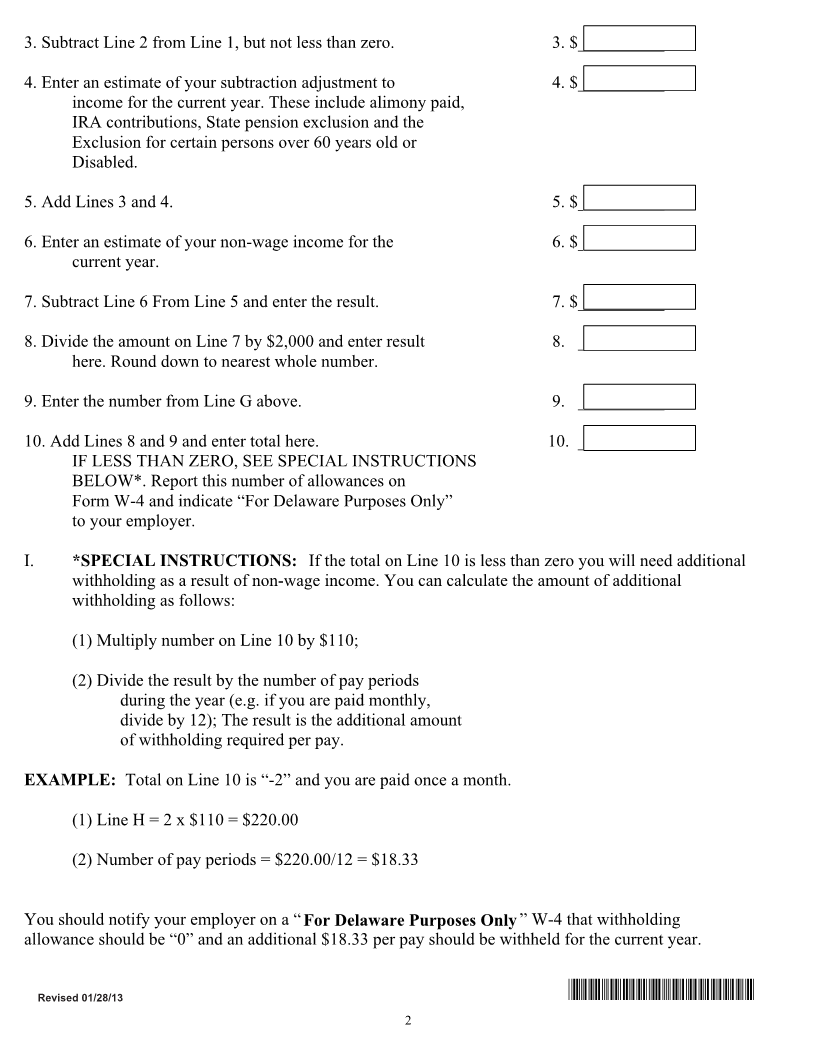

FORM SD/W-4A Reset Print Form STATE OF DELAWARE WITHHOLDINGALLOWANCE(S) COMPUTATION WORKSHEET A. Enter “1” for Yourself (2 if 60 years old or older) A. __________ if no one else claims you as a dependent. B. Enter “1” for your Spouse (2 if 60 years or older) B. __________ if no one else claims your spouse as a dependent. C. Enter number of dependents other than your spouse that C. __________ you will claim. D. Enter “1” if you qualify to take a child/dependent care D. __________ credit for one child or dependent and “2” if you qualify to take the credit for two or more children or dependents. E. Enter “1” for yourself if 65 or over and “1” if blind. E. __________ F. Enter “1” for spouse if 65 or over and “1” if blind. F. __________ G. Add Line A through F and enter total here. G. __________ If you plan to itemize or receive non-wage income, or claim other deductions and wish to adjust your withholding, continue with the following Section H. OTHERWISE STOP HERE and enter number from Line G onto Form W-4 and indicate “For Delaware Purposes Only”. H. DEDUCTIONS AND INCOME ADJUSTMENTS – NOTE– Use this section only if you plan to Itemize or claim other deductions or have non- Wage income. If computing this section on married filing separate or combined separate status, the following rule applies: include only the amount of itemized deductions that pertain to your separate return. 1. Enter an estimate of your itemized deductions 1. $ __________ for the current year, i.e. home mortgage interest, real estate and other taxes (excluding state income tax paid), charitable contributions, medical expenses in excess of 7.5% of adjusted gross income, and miscellaneous deductions (most miscellaneous deductions are now deductible only in excess of 2% of your adjusted gross income). 2. Delaware Standard Deduction of $3,250 2. $ 3,250.00 *DF40913019999* 1