Enlarge image

OFFICE OF SECRETARY OF STATE

CORPORATIONS DIVISION

2 Martin Luther King Jr. Dr. SE

Suite 313 West Tower

Atlanta, Georgia 30334

(404) 656-2817

sos.georgia.gov/corporations

Secretary of State

FILING PROCEDURES FOR FORMING

A GEORGIA LIMITED PARTNERSHIP

Limited partnerships (“LP”) are formed by filing a certificate of limited partnership with the Secretary

of State. The minimum requirements of Georgia law are outlined herein. Many other provisions may,

and perhaps should, be included in the certificate. It is very simple to form an LP. The question of

whether or not an LP should be formed is complex. The Corporations Division strongly recommends

that filers obtain professional legal, tax and/or business advice to assure the filer’s goals and intentions

are met, and that requirements of the law are satisfied, both before and after formation of the entity.

Name Reservation

A name may be reserved prior to filing entity formation or registration documents. The reservation may be

made online or by submitting a Name Reservation Request form. A reservation fee of $25 must accompany

the request. There is a $10.00 service charge for filing a name reservation request by paper. Fees are non-

refundable. If the name reservation is approved, a name reservation number will be provided to the filer by

return email. A name reservation is effective for 30 days or until the filing forming or registering the entity

is submitted, whichever is sooner. Name reservation requests are generally processed within 3 to 5 business

days of receipt of an online request and within 5 to 7 business days of receipt of a mail-in request. To redeem

a name reservation, enter the reservation number in the field provided on an online business formation

application or, if submitting a paper filing by mail or hand-delivery, place the number on the Transmittal

Information Form that is filed with the articles of incorporation. Name reservations are not available by

telephone. Entity formation and registration filings are accepted without a name reservation.

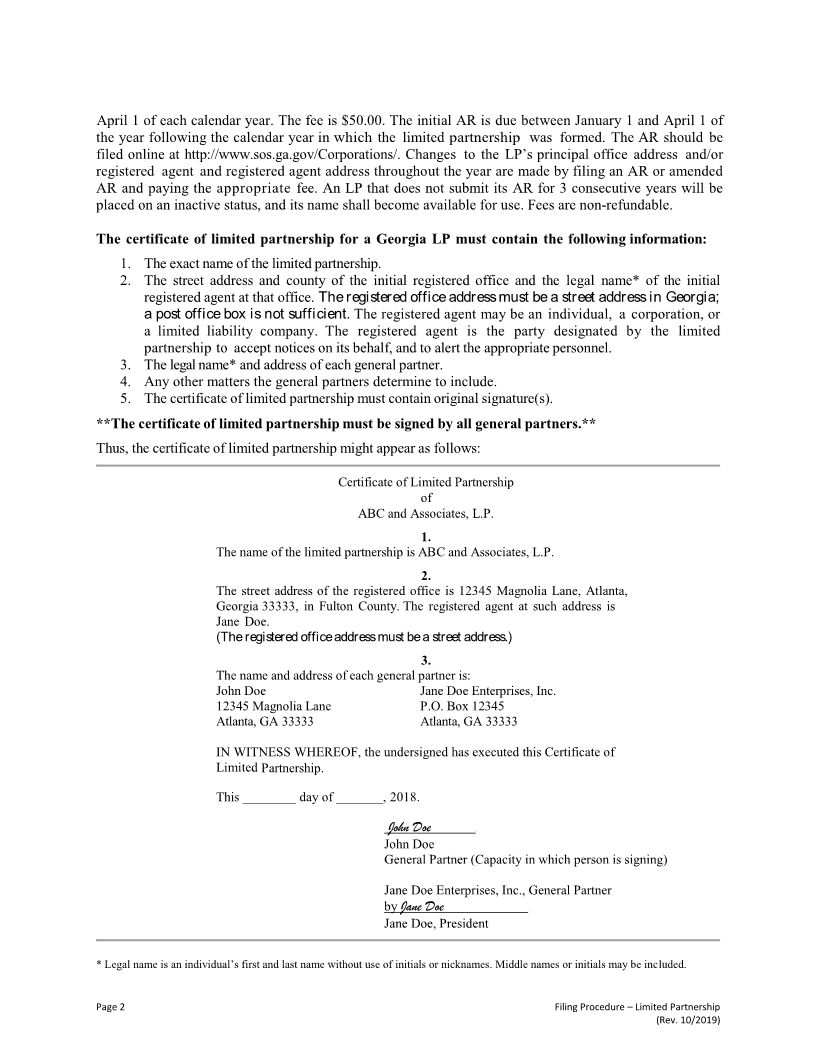

Preparation of Certificate of Limited Partnership

Certificates of limited partnership must include the information described in O.C.G.A. § 14-9-201.

Certificates of limited partnership may be filed online or mailed to the Corporations Division at the above

address. Certificates mailed to the office must be submitted on white 8½x11 paper. All general partners

stated in the certificate must sign the certificate of limited partnership, but an attorney in fact may sign

the certificate on behalf of a general partner. If a general partner is a corporation, an officer must sign

on behalf of the corporate general partner. The signer(s) should indicate in what capacity he or she is

signing. The signature does not need to be notarized.

Filing of Certificate of Limited Partnership and Transmittal Information Form 246

Certificate of limited partnership may be filed online or may be mailed or hand-delivered to the Corporations

Division. The fee to file online is $100.00; the fee to file by mail or hand-delivery is $110.00 ($100 filing fee

+ $10 paper filing service charge). For filings not submitted online, the certificate of limited partnership,

a completed Transmittal Information Form (CD 246), and the $110.00 fee payment should be mailed or

delivered to the Corporations Division at the above address. Checks or money orders should be made

payable to “Secretary of State.” A certificate of limited partnership is effective on the date received by the

Corporations Division unless a delayed effective date is specified therein. A certificate of formation will

be mailed to the applicant, usually in 5 to 7 business days. Workload issues will sometimes result in a

longer turnaround time, perhaps up to 12 business days. Filings that are not complete will be returned to

the applicant along with a notice that describes the deficiency. If corrected and returned within 30 days of

the date of the deficient document notice, the initial date of receipt will be the date of formation. Deficient

filings are deemed abandoned if still pending after 60 days from the date of the deficient document notice.

After the filing is deemed abandoned, a new filing, including new filing fees, will be required. Fees are

non-refundable.

Annual Registration (“AR”)

Each limited partnership must file an AR with the Secretary of State between January 1 and