Enlarge image

OFFICE OF SECRETARY OF STATE

CORPORATIONS DIVISION

2 Martin Luther King Jr. Dr. SE

Suite 313 West Tower

Atlanta, Georgia 30334 (404) 656-2817

sos.georgia.gov/corporations

Secretary of State

FILING PROCEDURES FOR FORMING

A GEORGIA CORPORATION

Corporations are formed by filing articles of incorporation with the Secretary of State. The minimum

requirements of Georgia law are outlined herein. Many other provisions may, and perhaps should, be

included in the articles. It is very simple to form a corporation. The question of whether or not a corporation

should be formed is complex. The Corporations Division strongly recommends that filers obtain

professional legal, tax and/or business advice to assure the filer’s goals and intentions are met, and that

requirements of the law are satisfied, both before and after formation of the entity.

Name Reservation

A name may be reserved prior to filing entity formation or registration documents. The reservation may be made

online or by submitting a Name Reservation Request form. A reservation fee of $25 must accompany the request.

There is a $10.00 service charge for filing a name reservation request by paper. Fees are non-refundable. If the

name reservation is approved, a name reservation number will be provided to the filer by return email. A name

reservation is effective for 30 days or until the filing forming or registering the entity is submitted, whichever is

sooner. Name reservation requests are generally processed within 5 to 7 business days of receipt. To redeem a

name reservation, enter the reservation number in the field provided on an online business formation application

or, if submitting a paper filing by mail or hand-delivery, place the number on the Transmittal Information Form

that is filed with the articles of incorporation. Name reservations are not available by telephone. Entity formation

and registration filings are accepted without a name reservation.

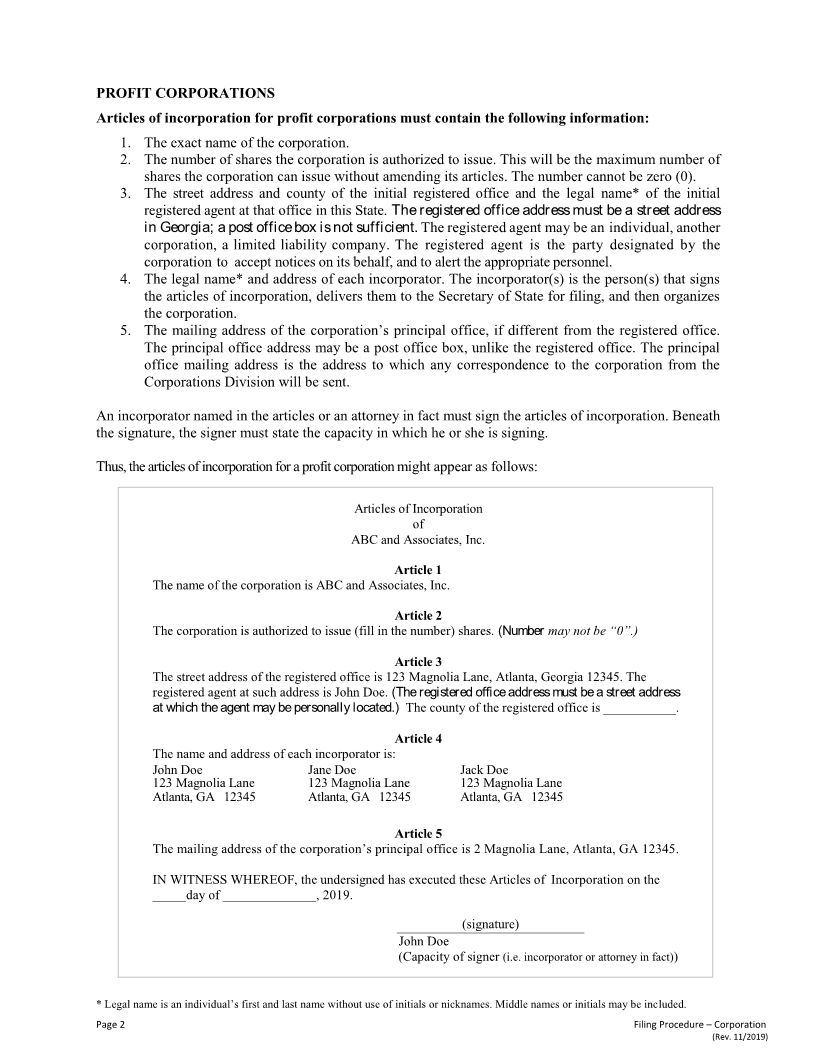

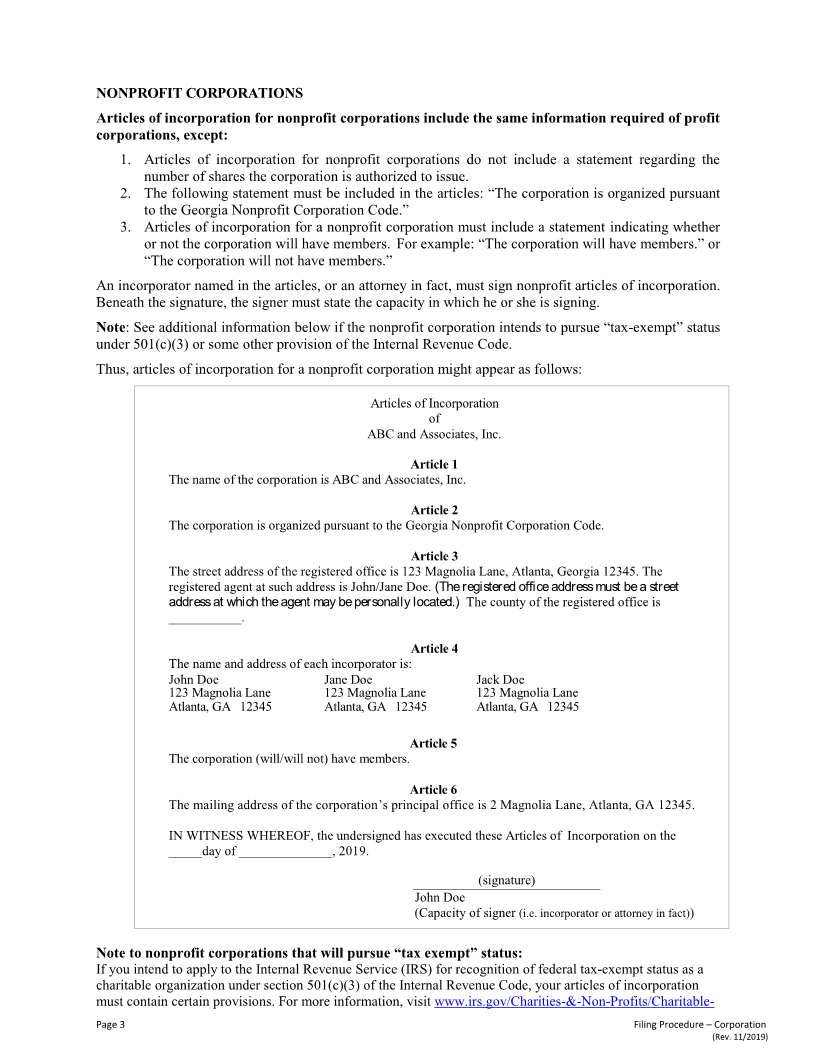

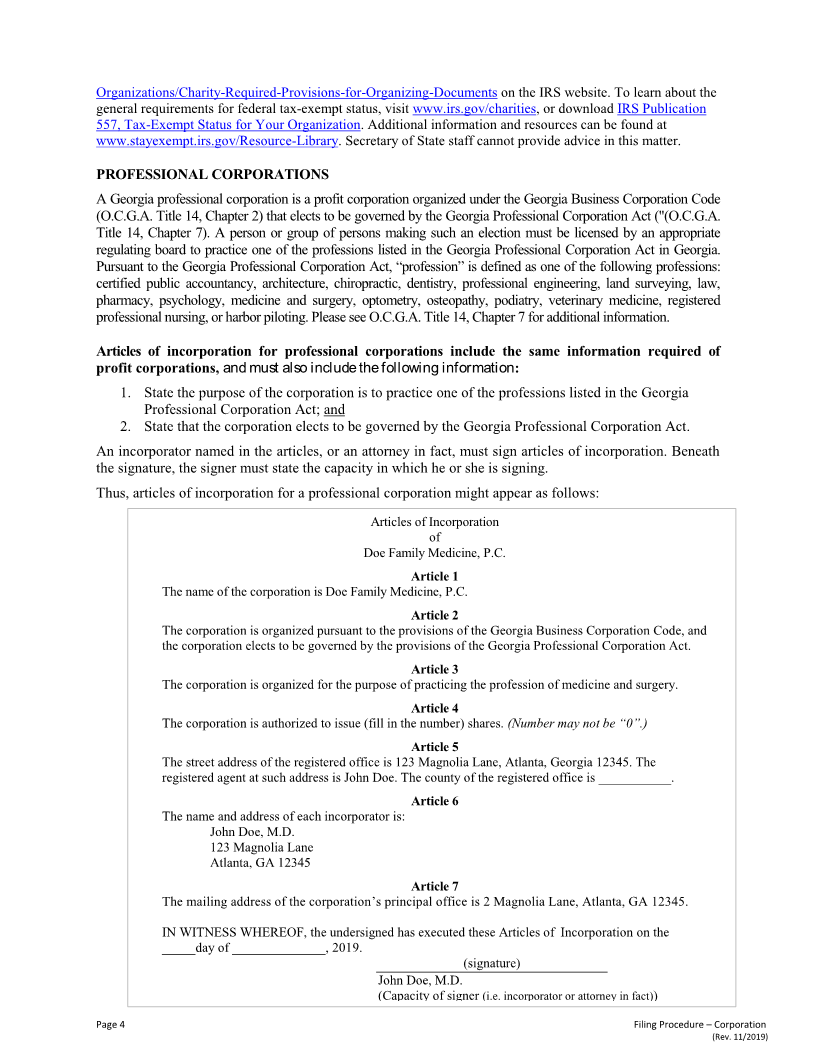

Preparation of Articles of Incorporation

Articles of incorporation must include the information described in O.C.G.A. § 14-2-202 (profit corporation),

O.C.G.A. § 14-3-202 (nonprofit corporation), or O.C.G.A. §§ 14-2-202 and 14-7-3 (professional corporation).

Articles mailed to the office must be submitted on white 8½ x 11 paper. An incorporator named in the articles

or an attorney in fact must sign articles of incorporation. The signer(s) should indicate in what capacity he or

she is signing. The signature does not need to be notarized.

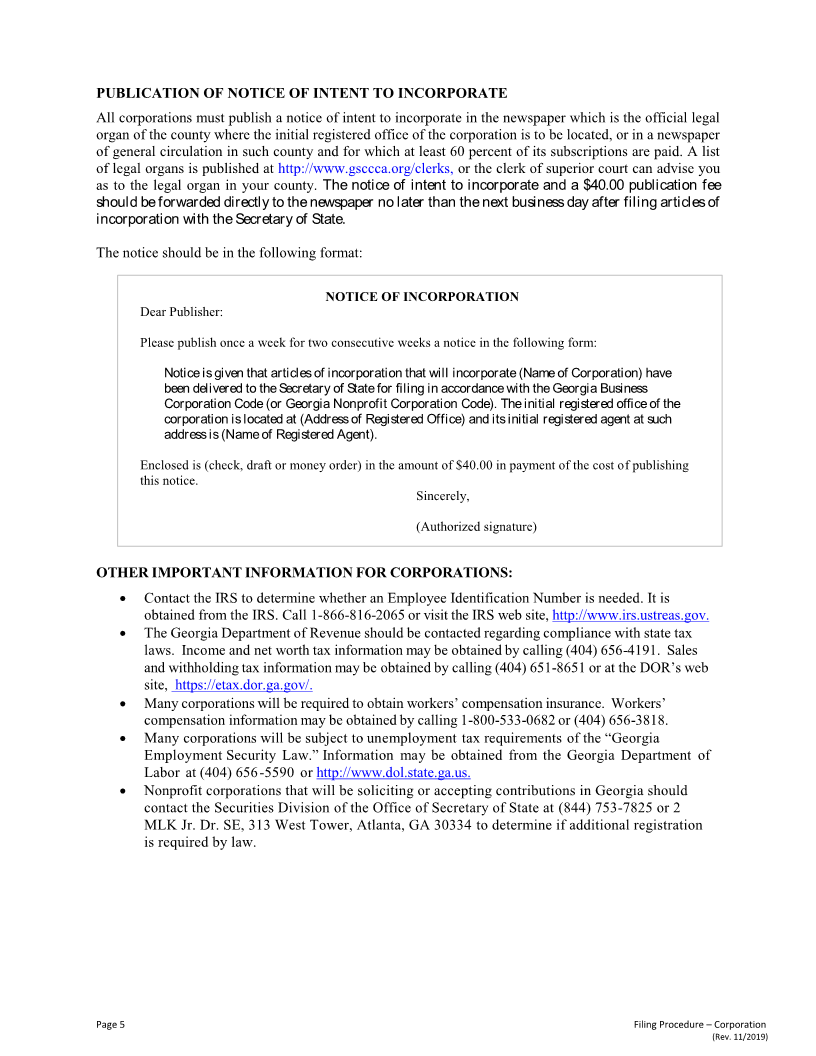

Filing of Articles of Incorporation and Transmittal Information Form 227

Articles may be filed online or may be mailed or hand-delivered to the Corporations Division. The fee to file online

is $100.00; the fee to file by mail or hand-delivery is $110.00 ($100 filing fee + $10 paper filing service charge).

For filings not submitted online, the articles of incorporation, a completed Transmittal Information Form (CD

227), and a $110.00 fee payment should be mailed or delivered to the Corporations Division at the above

address. Checks or money orders should be made payable to “Secretary of State.” Articles of incorporation are

effective on the date received by the Corporations Division unless a delayed effective date is specified therein.

If the articles are approved for filing, a certificate of incorporation will be sent to the applicant, usually within

5 to 7 business days for online filings and within 15 business days for paper filings submitted by mail or hand-

delivery and paper filings submitted online. Workload issues will sometimes result in a longer turnaround time,

perhaps up to 10 business days for online filings. Filings that are not complete will be returned to the applicant

along with a notice that describes the deficiency. If corrected and returned within 30 days of the date of the

deficient document notice, the initial date of receipt will be the date of formation. Deficient filings are deemed

abandoned if still pending after 60 days from the date of the deficient document notice. After the filing is deemed

abandoned, a new filing, including new filing fees, will be required. Fees are non-refundable.

Corporate Officers and Annual Registration (“AR”)

Within 90 days of incorporation, each Georgia corporation must file an initial AR that lists three principal

officers with the Secretary of State. The fee is $50.00 for profit corporations and $30.00 for nonprofit corporations.

Corporations that form between October 2 and December 31 must file the initial AR between

January 1 and April 1 of the next calendar year. Subsequent ARs are filed between January 1 and April 1 of each

designated AR period thereafter. The AR should be filed online at http://www.sos.ga.gov/Corporations/. Changes

to the corporation’s address, officers, and/or registered agent and registered office address throughout the year

are made by filing an AR or an amended AR and paying the appropriate fee. A corporation that does not submit

its AR is subject to administrative dissolution. An administratively dissolved corporation may be reinstated within

5 years of the effective date of dissolution. There is a $250 fee to reinstate an administratively dissolved

corporation. Fees are non-refundable.