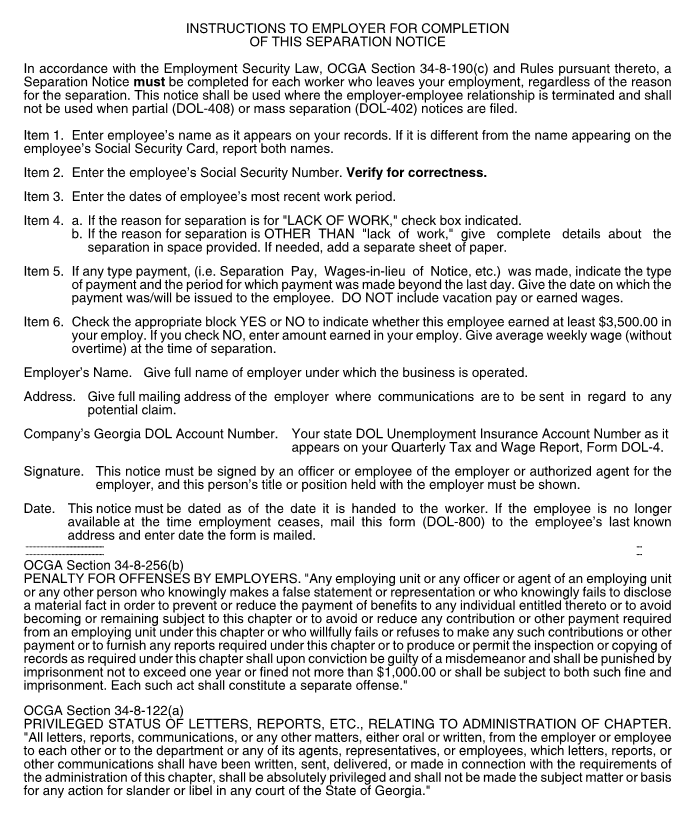

Enlarge image

State of Georgia

Department of Labor

SEPARATION NOTICE

1. Employee's Name 2. SSN

a. State any other name(s) under which employee worked.

3. Period of Last Employment: From To

4. REASON FOR SEPARATION:

a. LACK OF WORK

b. If for other than lack of work, state fully and clearly the circumstances of the separation:

5. Employee received payment for: (Severance Pay, Separation Pay, Wages-In-Lieu of Notice, bonus, profit sharing, etc.)

(DO NOT include vacation pay or earned wages)

in the amount of $ for period from to

(type of payment)

Date above payment(s) was/will be issued to employee

IF EMPLOYEE RETIRED, furnish amount of retirement pay and what percentage of contributions were paid by the employer.

per month % of contributions paid by employer

6. Did this employee earn at least $3,500.00 in your employ? YES NO If NO, how much? $

Average Weekly Wage

Employer's Ga. D. O. L. Account Number

Name (Number shown on Employer's Quarterly Tax and Wage Report,

Form DOL-4.)

Address

(Street or RFD) I CERTIFY that the above worker has been separated from work

and the information furnished hereon is true and correct. This

City State report has been handed to or mailed to the worker.

ZIP Code

Employer's

Telephone No.

(Area Code) (Number) Signature of Official, Employee of the Employer

or authorized agent for the employer

NOTICE TO EMPLOYER

At the time of separation, you are required by the Employment

Security Law, OCGA Section 34-8-190(c), to provide the

employee with this document, properly executed, giving the Title of Person Signing

reasons for separation. If you subsequently receive a request

for the same information on a DOL-1199FF, you may attach a copy

of this form (DOL-800) as a part of your response. Date Completed and Released to Employee

NOTICE TO EMPLOYEE

OCGA SECTION 34-8-190(c) OF THE EMPLOYMENT SECURITY LAW REQUIRES THAT YOU TAKE

THIS NOTICE TO THE GEORGIA DEPARTMENT OF LABOR CAREER CENTER IF YOU FILE A CLAIM

FOR UNEMPLOYMENT INSURANCE BENEFITS.

SEE REVERSE SIDE FOR ADDITIONAL INFORMATION.

DOL-800 (R-8/05)