Enlarge image

COMPLETING PARTS I AND II OF EMPLOYER'S QUARTERLY TAX AND WAGE REPORT, FORM DOL-4N

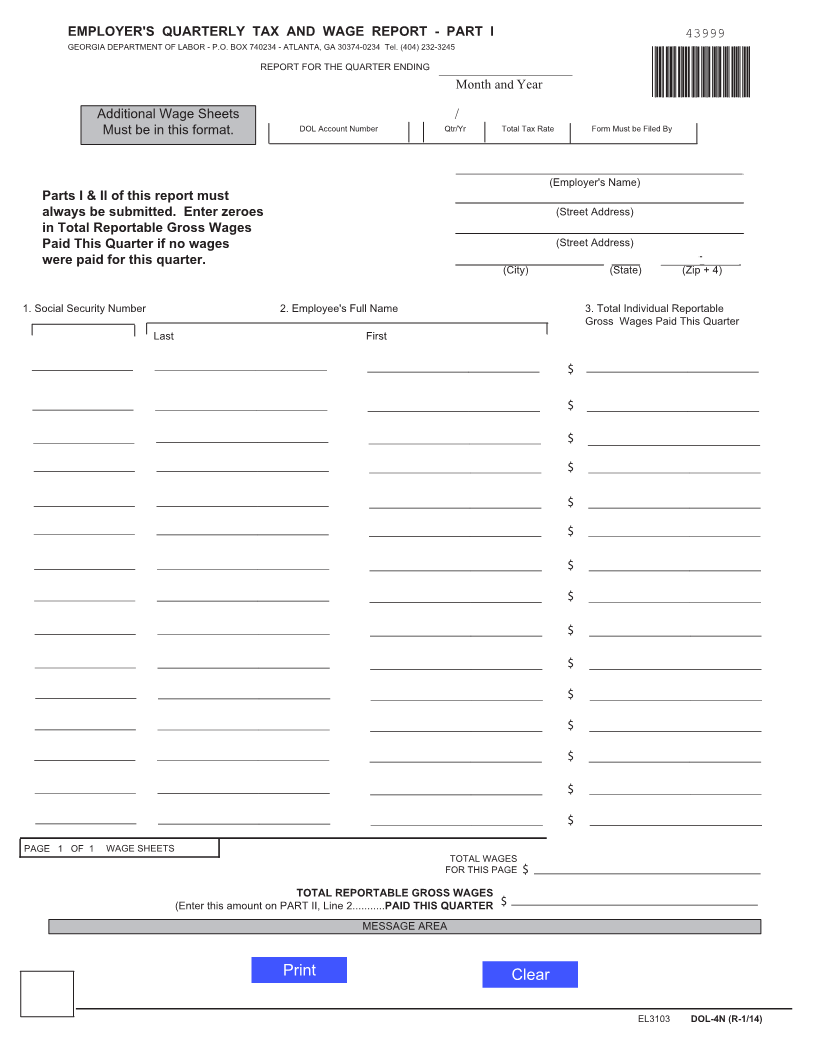

Part I is designed for reporting wages and names of employees, including corporate officers. In the top section of the form, you

must select the quarter ending month, enter the year, and your Georgia Department of Labor (GDOL) account number. If you are

a new employer or have not been assigned an account number, enter "Applied For" in the account number field and attach form

DOL-1A, Employer Status Report, if not previously submitted. Enter your business name and complete mailing address.

You must enter the Social Security Number, full last name and full first name and total reportable gross wages for the quarter for

each employee. Reportable gross wages are the total gross wages (to include tip wages) minus 125 Cafeteria Plan deductions

taken during the quarter. Wages must be reported for the quarter in which wages were actually paid. If you are an employer with

more than 100 employees, you must file electronically by magnetic media (DVD, CD-Rom, or USB Flash Drive) or online at

http://dol.georgia.gov/file-tax-and-wage-reports-and-make-payments.

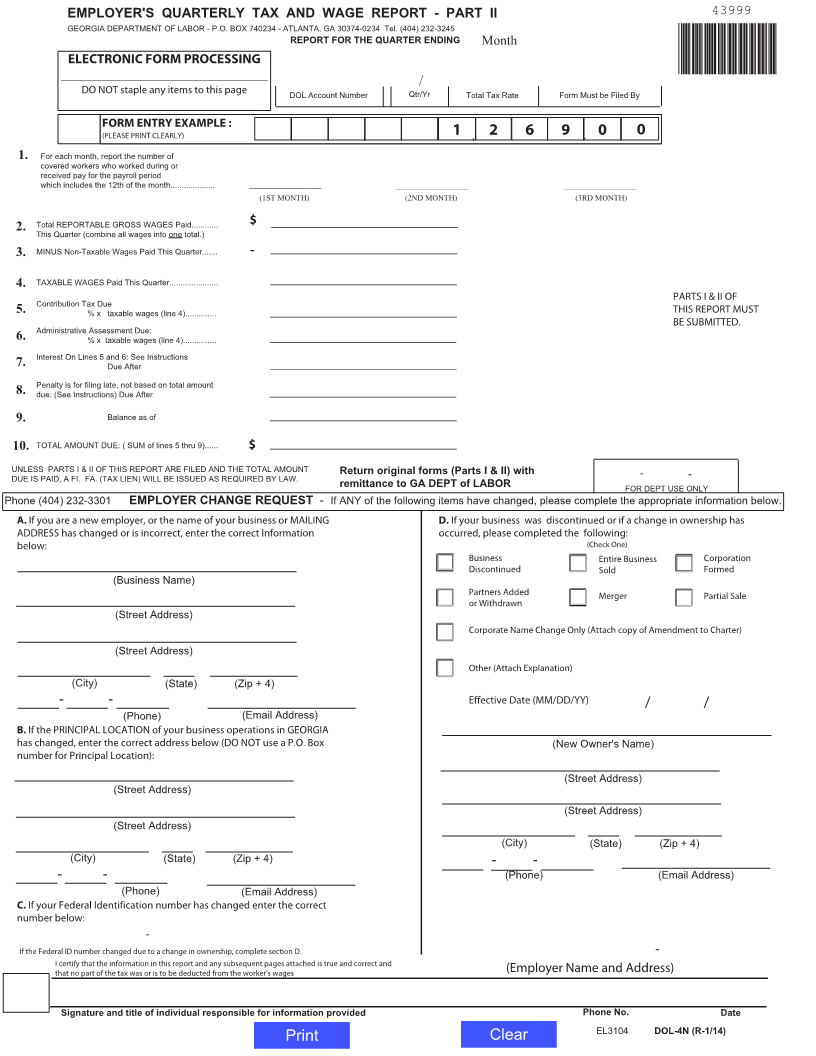

Part II is for reporting tax summary information and changes to your account.

Line 1 Enter monthly covered employment data, as defined in Line 1.

Line 2 Show total reportable gross wages paid for the quarter (for all employees. Enter zeros, if no wages were paid this

quarter).

Line 3 Subtract non-taxable wages (wages above $9500 per employee per calendar year).

Line 4 Enter the difference between Line 2 and Line 3.

Line 5 Compute Contribution Tax. Enter your assigned contribution tax rate that is provided on your

Annual Tax Rate Notice. New employers must use 2.64%. For tax periods prior to January 1, 2017,

new employers must use 2.62%.

Line 6 Compute Administrative Assessment. Effective January 1, 2017 the rate is .06% (.0006). For tax periods prior to

January 1, 2017, the Administrative Assessment rate is .08% (.0008). Administrative Assessment applies to all

employers except minimum rated and maximum rated employers and those employers who have elected to make

payments in lieu of contribution as provided by Code Section 34-8-158.

Line 7 Compute interest for late payment at 1.5% per month (a month is one or more days of any calendar month

after the due date). Interest accrues until all tax and administrative assessment are paid.

Line 8 Enter penalty if the report is filed late. Penalty required is $20 or .05% (.0005) of total wages, whichever is

greater, for each month. Compute penalty as .05% (.0005) of total wages whenever total wages for the quarter

are more than $40,000.

Line 9 To be completed by the Department, if applicable.

Line 10 Enter the amount owed, adjusted by subtracting any credit(s) or adding any debit amount(s) on the

account from previous quarters.

Account changes should be reported in Sections A-D at the bottom of Part II of the form. Should you need assistance completing

Sections A-D call 404-232-3301. Sign and submit Parts I and II together by the due date.

Visit dol.georgia.gov for additional filing and payment options.

If unable to pay online, make check or money order payable to Georgia Department of Labor, include your GDOL account number

and mail to:

Georgia Department of Labor

P. O. Box 740234

Atlanta, GA 30374-0234

DOL-4N Instr. (R-12/16)

EL3107