Enlarge image

Georgia Department of Labor

Electronic Filing

Requirements

DOL-4606 (R-6/18)

Enlarge image |

Georgia Department of Labor

Electronic Filing

Requirements

DOL-4606 (R-6/18)

|

Enlarge image |

Table of Contents

General Information for Successful Electronic Filing ................................................ 1

Filing Quarterly Tax and Wage Reports Online .......................................................... 2

Magnetic Media Filing ................................................................................................... 4

NASWA Y2K Wage Record Format (DOL-4N, Part I) ............................................... 5

GDOL N Record Tax Record Format (DOL-4N, Part II)............................................ 6

Magnetic Media Transmittal Form ............................................................................... 7

DOL-4606 (R-6/18)

|

Enlarge image |

GEORGIA DEPARTMENT OF LABOR

Electronic Filing Requirements

Georgia Department of Labor (GDOL) requires employers reporting 100 or more employees to

file electronically. However, all employers are encouraged to use one of the available electronic

filing methods. The following information outlines GDOL's specifications for submitting quarterly

tax and wage reports electronically. Failure to follow the outlined requirements will result in the

rejection of reports and may result in the assessment of late filing penalties if the reports are

not filed timely.

General Information for Successful Electronic Filing

Employers must first have a valid GDOL account number to use GDOL’s online

services. Complete the Online Employer Tax Registration application to obtain an

account number.

Employers must register with the GDOL Employer Portal to file quarterly tax and wage

reports electronically.

Employers must provide current employer contact information to ensure prompt

notification of the filing status.

Adjustments to previously filed tax and wage reports are not accepted electronically.

For adjustments or amendments, complete and submit Report to Add New Wages

and/or Correct Reported Wages (DOL-3C) form.

Payroll Service Providers (PSPs) and employers may submit electronic tax and wage

reports via Secure File Transfer Protocol (SFTP). For more information, email

UITax_ElectronicFileUpload@gdol.ga.gov or call 404.232.3265.

Wage records must be reported in the proper format and compliant with the Internal

Revenue Service (IRS) to include a valid Social Security Number (SSN) properly

formatted for a successful submission. Do not submit wage records with SSNs in any of

the following formats:

Invalid SSN formats include

SSN field is blank (i.e., no number is reported) SSN is “987-65-4321”

SSN is not numeric SSN begins with “000”

SSN is not 9 digits SSN begins with “666”

Multiple employees are reported with the same SSN SSN have middle two digits of “00”

SSN consists of the same digits, i.e., 111-11-1111 SSN have last four digits of “0000”

SSN begins with “9” SSN contains dash(es)

SSN is “123-45-6789” SSN with the last four digits only

If you have questions or concerns, contact the Electronic Filing Unit at

UITax_ElectronicFileUpload@gdol.ga.gov or call 404.232.3265.

Page|1 DOL-4606 (R-6/18)

|

Enlarge image |

GEORGIA DEPARTMENT OF LABOR

Electronic Filing Requirements

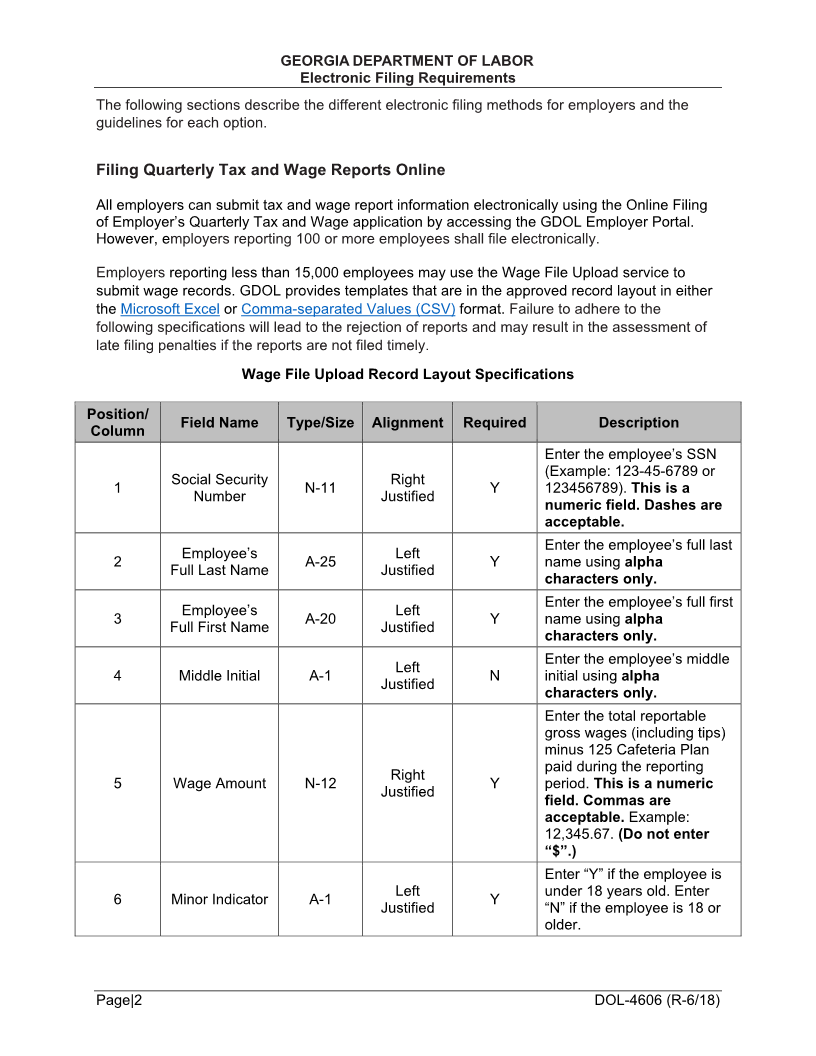

The following sections describe the different electronic filing methods for employers and the

guidelines for each option.

Filing Quarterly Tax and Wage Reports Online

All employers can submit tax and wage report information electronically using the Online Filing

of Employer’s Quarterly Tax and Wage application by accessing the GDOL Employer Portal.

However, employers reporting 100 or more employees shall file electronically.

Employers reporting less than 15,000 employees may use the Wage File Upload service to

submit wage records. GDOL provides templates that are in the approved record layout in either

the Microsoft Excel or Comma-separated Values (CSV) format. Failure to adhere to the

following specifications will lead to the rejection of reports and may result in the assessment of

late filing penalties if the reports are not filed timely.

Wage File Upload Record Layout Specifications

Position/

Field Name Type/Size Alignment Required Description

Column

Enter the employee’s SSN

(Example: 123-45-6789 or

Social Security Right

1 N-11 Y 123456789). This is a

Number Justified

numeric field.Dashes are

acceptable.

Enter the employee’s full last

Employee’s Left

2 A-25 Y name using alpha

Full Last Name Justified

characters only.

Enter the employee’s full first

Employee’s Left

3 A-20 Y name using alpha

Full First Name Justified

characters only.

Enter the employee’s middle

Left

4 Middle Initial A-1 N initial using alpha

Justified

characters only.

Enter the total reportable

gross wages (including tips)

minus 125 Cafeteria Plan

paid during the reporting

Right

5 Wage Amount N-12 Y period. This is a numeric

Justified

field.Commas are

acceptable. Example:

12,345.67. (Do not enter

“$”.)

Enter “Y” if the employee is

Left under 18 years old. Enter

6 Minor Indicator A-1 Y

Justified “N” if the employee is 18 or

older.

Page|2 DOL-4606 (R-6/18)

|

Enlarge image |

GEORGIA DEPARTMENT OF LABOR

Electronic Filing Requirements

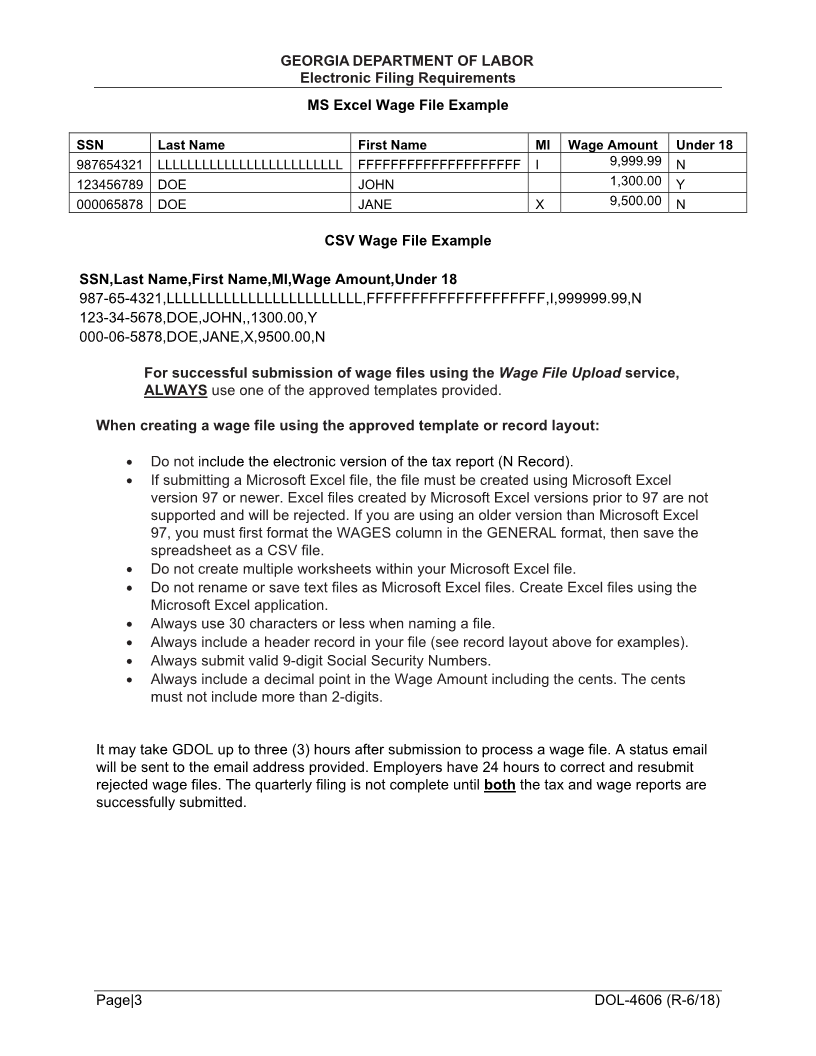

MS Excel Wage File Example

SSN Last Name First Name MI Wage Amount Under 18

987654321 LLLLLLLLLLLLLLLLLLLLLLLLL FFFFFFFFFFFFFFFFFFFF I 9,999.99 N

1,300.00

123456789 DOE JOHN Y

000065878 DOE JANE X 9,500.00 N

CSV Wage File Example

SSN,Last Name,First Name,MI,Wage Amount,Under 18

987-65-4321,LLLLLLLLLLLLLLLLLLLLLLLL,FFFFFFFFFFFFFFFFFFFF,I,999999.99,N

123-34-5678,DOE,JOHN,,1300.00,Y

000-06-5878,DOE,JANE,X,9500.00,N

For successful submission of wage files using the Wage File Upload service,

ALWAYS use one of the approved templates provided.

When creating a wage file using the approved template or record layout:

Do not include the electronic version of the tax report (N Record).

If submitting a Microsoft Excel file, the file must be created using Microsoft Excel

version 97 or newer. Excel files created by Microsoft Excel versions prior to 97 are not

supported and will be rejected. If you are using an older version than Microsoft Excel

97, you must first format the WAGES column in the GENERAL format, then save the

spreadsheet as a CSV file.

Do not create multiple worksheets within your Microsoft Excel file.

Do not rename or save text files as Microsoft Excel files. Create Excel files using the

Microsoft Excel application.

Always use 30 characters or less when naming a file.

Always include a header record in your file (see record layout above for examples).

Always submit valid 9-digit Social Security Numbers.

Always include a decimal point in the Wage Amount including the cents. The cents

must not include more than 2-digits.

It may take GDOL up to three (3) hours after submission to process a wage file. A status email

will be sent to the email address provided. Employers have 24 hours to correct and resubmit

rejected wage files. The quarterly filing is not complete until both the tax and wage reports are

successfully submitted.

Page|3 DOL-4606 (R-6/18)

|

Enlarge image |

GEORGIA DEPARTMENT OF LABOR

Electronic Filing Requirements

Magnetic Media Filing

Employers may elect to submit their Quarterly Tax and Wage Report via Magnetic Media. USB

Flash Drives or CD-ROM/DVDs are the only forms of magnetic media accepted for quarterly filing

of tax and wage files.

Quarterly Tax and Wage Report files submitted via USB Flash Drives or CD-ROM/DVDs must be in

the NASWA Y2K Wage Report format (see page 5) and the GDOL Tax Report (N Record) layout

(see page 6). Failure to submit electronic tax and wage reports in the approved record layouts will

result in the rejection of the reports. If the reports are not submitted timely, late filing penalties may

apply.

For successful submission of tax and wage files using USB Flash Drives or CD-ROM/DVDs,

ALWAYS:

Submit test files with a paper transmittal form at least four weeks prior to submitting live data, if

using the GDOL Tax Report (N Record) layout and NASWA Y2K Wage Report layout for the

first time. Failure to submit test files may delay the processing of your Quarterly Tax and Wage

Report and may result in late filing penalties.

Submit a paper transmittal form with the flash drive. (See page 7 for a sample transmittal form.

Complete contact information is required.)

Include a valid 8-digit GDOL account number (without the dash in the account number) on

each tax and/or wage record, including any leading zeroes. Do not use alpha or special

characters.

Compress all individual files into one single .zip file on a USB Flash Drive or CD-ROM/DVDs, if

submitting files for multiple employers.

Submit remittances (payments) via ACH Debit or Credit. For more information on ACH Credit,

contact the Electronic filing Unit.

To prevent the rejection of tax and wage reports filed by USB Flash Drives or CD-ROM/DVDs,

DO NOT SUBMIT:

Tax and/or wage files in Rich text, UNIX, or Microsoft Excel format.

Tax and/or wage files without valid GDOL account number(s). To apply for a GDOL tax

account number, access Online Employer Tax Registration.

Tax and/or Wage reports using a Federal Employer Identification (FEIN) or pseudo number

instead of the GDOL account number.

Wage records without valid, full 9-digit Social Security Numbers (omit dashes).

Negative wages or adjustments/amendments to tax or wage reports electronically. To amend

previously filed reports, complete the Report to Add New Wages and/or Correct Reported

Wages (DOL-3C) form found under Forms and Publications on the GDOL website at

www.dol.georgia.gov.

Send the USB Flash Drive or CD-ROM/DVDs to:

Georgia Department of Labor

Electronic Filing Unit

148 Andrew Young International Blvd., NE

Suite 768

Atlanta, GA 30303

If you have questions or concerns, contact the Electronic Filing Unit at

UITax_ElectronicFileUpload@gdol.ga.gov or call 404.232.3265.

Page|4 DOL-4606 (R-6/18)

|

Enlarge image |

GEORGIA DEPARTMENT OF LABOR

Electronic Filing Requirements

NASWA Y2K Wage Record Format

(DOL-4N, Part I)

CODE S -SUPPLEMENTAL RECORD: Year 2000 NASWA Unemployment Insurance code

“S” supplemental record format as defined by the Georgia Department of Labor for direct wage

reporting by electronic media. Total Record Length = 275 (276 if necessary) for each wage

record. If using PC media, a soft carriage return/line feed must be at the end of each record,

and created in ASCII-1 language.

POSITION FIELD NAME TYPE/SIZE DESCRIPTION AND REMARKS

1 Record Identifier N-1 Constant “S”

Social Security Enter the employee’s SSN (numeric only). Omit

2-10 N-9 hyphens and spaces.

Number

Enter the employee’s full last name, left justified in

Employee Last

11-30 A-20 all CAPS, and no lowercase characters. Omit

Name

hyphen, special characters, and spaces.

Enter the employee’s full first name, left justified in

Employee First

31-42 A-12 all CAPS and no lowercase characters. Omit

Name hyphen, special characters, and spaces.

Enter the employee’s middle initial in all CAPS

Employee Middle

43 A-1 and no lowercase characters. Omit hyphen,

Initial

special characters, and spaces.

Enter the appropriate FIPS postal numeric code.

44-45 State Code N-2

The Georgia code is “13.”

46-63 GDOL Wage Filler N-18 Enter blanks or zeroes.

64-68 GDOL Wage Filler 5 Enter blanks or zeroes.

Enter the total reportable gross wages minus 125

Total Reportable Cafeteria Plan, paid during the period. Include tip

69-77 N-9 wages. Right justify and zero fill.

Gross Wages

Example: Enter $7,536.20 as 000753620.

78-153 76 Not required by GDOL.

GDOL Employer Enter the 8-digit GDOL employer accountnumber.

154-161 N-8 DO NOT enter the dash.

Account Number

162-214 53 Not required by GDOL.

Enter the last month and four-digit year for the

Reporting Period calendar quarter for which this report applies.

215-220 N-6

Month/Year Example: Enter “032018” for the quarter of

January–March of 2018.

221-275 55 Not required by GDOL.

276 If necessary, enter a blank.

1

Page|5 DOL-4606 (R-6/18)

|

Enlarge image |

GEORGIA DEPARTMENT OF LABOR

Electronic Filing Requirements

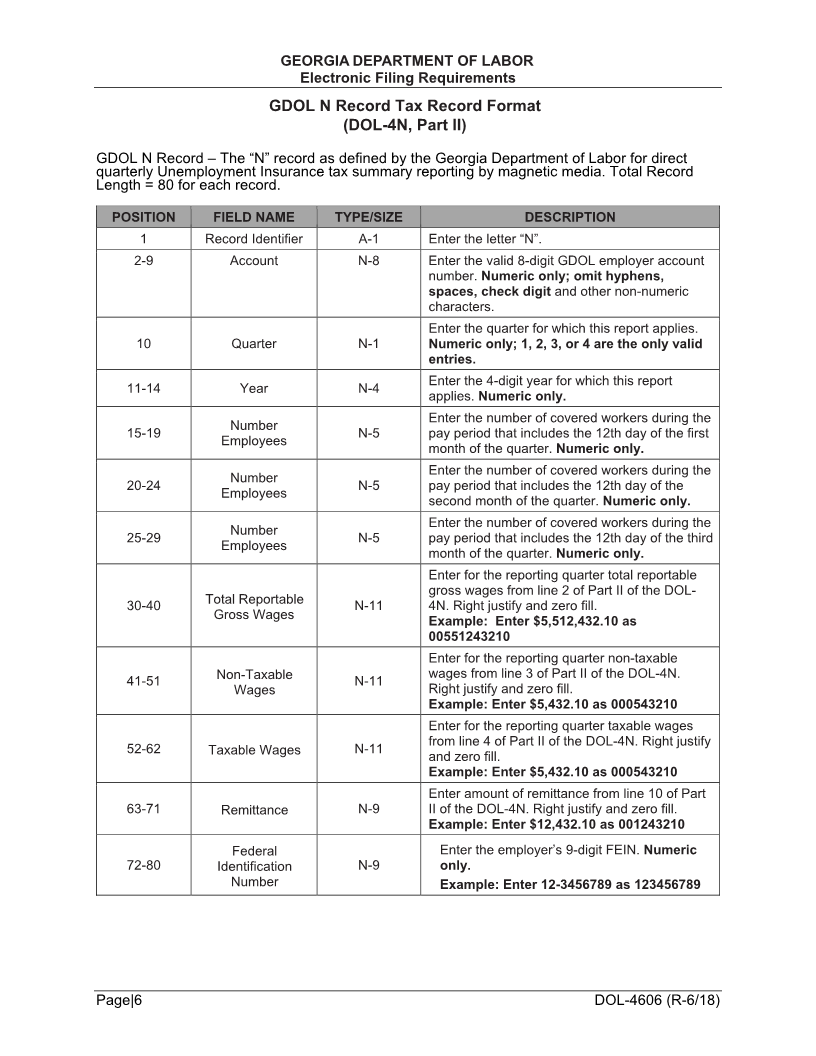

GDOL N Record Tax Record Format

(DOL-4N, Part II)

GDOL N Record – The “N” record as defined by the Georgia Department of Labor for direct

quarterly Unemployment Insurance tax summary reporting by magnetic media. Total Record

Length = 80 for each record.

POSITION FIELD NAME TYPE/SIZE DESCRIPTION

1 Record Identifier A-1 Enter the letter “N”.

2-9 Account N-8 Enter the valid 8-digit GDOL employer account

number. Numeric only; omit hyphens,

spaces, check digit and other non-numeric

characters.

Enter the quarter for which this report applies.

10 Quarter N-1 Numeric only; 1, 2, 3, or 4 are the only valid

entries.

Enter the 4-digit year for which this report

11-14 Year N-4

applies. Numeric only.

Enter the number of covered workers during the

Number

15-19 N-5 pay period that includes the 12th day of the first

Employees

month of the quarter. Numeric only.

Enter the number of covered workers during the

Number

20-24 N-5 pay period that includes the 12th day ofthe

Employees

second month of the quarter. Numeric only.

Enter the number of covered workers during the

Number

25-29 N-5 pay period that includes the 12th day of the third

Employees

month of the quarter. Numeric only.

Enter for the reporting quarter total reportable

gross wages from line 2 of Part II of the DOL-

30-40 Total Reportable N-11 4N. Right justify and zero fill.

Gross Wages Example: Enter $5,512,432.10 as

00551243210

Enter for the reporting quarter non-taxable

wages from line 3 of Part II of the DOL-4N.

41-51 Non-Taxable N-11

Wages Right justify and zero fill.

Example: Enter $5,432.10 as 000543210

Enter for the reporting quarter taxable wages

from line 4 of Part II of the DOL-4N. Right justify

52-62 Taxable Wages N-11

and zero fill.

Example: Enter $5,432.10 as 000543210

Enter amount of remittance from line 10 of Part

63-71 Remittance N-9 II of the DOL-4N. Right justify and zero fill.

Example: Enter $12,432.10 as 001243210

Federal Enter the employer’s 9-digit FEIN. Numeric

72-80 Identification N-9 only.

Number Example: Enter 12-3456789 as 123456789

Page|6 DOL-4606 (R-6/18)

|

Enlarge image |

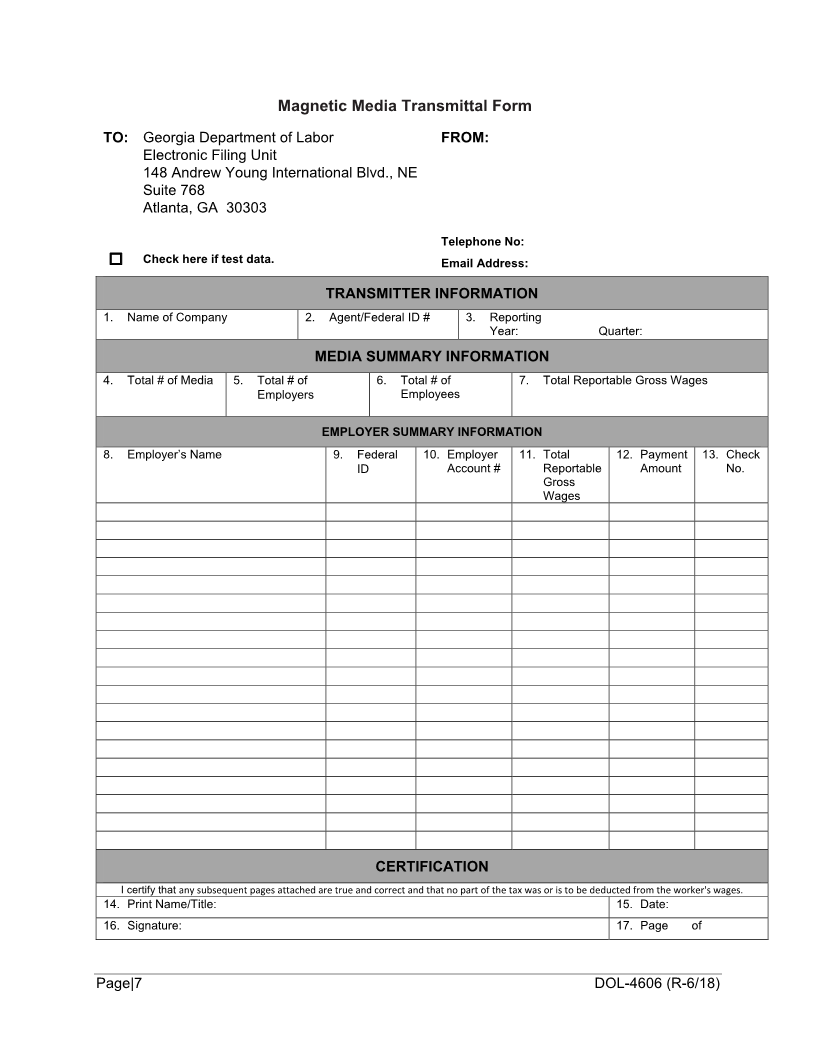

Magnetic Media Transmittal Form

TO: Georgia Department of Labor FROM:

Electronic Filing Unit

148 Andrew Young International Blvd., NE

Suite 768

Atlanta, GA 30303

Telephone No:

Check here if test data. Email Address:

TRANSMITTER INFORMATION

1. Name of Company 2. Agent/Federal ID # 3. Reporting

Year: Quarter:

MEDIA SUMMARY INFORMATION

4. Total # of Media 5. Total # of 6. Total # of 7. Total Reportable Gross Wages

Employers Employees

EMPLOYER SUMMARY INFORMATION

8. Employer’s Name 9. Federal 10. Employer 11. Total 12. Payment 13. Check

ID Account # Reportable Amount No.

Gross

Wages

CERTIFICATION

I certify that any subsequent pages attached are true and correct and that no part of the tax was or is to be deducted from the worker's wages.

14. Print Name/Title: 15. Date:

16. Signature: 17. Page of

Page|7 DOL-4606 (R-6/18)

|

Enlarge image |

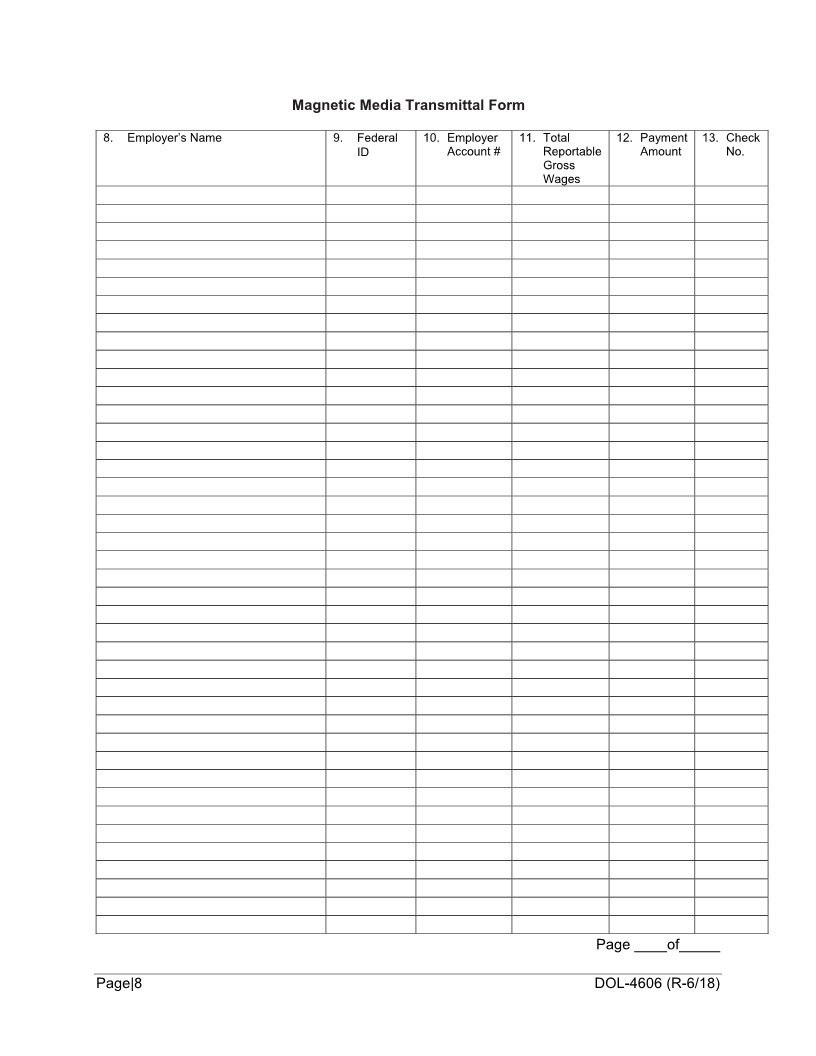

Magnetic Media Transmittal Form

8. Employer’s Name 9. Federal 10. Employer 11. Total 12. Payment 13. Check

ID Account # Reportable Amount No.

Gross

Wages

Page ____of_____

Page|8 DOL-4606 (R-6/18)

|

Enlarge image | No text to extract. |