Enlarge image

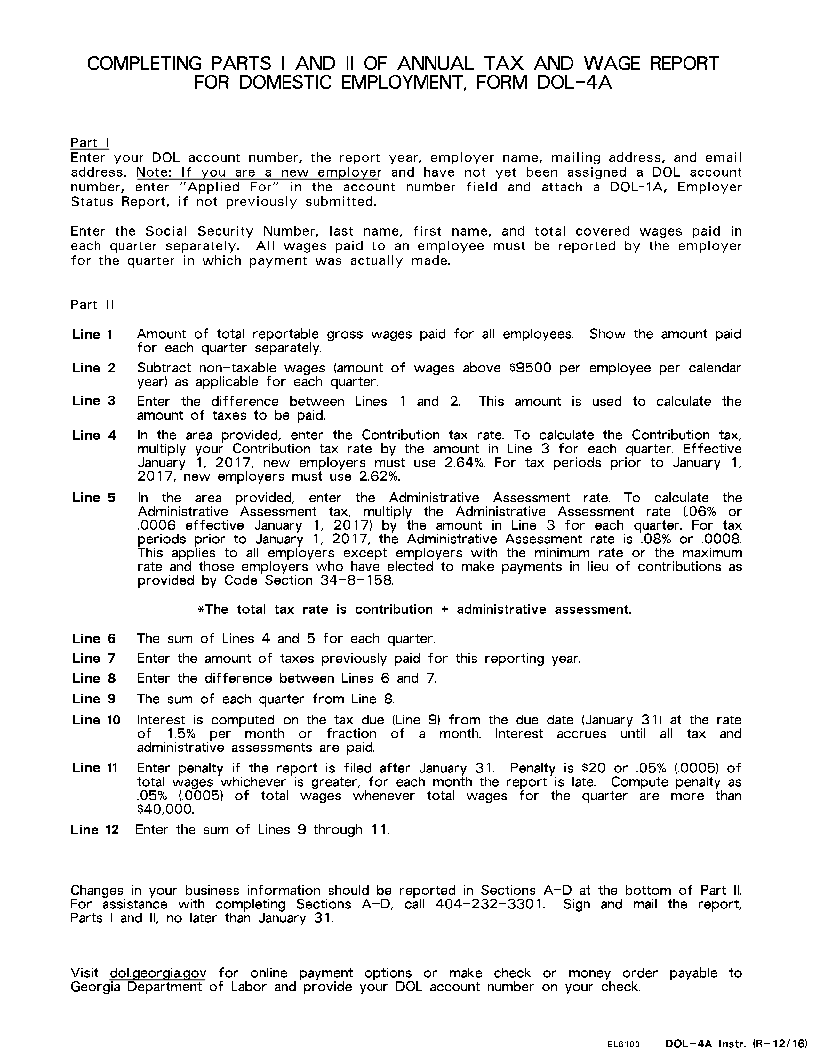

COMPLETING PARTS I AND II OF ANNUAL TAX AND WAGE REPORT

FOR DOMESTIC EMPLOYMENT, FORM DOL-4A

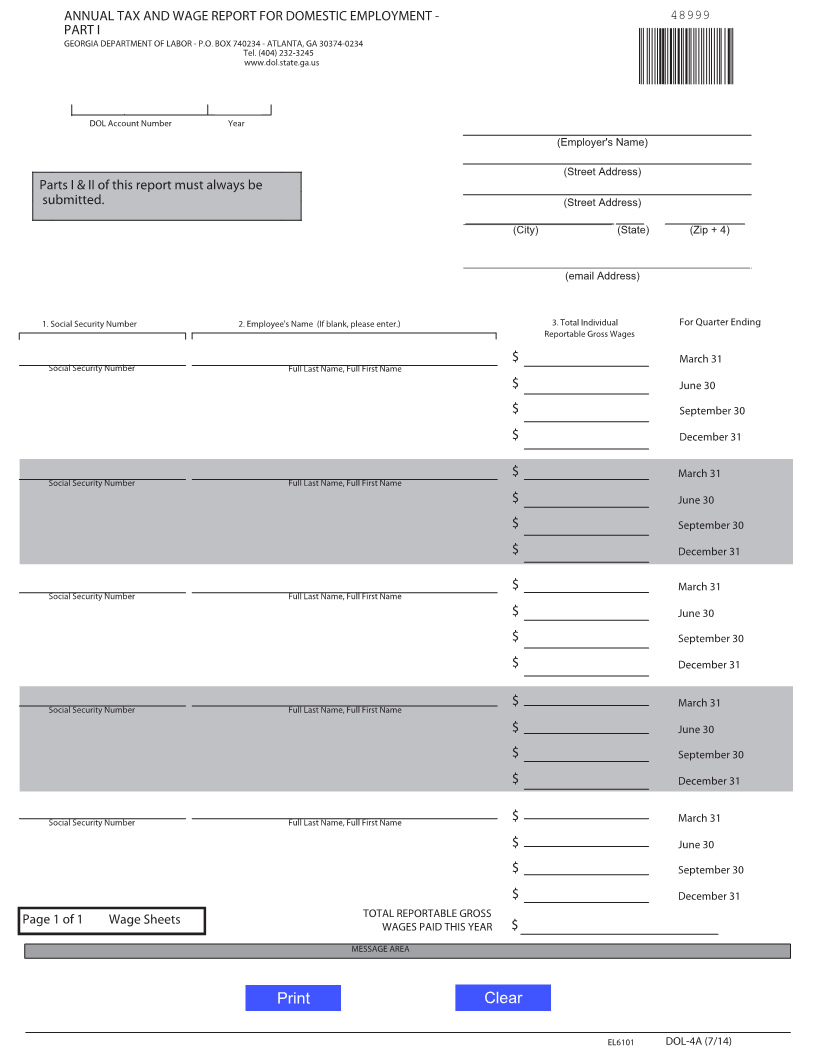

Part I

Enter your DOL account number, the report year, employer name, mailing address, and email

address. Note: If you are a new employer and have not yet been assigned a DOL account

number, enter "Applied For" in the account number field and attach a DOL-1A, Employer

Status Report, if not previously submitted.

Enter the Social Security Number, last name, first name, and total covered wages paid in

each quarter separately. All wages paid to an employee must be reported by the employer

for the quarter in which payment was actually made.

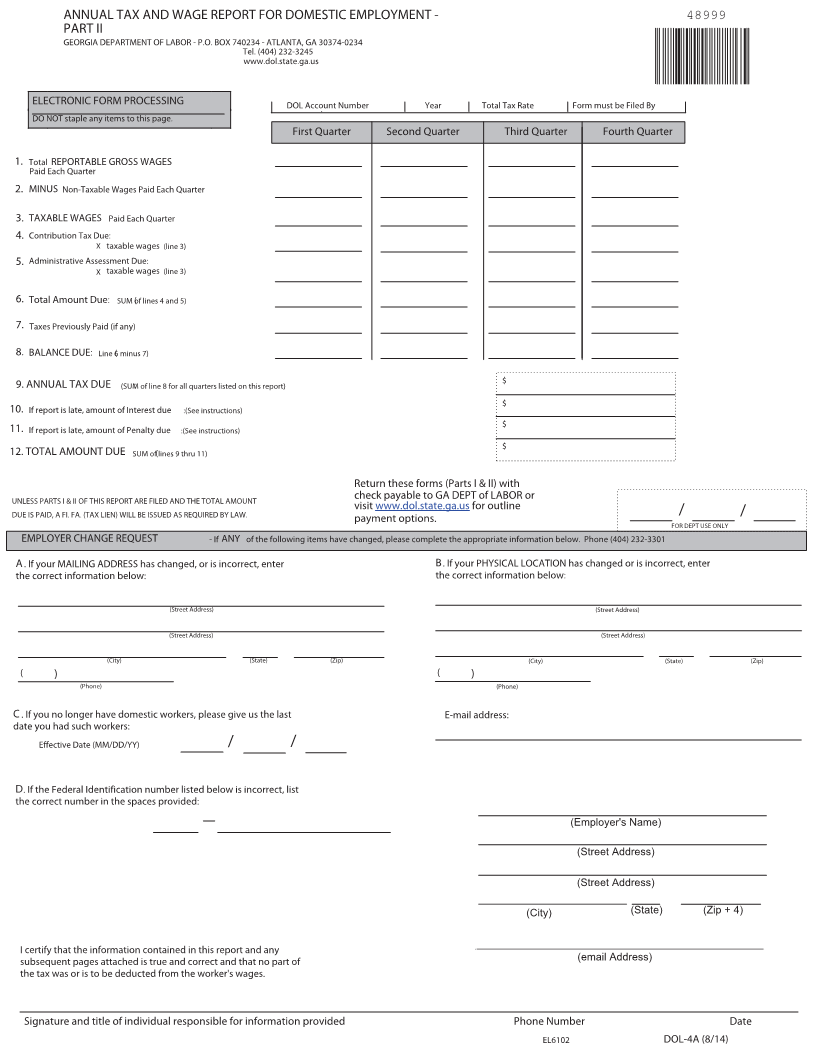

Part II

Line 1 Amount of total reportable gross wages paid for all employees. Show the amount paid

for each quarter separately.

Line 2 Subtract non-taxable wages (amount of wages above $9500 per employee per calendar

year) as applicable for each quarter.

Line 3 Enter the difference between Lines 1 and 2. This amount is used to calculate the

amount of taxes to be paid.

Line 4 In the area provided, enter the Contribution tax rate. To calculate the Contribution tax,

multiply your Contribution tax rate by the amount in Line 3 for each quarter. Effective

January 1, 2017, new employers must use 2.64%. For tax periods prior to January 1,

2017, new employers must use 2.62%.

Line 5 In the area provided, enter the Administrative Assessment rate. To calculate the

Administrative Assessment tax, multiply the Administrative Assessment rate (.06% or

.0006 effective January 1, 2017) by the amount in Line 3 for each quarter. For tax

periods prior to January 1, 2017, the Administrative Assessment rate is .08% or .0008.

This applies to all employers except employers with the minimum rate or the maximum

rate and those employers who have elected to make payments in lieu of contributions as

provided by Code Section 34-8-158.

*The total tax rate is contribution + administrative assessment.

Line 6 The sum of Lines 4 and 5 for each quarter.

Line 7 Enter the amount of taxes previously paid for this reporting year.

Line 8 Enter the difference between Lines 6 and 7.

Line 9 The sum of each quarter from Line 8.

Line 10 Interest is computed on the tax due (Line 9) from the due date (January 31) at the rate

of 1.5% per month or fraction of a month. Interest accrues until all tax and

administrative assessments are paid.

Line 11 Enter penalty if the report is filed after January 31. Penalty is $20 or .05% (.0005) of

total wages whichever is greater, for each month the report is late. Compute penalty as

.05% (.0005) of total wages whenever total wages for the quarter are more than

$40,000.

Line 12 Enter the sum of Lines 9 through 11.

Changes in your business information should be reported in Sections A-D at the bottom of Part II.

For assistance with completing Sections A-D, call 404-232-3301. Sign and mail the report,

Parts I and II, no later than January 31.

Visit dol.georgia.gov for online payment options or make check or money order payable to

Georgia Department of Labor and provide your DOL account number on your check.

EL6103 DOL-4A Instr. (R-12/16)