Enlarge image

DE 400-V 2017 FIDUCIARY FORM

What is a Payment Voucher and Why Should I Use It? How Do I Make My Payment?

A payment voucher is a statement you send with your payment - Make your check or money order payable to the

when you have a balance due on your electronically filed tax return. “Delaware Division of Revenue”. Don’t send cash.

It is like the part of other bills–utilities, credit cards, etc.–that you

send back with your payment. - Make sure your name and address appear on your

check or money order.

This payment voucher is intended for use only when you have filed - Write your EIN, daytime telephone number, and “2017

your Delaware return electronically and have a balance due to Form 400V” on your check or money order.

the State of Delaware. By submitting a voucher with the payment,

the Delaware Division of Revenue is better able to match up your - Detach the payment voucher at the perforation.

payment with your previously received return.

- Mail your payment and payment voucher to the address

If you have a balance due on your 2017 Form 400, please send the below.

payment voucher with your payment. By sending it, you will help

save tax dollars since we will be able to process your payment more Mail To:

accurately and efficiently. We strongly encourage you to use Form Delaware Division of Revenue

DE-400V, but it is not required. P.O. Box 2044

Wilmington, DE 19899-2044

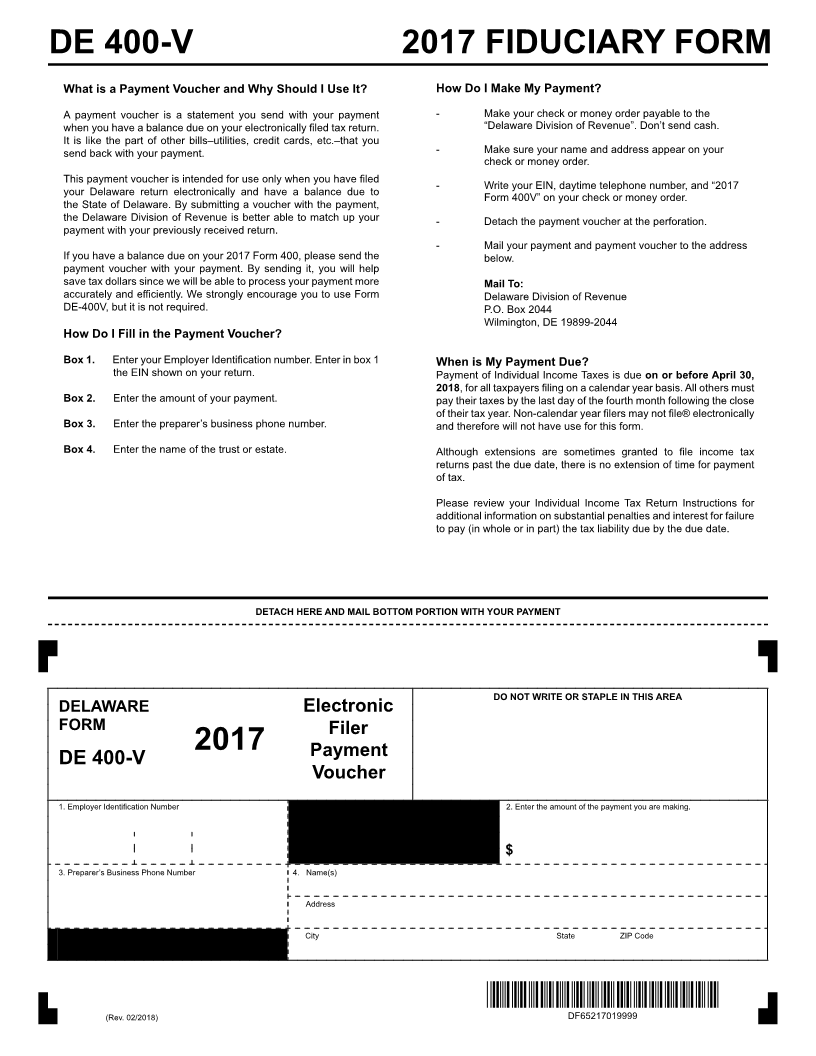

How Do I Fill in the Payment Voucher?

Box 1. Enter your Employer Identification number. Enter in box 1 When is My Payment Due?

the EIN shown on your return. Payment of Individual Income Taxes is due on or before April 30,

2018, for all taxpayers filing on a calendar year basis. All others must

Box 2. Enter the amount of your payment. pay their taxes by the last day of the fourth month following the close

of their tax year. Non-calendar year filers may not file® electronically

Box 3. Enter the preparer’s business phone number. and therefore will not have use for this form.

Box 4. Enter the name of the trust or estate. Although extensions are sometimes granted to file income tax

returns past the due date, there is no extension of time for payment

of tax.

Please review your Individual Income Tax Return Instructions for

additional information on substantial penalties and interest for failure

to pay (in whole or in part) the tax liability due by the due date.

DETACH HERE AND MAIL BOTTOM PORTION WITH YOUR PAYMENT

DO NOT WRITE OR STAPLE IN THIS AREA

DELAWARE Electronic

FORM Filer

2017 Payment

DE 400-V

Voucher

1. Employer Identification Number 2. Enter the amount of the payment you are making.

$

3. Preparer’s Business Phone Number 4. Name(s)

Address

City State ZIP Code

*DF65217019999*

(Rev. 02/2018) DF65217019999