Enlarge image

Tax Clearance Application GENERAL INSTRUCTIONS

PURPOSE OF FORM Section 5 - Important Information

To apply for Certificate of Compliance for either, Letter of Power of Attorney

Good Standing,Dissolution or Withdrawal If this application is submitted by anyone other than a

corporate officer, general partner, or individual (sole

SPECIFIC INSTRUCTIONS proprietor), Arizona Form 285B, Disclosure Authorization

Form, is required. Visit our website at www.azdor.gov and

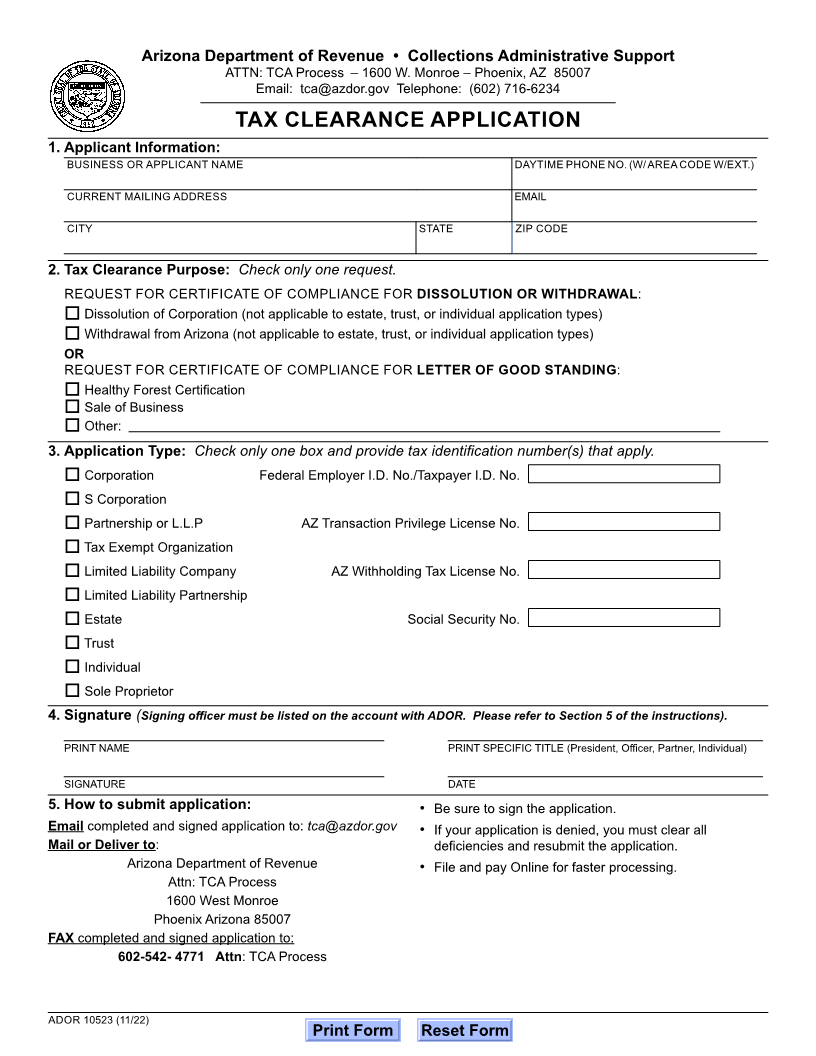

Section 1 - Applicant Information click on the Forms link to obtain Form 285B.

Enter the applicant’s name, as licensed, name of the

entity for which the certificate will be issued. The Confidentiality: The department does not release

information to anyone other than the taxpayer or a

application will be denied if the name does not match the

representative as evidenced by a valid power of attorney

Taxpayer Identification Number or the Federal Employer

or disclosure Authorization form on file with the department

Identification Number entered. . (A file number per the

or with the application.

Arizona Corporation Commissions has no relation to a

Federal Employer Taxpayer Identification Number). Denied/Approval Applications: If your application

is denied, a denial letter will be sent by mail. Once the

Enter the applicant’s daytime telephone number with ext.,

deficiencies are cleared, you must resubmit a new

current mailing address, city, state and zip code.

application to restart the process. If your application is

Section 2 - Tax Clearance Purpose approved a certificate will be sent by mail.

Check the box for the type of certificate requested: Processing: Arizona does not have an expedited

process for Tax Clearance Applications. An application

A Certificate of Compliance for Dissolution or

for a Letter of Good Standing (A.R.S.42-1110) takes

Withdrawal is specifically for dissolution of a corporation or 15

is for an entity wishing to withdraw from Arizona. business days to process. An application for Dissolution

or Withdrawal (A.R.S.43-1151) takes 30 business days

A Letter of Good Standing request is for the healthy forest to process. There is no fee for this service. For faster

certification, air carrier apportionment, personal reason, processing, please file and pay Online.

renewable energy tax incentive, residency, sale of a

Compliance: You must be in full compliance with any

business, or other reason.

and all Arizona tax filing and tax payment requirements

Section 3 - Application Type in order to receive a certificate. All delinquent returns

filed and balances must be paid in full prior to filing tax

Check only one box for the type of entity making the clearance application. If you are on a payment plan this

request.

will not suffice, your account needs to be paid in full.

Enter the Federal Employer Identification Number or the

Dissolution and Withdrawal: You must have cancelled

Taxpayer Identification Number.

all required licenses with the department in order to receive

Enter the Arizona Transaction Privilege License Number. a certificate. You must have filed a final corporate income

If the business does not have one, leave blank. tax return in order to receive a certificate.

Enter the Arizona Withholding Tax License Number. If the If your business files a consolidated return, a notarized

business does not have one, leave blank. Letter of Assumption must be submitted from the ultimate

parent company with your application.

Estates or Trusts: Enter the Taxpayer Identification

Number or Federal Employer Identification Number. Other Information:

If your business files a consolidated return, a notarized

Individuals: Enter your Social Security Number. (Last

Letter of Assumption must be submitted from the ultimate

six years or prior will be checked)

parent company with your application.

Section 4 - Signature If your business is tax exempt or non-profit, you must

This area is for the signature of the individual taxpayer, submit with your application a Letter of Determination from

the corporate officer, partner or member of the business the Internal Revenue Service.

requesting the certificate. Application Submission:

Print the name of the taxpayer. Print the title of the taxpayer, For submission details please see the following Tax

owner, partner, president, vice president, etc. Sign and Clearance Application form on the next page.

date the application. The name must be legible.

Unsigned applications will not be processed.

ADOR 10523 (11/22) INSTRUCTIONS