Enlarge image

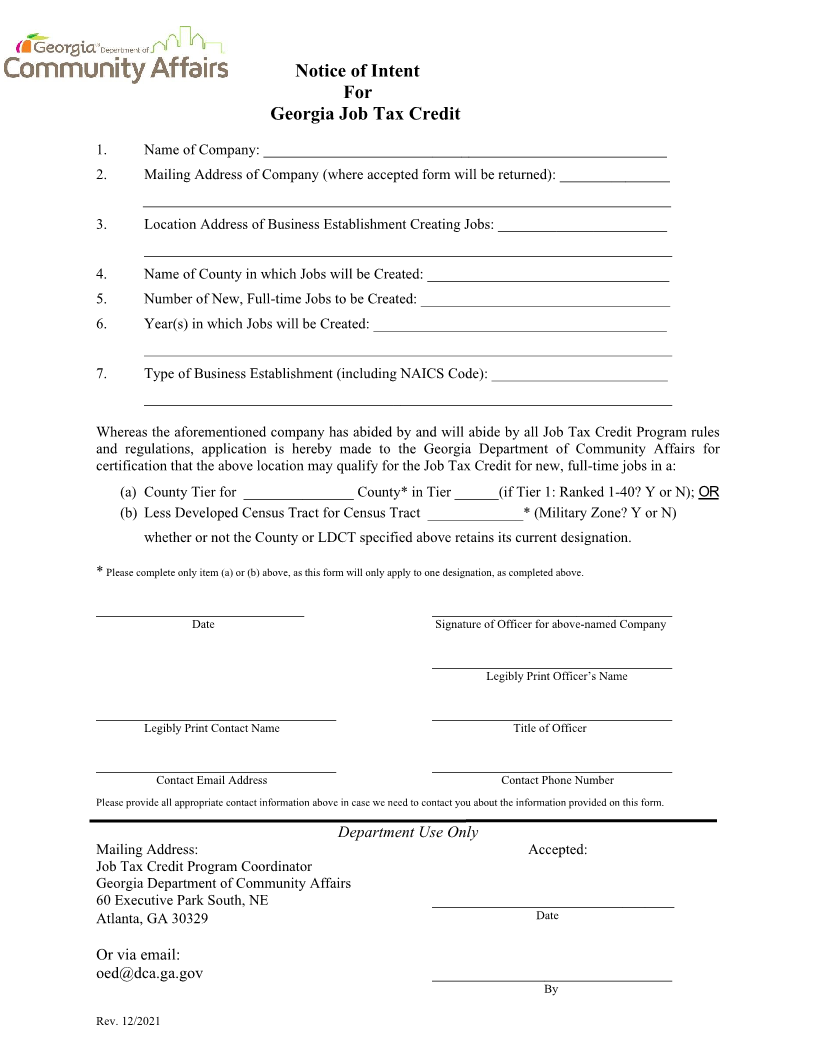

Instructions for Preparing

Notice of Intent

The Notice of Intent (NOI) is provided to assist businesses which are expanding or locating in

the state and whose county tier is reclassified or census tract area is removed from the Less

Developed Census Tract listing. Timely filing of the NOI will allow a business to continue to

claim the tier or census tract classification in effect at the time the NOI is filed. Please note that

st

the NOI must be filed with DCA no later than March 31 after the rankings are released in order

to continue to claim the prior year ranking. (i.e. to preserve the 2021 ranking, the NOI must be

filed with DCA no later than March 31, 2022.)

Line 1 – Enter the name of the taxpayer creating jobs.

Line 2 – Mailing address to which accepted Notice of Intent should be returned.

Line 3 – Location address(es) in Georgia where jobs will be created.

Line 4 – County or counties in Georgia where jobs will be created. Please note that multiple

counties may be listed on the same form as long as they are all within the same tier. Different

county tier locations must be listed on separate forms.

Line 5 – This number should reflect the number of proposed new, full-time jobs that the

taxpayer will create over the next three (3) years and should at least equal the tier threshold

required. (Note that the minimum job threshold must be met in a single tax year and that new,

full-time jobs must conform to the applicable definitions found in the Job Tax Credit

Regulations.)

Line 6 –The years listed should reflect the three (3) years of job creation for which the notice is

submitted, not to exceed five (5) years from the submission date.

Line 7 – List the most appropriate NAICS Code for the type of operation where jobs will be

created and briefly describe the type of operation at the location where the jobs will be created.

Complete only one to preserve the proper designation of the specified location: (a) to certify the

county tier OR (b) to certify the less developed census tract.

- For the county tier, fill in (a) with the name of the county and the tier number.

- For the less developed census tract, fill in (b) with the census tract number.

Please note that only (a) or (b) should be completed, depending upon whether the credit will be

claimed under the county tier designation or the less developed census tract designation.

Additional information on the Job Tax Credit Program and the Notice of Intent are available in

the program regulations available on DCA’s web site at:

https://www.dca.ga.gov/community-economic-development/incentive-programs/job-tax-credits

Rev. 12/2021