Enlarge image

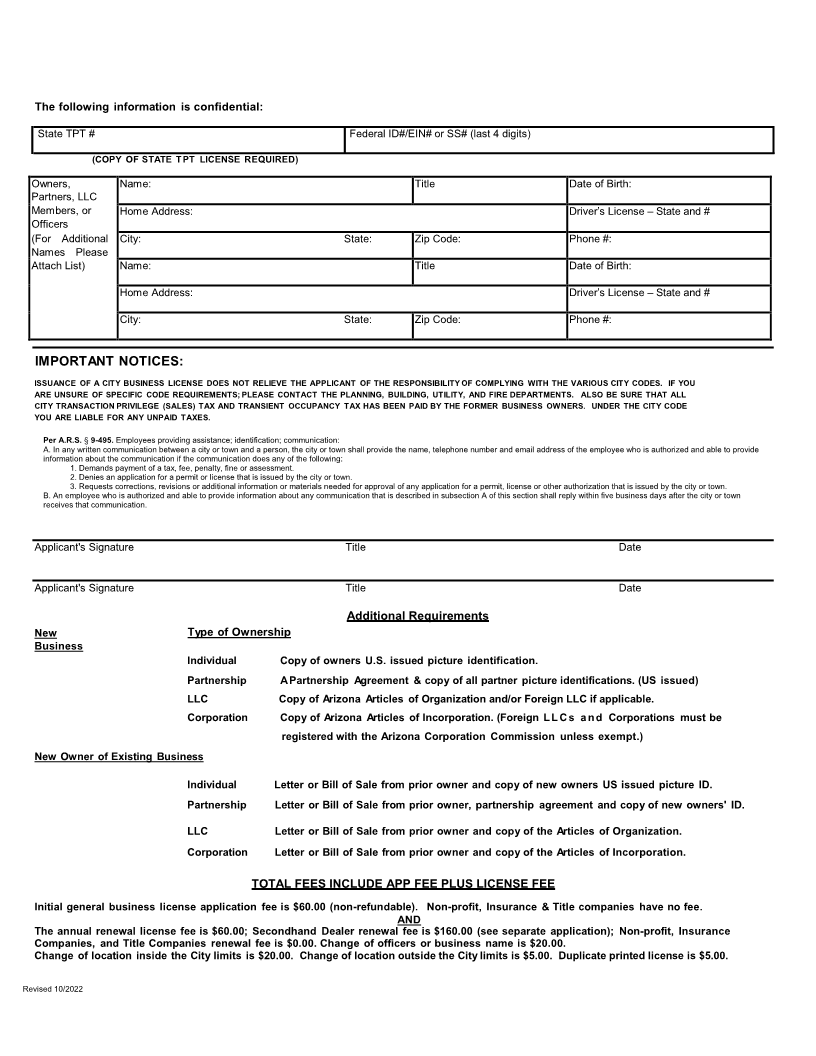

BUSINESS LICENSE APPLICATION

CITY OF BULLHEAD CITY

Business License Office

PO Box 23189

Bullhead City, AZ 86439-3189

Office: (928) 763-0110 - Fax: (928) 763-0131 - E-mail: bhcbusinesslicense @bullheadcityaz.gov

Location: 2355 Trane Rd, Bullhead City, AZ 86442

EACH SECTION OF THIS APPLICATION MUST BE COMPLETED BEFORE A LICENSE WILL BE ISSUED. For Office Use Only

Check One: New Business Former Owner (If Applicable): Application Date: License Type:

TPT OBL

New Owner of Existing Business Start Date: Application & License Fee

For Changes Name Change Only Current City License#: Date of Change:

To Existing Location Change License #

Licenses: Change Corporate Officers

SECTION I : BUSINESS LOCATION INFORMATION

Business Name: Approvals

Street Address: Suite or Apt. # Business License Office

A D

City: State: Zip Business Telephone #: Building Department

A D

E-Mail Address: Business Fax # Planning/Zoning Department

A D

SECTION II: MAILING ADDRESS Fire Department

Enter name if Different From Section I (above) or Enter "In-Care-of" Name: A D

Health Department

Address A D

Police Department

City State Zip A D

SECTION III: BUSINESS OW NERSHIP & RECORD LOCATION

Ownership: Individual LLC Corp. Gen Partnership S Corp. Other/Non-Profit

If LLC do you file with IRS as: Sole Proprietor Corporation

If Corporation or LLC, it must be registered with the Arizona Corporation Commission unless exempt.

Contact person or Name: Day Time Phone #: Night Phone #:

owner

Corporation or LLC

if different than DBA

Corporate or LLC Name and Address: Phone #:

Statutory Agent

SECTION IV: BUSINESS TYPE

Business Retail-New Products Only Amusements Other/Services Construction Contracting

Type Restaurants/Bars Taxi W holesaler ROC#

Rental of Tangible Personal Property Hotel/Motel Home Occupation

Describe in detail

business activity:

SECTION V: BUSINESS PREMISES STATUS

CHECK ONE: Is your business location your residence? Yes No

Do you rent/lease commercial property from another? Yes No

In City If yes to either of these, please complete the Landlord/Property Information.

Landlord/Property Manager Name: Address: Phone #:

Out of City

Do you rent a portion of the business premises to another entity? Yes No

If YES, please list the name and telephone of the other entity:

Indicate reporting status for filing S t a t e a n d City Transaction Privilege (Sales) T ax Returns:

Monthly Quarterly Annually

Number of employees:

Give a listing of all locations where the business has operated or where the applicant has operated a business during the

last five years: (If not applicable, please write N/A.)

Revised 10/2022