Enlarge image

512

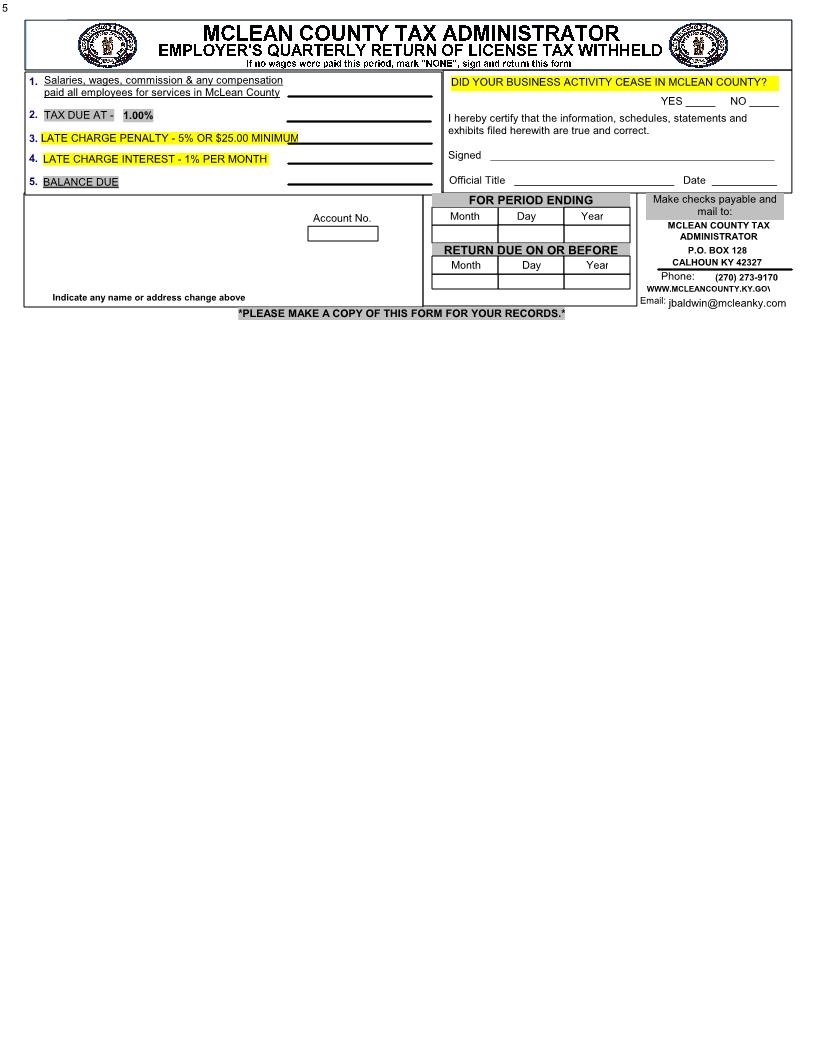

MCLEAN COUNTY TAX ADMINISTRATOR

EMPLOYER'S QUARTERLY RETURN OF LICENSE TAX WITHHELD

If no wages were paid this period, mark "NONE", sign and return this form

1. Salaries, wages, commission & any compensation DID YOUR BUSINESS ACTIVITY CEASE IN MCLEAN COUNTY?

paid all employees for services in McLean County

YES _____ NO _____

2. TAX DUE AT - 1.00% I hereby certify that the information, schedules, statements and

exhibits filed herewith are true and correct.

3. LATE CHARGE PENALTY - 5% OR $25.00 MINIMUM

4. LATE CHARGE INTEREST - 1% PER MONTH Signed ________________________________________________

5. BALANCE DUE Official Title ___________________________ Date ___________

FOR PERIOD ENDING Make checks payable and

JOSH CONSULTING SERVICES INC Account No. Month Day Year mail to:

MCLEAN COUNTY TAX

YOGI 11 INC DBA MARATHON 05007 09 30 2021 ADMINISTRATOR

1051 PERIMETER DR STE 260 RETURN DUE ON OR BEFORE P.O. BOX 128

SCHAUMBURG IL 60173 Month Day Year CALHOUN KY 42327

10 31 2021 Phone: (270) 273-9170

WWW.MCLEANCOUNTY.KY.GOV

Indicate any name or address change above Email: jedmonds@mcleanky.comjbaldwin@mcleanky.com

*PLEASE MAKE A COPY OF THIS FORM FOR YOUR RECORDS.*