Enlarge image

MCLEAN COUNTY TAX ADMINISTR

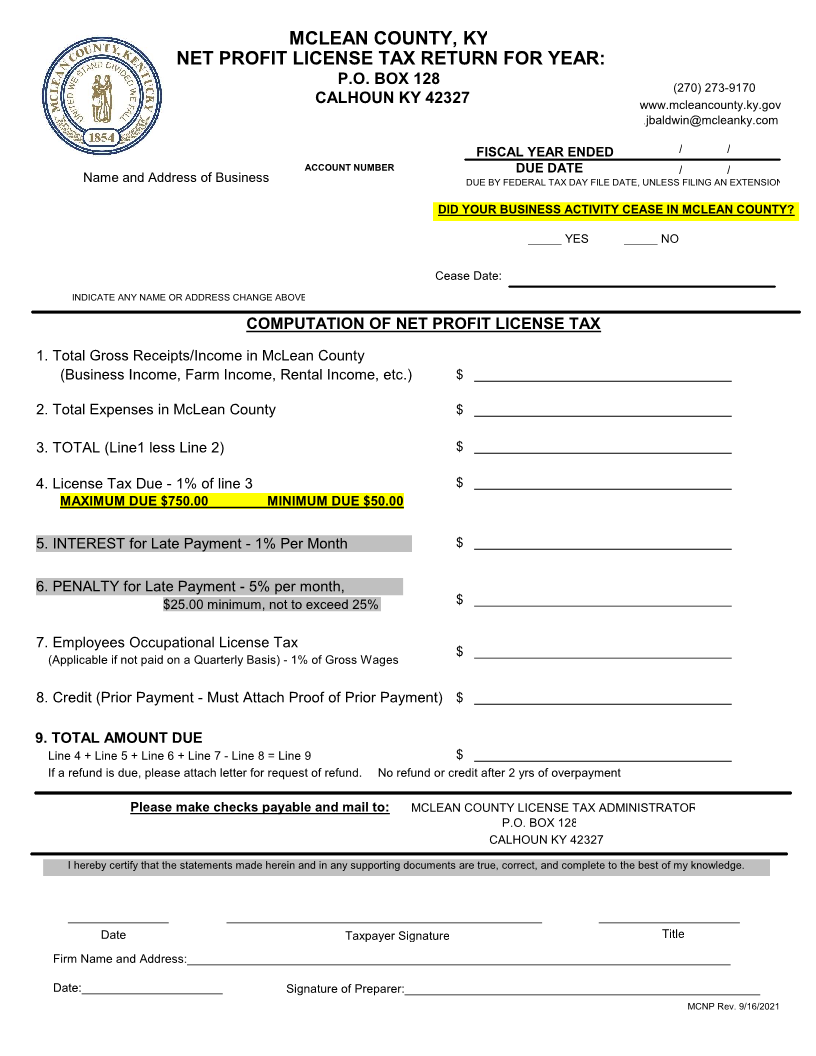

MCLEAN COUNTY, KY

NET PROFIT LICENSE TAX RETURN FOR YEAR: 2021

P.O. BOX 128

(270) 273-9170

CALHOUN KY 42327 www.mcleancounty.ky.govwww.mcleancounty.ky.gov

jedmonds@mcleanky.comjbaldwin@mcleanky.com

FISCAL YEAR ENDED 12 / 31 / 2021

ACCOUNT NUMBER DUE DATE 04 / 15 / 2022

Name and Address of Business 00002 DUE BY FEDERAL TAX DAY FILE DATE, UNLESS FILING AN EXTENSION

MICHAEL L BRAWNER, JR

DID YOUR BUSINESS ACTIVITY CEASE IN MCLEAN COUNTY?

PO BOX 467 _____ YES _____ NO

CALHOUN KY 42327

Cease Date:

INDICATE ANY NAME OR ADDRESS CHANGE ABOVE

COMPUTATION OF NET PROFIT LICENSE TAX

1. Total Gross Receipts/Income in McLean County

(Business Income, Farm Income, Rental Income, etc.) $ ___________________________________

2. Total Expenses in McLean County $ ___________________________________

3. TOTAL (Line1 less Line 2) $ ___________________________________

4. License Tax Due - 1% of line 3 $ ___________________________________

MAXIMUM DUE $750.00 MINIMUM DUE $50.00

5. INTEREST for Late Payment - 1% Per Month $ ___________________________________

6. PENALTY for Late Payment - 5% per month,

$25.00 minimum, not to exceed 25% $ ___________________________________

7. Employees Occupational License Tax

$ ___________________________________

(Applicable if not paid on a Quarterly Basis) - 1% of Gross Wages

8. Credit (Prior Payment - Must Attach Proof of Prior Payment) $ ___________________________________

9. TOTAL AMOUNT DUE

Line 4 + Line 5 + Line 6 + Line 7 - Line 8 = Line 9 $ ___________________________________

If a refund is due, please attach letter for request of refund. No refund or credit after 2 yrs of overpayment

Please make checks payable and mail to: MCLEAN COUNTY LICENSE TAX ADMINISTRATOR

P.O. BOX 128

CALHOUN KY 42327

I hereby certify that the statements made herein and in any supporting documents are true, correct, and complete to the best of my knowledge.

_______________ _______________________________________________ _____________________

Date Taxpayer Signature Title

Firm Name and Address:_________________________________________________________________________________

Date:_____________________ Signature of Preparer:_____________________________________________________

MCNP Rev. 9/16/2021