Enlarge image

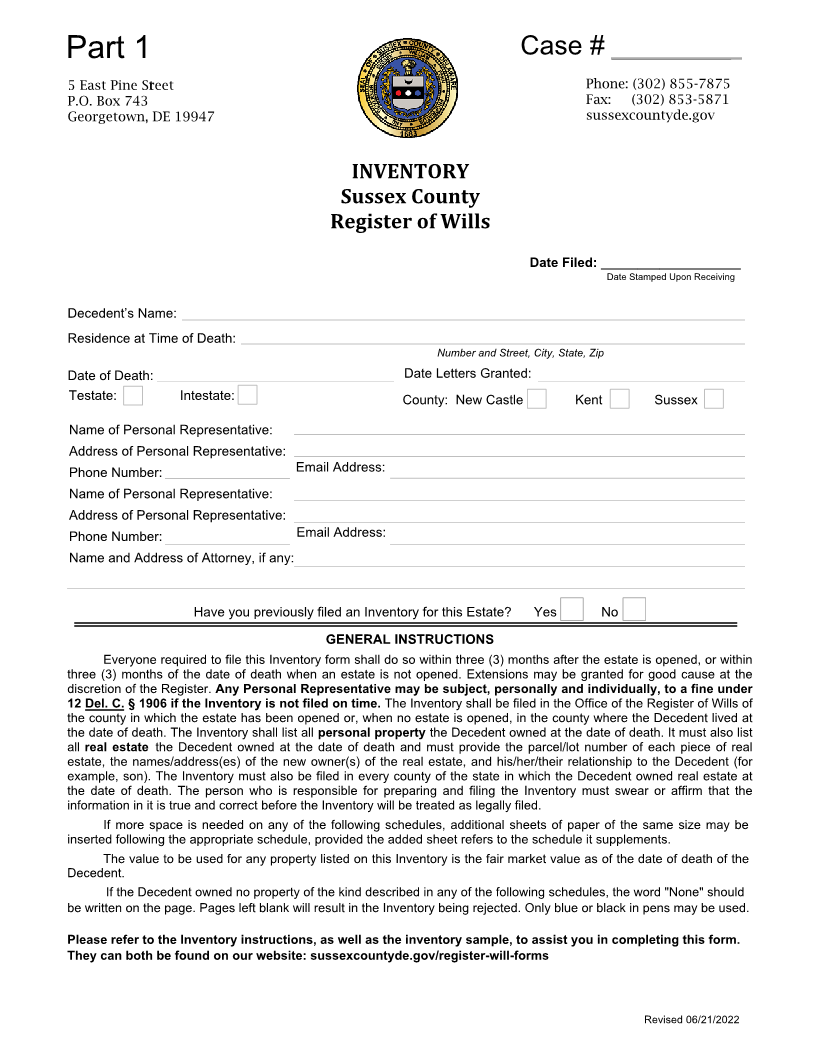

Part 1 Case # ________

5 East Pi ne St reet Phone: (302) 855-7875

P.O. Box 743 Fax: (302) 853-5871

Georgetown, DE 19947 sussexcountyde.gov

INVENTORY

Sussex County

Registe r of Wills

DateFiled : _____ ______________

Date Stamped Upon Receiving

Decedent’s Name:

Residence at Time of Death:

Number and Street, City, State, Zip

Date of Death: Date Letters Granted:

Testate: Intestate: County: New Castle Kent Sussex

Name of Personal Representative:

Address of Personal Representative:

Phone Number: Email Address:

Name of Personal Representative:

Address of Personal Representative:

Phone Number: Email Address:

Name and Address of Attorney, if any:

Have you previously filed an Inventory for this Estate? Yes No

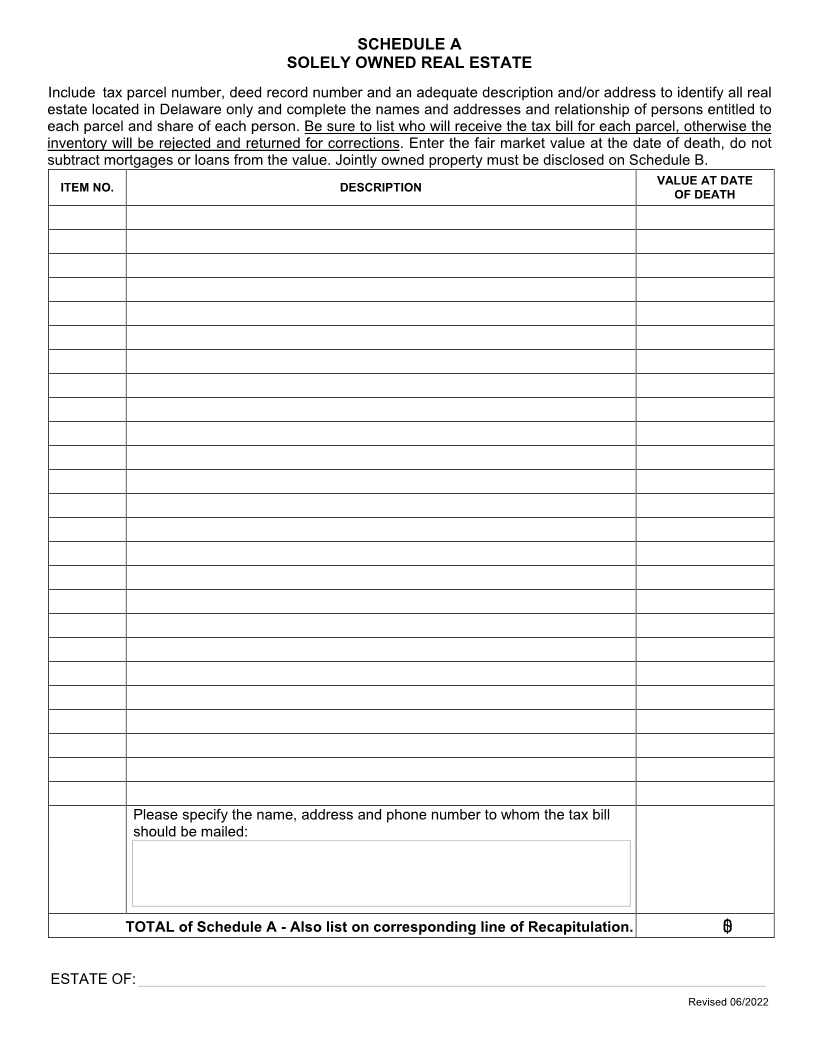

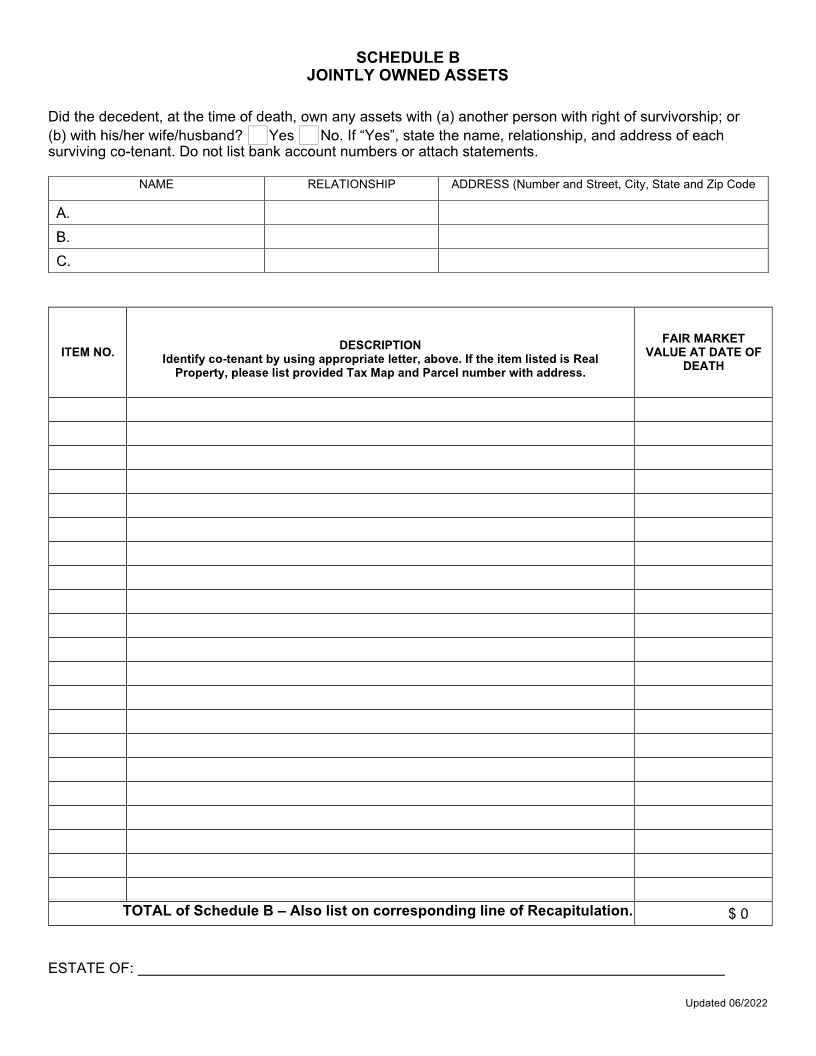

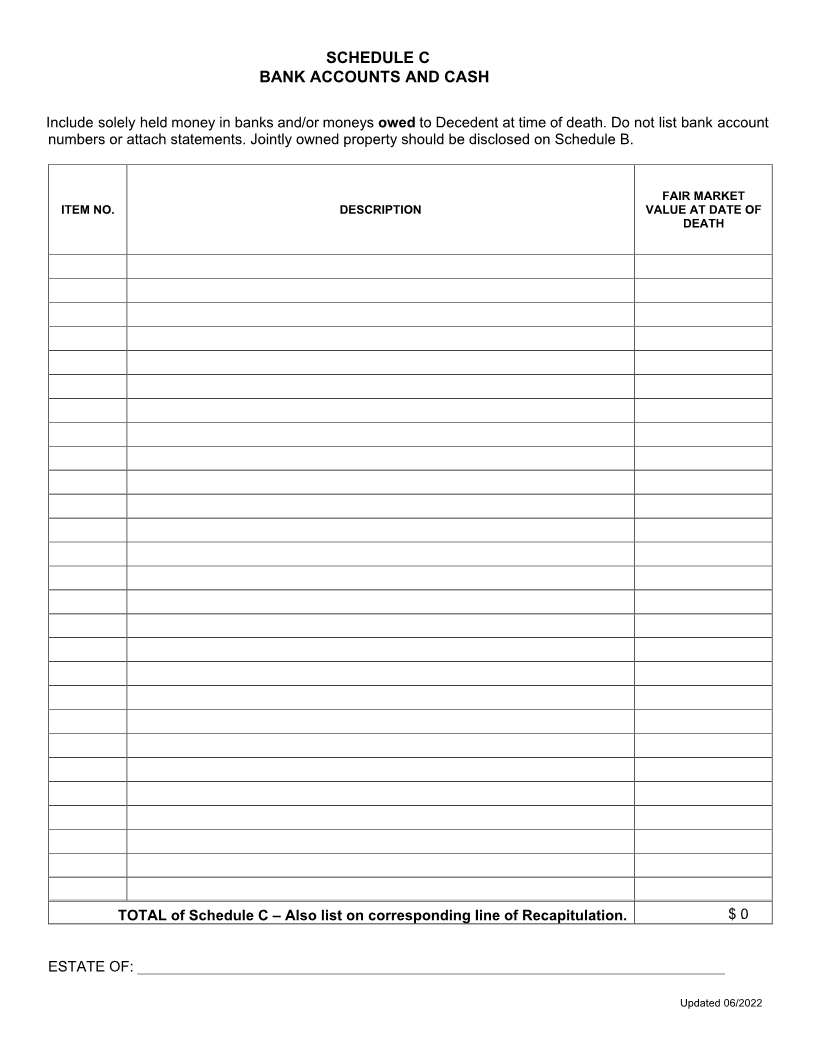

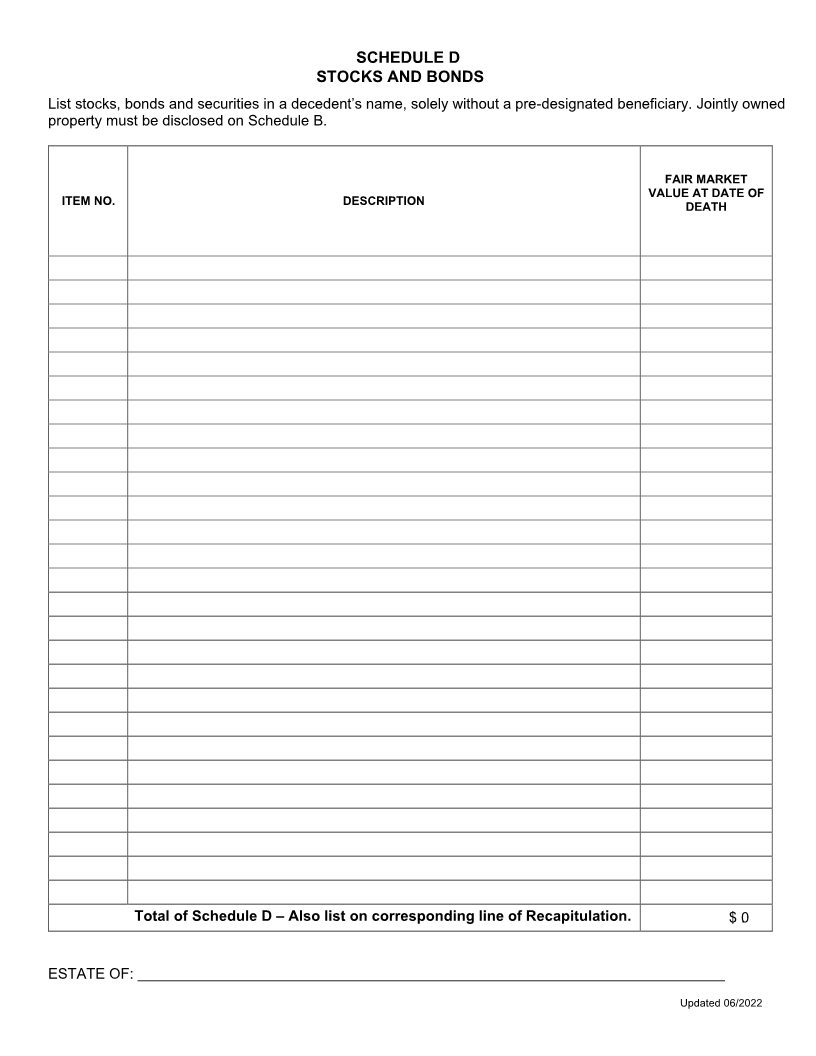

GENERAL INSTRUCTIONS

Everyone required to file this Inventory form shall do so within three (3) months after the estate is opened, or within

three (3) months of the date of death when an estate is not opened. Extensions may be granted for good cause at the

discretion of the Register. Any Personal Representative may be subject, personally and individually, to a fine under

12 Del. C. §1906 if the Inventory is not filed on time. The Inventory shall be filed in the Office of the Register of Wills of

the county in which the estate has been opened or, when no estate is opened, in the county where the Decedent lived at

the date of death. The Inventory shall list all personal property the Decedent owned at the date of death. It must also list

all real estate the Decedent owned at the date of death and must provide the parcel/lot number of each piece of real

estate, the names/address(es) of the new owner(s) of the real estate, and his/her/their relationship to the Decedent (for

example, son). The Inventory must also be filed in every county of the state in which the Decedent owned real estate at

the date of death. The person who is responsible for preparing and filing the Inventory must swear or affirm that the

information in it is true and correct before the Inventory will be treated as legally filed.

If more space is needed on any of the following schedules, additional sheets of paper of the same size may be

inserted following the appropriate schedule, provided the added sheet refers to the s chedule it supplements.

The value to be used for any property listed on this Inventory is the fair market value as of the date of death of the

Decedent.

If the Decedent owned no property of the kind described in any of the following schedules, the word "None" should

be written on the page. Pages left blank will result in the Inventory being rejected. Only blue or black in pens may be used.

Please refer to the Inventory instructions, as well as the inventory sample, to assist you in completing this form.

They can both be found on our website: sussexcountyde.gov/register-will-forms

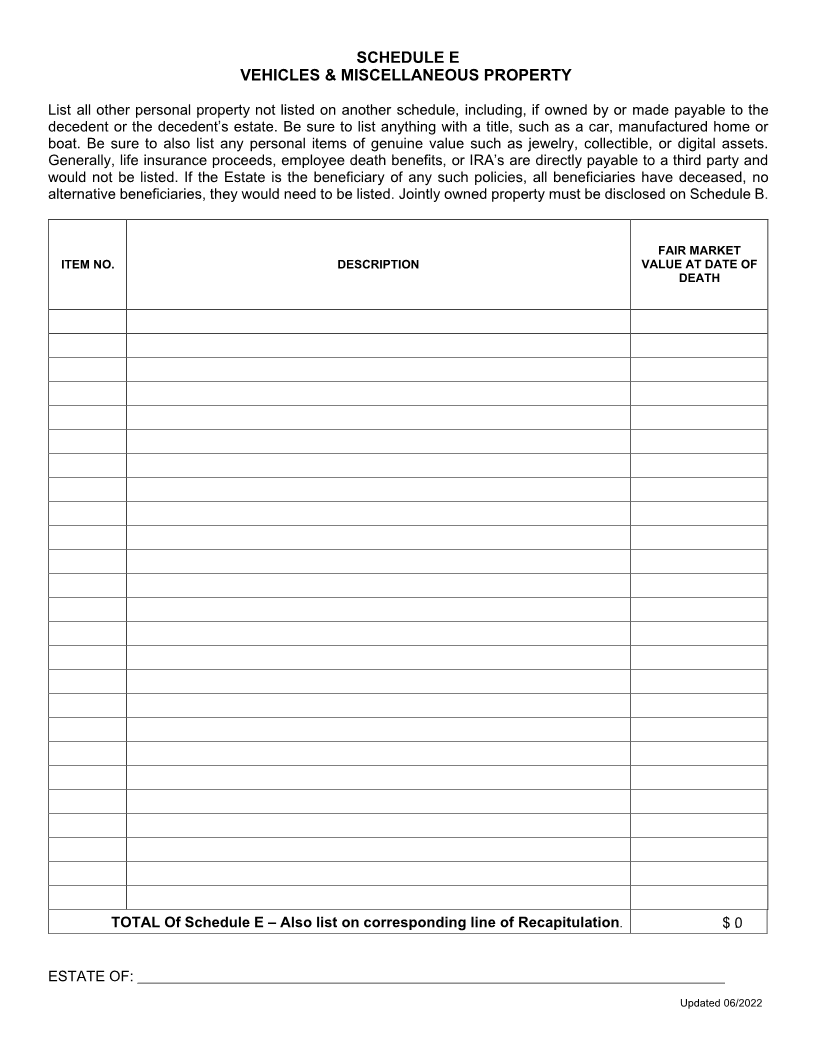

Revised 06/21/2022