Enlarge image

Installment Agreement Request

PLEASE READ:

• DO NOT submit this form if you are currently in bankruptcy, have unfiled state tax returns that are past due, have a pending

offer in compromise with the Department, or your state tax liability has been assigned to a private collection agency.

If your liability has been assigned to a private collection agency, contact that agency.

• DO try and submit this form electronically by visiting the Department’s Georgia Tax Center at https://gtc.dor.ga.gov.

Please note that you will not be able to submit an installment payment agreement request via the Georgia Tax Center if you

have an active protest or appeal, are subject to a Department enforcement action, are in bankruptcy, have an accepted offer

in compromise, or already have an active payment plan with the Department.

• DO enter the Letter ID in Line 1 if you received a notice from the Department showing an amount due.

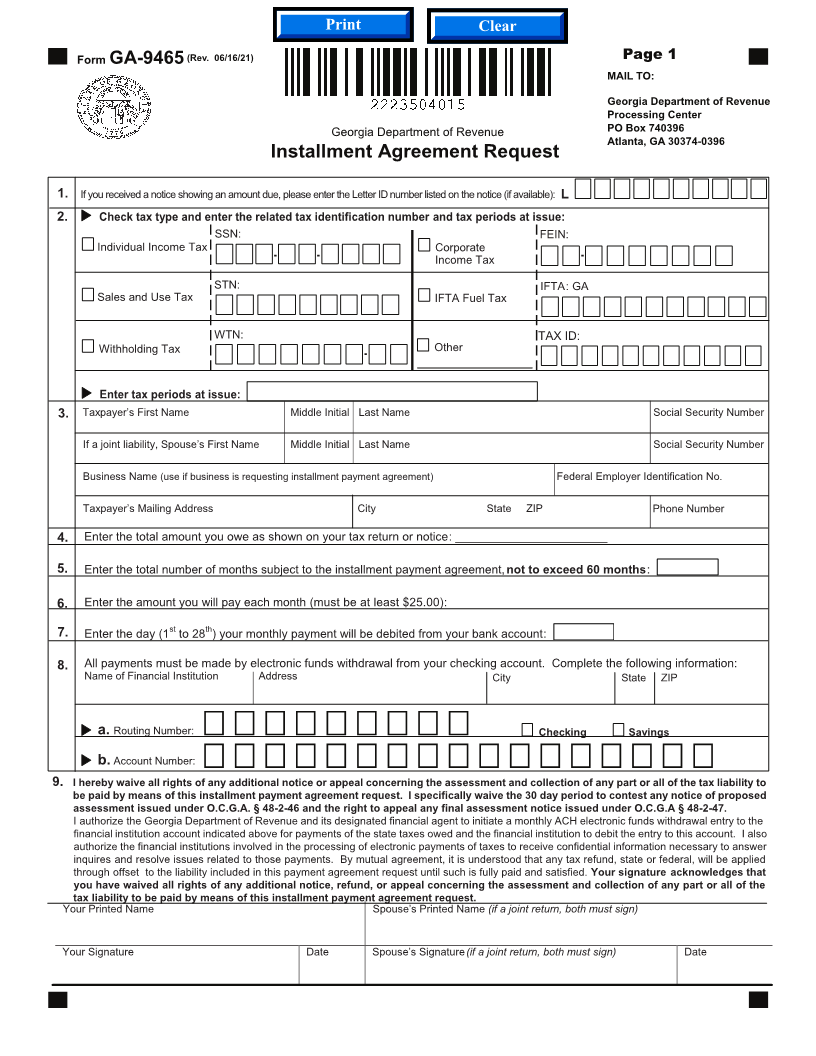

Instructions for Form GA- 9465, Installment Agreement Request

General Instructions

Purpose of Form

Use Form GA-9465 to request a monthly installment plan if By approving your request, we agree to let you pay the tax you

you cannot pay the full amount you owe shown on your tax owe in monthly installments instead of immediately paying the

return (or on a notice we sent you). Generally, you can have amount in full. In return, you agree to make your monthly

up to 60 months to pay. Before requesting an installment payments on time. You also agree to meet all your future tax

agreement, you should consider other less costly alternatives, liabilities. For example, this means that you must have

such as getting a bank loan or using available credit on a enough withholding or estimated tax payments so that your

credit card. income tax liability for future years is paid in full when you

Do not file this form if you are in bankruptcy or have a pending timely file your return. Your request for an installment agree-

offer-in-compromise. If your tax liability has been assigned to ment will be denied if all required tax returns have not been

a private collection agency, contact that particular agency for filed.

payment plan options.

If a tax execution has already been recorded prior to the

How the Installment Agreement Works approval of the agreement, the Department will not initiate

We will usually let you know within 30 days after we receive enforcement action against you to collect the outstanding tax

your request whether it is approved or denied. If we approve debt. Upon default of the installment agreement, the Depart-

your request, you will receive a notice detailing the terms ment may initiate all appropriate enforced collection activity.

of the agreement. Please note that an additional $50 The issuance of a tax execution will result in the imposi-

administration fee will be added to the first payment due. tion of an additional 20% collection fee that will be added

You may qualify to pay a reduced fee of $25 if your income is to the tax liability.

less than $22,050.

You will also be charged interest and may be charged a late Payment Method

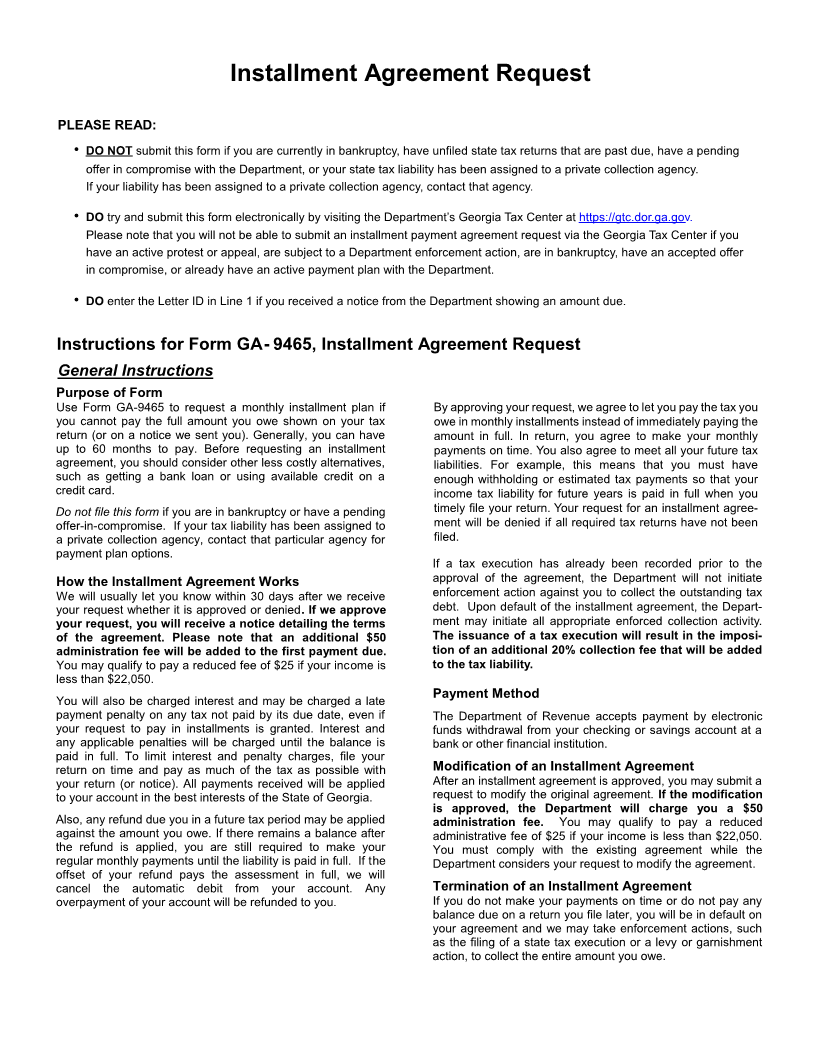

payment penalty on any tax not paid by its due date, even if The Department of Revenue accepts payment by electronic

your request to pay in installments is granted. Interest and funds withdrawal from your checking or savings account at a

any applicable penalties will be charged until the balance is bank or other financial institution.

paid in full. To limit interest and penalty charges, file your

return on time and pay as much of the tax as possible with Modification of an Installment Agreement

your return (or notice). All payments received will be applied After an installment agreement is approved, you may submit a

to your account in the best interests of the State of Georgia. request to modify the original agreement. If the modification

is approved, the Department will charge you a $50

Also, any refund due you in a future tax period may be applied administration fee. You may qualify to pay a reduced

against the amount you owe. If there remains a balance after administrative fee of $25 if your income is less than $22,050.

the refund is applied, you are still required to make your You must comply with the existing agreement while the

regular monthly payments until the liability is paid in full. If the Department considers your request to modify the agreement.

offset of your refund pays the assessment in full, we will

cancel the automatic debit from your account. Any Termination of an Installment Agreement

overpayment of your account will be refunded to you. If you do not make your payments on time or do not pay any

balance due on a return you file later, you will be in default on

your agreement and we may take enforcement actions, such

as the filing of a state tax execution or a levy or garnishment

action, to collect the entire amount you owe.