Enlarge image

Protest of Proposed Assessment or Refund Denial

GENERAL INSTRUCTIONS:

PLEASE READ:

• DO use this form if you disagree with either the amount due on a Notice of Proposed Assessment or the Department's

denial of your request for refund.

• DO attach a copy of the Proposed Assessment or Notice of Refund Denial, as well as any supporting documents.

• DO enter the Letter ID listed on the Proposed Assessment or Notice of Refund Denial in Section 2 of this form. This

information will assist the Department in timely resolving your protest.

• DO try to submit this form electronically by visiting the Department’s Georgia Tax Center at https://gtc.dor.ga.gov.

• DO NOT submit this form if you want to request an installment payment agreement, seek a penalty waiver, or submit an

offer in compromise. Go online to the Georgia Tax Center (https://gtc.dor.ga.gov) for these options.

LINE BY LINE INSTRUCTIONS:

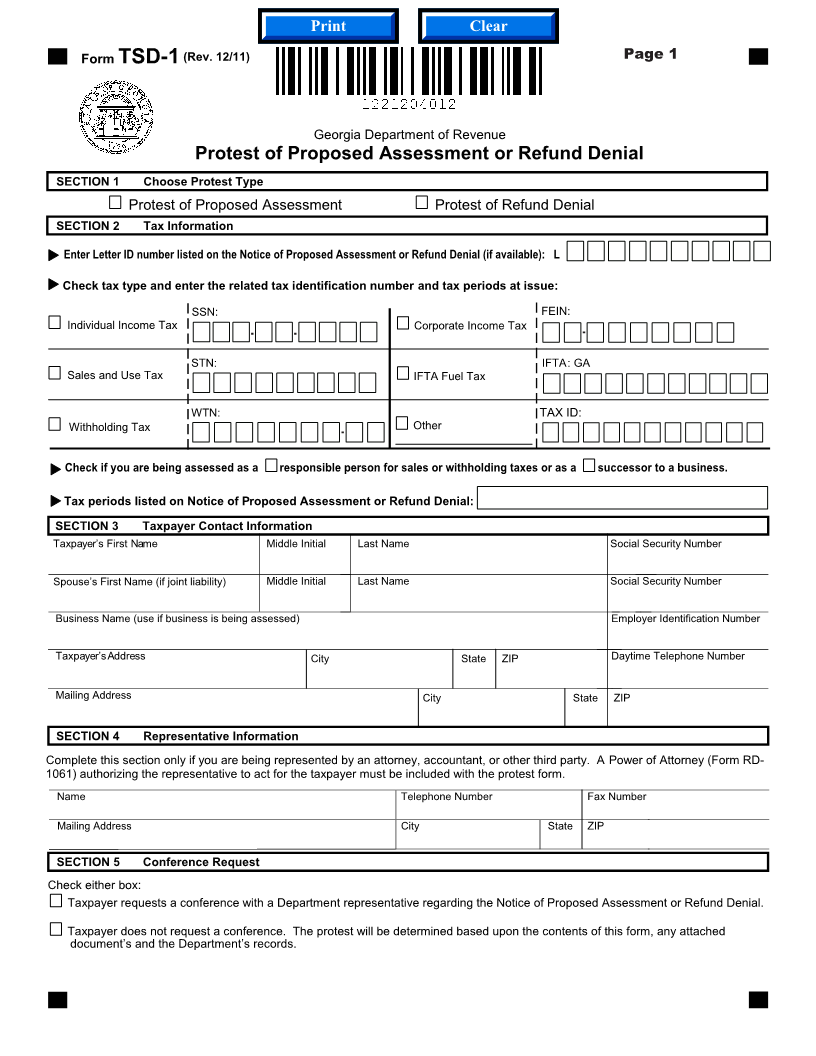

Section 1 Select Protest Type

Check the appropriate box for the type of protest.

Section 2 Letter ID

If you received a notice from the Department showing an amount due, enter the Letter ID listed on the notice.

Check the appropriate tax type and enter the related tax identification number.

Check the appropriate box if you are being assessed as either (i) a responsible person for a sales or income tax withholding

liability or (ii) as a successor to a prior business.

Enter the tax periods from the Notice of Proposed Assessment or Refund Denial.

Section 3 Taxpayer Contact Information

Enter your Name (First, Middle Initial, and Last Name).

Enter your Social Security Number.

Enter your Spouse’s Name (First, Middle Initial, and Last Name), if a joint liability exists.

Enter your Spouse’s Social Security Number, if a joint liability exists.

Enter your Business Name, if business is being assessed.

Enter Employer Identification Number.

Enter Taxpayer’s Address (number, street, and room or suite no., city, state, ZIP code).

Enter Daytime Telephone Number.

Enter Mailing Address (if different from above) (number, street, and room or suite no., city, state, ZIP code).

Section 4 Representative Information

If you are being represented by an attorney, accountant or other third party complete this section.

Section 5 Conference Request

Check the appropriate box if you would like to request a conference with the Department.

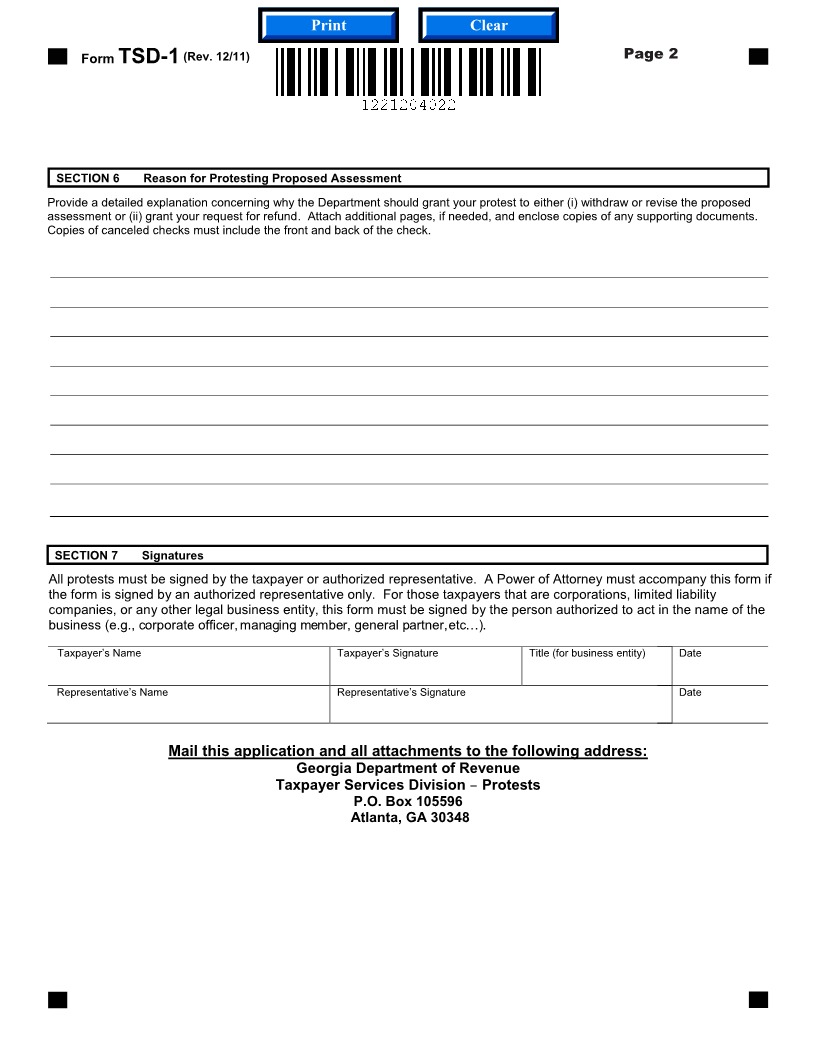

Section 6 Reason for Protesting Proposed Assessment

Provide a detailed explanation of why the Department should grant your protest.

Section 7 Signatures

Taxpayer or Representative must sign form.