Enlarge image

Print Clear

Page 1

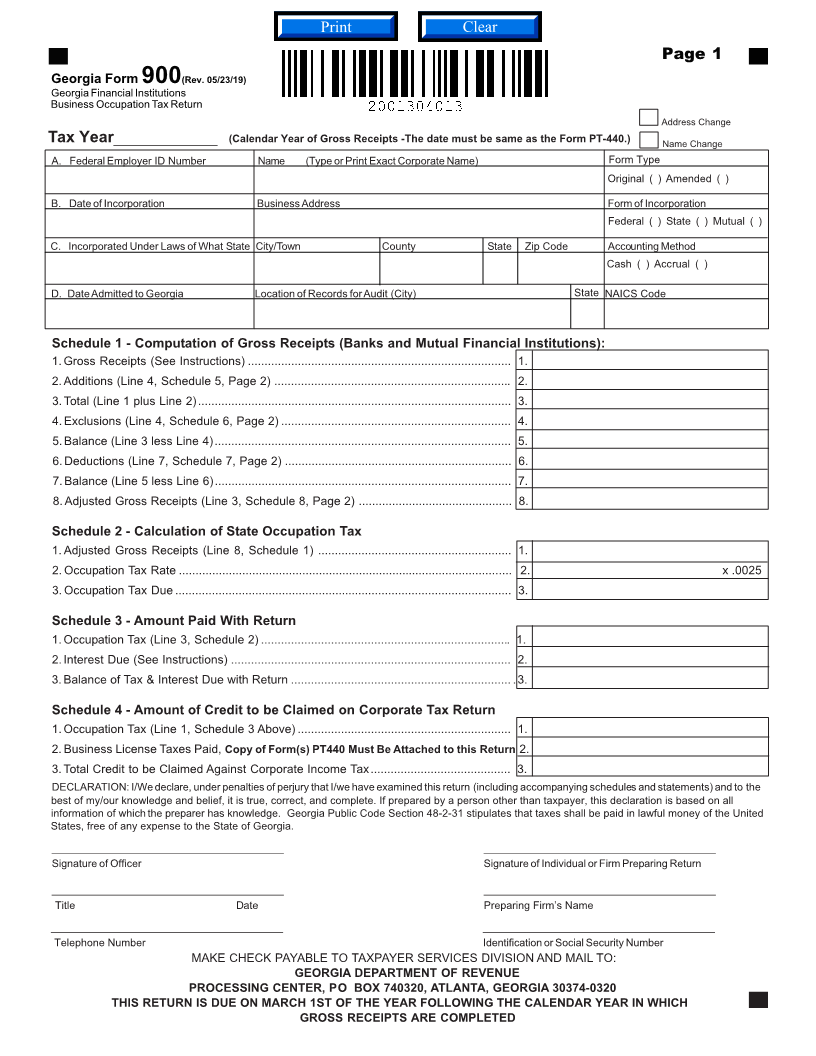

Georgia Form 900(Rev. 05/23/19)

Georgia Financial Institutions

Business Occupation Tax Return

Address Change

T ax _____________ (Calendar Year of Gross Receipts -The date must be same as the Form PT-440.) Name Change Year

A. Federal Employer ID Number Name (Type or Print Exact Corporate Name) Form Type

Original ( ) Amended ( )

B. Date of Incorporation BusinessAddress Form of Incorporation

Federal ( ) State ( ) Mutual ( )

C. Incorporated Under Laws of What State City/Town Co u n ty State Zip Code Accounting Method

Cash ( ) Accrual( )

D. DateAdmitted to Georgia Location of Records forAudit (City) State NAICS Code

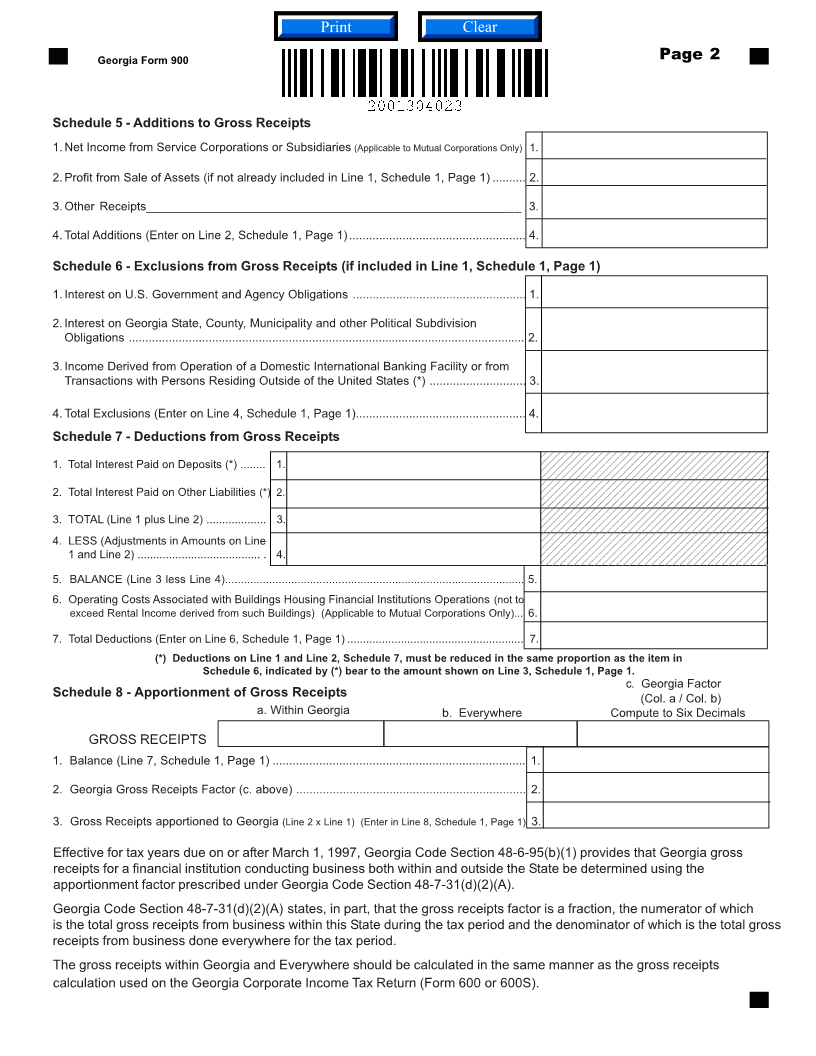

Schedule 1 - Computation of Gross Receipts (Banks and Mutual Financial Institutions):

1.Gross Receipts (See Instructions) ............................................................................... 1.

2.Additions (Line 4, Schedule 5, Page 2) ....................................................................... 2.

3.Total (Line 1 plus Line 2).............................................................................................. 3.

4.Exclusions (Line 4, Schedule 6, Page 2) ..................................................................... 4.

5.Balance (Line 3 less Line 4)......................................................................................... 5.

6.Deductions (Line 7, Schedule 7, Page 2) .................................................................... 6.

7.Balance (Line 5 less Line 6)......................................................................................... 7.

8.Adjusted Gross Receipts (Line 3, Schedule 8, Page 2) .............................................. 8.

Schedule 2 - Calculation of State Occupation Tax

1. Adjusted Gross Receipts (Line 8, Schedule 1) .......................................................... 1.

2. Occupation Tax Rate .................................................................................................... 2. x .0025

3. Occupation Tax Due ..................................................................................................... 3.

Schedule 3 - Amount Paid With Return

1.Occupation Tax (Line 3, Schedule 2) ........................................................................... 1.

2.Interest Due (See Instructions) .................................................................................... 2.

3.Balance of Tax& Interest Due with Return .................................................................. .3.

Schedule 4 - Amount of Credit to be Claimed on Corporate Tax Return

1.Occupation Tax (Line 1, Schedule 3 Above) ................................................................ 1.

2. Business License Taxes Paid, Copy of Form(s) PT440 Must Be Attached to this Return 2.

3.Total Credit to be Claimed Against Corporate Income Tax.......................................... 3.

DECLARATION: I/Wedeclare, under penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the

best of my/our knowledge and belief, it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all

information of which the preparer has knowledge. Georgia Public Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United

States, free of any expense to the State of Georgia.

_____________________________ _____________________________

Signature of Officer Signature of Individual or Firm Preparing Return

_____________________________ _____________________________

Title Date Preparing Firm’s Name

_____________________________ _____________________________

Telephone Number Identification or Social Security Number

MAKE CHECK PAYABLE TO TAXPAYER SERVICES DIVISION AND MAIL TO:

GEORGIA DEPARTMENT OF REVENUE

PROCESSING CENTER, P O BOX 740320, ATLANTA, GEORGIA 30374-0320

THIS RETURN IS DUE ON MARCH 1ST OF THE YEAR FOLLOWING THE CALENDAR YEAR IN WHICH

GROSS RECEIPTS ARE COMPLETED