- 4 -

Enlarge image

|

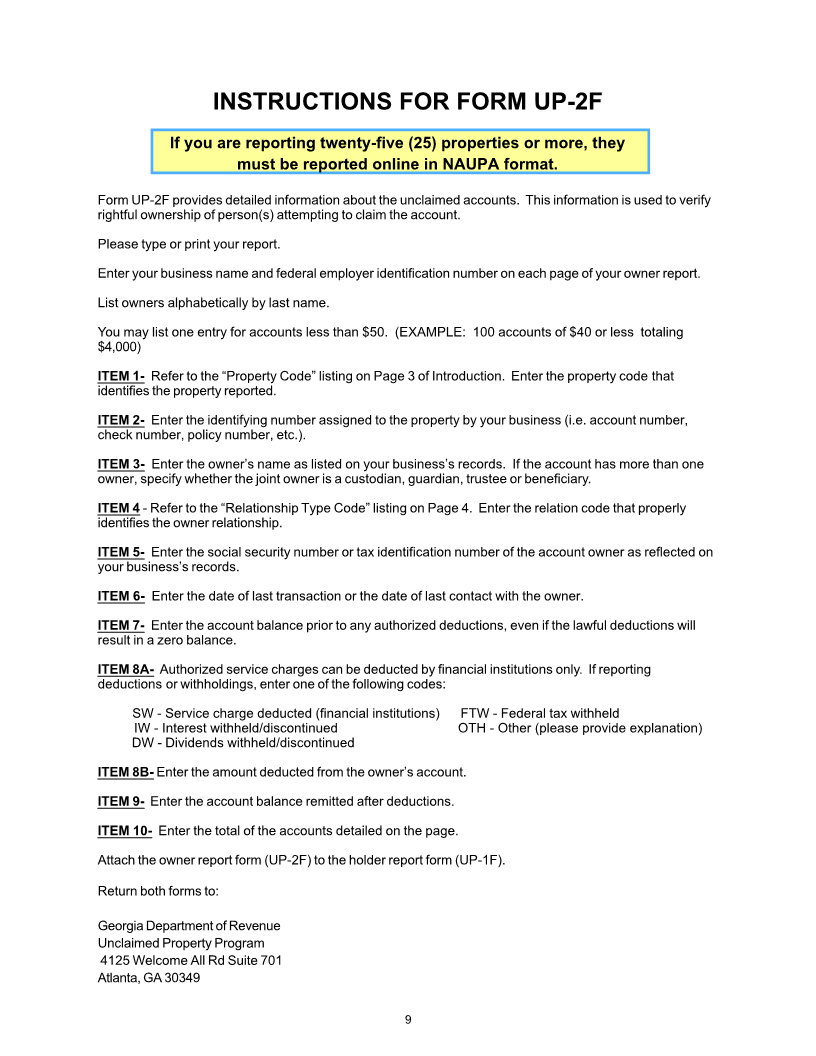

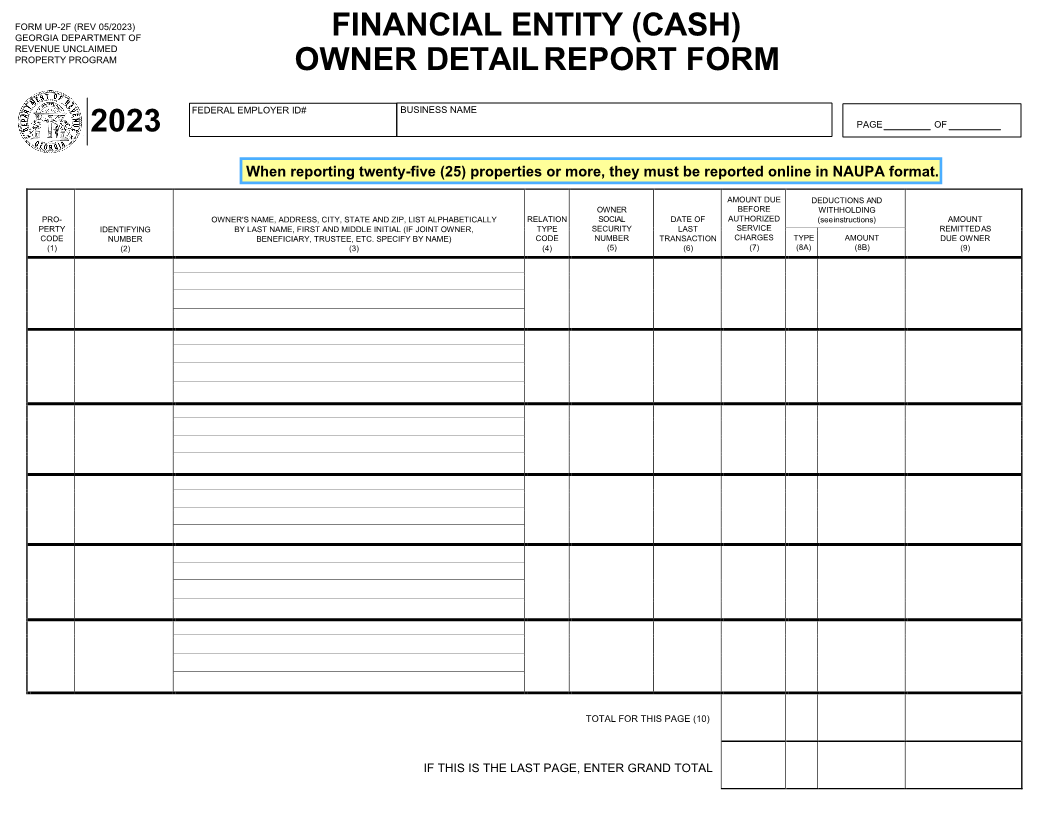

INSTRUCTIONS FOR FORM UP-2F

If you are reporting twenty-five (25) properties or more, they

must be reported online in NAUPA format.

Form UP-2F provides detailed information about the unclaimed accounts. This information is used to verify

rightful ownership of person(s) attempting to claim the account.

Please type or print your report.

Enter your business name and federal employer identification number on each page of your owner report.

List owners alphabetically by last name.

You may list one entry for accounts less than $50. (EXAMPLE: 100 accounts of $40 or less totaling

$4,000)

ITEM 1- Refer to the “Property Code” listing on Page 3 of Introduction. Enter the property code that

identifies the property reported.

ITEM 2- Enter the identifying number assigned to the property by your business (i.e. account number,

check number, policy number, etc.).

ITEM 3- Enter the owner’s name as listed on your business’s records. If the account has more than one

owner, specify whether the joint owner is a custodian, guardian, trustee or beneficiary.

ITEM 4 - Refer to the “Relationship Type Code” listing on Page 4. Enter the relation codethat properly

identifies the owner relationship.

ITEM 5- Enter the social security number or tax identification number of the account owner as reflected on

your business’s records.

ITEM 6- Enter the date of last transaction or the date of last contact with the owner.

ITEM 7- Enter the account balance prior to any authorized deductions, even if the lawful deductions will

result in a zero balance.

ITEM 8A- Authorized service charges can be deducted by financial institutions only. If reporting

deductions or withholdings, enter one of the following codes:

SW - Service charge deducted (financial institutions) FTW - Federal tax withheld

IW - Interest withheld/discontinued OTH - Other (please provide explanation)

DW - Dividends withheld/discontinued

ITEM 8B- Enter the amount deducted from the owner’s account.

ITEM 9- Enter the account balance remitted after deductions.

ITEM 10- Enter the total of the accounts detailed on the page.

Attach the owner report form (UP-2F) to the holder report form (UP-1F).

Return both forms to:

Georgia Department of Revenue

Unclaimed Property Program

4125 Welcome All Rd Suite 701

Atlanta, GA 30349

9

|