- 5 -

Enlarge image

|

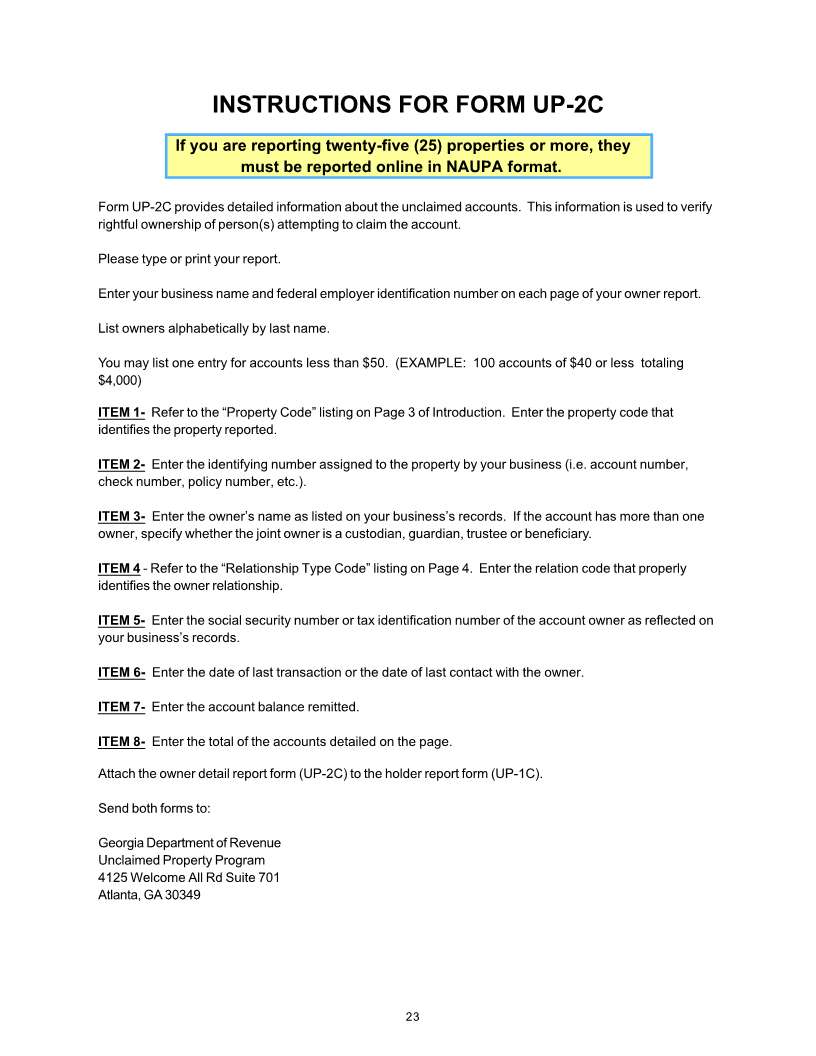

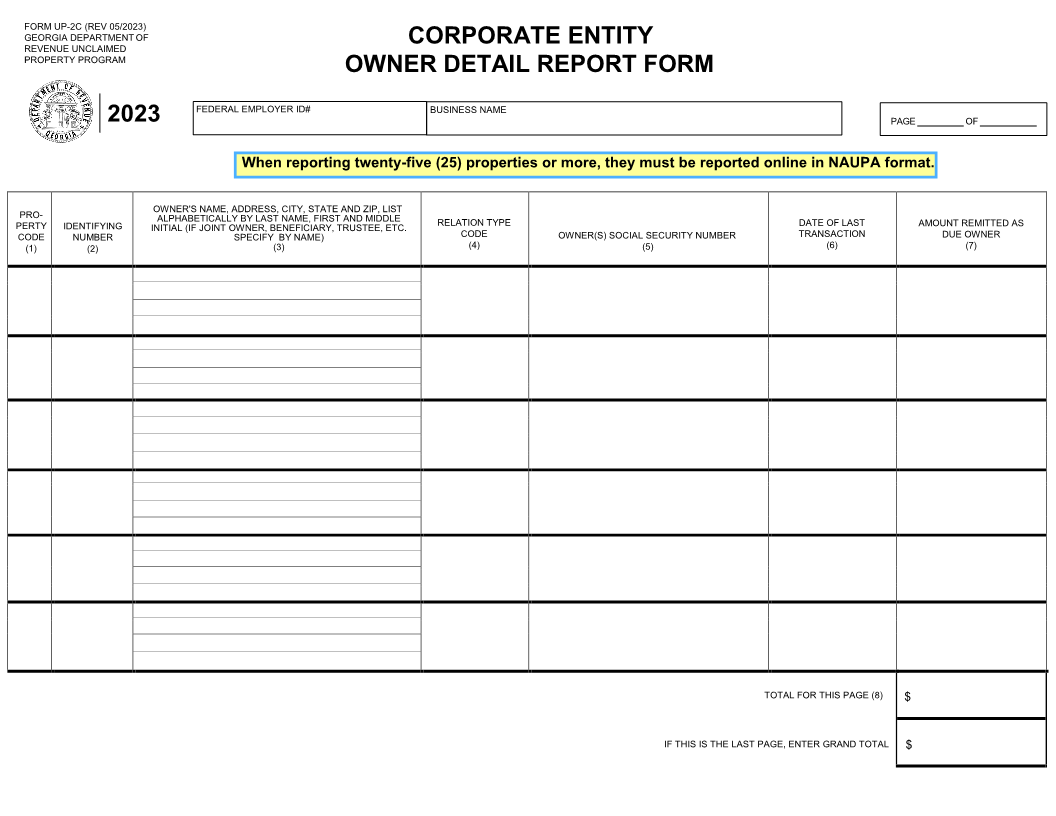

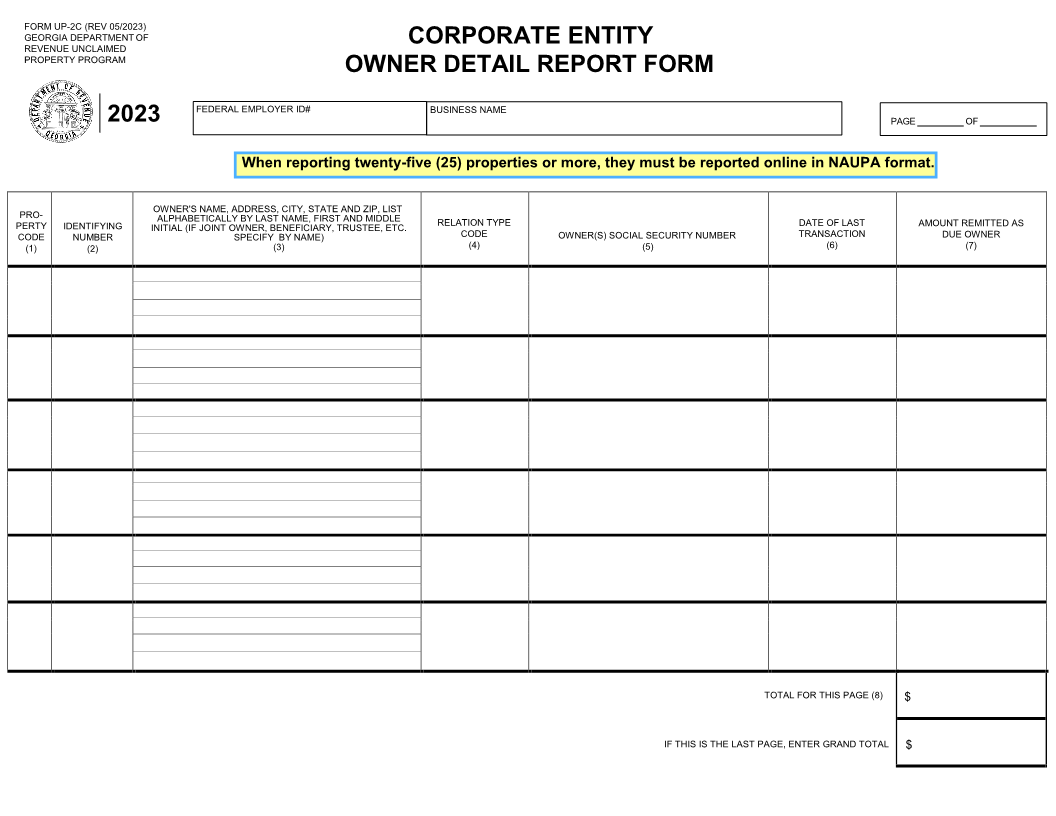

FORM UP-2C (REV 0 /5 2023)

GEORGIA DEPARTMENT OF CORPORATE ENTITY

REVENUE UNCLAIMED

PROPERTY PROGRAM

OWNER DETAIL REPORT FORM

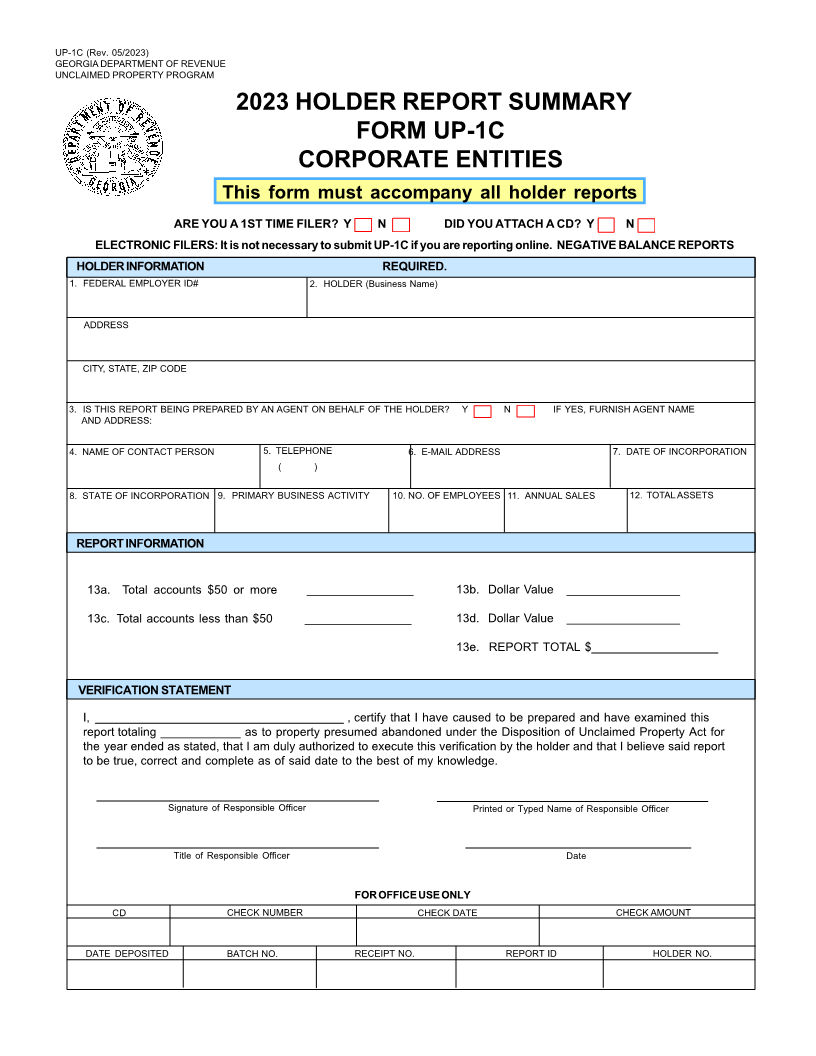

FEDERAL EMPLOYER ID# BUSINESS NAME

2023 PAGE OF

When reporting twenty-five (25) properties or more, they must be reported online in NAUPA format.

PRO- OWNER'S NAME, ADDRESS, CITY, STATE AND ZIP, LIST

ALPHABETICALLY BY LAST NAME, FIRST AND MIDDLE

PERTY IDENTIFYING INITIAL (IF JOINT OWNER, BENEFICIARY, TRUSTEE, ETC. RELATION TYPE DATE OF LAST AMOUNT REMITTED AS

CODE NUMBER SPECIFY BY NAME) CODE OWNER(S) SOCIAL SECURITY NUMBER TRANSACTION DUE OWNER

(1) (2) (3) (4) (5) (6) (7)

TOTAL FOR THIS PAGE (8) $

IF THIS IS THE LAST PAGE, ENTER GRAND TOTAL $

|