Enlarge image

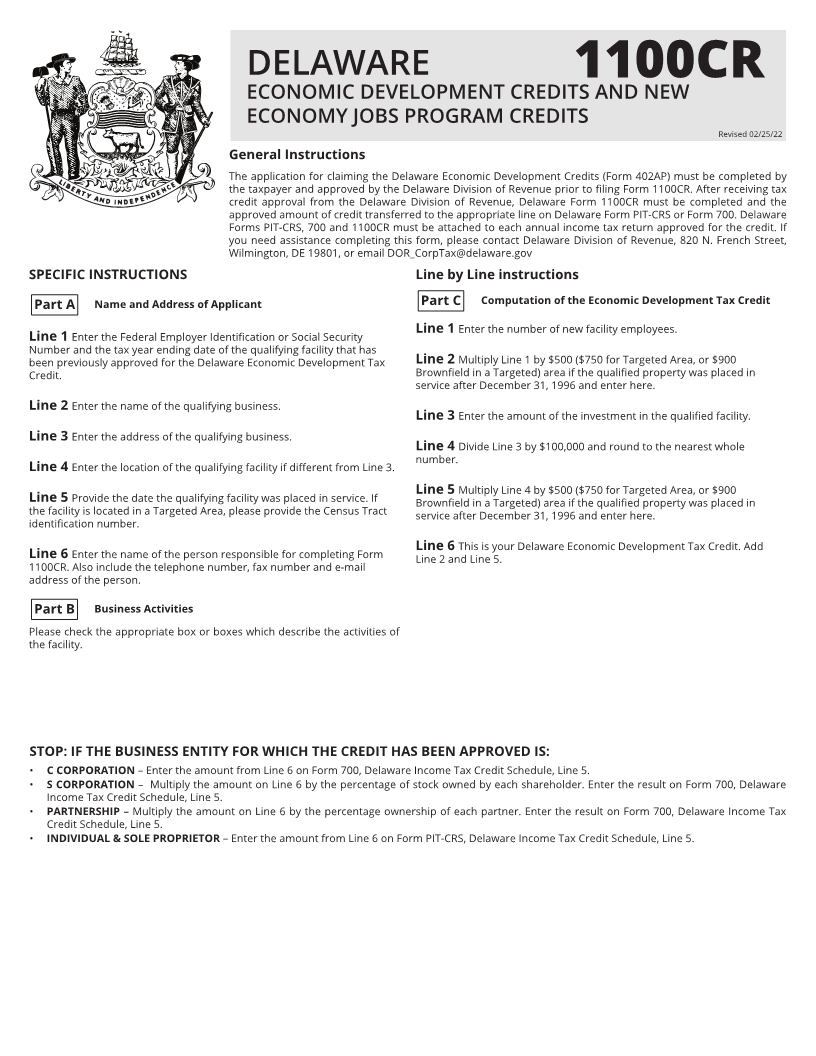

DELAWARE

1100CR

ECONOMIC DEVELOPMENT CREDITS AND NEW

ECONOMY JOBS PROGRAM CREDITS

Revised 02/25/22

General Instructions

The application for claiming the Delaware Economic Development Credits (Form 402AP) must be completed by

the taxpayer and approved by the Delaware Division of Revenue prior to filing Form 1100CR. After receiving tax

credit approval from the Delaware Division of Revenue, Delaware Form 1100CR must be completed and the

approved amount of credit transferred to the appropriate line on Delaware Form PIT-CRS or Form 700. Delaware

Forms PIT-CRS, 700 and 1100CR must be attached to each annual income tax return approved for the credit. If

you need assistance completing this form, please contact Delaware Division of Revenue, 820 N. French Street,

Wilmington, DE 19801, or email DOR_CorpTax@delaware.gov

SPECIFIC INSTRUCTIONS Line by Line instructions

Part A Name and Address of Applicant Part C Computation of the Economic Development Tax Credit

Line 1 Enter the number of new facility employees.

Line 1 Enter the Federal Employer Identification or Social Security

Number and the tax year ending date of the qualifying facility that has

been previously approved for the Delaware Economic Development Tax Line 2 Multiply Line 1 by $500 ($750 for Targeted Area, or $900

Credit. Brownfield in a Targeted) area if the qualified property was placed in

service after December 31, 1996 and enter here.

Line 2 Enter the name of the qualifying business.

Line 3 Enter the amount of the investment in the qualified facility.

Line 3 Enter the address of the qualifying business.

Line 4 Divide Line 3 by $100,000 and round to the nearest whole

number.

Line 4 Enter the location of the qualifying facility if different from Line 3.

Line 5 Multiply Line 4 by $500 ($750 for Targeted Area, or $900

Line 5 Provide the date the qualifying facility was placed in service. If Brownfield in a Targeted) area if the qualified property was placed in

the facility is located in a Targeted Area, please provide the Census Tract service after December 31, 1996 and enter here.

identification number.

Line 6 This is your Delaware Economic Development Tax Credit. Add

Line 6 Enter the name of the person responsible for completing Form Line 2 and Line 5.

1100CR. Also include the telephone number, fax number and e-mail

address of the person.

Part B Business Activities

Please check the appropriate box or boxes which describe the activities of

the facility.

STOP: IF THE BUSINESS ENTITY FOR WHICH THE CREDIT HAS BEEN APPROVED IS:

• C CORPORATION – Enter the amount from Line 6 on Form 700, Delaware Income Tax Credit Schedule, Line 5.

• S CORPORATION – Multiply the amount on Line 6 by the percentage of stock owned by each shareholder. Enter the result on Form 700, Delaware

Income Tax Credit Schedule, Line 5.

• PARTNERSHIP – Multiply the amount on Line 6 by the percentage ownership of each partner. Enter the result on Form 700, Delaware Income Tax

Credit Schedule, Line 5.

• INDIVIDUAL & SOLE PROPRIETOR – Enter the amount from Line 6 on Form PIT-CRS, Delaware Income Tax Credit Schedule, Line 5.